Bitcoin and Ethereum Dip: Liquidations and ETF Weakness May Signal Volatility

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The recent Bitcoin and Ethereum price dip was triggered by heavy long liquidations totaling $647 million and cooling ETF inflows, leading to a synchronized market drop from consolidation levels. BTC fell to $85,000, while ETH slid to $2,806, erasing recent gains amid whale activity and exchange inflows.

-

Key trigger: Mass liquidations hit longs for $572 million, with BTC accounting for $201 million and ETH $159 million.

-

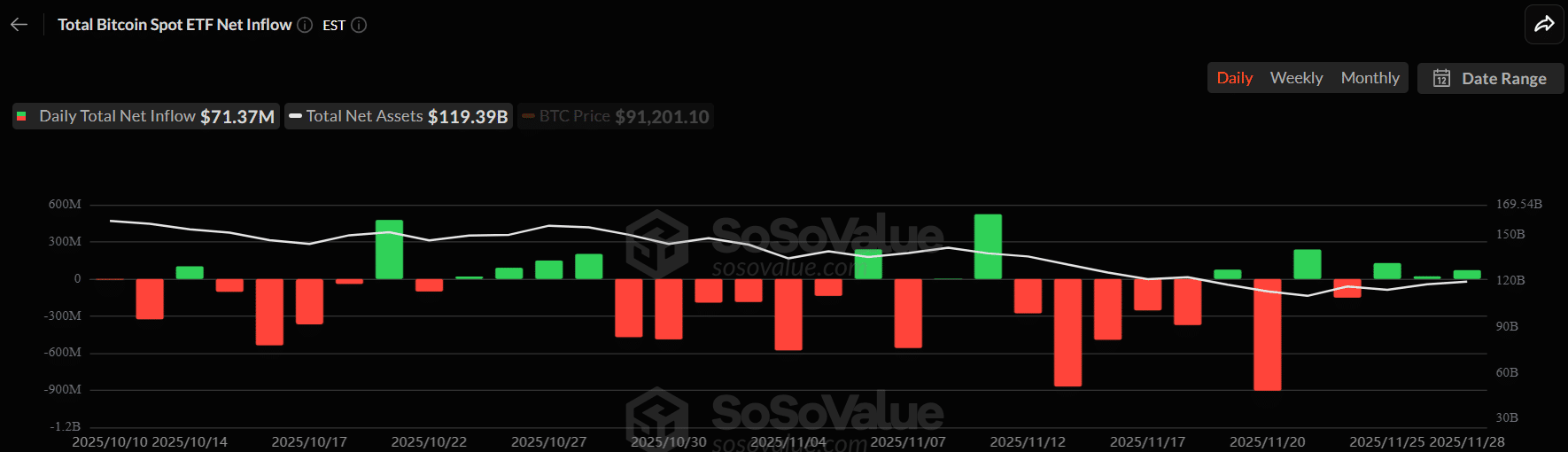

Bitcoin spot ETFs saw modest $71 million inflows after prior outflows of up to $1.1 billion, signaling reduced demand.

