Binance UNI Inflows Signal Potential Selling as Altcoins Like SHIB See Outflows

UNI/USDT

$127,846,437.75

$3.771 / $3.537

Change: $0.2340 (6.62%)

+0.0046%

Longs pay

Contents

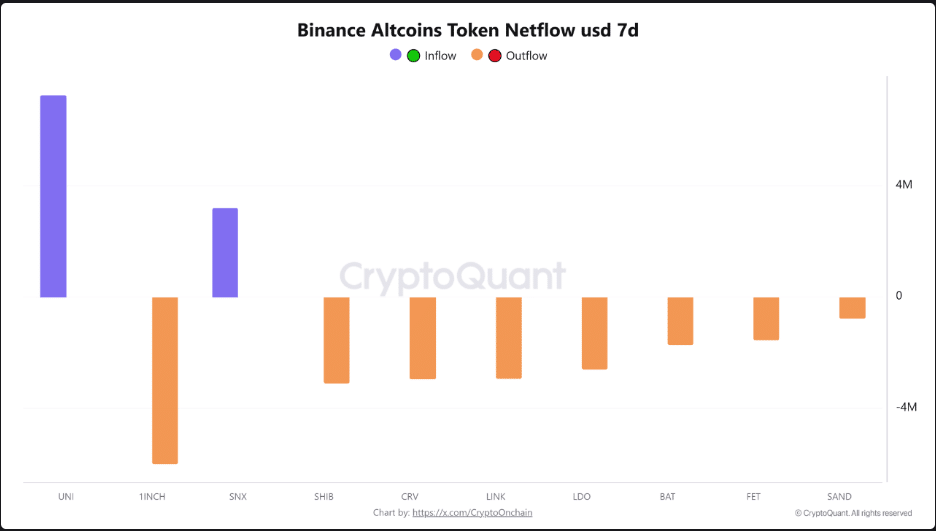

Binance altcoin netflow reveals strong inflows for UNI and SNX, signaling potential short-term trading activity, while 1INCH, SHIB, LINK, and CRV experience significant outflows indicating long-term accumulation strategies among traders.

-

UNI Inflows on Binance: Over 7.2 million UNI tokens entered exchange wallets in the past week, suggesting traders are preparing for increased liquidity and possible sales.

-

SNX sees similar trends with 3.2 million tokens inflowing, reflecting heightened short-term interest amid market caution.

-

Outflows include nearly 6 million 1INCH and around 3 million each for SHIB, CRV, and LINK, pointing to reduced exchange supply and secure storage preferences.

Discover Binance altcoin netflow trends: UNI and SNX inflows vs. outflows in 1INCH, SHIB, LINK, CRV. Analyze trader strategies and market implications for informed decisions. Stay updated on crypto movements today.

What Are the Key Binance Altcoin Netflow Trends Right Now?

Binance altcoin netflow data highlights a split in trader behavior, with UNI and SNX seeing substantial inflows while 1INCH, SHIB, LINK, and CRV face notable outflows. These movements indicate some participants are gearing up for short-term trades, whereas others prioritize long-term holding through self-custody. On-chain analytics from sources like CryptoQuant underscore this divergence as a response to current market dynamics.

How Do UNI and SNX Inflows Signal Market Positioning?

Recent on-chain data from CryptoQuant indicates that approximately 7.2 million UNI tokens flowed into Binance over the past seven days, alongside 3.2 million SNX. Such inflows typically reflect traders depositing assets to capitalize on liquidity opportunities or prepare for sales. In a cautious market environment, this buildup can lead to increased volatility as more tokens become available for trading. Analysts, including CryptoOnchain, observe that these patterns align with short-term rotations, where UNI’s role in decentralized exchanges and SNX’s staking mechanics draw attention. For instance, CryptoOnchain stated, “UNI and SNX are currently attracting attention due to the volume of tokens moving into centralized accounts,” emphasizing the potential for near-term activity. This data, tracked through blockchain explorers, helps investors gauge supply pressures without relying on speculative forecasts.

Source: CryptoQuant

The implications extend beyond immediate trading; as exchange reserves grow for these assets, it could influence price stability. Historical patterns show that similar inflows have preceded periods of heightened volume, particularly for governance and derivatives tokens like UNI and SNX. Market participants monitor these metrics closely, as they provide factual insights into supply dynamics on one of the largest centralized exchanges.

Frequently Asked Questions

What Causes Inflows and Outflows in Binance Altcoin Netflow?

Inflows to Binance, such as those for UNI and SNX, often stem from traders seeking liquidity for short-term trades or arbitrage, depositing tokens to access exchange order books. Outflows for assets like 1INCH, SHIB, LINK, and CRV typically indicate a shift toward self-custody, reducing exposure to platform risks and signaling confidence in long-term value, based on data from analytics platforms like CryptoQuant.

Why Are Traders Withdrawing SHIB and LINK from Binance?

Traders are withdrawing SHIB and LINK from Binance to secure tokens in private wallets, minimizing risks from market volatility and exchange events. This natural accumulation strategy, evident in over 3 million tokens outflowing each in the past week, supports price floors by limiting liquid supply, as noted in on-chain reports from experts like CryptoOnchain.

Key Takeaways

- Divergent Netflows: UNI and SNX inflows of 7.2 million and 3.2 million tokens respectively highlight short-term trading preparations on Binance.

- Accumulation Signals: Outflows exceeding 3 million tokens each for 1INCH, SHIB, CRV, and LINK demonstrate a preference for long-term holding outside exchanges.

- Market Insight: Monitor these patterns to understand trader sentiment; consider diversifying strategies based on asset-specific behaviors for better portfolio management.

Conclusion

The latest Binance altcoin netflow trends reveal a nuanced market where UNI and SNX inflows suggest active positioning for liquidity events, contrasting with outflows in 1INCH, SHIB, LINK, and CRV that point to accumulation. Drawing from authoritative on-chain data provided by CryptoQuant and insights from analysts like CryptoOnchain, these movements underscore varying trader strategies amid ongoing volatility. As the crypto landscape evolves, staying attuned to such netflow shifts can empower informed decisions, potentially leading to more resilient investment approaches in the coming months.

Binance altcoin netflow data shows strong UNI and SNX inflows alongside major outflows in 1INCH, SHIB, LINK, and CRV as traders adjust their positions.

- Binance records large UNI and SNX inflows, showing traders are increasing exchange balances while preparing for heightened short-term activity across both assets.

- Strong outflows in 1INCH, SHIB, CRV, and LINK show traders steadily removing tokens from Binance to reduce available supply and strengthen long-term storage positions.

- Diverging flows across multiple assets show a market adjusting to different strategies as participants balance potential trading interest with ongoing withdrawal-driven accumulation.

Altcoin netflow on Binance is presenting contrasting movements this week as fresh on-chain data shows differing approaches among market participants. While some traders appear to be positioning for potential selling, others are steadily withdrawing tokens into self-custody.

Exchange Inflows Reflect Possible Selling Intent

Recent figures from CryptoQuant show a sizable inflow of UNI and SNX into Binance. Around 7.2 million UNI and 3.2 million SNX were transferred to exchange wallets during the past seven days. This movement often suggests holders are preparing to convert assets into liquidity.

These additions to the exchange’s supply create room for increased trading activity around these tokens. Market participants generally view such inflows as preparation for distribution, especially when the broader environment remains cautious. With more tokens available for trading, traders may expect heightened activity around short-term positions.

According to CryptoQuant analyst CryptoOnchain, UNI and SNX are currently attracting attention due to the volume of tokens moving into centralized accounts. This observation aligns with broader market commentary surrounding short-term token rotation.

Token Outflows Point Toward Accumulation Behavior

Other altcoins on Binance have shown a different pattern. The data indicates that nearly 6 million 1INCH left the exchange within the same period. Similar withdrawals were recorded for SHIB, CRV, and LINK, each showing outflows of roughly 3 million tokens.

These movements suggest traders are opting for private storage, thereby reducing the liquid supply available on Binance. Historically, such behavior is common when participants prefer to secure tokens long-term rather than leave them exposed to market volatility. The reduced exchange float may support stabilization as fewer tokens remain available for rapid selling.

CryptoOnchain also noted that LDO saw about $2.5 million in outflows, extending the trend of withdrawal-focused activity. This shift reveals steady interest from participants who view holding outside exchanges as the preferred strategy in the current climate.

Divergent Sentiment Shapes the Broader Market Outlook

The contrasting netflow data illustrates a market where sentiment varies depending on the asset. UNI and SNX appear positioned for near-term trading as exchange reserves grow. Meanwhile, tokens such as SHIB, LINK, CRV, and 1INCH show accumulated interest through consistent outflows.

Market watchers often analyze these patterns to understand shifts in trader positioning. The combination of exchange inflows and outflows creates a mixed environment, especially when major tokens experience different forms of movement. This framework allows participants to gauge how supply and behavior evolve across the altcoin market.

With CryptoOnchain continuing to track these developments publicly, the data offers insight into how Binance users adjust strategies. The divergence between accumulation and potential selling suggests that traders are responding to current conditions with distinct preferences across assets.

Comments

Other Articles

Chainlink Nears $30 as Dogecoin Eyes $0.55 Amid Cold Wallet’s Potential 285x Gains

August 4, 2025 at 03:18 AM UTC

Bitcoin Plummets Below $60,000 Amidst Massive Crypto Market Sell-Off

August 4, 2024 at 10:10 AM UTC

Bitcoin Hovers Near $67K Amid Market Turmoil Following Biden’s Withdrawal

July 23, 2024 at 09:20 AM UTC