Bhutan Sold $22 Million Worth of BTC: Holdings Are Dwindling

BTC/USDT

$21,201,579,335.94

$68,086.00 / $64,290.71

Change: $3,795.29 (5.90%)

-0.0009%

Shorts pay

Contents

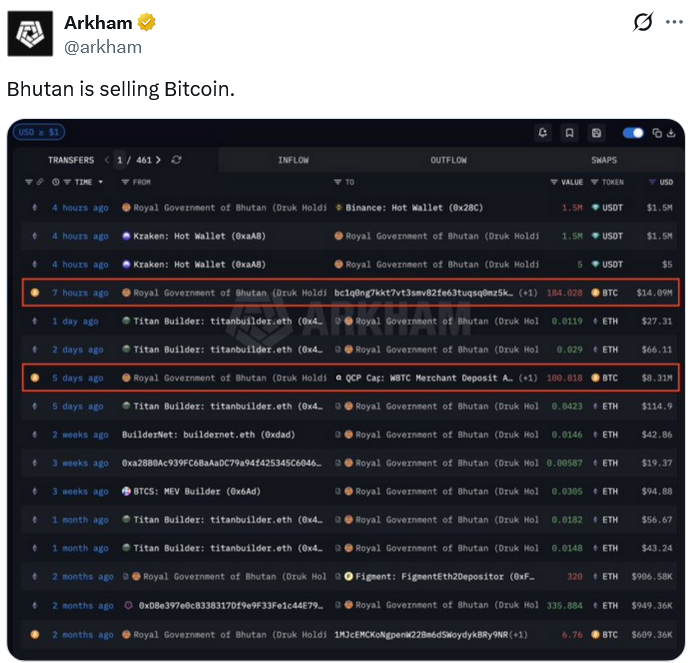

Bhutan transferred over 22 million dollars worth of assets by putting its state-mined Bitcoins (BTC) up for sale. According to data from blockchain analysis platform Arkham, a total of BTC worth 22.3 million dollars were sent to crypto market maker QCP Capital from the country's national reserves: 184 BTC (14 million dollars) on Wednesday and 100.8 BTC (8.3 million dollars) last Friday. These transfers usually indicate a sale transaction.

Details of Bhutan's Bitcoin Sales

Bhutan, although it has accumulated about 765 million dollars worth of BTC through Bitcoin mining supported by hydroelectric power since 2019, is eroding its reserves with recent sales. Holdings have declined from the October 2024 peak of 13,295 BTC to currently 5,700 BTC, dropping to seventh place among nation-states according to Bitcoin Treasuries data. These sales, directed to a market maker, signal liquidity needs or profit taking. For more detailed BTC analysis, click here.

Mining Costs Rose After the 2024 Halving

After the 2024 Bitcoin halving, the cost of mining one BTC doubled while production fell well below the 8,200 BTC in 2023. Even Bhutan's cheap hydroelectric advantage couldn't withstand this pressure; sales accelerated to balance operational costs. The country may have to diversify its mining revenues.

Source: Arkham

BTC Price Fell Below 70,000 Dollars: First Time Since November 2024

The BTC price fell below 72,000 dollars, down 42.8% from its all-time high of 126,080 dollars. Latest development: it fell below 70,000 dollars for the first time since November 6, 2024 (current price: 70,016 dollars, 24-hour change -7.70%). This decline reflects the general selling pressure triggered by Bhutan's sales. Check BTC futures.

BTC Technical Analysis: Oversold RSI and Key Levels

RSI at 21.30 is in the oversold region; the trend is downward, Supertrend giving a bearish signal. EMA 20: 83,009 dollars. Supports: S1 70,076 dollars (strong, 82% score), S2 66,748 dollars. Resistances: R1 73,158 dollars (62% score), R2 76,972 dollars. In the short term, S1 may be tested, with recovery awaiting a breakout above R1. BTC spot analysis is recommended.