Bitcoin Advocates Question Saylor’s View of BTC as Hard Asset Rather Than Money

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Michael Saylor’s updated Bitcoin thesis portrays BTC as a hard asset like crude oil, not primarily as electronic cash, sparking debate among advocates. MicroStrategy’s strategy involves refining Bitcoin into financial products via stocks and notes, holding 671,268 BTC as of December 15, 2025.

-

Michael Saylor views Bitcoin as a foundational asset for financial innovation, similar to crude oil ready for refinement into usable products.

-

Saylor’s approach emphasizes Bitcoin’s role in corporate treasury strategies, enabling leveraged exposure through shares and debt instruments.

-

MicroStrategy holds 671,268 Bitcoin, acquired through aggressive buying over nearly five years, including billions raised via convertible notes and preferred stock.

Michael Saylor’s Bitcoin thesis redefines BTC as a hard asset, not just money, fueling advocate divides. Explore how MicroStrategy refines it into financial tools. Stay ahead—subscribe for crypto insights today! (152 characters)

What is Michael Saylor’s View on Bitcoin?

Michael Saylor, executive chairman of MicroStrategy, views Bitcoin primarily as a hard asset rather than a peer-to-peer electronic cash system as originally envisioned by Satoshi Nakamoto. In his keynote at the Bitcoin MENA conference in Abu Dhabi, Saylor outlined plans resembling a “Bitcoin central bank,” where MicroStrategy refines “crude Bitcoin” into various financial products. This perspective positions Bitcoin as a foundational resource, akin to crude oil, enabling the creation of accessible investment vehicles like stocks and bonds backed by BTC holdings.

