Binance Considers Reducing CZ’s Stake to Enhance US Market Presence

WLFI/USDT

$83,229,461.44

$0.1130 / $0.1054

Change: $0.007600 (7.21%)

-0.0040%

Shorts pay

Contents

Binance is exploring a US return by potentially reducing co-founder Changpeng Zhao’s majority stake to navigate regulatory challenges and expand in key states. This strategic shift aims to bolster its presence in the world’s second-largest crypto market, amid partnerships with firms like BlackRock and World Liberty Financial.

-

Regulatory Hurdle: CZ’s controlling stake has blocked expansion in strategic US states, per sources familiar with discussions.

-

Potential Partnerships: Binance eyes collaborations with US entities like BlackRock and Trump-linked World Liberty Financial to enhance its footprint.

-

Market Impact: The US ranks second in global crypto adoption, per Chainalysis’ 2025 Global Crypto Adoption Index, offering vast liquidity opportunities.

Binance eyes US return amid regulatory shifts: Explore how CZ’s stake reduction and partnerships could reshape crypto access in America’s key market. Stay informed on this pivotal expansion. (148 characters)

What is Binance’s Plan for Returning to the US Market?

Binance US return strategies focus on overcoming regulatory barriers through structural changes, including a possible reduction in co-founder Changpeng Zhao’s majority stake. This move addresses hurdles that have limited expansion in critical US states since the exchange’s 2019 exit. The discussions remain preliminary, with no firm announcements, but signal a renewed push for American market access.

Source: CZ

How Might Partnerships Aid Binance’s US Expansion?

Binance is evaluating alliances with prominent US-based firms to solidify its position. For instance, potential ties with asset manager BlackRock could integrate traditional finance with crypto services, while collaboration with decentralized finance platform World Liberty Financial—associated with former President Donald Trump—might leverage political goodwill. These partnerships aim to comply with stringent US regulations, drawing on BlackRock’s expertise in asset management and WLFI’s innovative DeFi approaches. Sources indicate these talks are part of broader efforts to access US liquidity, which Chainalysis ranks as pivotal in its 2025 Global Crypto Adoption Index, where the US holds the second spot globally. Expert analysts note that such integrations could enhance Binance’s compliance framework, reducing risks from past SEC allegations against its global and US operations.

Since exiting the US in June 2019, Binance has operated separately from Binance.US, a compliant entity run by BAM Trading Services. This separation ensures US users access a limited platform without derivatives or global liquidity pools. Bloomberg reports, based on insiders, highlight Zhao’s stake as a persistent obstacle, prompting fluid conversations on restructuring. In October, following a presidential pardon, Zhao expressed commitment via social media: “Will do everything we can to help make America the capital of crypto and advance Web3 worldwide.”

The pardon sparked industry speculation, with executives anticipating a more crypto-friendly regulatory environment. However, Binance.US remains distinct, facing its own challenges after 2023 SEC claims that it and the global platform were interconnected—allegations both entities have contested.

