Bitcoin Briefly Tops $94K Amid Muted Market Response to Fed Rate Cut

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin briefly surpassed $94,000 after a major institutional investment and the US Federal Reserve’s 25-basis-point interest rate cut, yet overall crypto market sentiment remained cautious amid anticipation for broader economic shifts.

-

Bitcoin hit a weekly high of $94,330 following a $962 million acquisition by a leading firm.

-

The Fed’s rate cut provided a temporary lift to risk assets like cryptocurrencies, but gains faded quickly.

-

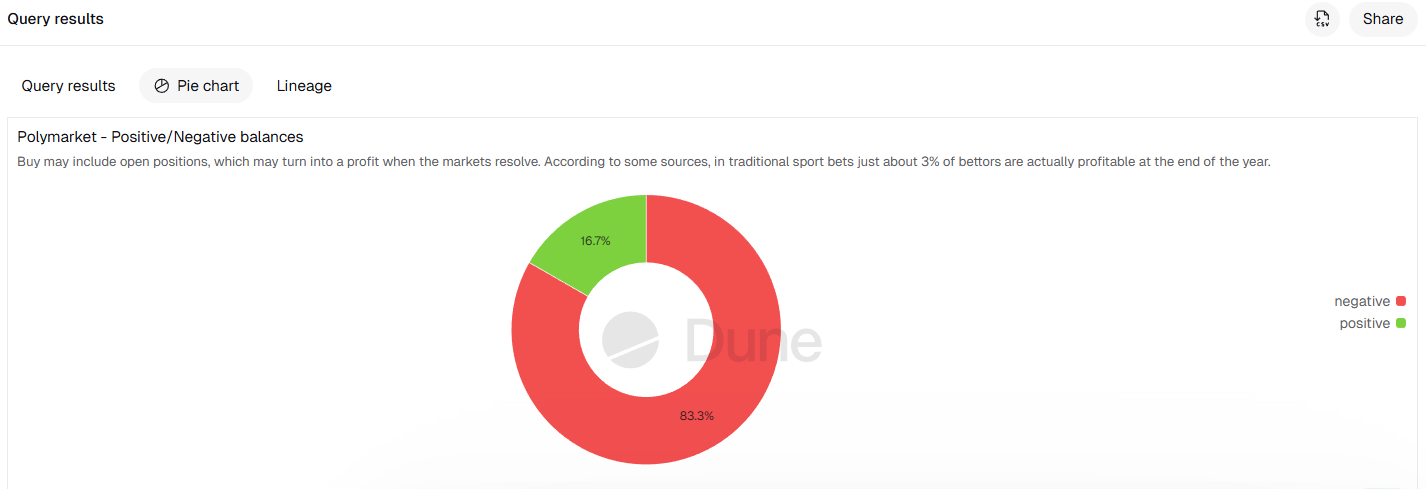

Analysts highlight growing institutional adoption through ETFs and blockchain improvements as key drivers for future growth, with 83% of prediction market users facing losses.

Explore Bitcoin’s brief surge past $94K post-Fed rate cut and crypto’s evolving landscape with institutional inflows and DeFi innovations—stay ahead in 2025’s market dynamics.

What Impact Did the Federal Reserve’s Interest Rate Cut Have on Bitcoin Price?

The Federal Reserve’s interest rate cut led to a short-lived Bitcoin price increase to $94,330, driven by enhanced investor morale from lower borrowing costs. However, the move was anticipated, limiting sustained gains as markets had already priced in the adjustment. Despite this, underlying developments like rising ETF approvals signal long-term potential for cryptocurrency adoption.

How Is the Crypto Industry Approaching Its Netscape Moment?

