Bernstein Maintains BTC $150,000 Target

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

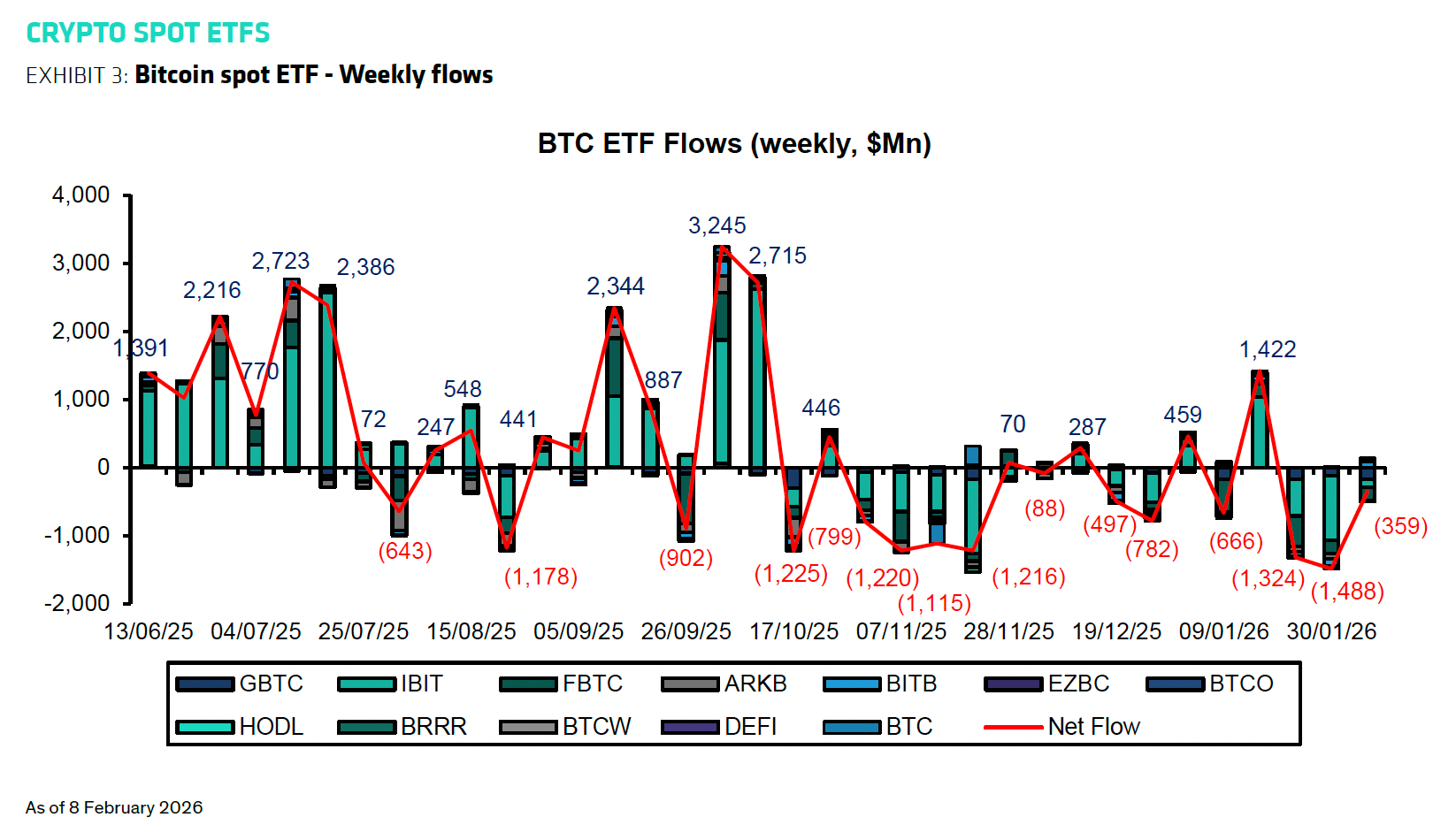

Bernstein analysts maintained their $150,000 price target for Bitcoin (BTC) on Monday. They stated that the recent selling wave stems from a lack of investor confidence, not structural issues, representing the weakest bear scenario. There is no major disruption in BTC market infrastructure; only a 7% net outflow from spot BTC ETFs occurred, and the price fell approximately 50%. Analysts said, “The current price movement is only a confidence crisis; nothing is broken.”

