BIS Warns of Liquidity Risks in Tokenized Funds Dominated by BlackRock’s BUIDL

OP/USDT

$91,578,723.81

$0.1211 / $0.1092

Change: $0.0119 (10.90%)

+0.0019%

Longs pay

Contents

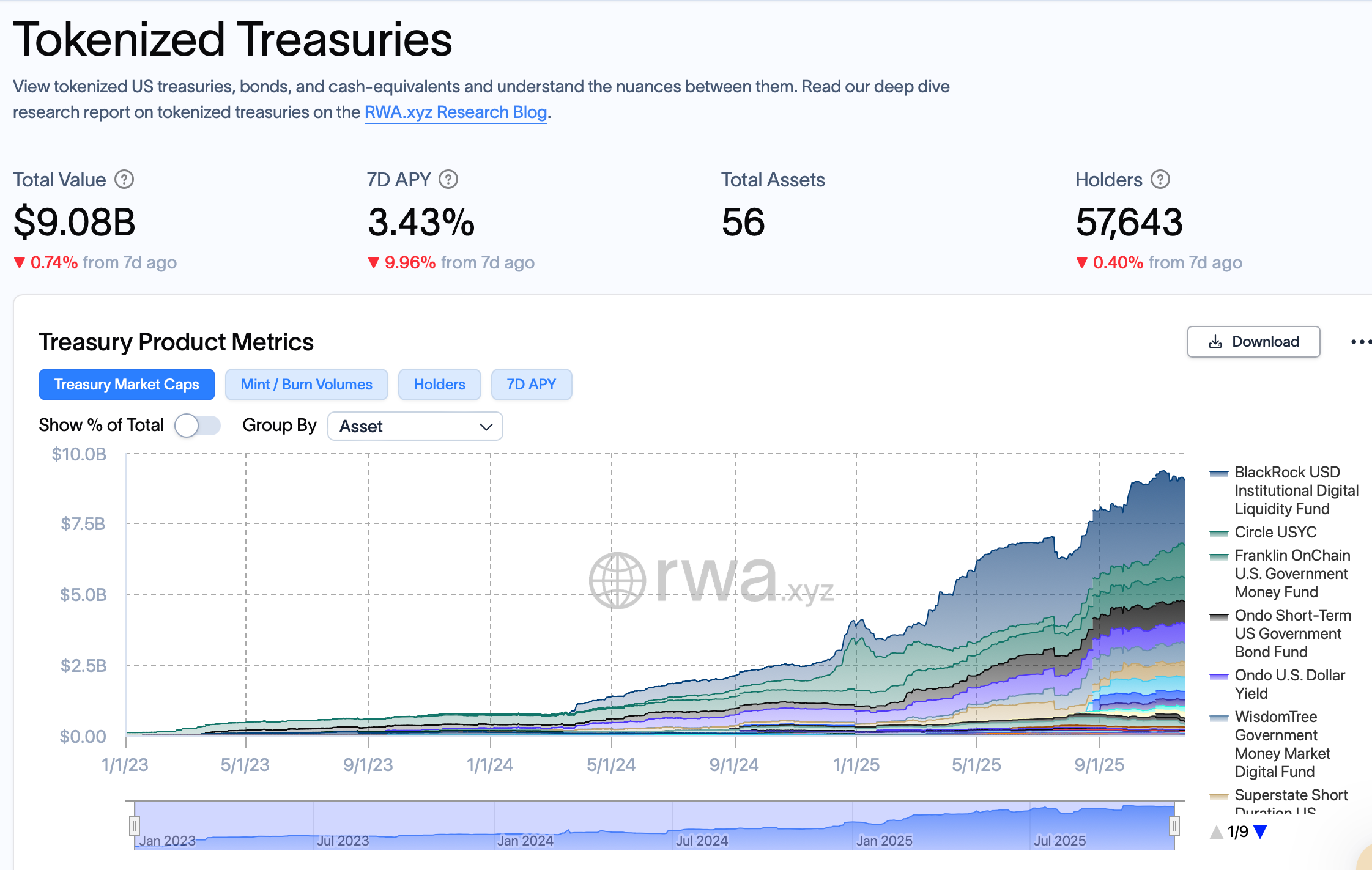

Tokenized money market funds have surged nearly tenfold to nearly $9 billion since 2023, per a Bank for International Settlements report. These blockchain-based assets offer stable yields from US Treasurys but introduce liquidity risks and potential contagion in crypto markets.

-

Tokenized money market funds represent blockchain versions of traditional short-term investment portfolios, primarily backed by US Treasurys.

-

They provide on-chain access to interest-bearing assets with securities-like protections, surpassing stablecoins in stability and yield.

-

Assets under management reached $9 billion by late 2025, up from $770 million in 2023, according to Bank for International Settlements data.

Discover how tokenized money market funds are transforming crypto yields and risks. Explore BIS insights on growth, benefits, and liquidity challenges in this essential guide for investors.

What Are Tokenized Money Market Funds?

Tokenized money market funds are digital representations of traditional money market portfolios on public blockchains, allowing investors to access short-term, low-risk assets like US Treasurys directly on-chain. According to a recent Bank for International Settlements bulletin, these funds have become crucial yield-bearing assets in the crypto space, combining blockchain efficiency with the security of government-backed securities. They differ from stablecoins by offering genuine interest returns while maintaining principal stability.

What Risks Do Tokenized Money Market Funds Pose According to BIS?

