Bitcoin and USDT Exhibit Strong Negative Correlation in Exchange Flows, Glassnode Reports

BTC/USDT

$30,482,073,707.86

$69,550.00 / $63,820.50

Change: $5,729.50 (8.98%)

+0.0004%

Longs pay

Contents

The Bitcoin USDT correlation reveals a strong negative relationship between Bitcoin’s price movements and USDT net flows to exchanges over the past two years. During Bitcoin bull runs, USDT outflows increase as investors take profits, while inflows occur amid price corrections, signaling market shifts.

-

Net USDT outflows from exchanges align with Bitcoin price surges, often exceeding $100 million daily during euphoric phases.

-

Blockchain analytics show USDT minting during Bitcoin bull markets and burning in downturns, highlighting interconnected dynamics.

-

Bitcoin holds a $1.8 trillion market cap, with USDT at $184 billion; this duo leads crypto valuations amid growing adoption.

Bitcoin USDT correlation uncovers key market signals: outflows spike with BTC gains. Explore stablecoin flows, regulatory advances, and adoption trends driving crypto’s future. Stay informed on these vital links today.

What is the Bitcoin USDT Correlation?

Bitcoin USDT correlation refers to the observed inverse relationship between Bitcoin’s price fluctuations and the net flows of Tether’s USDT stablecoin to cryptocurrency exchanges. Over the last two years, data indicates that as Bitcoin’s value rises, significant outflows of USDT from exchanges occur, often signaling profit-taking by investors. Conversely, during price dips, inflows increase, suggesting capital preservation or preparation for buying opportunities.

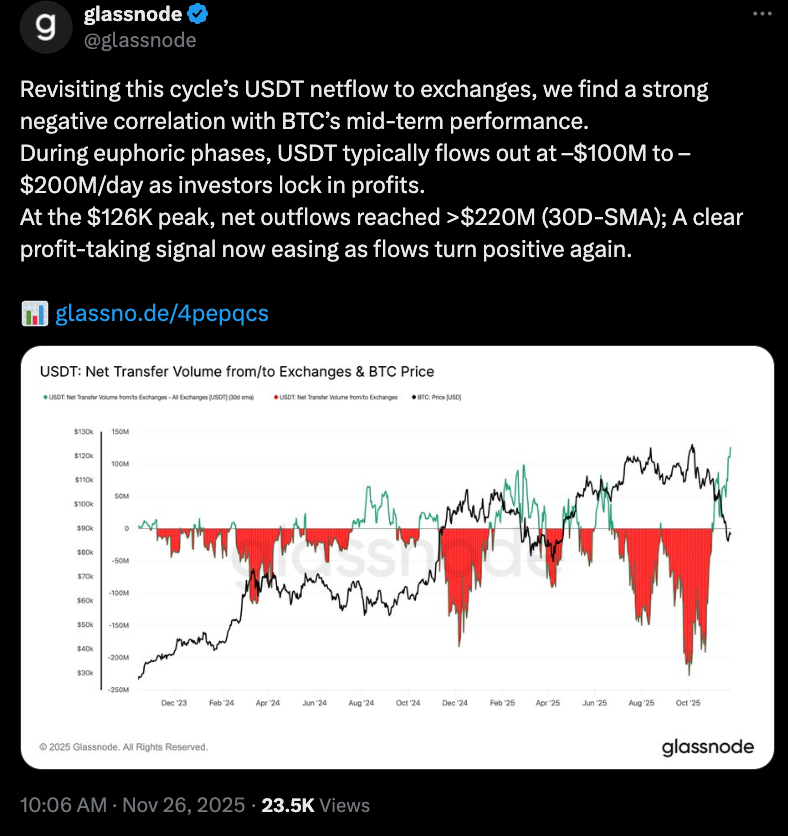

This pattern underscores the symbiotic role stablecoins like USDT play in the broader cryptocurrency ecosystem. Blockchain analytics provider Glassnode highlighted this dynamic in a recent report, noting outflows of $100 million to $200 million per day during peak euphoria. At Bitcoin’s recent high near $126,000 in October, these outflows surpassed $220 million on a 30-day simple moving average, marking a clear profit-taking phase that has since eased as flows normalized.

Source: Glassnode

Glassnode’s analysis, shared via a Wednesday post on X, compared Bitcoin’s price trajectory with USDT net flows starting from December 2023. The findings emphasize how these movements provide actionable insights for traders monitoring market sentiment. As the world’s largest cryptocurrency by market cap at approximately $1.8 trillion, Bitcoin’s interplay with USDT—the third-largest token at $184 billion—illustrates the stabilizing yet influential force of stablecoins in volatile markets.