-

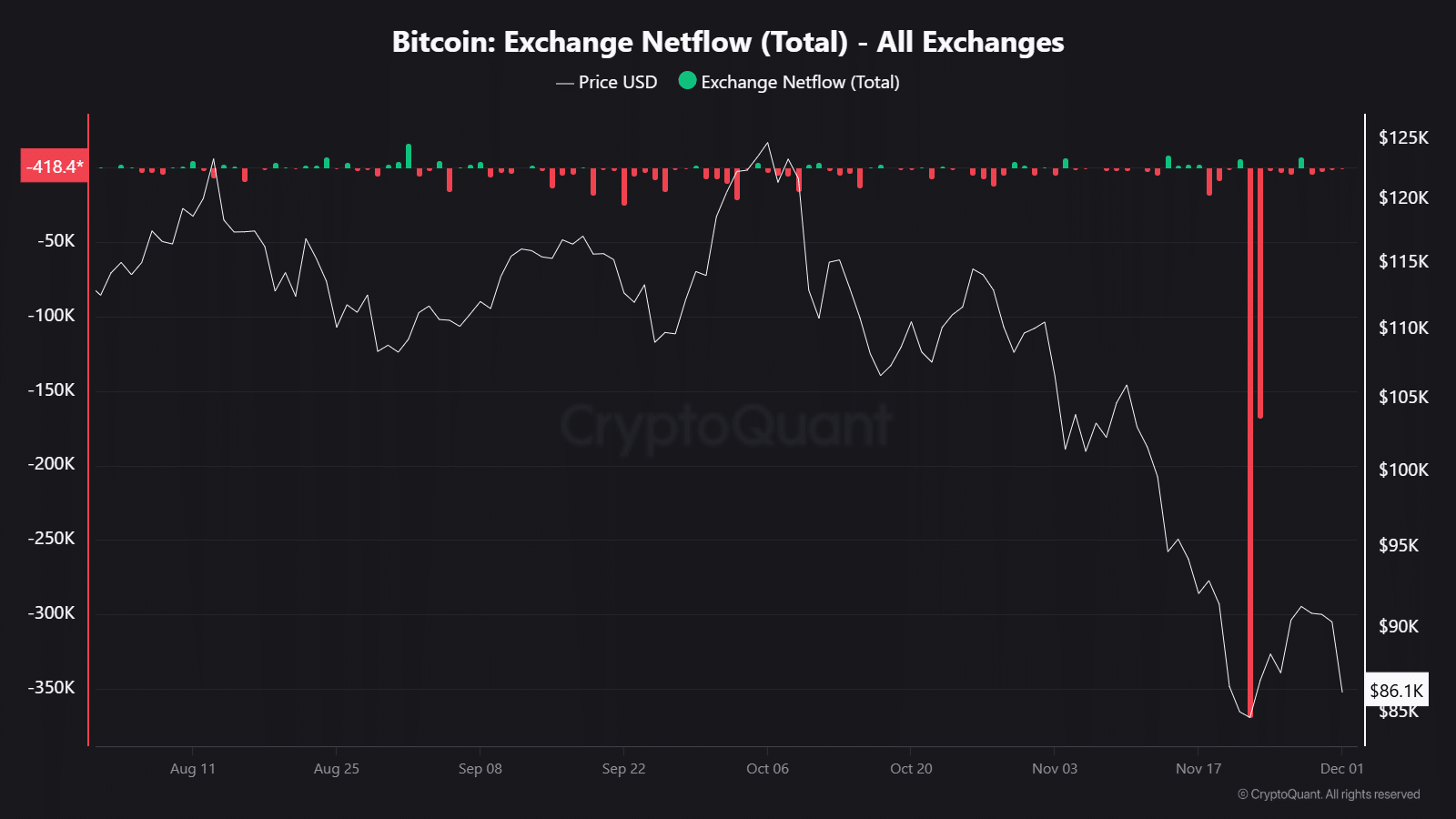

Elevated whale transactions above $1 million preceded the volatility, with Bitcoin exchange inflows spiking to -350K BTC.

Discover the causes behind the Bitcoin and Ethereum price dip in December 2025. Analyze liquidations, ETF flows, and whale moves for market insights. Stay informed on crypto trends today.

What Caused the Recent Bitcoin and Ethereum Price Dip?