The Bank for International Settlements highlights several risks associated with tokenized money market funds, including operational vulnerabilities and liquidity mismatches. These funds rely on permissioned wallets and off-chain infrastructure for pricing and settlement, which could falter during high redemption volumes. For instance, while token transfers occur instantly on blockchains, the underlying assets settle through traditional markets, potentially exacerbating volatility in stressed conditions.

Interconnections with stablecoins amplify contagion risks, as rapid conversions or leveraged trading could propagate shocks across ecosystems. The BIS report notes that a small number of large holders dominate these funds, increasing the potential for rapid outflows. Expert analysis from the bulletin emphasizes that without robust safeguards, these innovations could mirror past financial crises but at blockchain speeds. Data from RWA.xyz indicates over $9 billion in tokenized assets, underscoring the scale of potential impact.

Tokenized money market funds have grown nearly tenfold since 2023, but the Bank for International Settlements warns their adoption brings new liquidity and contagion risks. These blockchain-based instruments offer money-market returns and securities-level protections that stablecoins can’t provide.

According to the bulletin, tokenized money market funds now hold nearly $9 billion in assets, up from about $770 million at the end of 2023. The BIS warned that as these tokenized Treasury portfolios become a key source of collateral in the crypto ecosystem, they also bring new operational and liquidity risks.

Tokenized money market funds are blockchain-based representations of traditional money market portfolios, providing investors with onchain access to short-term, interest-bearing assets, such as US Treasurys.

The BIS noted that while these tokens offer the flexibility of stablecoins, they depend on permissioned wallets, offchain market plumbing and a small set of large holders; factors that could accelerate stress if redemptions spike or onchain liquidity thins out.

Although the tokens move on public blockchains, the underlying portfolios, pricing and settlement still occur in traditional markets. BIS says that gap creates a structural mismatch: token transfers settle instantly, while the assets behind them do not. During periods of heavy withdrawals, this gap may make it more challenging for funds to meet redemptions without contributing to further volatility.

Interlinkages with stablecoins create additional risk, as some tokenized money market funds also enable rapid conversions into stablecoins or are used for leveraged trades. The BIS warns that these feedback loops could allow market stress to spread much faster than in traditional money market funds.

The analysis was released just a day after the institution appointed International Monetary Fund chief and CBDC backer Tommaso Mancini-Griffoli as the next head of its Innovation Hub.

Related: Tokenized money market funds emerge as Wall Street’s answer to stablecoins

Asset Managers Ramp Up Fund Tokenization

The world’s top asset managers have been accelerating the expansion of tokenized money market funds across multiple blockchain networks. This push reflects growing confidence in blockchain technology for institutional finance, blending traditional asset management with decentralized efficiency.

Franklin Templeton announced on Nov. 12 the integration of its Benji tokenization platform with the Canton Network, bringing tokenized assets — including its onchain US government money market fund — into a blockchain ecosystem designed for financial institutions. This move enhances interoperability for institutional players seeking secure, compliant on-chain solutions.

Asset manager BlackRock also recently announced the expansion of its tokenized money market fund, the USD Institutional Digital Liquidity Fund (BUIDL), to Aptos, Arbitrum, Avalanche, Optimism and Polygon, broadening beyond Ethereum. By diversifying chains, BlackRock aims to reduce congestion risks and improve accessibility for global investors.

RWA.xyz data shows that BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) currently dominates the onchain money market landscape, with more than $2.5 billion in tokenized assets. This leadership position highlights BlackRock’s influence in bridging TradFi and DeFi.

Franklin Templeton’s BENJI fund has over $844 million in tokenized US government securities, according to the data. Other players, such as WisdomTree and State Street, are exploring similar initiatives, signaling a broader industry trend toward tokenization.

The growth of these funds stems from their ability to deliver predictable yields in a volatile crypto environment. US Treasurys, as the primary backing, provide low-risk exposure, with yields typically ranging from 4-5% annually based on recent Federal Reserve rates. This attractiveness has drawn institutional capital, positioning tokenized money market funds as a cornerstone of on-chain finance.

Frequently Asked Questions

How Do Tokenized Money Market Funds Differ from Stablecoins?

Tokenized money market funds offer interest-bearing returns from assets like US Treasurys, unlike stablecoins which maintain a $1 peg without yields. They provide securities-grade protections and on-chain liquidity, making them suitable for institutional collateral, as outlined in the Bank for International Settlements report. This combination addresses stablecoin limitations in yield and regulatory compliance.

What Are the Main Liquidity Risks in On-Chain Money Market Funds?

The primary liquidity risks arise from mismatches between instant on-chain token transfers and slower off-chain asset settlements, per BIS analysis. Heavy redemptions could strain funds, especially with concentrated holdings among large investors. Natural integration with stablecoins may accelerate contagion, requiring careful risk management for sustainable growth.

Key Takeaways

- Rapid Growth: Tokenized money market funds have expanded to $9 billion in assets since 2023, driven by institutional adoption.

- Innovation Benefits: They deliver stable yields and blockchain efficiency, serving as superior alternatives to stablecoins for collateral needs.

- Risk Awareness: Investors should monitor liquidity gaps and contagion potential, as warned by the Bank for International Settlements, to navigate this evolving space effectively.

Conclusion

Tokenized money market funds are reshaping the crypto landscape by merging traditional finance security with blockchain innovation, as evidenced by the Bank for International Settlements report on their $9 billion growth and associated risks. While offering compelling yields from US Treasurys, the liquidity and contagion challenges underscore the need for robust oversight. As asset managers like BlackRock and Franklin Templeton expand these offerings, staying informed on BIS insights will be key for investors aiming to capitalize on this trend safely.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026