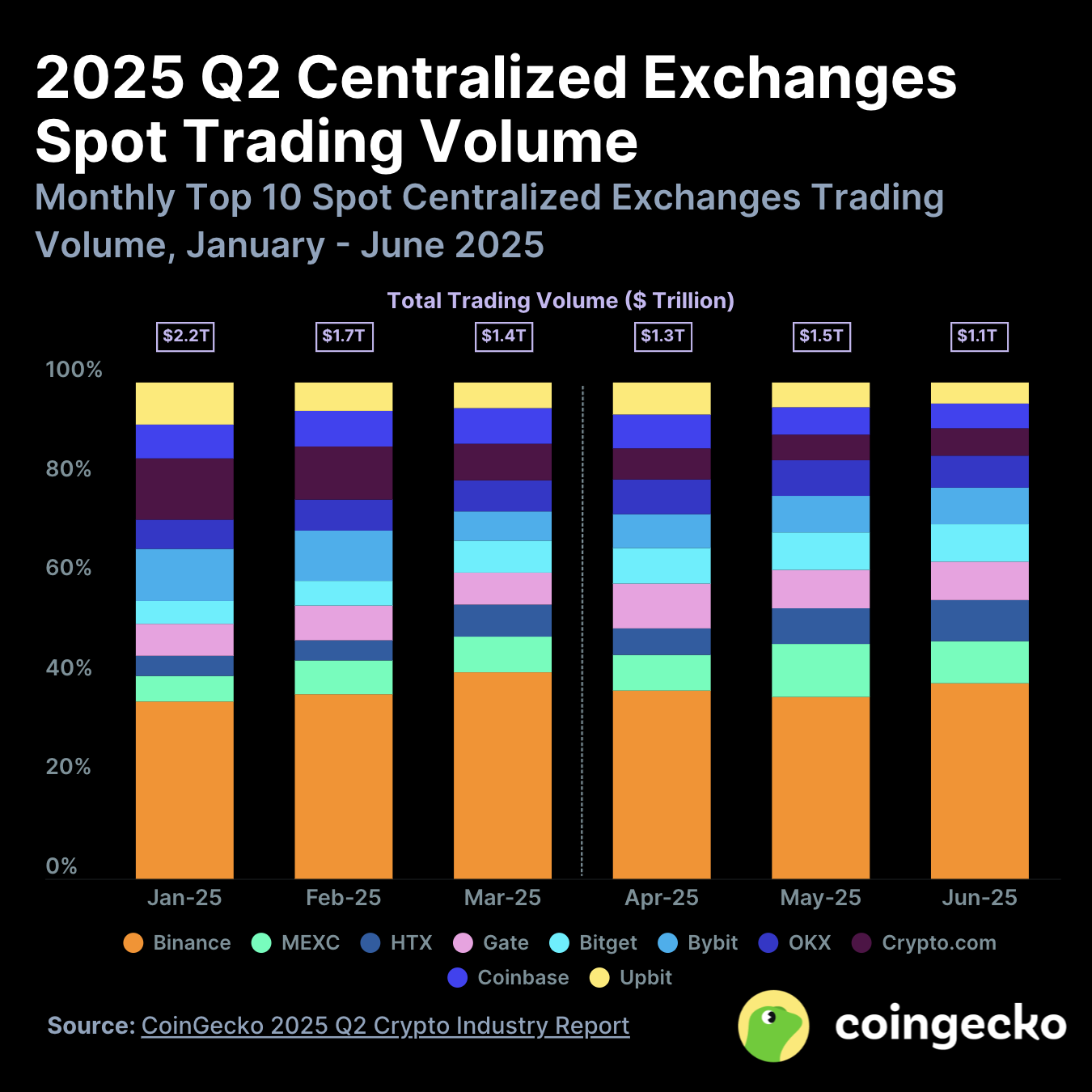

Binance claims the top spot among centralized crypto exchanges in terms of trading volume. Source: CoinGecko

As the leading exchange by volume, per CoinGecko data, Binance’s global dominance underscores the stakes of US re-entry. The market’s adoption metrics, per Chainalysis, position it as essential for worldwide liquidity flows. Recent leadership changes, such as naming co-founder Yi He as co-CEO alongside Richard Teng, further signal internal preparations for expansion.

Frequently Asked Questions

Why Did Binance Exit the US Initially?

Binance ceased US operations in 2019 to adhere to regulatory requirements, launching the independent Binance.US for compliant services. This split addressed concerns over unlicensed activities, allowing the global platform to focus internationally while BAM Trading Services managed American users under SEC oversight. (48 words)

What Regulatory Challenges Does Binance Face in Returning to the US?

Binance’s return hinges on resolving issues like Zhao’s controlling stake, which insiders say impedes licensing in key states. Past SEC enforcement actions in 2023 highlighted operational overlaps, but ongoing reforms and partnerships aim to ensure full compliance, paving the way for broader market access in this high-adoption region. (62 words)

Key Takeaways

- Stake Reduction Strategy: Lowering CZ’s majority ownership could unlock US state expansions, addressing a core regulatory barrier.

- Strategic Alliances: Ties with BlackRock and World Liberty Financial may bridge traditional finance and crypto, enhancing legitimacy.

- Market Opportunity: US re-entry taps into second-ranked global adoption, boosting liquidity and growth for Binance’s ecosystem.

Conclusion

Binance’s potential US return through stake adjustments and US expansion partnerships marks a cautious yet ambitious step toward reclaiming a vital market share. With the US solidifying as a crypto powerhouse per Chainalysis metrics, these moves could redefine global exchange dynamics. Investors and users should monitor developments closely, as regulatory clarity emerges in 2025, potentially ushering in a new era of accessible blockchain innovation.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026