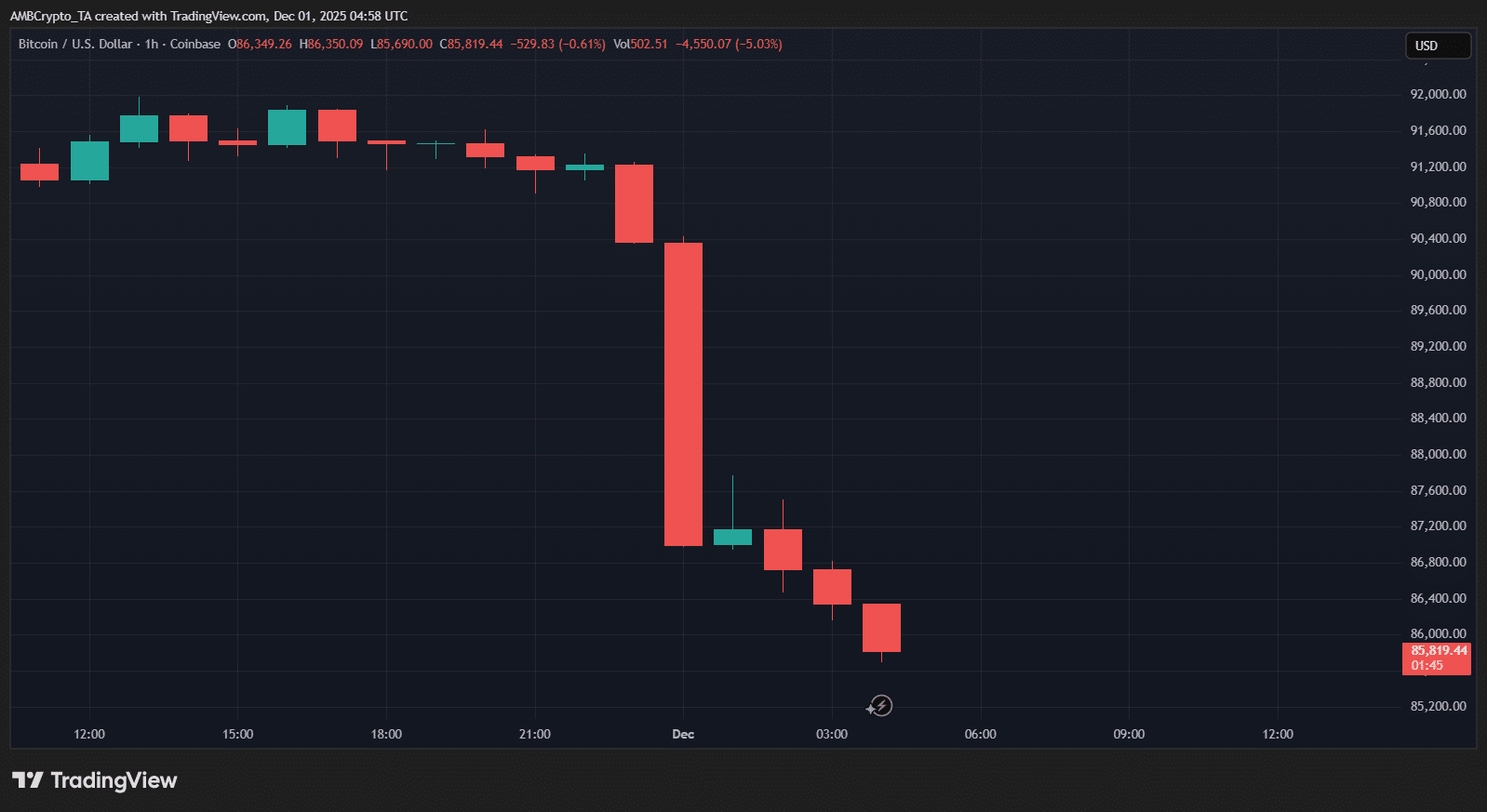

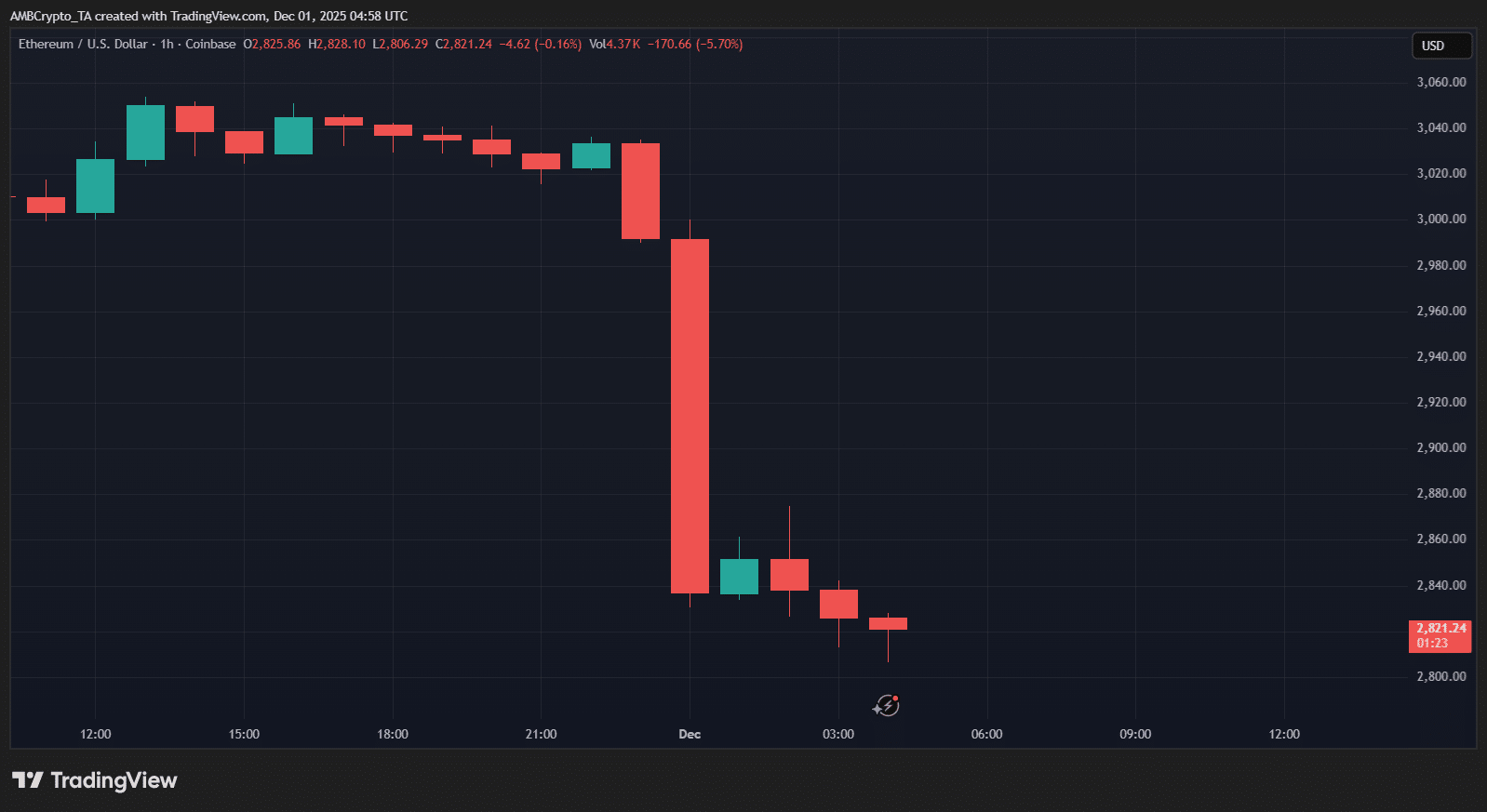

The Bitcoin and Ethereum price dip stemmed primarily from a cascade of long position liquidations and waning institutional interest via ETFs. Overnight, both assets experienced sharp declines during early December trading, with Bitcoin dropping from $86,300 to around $85,000 in under an hour, and Ethereum following suit from $2,825 to $2,806. This sudden shift disrupted prior consolidation patterns, amplified by increased whale movements and exchange deposits.

How Did Liquidations Impact the Bitcoin and Ethereum Price Dip?

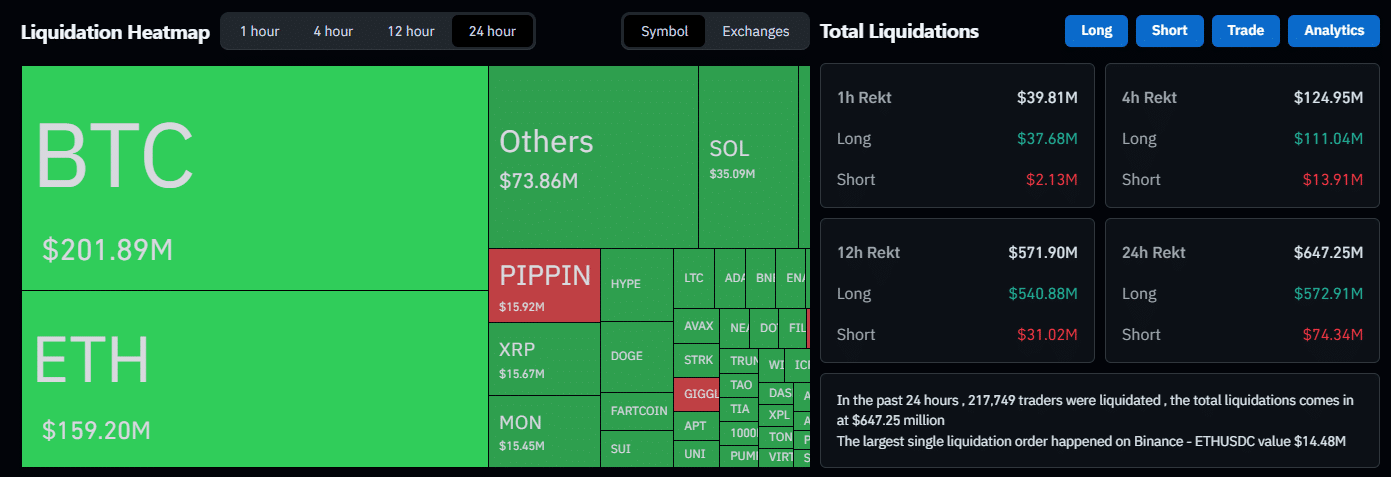

Liquidations played a pivotal role in exacerbating the Bitcoin and Ethereum price dip, wiping out over $647 million in positions across major exchanges in the last 24 hours. Long trades bore the brunt, suffering $572 million in losses, far outpacing short liquidations. For Bitcoin, $201.89 million was cleared, representing a significant portion of overleveraged bullish bets. Ethereum saw even steeper damage at $159.20 million liquidated, highlighting the vulnerability in perpetual futures markets.

Source: TradingView

Altcoins were not immune; Solana faced $35.09 million in liquidations, and Ripple’s XRP endured $15.67 million, contributing to the “Others” category totaling $73.86 million. The largest single event was a $14.48 million ETHUSDC position closure, underscoring the rapid chain reaction. In the preceding 12 hours, $571.90 million vanished, nearly all from longs, which forced additional selling pressure as margin calls triggered stop-losses. Market analysts from CoinGlass report that such events often cluster during low-volume overnight sessions, amplifying downward momentum.

Trading volumes spiked accordingly, with futures open interest dropping by 5-7% for both BTC and ETH pairs. This data aligns with historical patterns where high leverage ratios—currently around 25x for popular contracts—lead to volatility bursts. Experts like those at CryptoQuant note that post-liquidation rebounds can occur, but sustained ETF outflows may prolong the dip.

Source: TradingView

Frequently Asked Questions

Why Did Bitcoin and Ethereum Experience a Sudden Price Dip in Early December?

The Bitcoin and Ethereum price dip in early December resulted from synchronized liquidations and reduced ETF inflows. Over $647 million in positions were wiped out, primarily longs, amid whale transfers and exchange deposits that heightened selling pressure. This event followed days of consolidation, turning stability into a swift 1-2% decline for both assets.

Is the Bitcoin and Ethereum Dip a Sign of Broader Market Weakness?