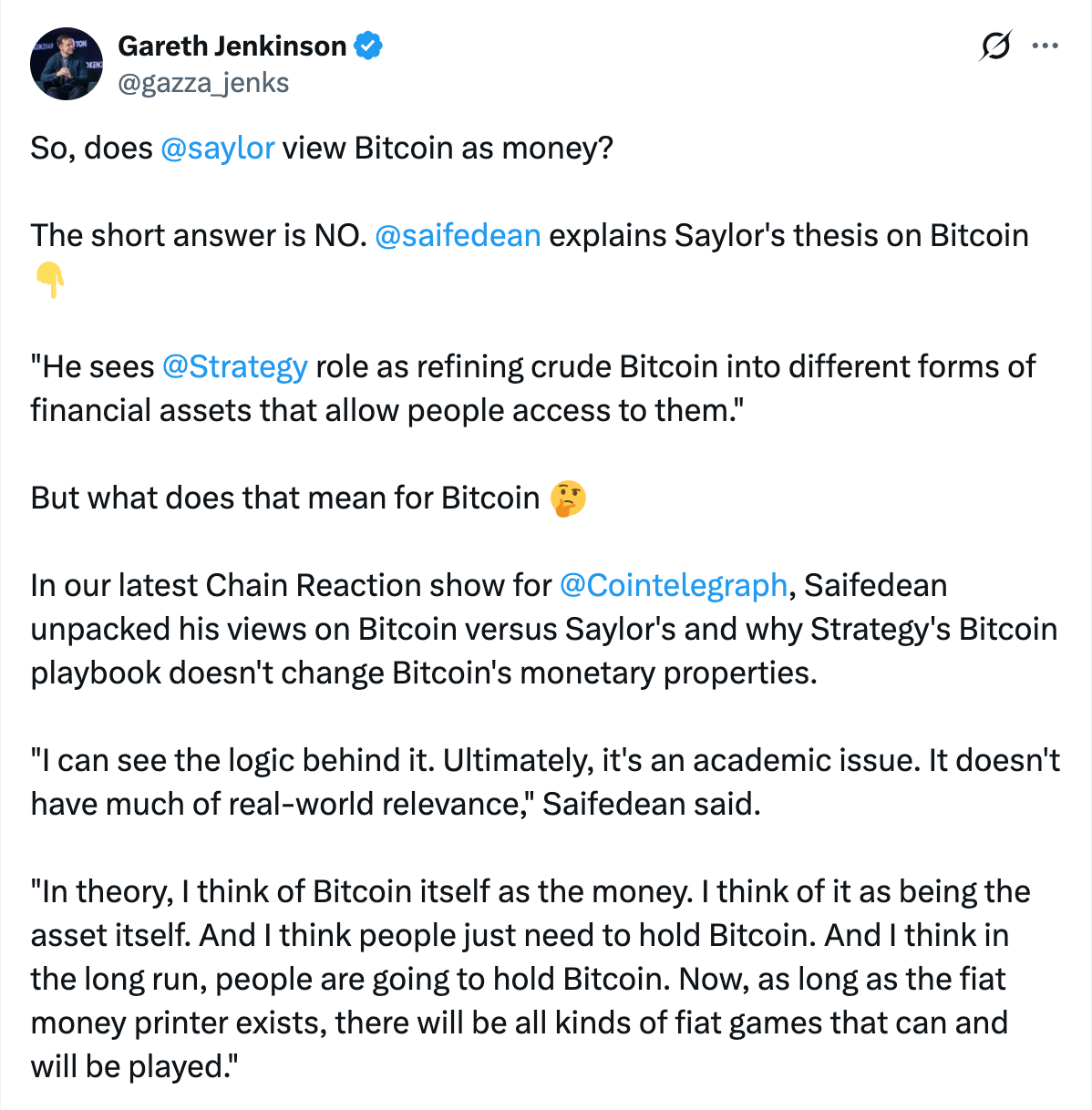

Source: Gareth Jenkinson

This thesis has divided Bitcoin advocates, with some questioning whether it aligns with Bitcoin’s monetary roots. Saylor’s company has amassed a substantial BTC treasury, using it to drive financial innovation without altering Bitcoin’s underlying properties.

Why Does Saylor See Bitcoin as a Hard Asset?

Michael Saylor’s analogy of Bitcoin to crude oil underscores its scarcity and durability, making it an ideal base for financial engineering. Economist Saifedean Ammous, author of The Bitcoin Standard, explained on a recent discussion that Saylor does not perceive Bitcoin through the traditional lens of money. “He sees Bitcoin more as an asset. One of the great metaphors he uses is that Bitcoin is like crude oil in that it is a hard asset,” Ammous stated. Just as Standard Oil transformed crude into kerosene and gasoline, MicroStrategy aims to convert Bitcoin into diversified financial instruments.

This approach leverages existing corporate finance tools to democratize Bitcoin exposure. MicroStrategy’s Class A Common Stock (MSTR) serves as a leveraged bet on Bitcoin’s price, given the firm’s focus on BTC accumulation. The company has raised billions through convertible senior notes—debt convertible to equity—and recently issued perpetual preferred stocks (STRK, STRF, STRD, STRC) to institutional investors. As of December 15, 2025, MicroStrategy holds 671,268 Bitcoin, acquired over nearly five years of strategic purchases.

Ammous, who converses regularly with Saylor and received a foreword from him for The Bitcoin Standard, emphasized that this playbook does not undermine Bitcoin’s monetary essence. “Ultimately, it’s an academic issue. It doesn’t have much of real-world relevance,” he noted. Despite global fiat money supply expanding 7%-15% annually and encouraging debt reliance, Ammous argues Bitcoin remains pristine capital. Businesses and individuals will increasingly need to acquire BTC to access affordable debt, ultimately driving broader adoption and reinforcing its role as money.

In the fiat-dominated world, such financial products are inevitable as Bitcoin’s value grows. “As Bitcoin grows, you’re going to be seeing these kinds of financial fiat tools and products being deployed on Bitcoin,” Ammous observed. This dynamic ensures more BTC accumulation, bolstering cash balances and solidifying Bitcoin’s monetary status in the long term.

Frequently Asked Questions

What is Michael Saylor’s Bitcoin Thesis?

Michael Saylor’s Bitcoin thesis frames BTC as a hard asset like crude oil, serving as the foundation for refined financial products. Through MicroStrategy, he enables investor access via stocks, notes, and preferred shares, without viewing it strictly as everyday money. This strategy has built a treasury of 671,268 BTC, promoting institutional adoption.

How Does MicroStrategy Use Bitcoin in Its Treasury Strategy?

MicroStrategy integrates Bitcoin as its primary treasury reserve, buying aggressively since 2020 to hedge against inflation. The firm issues shares and debt instruments backed by BTC, creating leveraged exposure for investors. This approach, detailed in Saylor’s Bitcoin MENA keynote, positions the company as a Bitcoin refinery for global finance.

Key Takeaways

- Michael Saylor’s Bitcoin View: Saylor sees BTC as a hard asset akin to crude oil, ideal for financial innovation rather than solely as electronic cash.

- MicroStrategy’s Holdings: The company owns 671,268 Bitcoin, funded by convertible notes and preferred stocks, demonstrating a successful treasury model.

- Expert Perspective: Saifedean Ammous affirms Bitcoin’s monetary properties endure, predicting increased adoption as fiat tools layer on top, urging holders to acquire BTC directly.

Conclusion

Michael Saylor’s Bitcoin thesis as a hard asset continues to spark debate, highlighting tensions between innovation and Bitcoin’s origins as digital money. With MicroStrategy’s substantial BTC reserves and tools like MSTR stock providing exposure, the ecosystem evolves toward broader integration. As fiat systems persist, Bitcoin’s role as pristine capital strengthens, paving the way for sustained growth—consider building your BTC position to navigate this dynamic landscape.