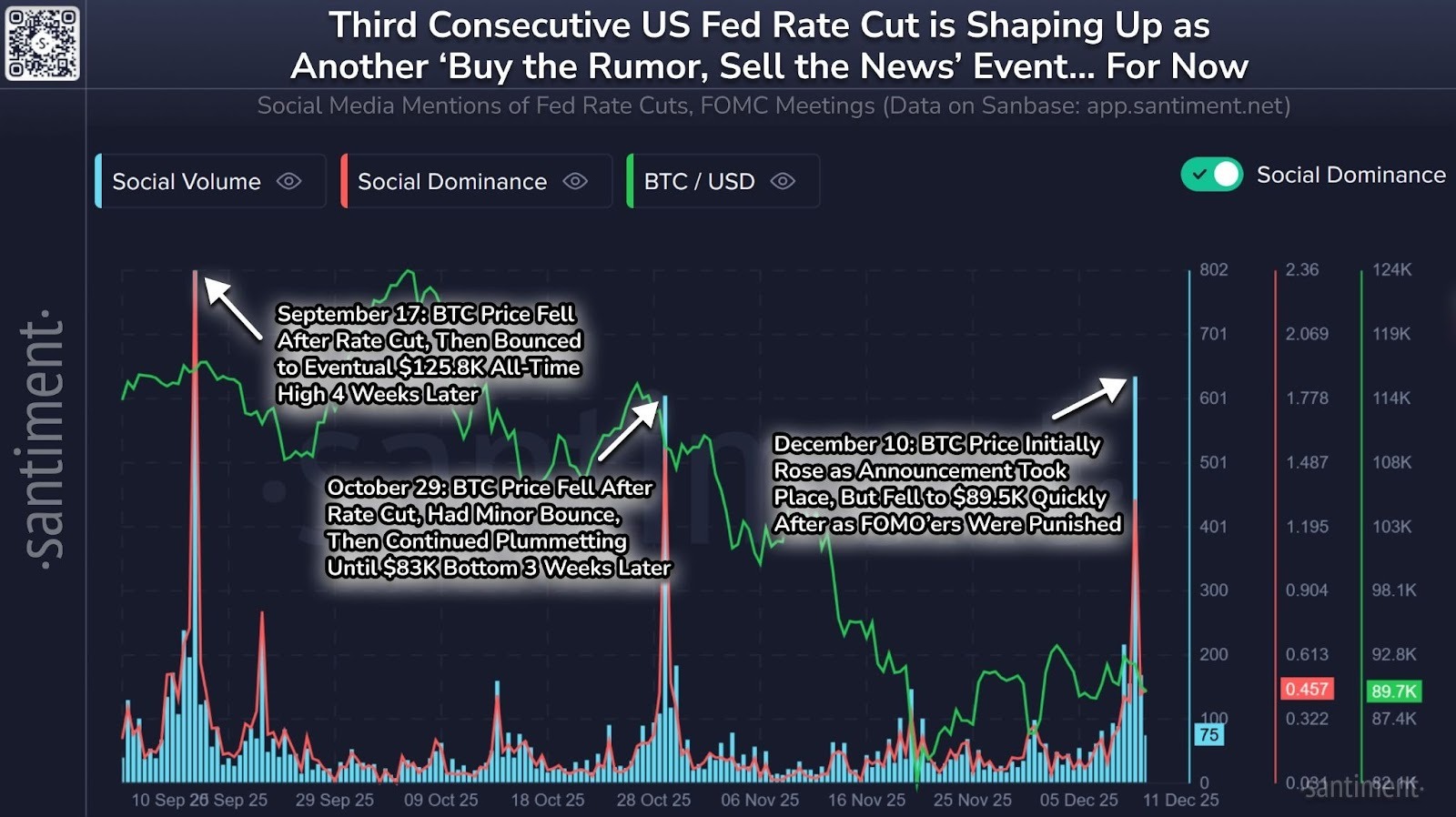

The crypto sector is nearing a transformative phase akin to Netscape’s role in internet adoption, fueled by robust blockchain advancements and regulated products attracting institutions. Paradigm co-founder Matt Huang noted that both institutional and cypherpunk elements are expanding rapidly, potentially mirroring the 1995 browser launch that sparked mass internet use. Microsoft’s later dominance underscores competitive risks, but current ETF growth and on-chain usability improvements position crypto for widespread integration. Data from Santiment shows historic sentiment patterns post-Fed cuts often align with price recoveries over time.

Historic sentiment and price patterns follow Fed rate cuts. Source: Santiment

Frequently Asked Questions

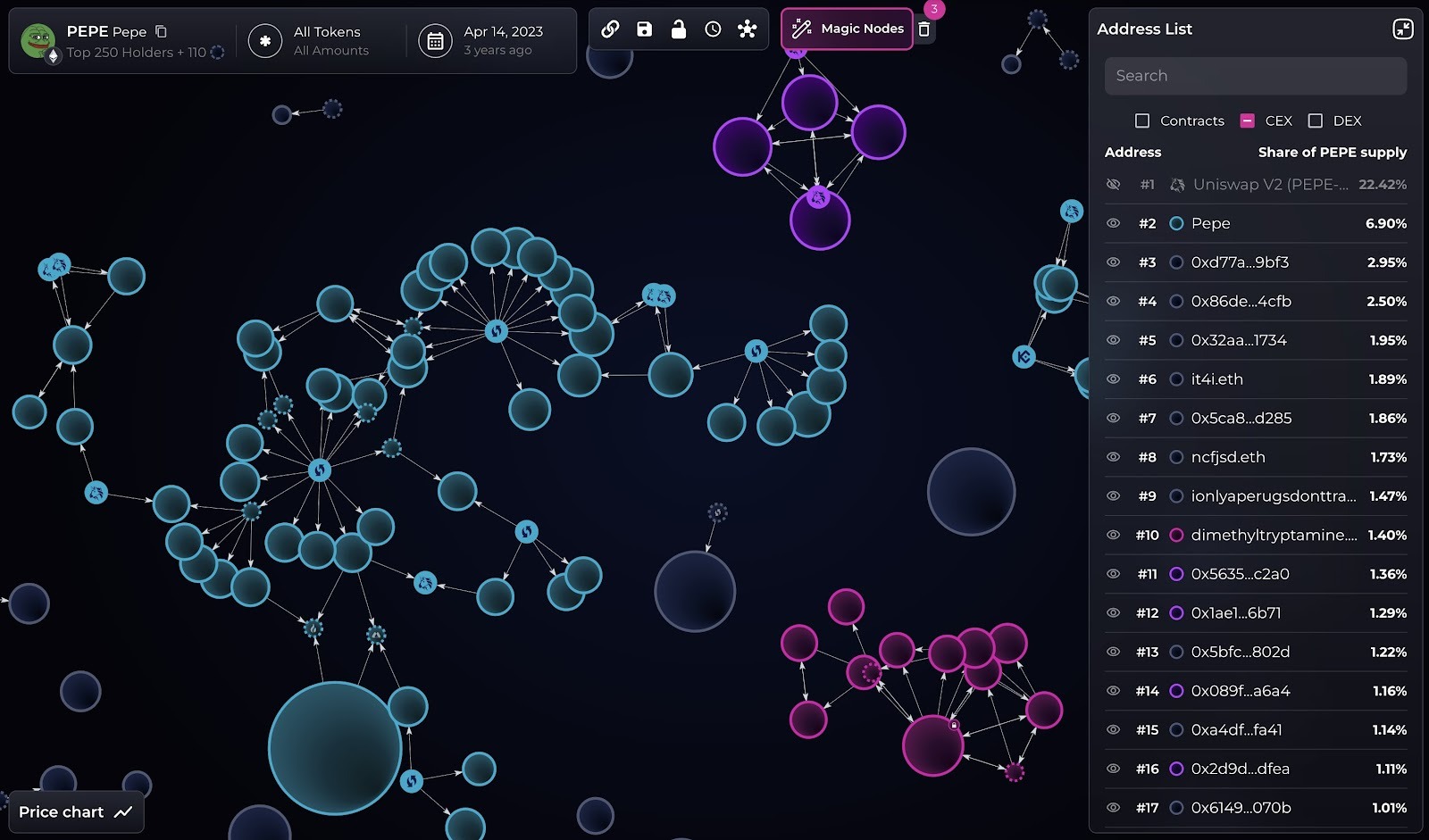

What Caused Doubts About PEPE Memecoin’s Fair Launch?

Blockchain analysis from Bubblemaps revealed that approximately 30% of PEPE’s initial supply was controlled by one entity at its April 2023 launch, contradicting claims of a stealth, presale-free rollout. This concentration led to $2 million in sales shortly after, creating early sell pressure and preventing a push toward $12 billion market cap, raising concerns over transparency for retail investors.

Why Are Retail Traders Losing on Prediction Markets?

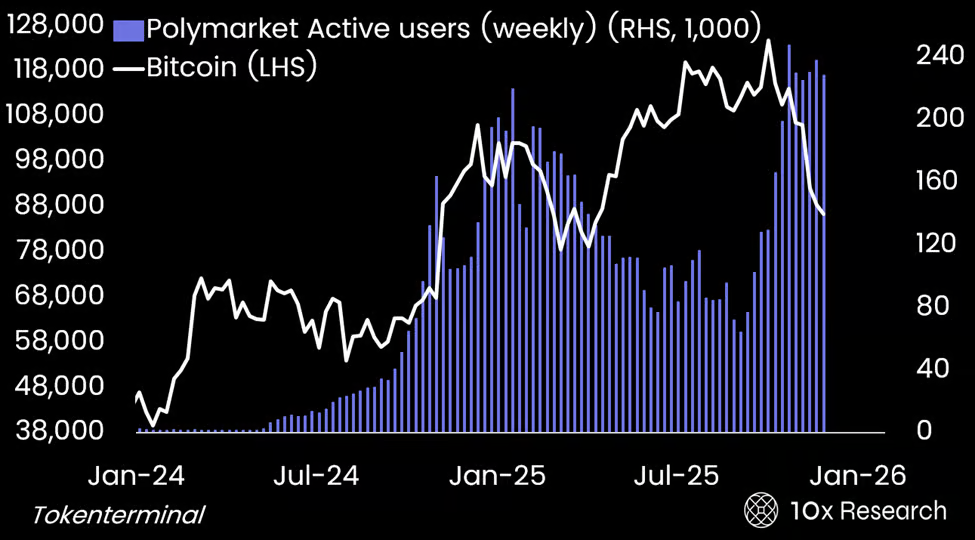

Prediction markets like Polymarket see most participants treating trades like casual bets, chasing excitement over strategy, as outlined in a 10x Research report. Only 16.7% of wallets show profits per Dune data, with an elite group of informed traders exploiting retail inefficiencies through hedging and probability pricing—making it essential for users to approach these platforms with discipline rather than impulse.

Key Takeaways

- Institutional Momentum Builds: A $962 million Bitcoin purchase marked the largest since July 2025, briefly pushing prices above $94,000 amid Fed policy shifts.

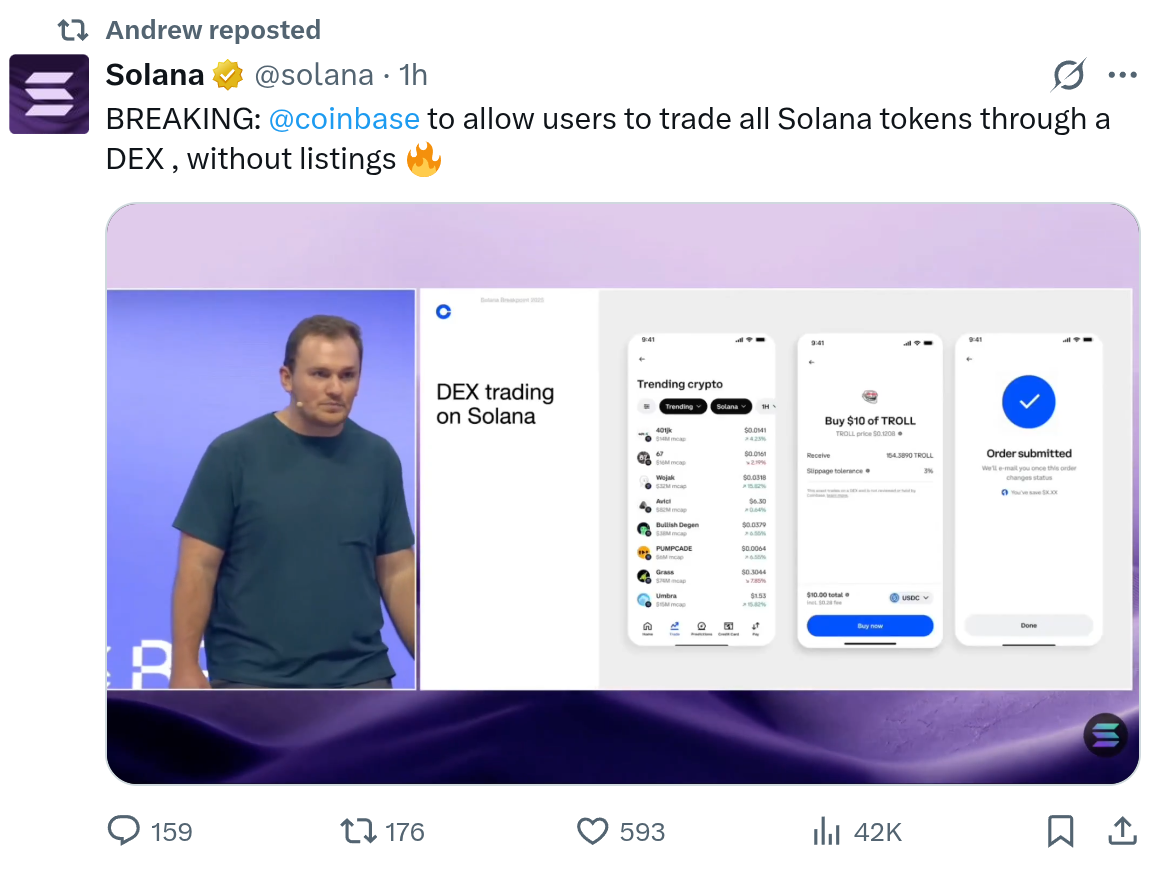

- DeFi and CeFi Convergence: Coinbase’s Solana DEX integration allows seamless access to native tokens without listings, expanding reach for builders and issuers while boosting liquidity.

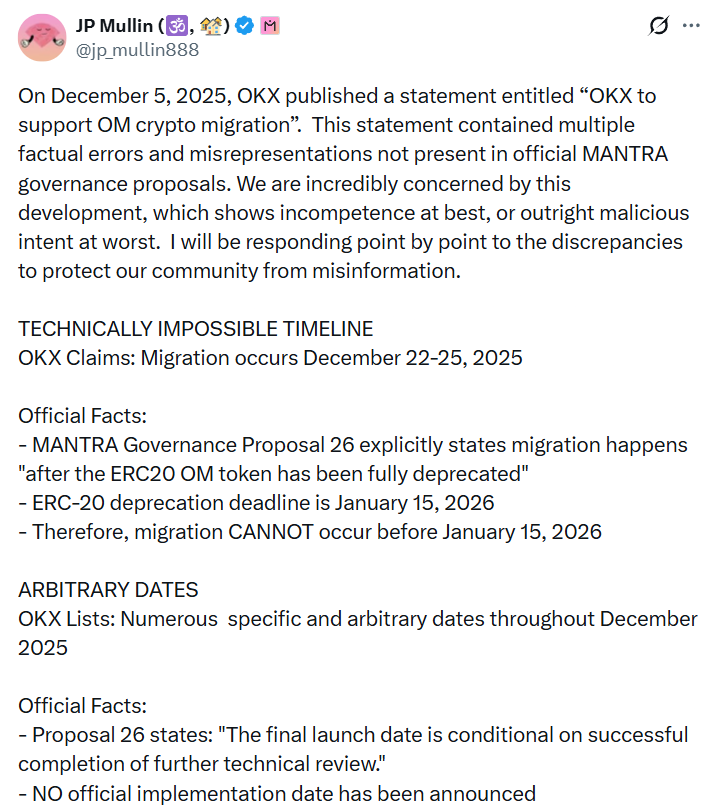

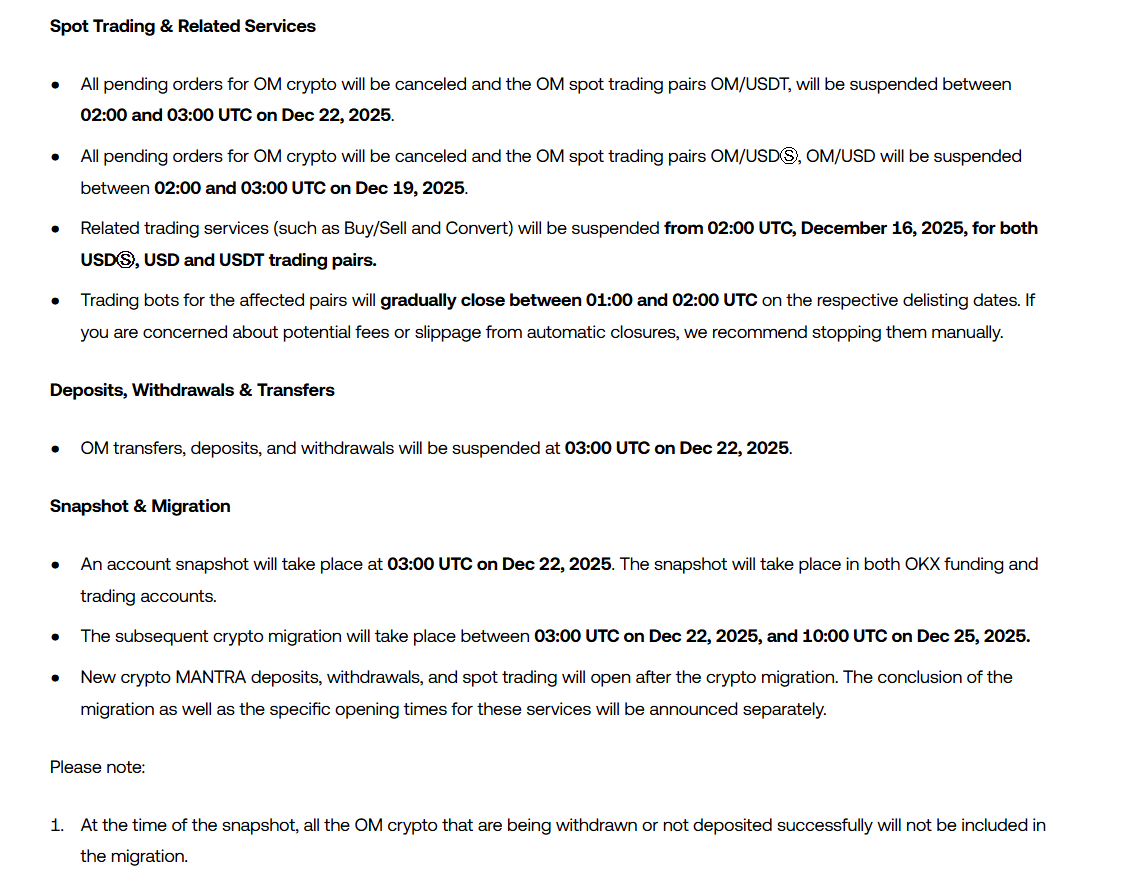

- Risk Awareness Essential: Tensions like Mantra’s dispute with OKX over token migration highlight the need for direct wallet control to avoid intermediary errors during transitions.