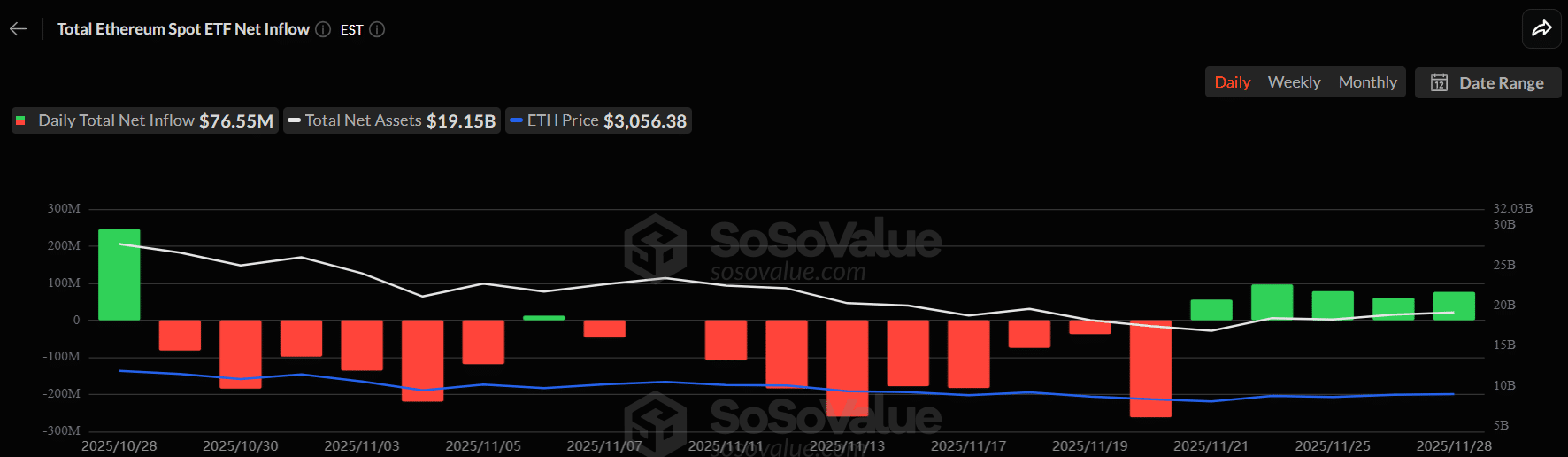

Yes, the Bitcoin and Ethereum dip indicates broader market weakness driven by institutional caution and leverage unwinding. ETF net inflows for BTC dropped to $71 million after heavy outflows, while ETH assets fell toward $19.15 billion. Voice searches for crypto stability often highlight how such dips reflect global risk aversion, with recovery hinging on renewed demand signals.

Source: CoinGlass

Institutional flows provide further context for the Bitcoin and Ethereum price dip. Bitcoin spot ETFs recorded just $71.37 million in net inflows, a stark contrast to previous days’ outflows exceeding $1.1 billion. This cooling demand preceded the price action, as investors shifted toward caution amid macroeconomic uncertainties. Ethereum ETFs mirrored this trend, with prolonged negative flows reducing total assets under management to approximately $19.15 billion, per data from established financial trackers.