Weekly BTC ETF flows. Source: Bloomberg, Bernstein analysis

Bernstein BTC Gold Comparison and Positive Outlook

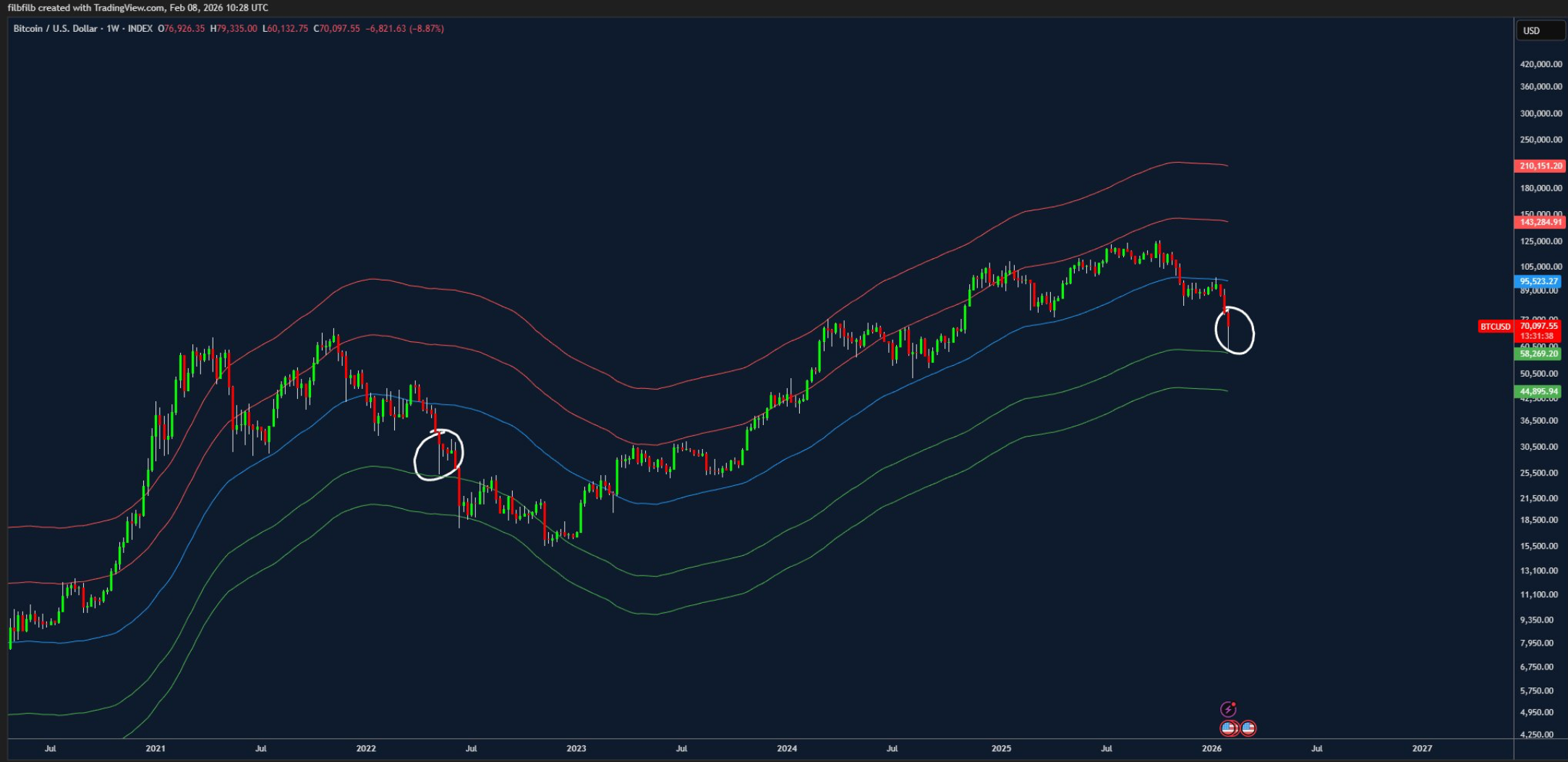

Bernstein stated that BTC’s weak performance compared to gold is due to it being viewed as a liquidity-sensitive risk asset, with tight financial conditions and high interest rates favoring AI stocks and precious metals. They dismissed narratives such as AI pulling crypto capital, quantum computing being a threat, and MicroStrategy’s leverage risk. They expect miners to sell below production costs. Once liquidity improves, according to BTC detailed analysis, BTC is forecasted to reach new highs. Bitwise CEO Hunter Horsley noted that institutions see the dip as an entry opportunity, while traders warn of a bottom below $50,000. BTC fell from $126,000 to $70,000.

BTC/USD one-week chart. Source: Filbfilb/X

Binance SAFU Fund and Large BTC Purchases from Garrett Jin

Institutional confidence signals are strengthening. The Binance SAFU Fund purchased an additional 4,225 BTC ($299.6 million), bringing total assets to 10,455 BTC ($734 million). Additionally, Garrett Jin deposited 5,000 BTC ($351 million) to Binance. These moves support Bernstein’s confidence crisis thesis and encourage buying BTC futures at bottom levels.

BTC Technical Analysis: RSI Oversold and Strong Supports

Current BTC price is $70,456, 24-hour change -%1.28. RSI at 33.68 is in oversold territory, trend is downward but Supertrend gives a bear signal. EMA 20: $78,228. Strong supports: S1 $62,910 (⭐79/100, -%10.69), S2 $68,308 (⭐65/100, -%3.02). Resistances: R1 $72,183 (⭐75/100, +%2.48), R2 $78,962 (⭐72/100, +%12.10). These levels are critical for potential recovery. ALT coins are also moving in parallel with BTC.