Source: Matt Huang

Cryptocurrency markets experienced a mixed week, with Bitcoin’s rally to $94,330 fueled by strategic investments and the anticipated Federal Reserve’s 25-basis-point cut, though enthusiasm waned as the policy was largely priced in. CoinEx analyst Jeff Ko emphasized that while lower rates typically boost risk assets, muted responses reflect broader caution ahead of the final FOMC meeting.

Source: Bubblemaps

Blockchain scrutiny has challenged the fair launch narrative of memecoin PEPE, where data indicates 30% of genesis tokens were bundled under one cluster, enabling heavy early dumps that curbed growth. This revelation underscores the importance of verifiable distribution in memecoin projects aiming for community trust.

Polymarket active users, weekly, Bitcoin left-hand-side price, year-to-date chart. Source: 10x Research

Prediction markets are becoming arenas where elite traders capitalize on retail enthusiasm, with 10x Research reporting that dopamine-driven bets lead to losses for 83% of Polymarket users. Rising participation draws professional desks to exploit informational edges, signaling a maturing yet uneven crypto trading ecosystem.

Polymarket, positive/negative wallet balances. Source: Dune.com

Coinbase’s expansion into Solana via DEX access marks a key step in blending centralized and decentralized finance, enabling millions of users to trade native SOL tokens without traditional listings. Protocol specialist Andrew Allen highlighted how sufficient liquidity now suffices for visibility on the platform, following a similar Base integration and paving the way for multi-chain support.

Source: Andrew Allen/Solana

Mantra’s CEO John Patrick Mullin advised OM token holders to withdraw from OKX due to discrepancies in the exchange’s migration announcement, including incorrect dates conflicting with the project’s January 2026 timeline. The shift from ERC-20 to Mantra Chain-native tokens aims to enhance functionality, but Mullin stressed avoiding reliance on potentially unreliable intermediaries, especially after limited communication since April events; OKX later amended their statement.

Source: JP Mullin

OKX’s OM Crypto Migration post. Source: okx.com

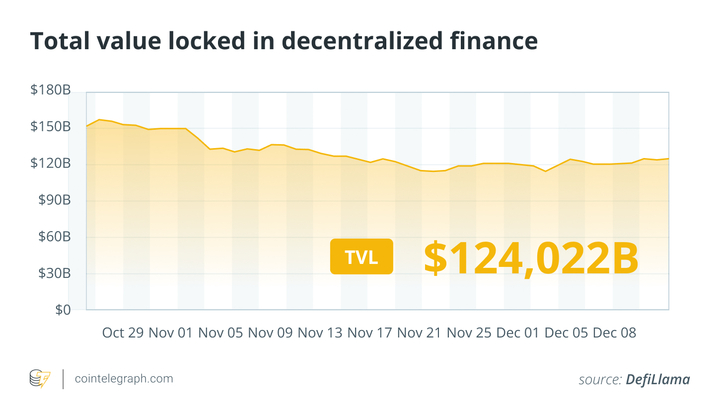

In the broader DeFi landscape, most top 100 cryptocurrencies declined, led by Kaspa’s 13% drop, per Cointelegraph Markets Pro and TradingView data. Total value locked metrics from DefiLlama illustrate ongoing protocol innovations amid market pressures, setting the stage for recovery as infrastructure matures.

Total value locked in DeFi. Source: DefiLlama

Conclusion

As the Federal Reserve’s interest rate cut temporarily elevated Bitcoin price levels without sparking lasting enthusiasm, the crypto industry’s Netscape moment emerges through institutional inflows, DeFi enhancements, and cross-chain integrations like Coinbase’s Solana move. With challenges in memecoin transparency and prediction market dynamics underscoring risks, investors should prioritize verified developments and self-custody—positioning 2025 as a pivotal year for sustainable growth and broader adoption.