Source: SoSoValue

Source: SoSoValue

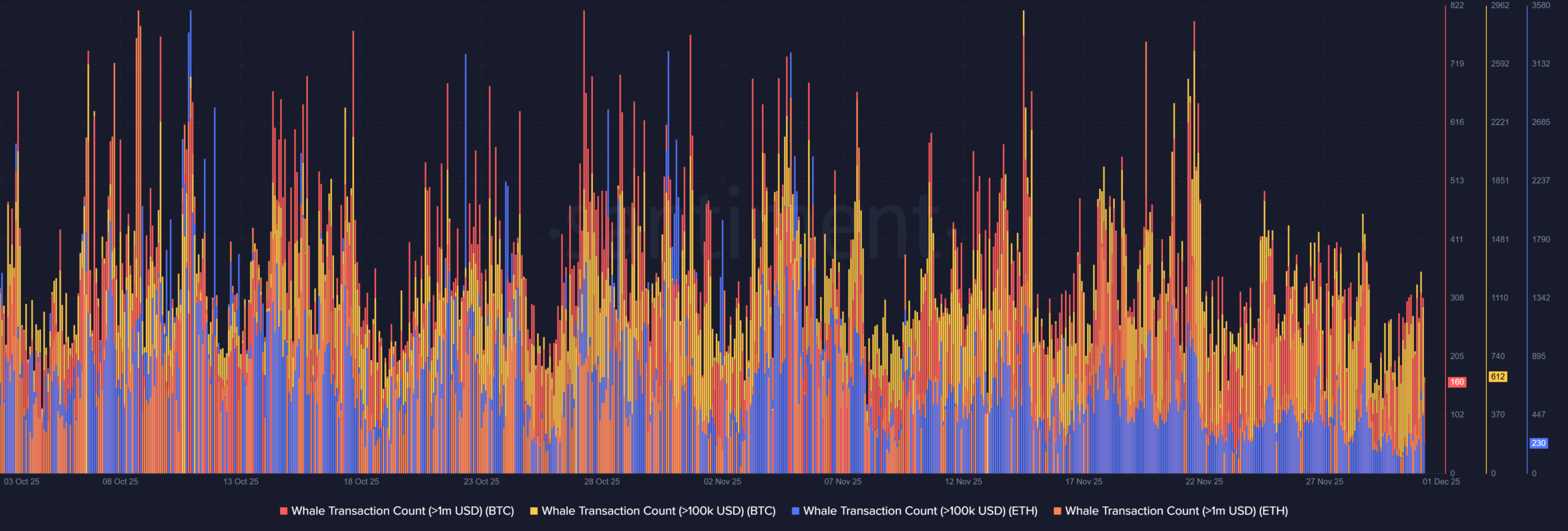

Whale involvement added another layer to the volatility surrounding the Bitcoin and Ethereum price dip. On-chain metrics revealed heightened activity, with transactions exceeding $1 million surging across both networks. Large holders transferred substantial volumes, often a precursor to price swings, as reported by blockchain analytics firms. For Bitcoin, this correlated with net exchange inflows peaking at around -350,000 BTC, suggesting potential sell-offs or hedging maneuvers near the $86,000 resistance level.

Source: Santiment

Source: CryptoQuant

Ethereum’s on-chain dynamics echoed Bitcoin’s, with similar whale spikes contributing to the synchronized dip. Ethereum’s total value locked in DeFi protocols dipped slightly, reflecting broader sentiment. According to Santiment, social media buzz around the event surged 30%, with traders discussing liquidation risks. This level of engagement often precedes further corrections but can also signal capitulation, paving the way for stabilization.

Broader market indicators reinforce the analysis of the Bitcoin and Ethereum price dip. The Crypto Fear & Greed Index hovered in the neutral zone, down from recent greed levels, indicating profit-taking after November’s rally. Global equity markets showed mixed signals, with tech stocks under pressure, indirectly influencing crypto as a high-beta asset class. Regulatory updates from the U.S. SEC on ETF staking proposals added uncertainty, though no direct causation was established.

Technical patterns on both charts displayed bearish confirmations post-dip. Bitcoin’s hourly candles broke below the $85,800 support, with RSI dipping into oversold territory below 30. Ethereum mirrored this, testing $2,800 as a key level. Volume profiles from TradingView suggest that without fresh inflows, both could retest lower supports at $84,000 for BTC and $2,750 for ETH.

Key Takeaways

- Massive Liquidations Fueled the Dip: Over $647 million in longs were erased, with BTC and ETH leading at $201 million and $159 million respectively, highlighting leverage risks in volatile markets.

- ETF Inflows Cooled Significantly: Bitcoin ETFs saw only $71 million net inflows after $1.1 billion outflows, while ETH assets declined to $19.15 billion, pointing to institutional hesitation.

- Whale Activity Signals Ongoing Volatility: Spikes in $1 million+ transactions and -350K BTC exchange inflows suggest potential for more swings—monitor on-chain data closely for entry points.

Conclusion

The Bitcoin and Ethereum price dip underscores the interplay of liquidations, ETF flows, and whale maneuvers in driving short-term market dynamics. As December trading unfolds, these factors—combined with technical breakdowns—may temper bullish expectations, though historical recoveries post-liquidation offer optimism. Investors should track exchange netflows and institutional sentiment for signs of reversal, positioning strategically in this evolving landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC

ETH Remains the Largest Long Position Despite ~$39.4M Unrealized Losses, Led by BTC OG Insider Whale on Hyperliquid

December 31, 2025 at 02:36 AM UTC