Earlier observations from Whale Alert in April further corroborated this trend. Their data showed a distinct pattern where the USDT issuer mints new tokens during Bitcoin bull runs to meet liquidity demands and burns them during corrections to maintain peg stability. This correlation not only reflects investor behavior but also highlights the operational mechanics of stablecoins in supporting crypto trading volumes.

How Do Stablecoin Flows Influence Bitcoin Adoption?

Stablecoin flows, particularly USDT, play a pivotal role in facilitating Bitcoin adoption by providing a reliable on-ramp for fiat-to-crypto conversions. When net outflows of USDT coincide with Bitcoin price increases, it often indicates heightened trading activity and investor confidence, drawing in new participants to the ecosystem. According to Glassnode, these flows act as a barometer for market phases: euphoric uptrends see aggressive profit realization, while corrections prompt inflows as traders hedge positions.

Supporting data from on-chain metrics reveals that USDT’s supply adjustments align closely with Bitcoin’s volatility. During the December 2023 to present period, periods of sustained Bitcoin gains were met with USDT net outflows averaging 20-30% higher than baseline levels. Experts note that this mechanism enhances liquidity, making Bitcoin more accessible for institutional and retail investors alike. For instance, Tether’s CEO Paolo Ardoino has emphasized the stablecoin’s role in bridging traditional finance with digital assets, citing its compliance with evolving regulations as a key driver.

In practical terms, this correlation aids in risk management. Traders use USDT flow data to anticipate Bitcoin’s short-term fragility, even when overall holder profitability remains high. Glassnode’s report warns of potential reversals when flows turn positive after heavy outflows, as seen post-October peak. This interplay extends beyond trading: stablecoins bolster Bitcoin’s utility in payments and remittances, fostering wider adoption amid favorable regulatory shifts.

The US government’s passage of the GENIUS Act in July established a clear framework for payment stablecoins, directly benefiting issuers like Tether. Ardoino confirmed USDT’s alignment with the law and announced the launch of USAT, a new dollar-pegged stablecoin compliant with GENIUS standards, in September. These developments signal a maturing landscape where stablecoins enhance Bitcoin’s legitimacy and integration into mainstream finance.

Parallel efforts in Bitcoin stockpiling further intertwine these assets. In March, US President Donald Trump signed an executive order to create a digital asset reserve, focusing on seized cryptocurrencies. Although implementation reports indicate reliance on existing holdings without immediate new acquisitions, this policy underscores governmental recognition of Bitcoin’s strategic value. States and federal entities are exploring similar reserves, potentially stabilizing prices and encouraging USDT usage for conversions.

Frequently Asked Questions

What Causes the Negative Correlation Between Bitcoin and USDT Flows?

The negative correlation arises from investor behavior during market cycles. In bull phases, traders convert USDT to Bitcoin or other assets to capture gains, leading to outflows. During corrections, they move back to USDT for safety, increasing inflows. Glassnode data shows this pattern persisting over two years, with daily outflows hitting $220 million at peaks.

How Will US Regulations Impact Bitcoin and Stablecoin Adoption?

US regulations like the GENIUS Act provide clarity for stablecoins, boosting trust and integration. This encourages broader Bitcoin adoption by easing on-ramps via compliant tokens like USDT and USAT. Executive orders for reserves signal long-term commitment, potentially reducing volatility and attracting institutional capital to both assets.

Key Takeaways

- Monitor USDT Flows for Bitcoin Signals: Net outflows often precede price peaks, offering timely profit-taking cues as seen in recent $220 million daily highs.

- Regulatory Tailwinds Drive Growth: The GENIUS Act and reserve initiatives position stablecoins and Bitcoin for increased mainstream use, with Tether adapting via new compliant products.

- Adopt Data-Driven Strategies: Use on-chain analytics from sources like Glassnode to navigate correlations, enhancing trading decisions in this interconnected market.

Conclusion

The Bitcoin USDT correlation exemplifies the intricate dynamics shaping cryptocurrency markets, where stablecoin flows serve as vital indicators of sentiment and liquidity. As regulatory frameworks like the GENIUS Act advance stablecoin adoption and Bitcoin secures governmental backing through reserves, these assets are poised for expanded roles in global finance. Investors should track these trends closely to capitalize on emerging opportunities in this evolving landscape.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC