Bitcoin Community Calls for JP Morgan Boycott Amid Potential Crypto Index Exclusion

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

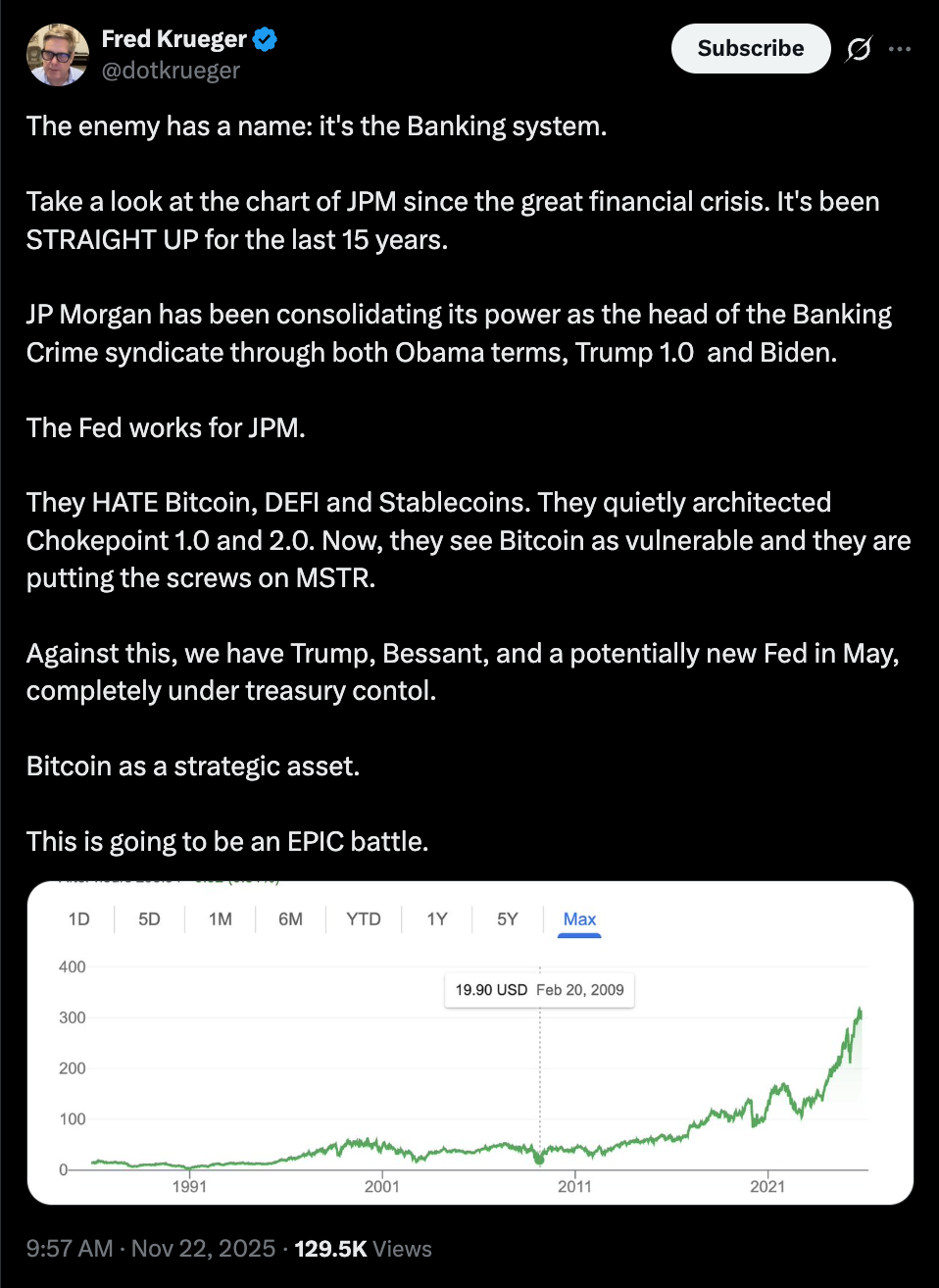

The Bitcoin community is calling for a boycott of JP Morgan after the bank highlighted MSCI’s potential exclusion of crypto treasury companies like MicroStrategy from major indexes starting January 2026, which could lead to forced sell-offs and impact Bitcoin prices.

-

MSCI’s new criteria targets firms with over 50% crypto on balance sheets, risking index removal.

-

Prominent Bitcoin advocates, including Grant Cardone and Max Keiser, are urging users to withdraw funds from JP Morgan.

-

This exclusion may trigger automatic share sell-offs by index-tracking funds, potentially pressuring crypto markets with reduced liquidity.

Discover why Bitcoin holders are boycotting JP Morgan over MSCI’s crypto treasury exclusion. Learn impacts on MicroStrategy and BTC prices. Stay informed on crypto regulations—read more now!

What is the Bitcoin community’s boycott of JP Morgan about?

The Bitcoin community’s boycott of JP Morgan stems from the bank’s report on MSCI’s proposed policy to exclude crypto treasury companies from key market indexes in January 2026. This move targets firms like MicroStrategy that hold significant Bitcoin reserves, potentially forcing sell-offs that could harm digital asset values. Community leaders view JP Morgan’s disclosure as undermining Bitcoin adoption in traditional finance.

How will MSCI’s exclusion affect crypto treasury companies?

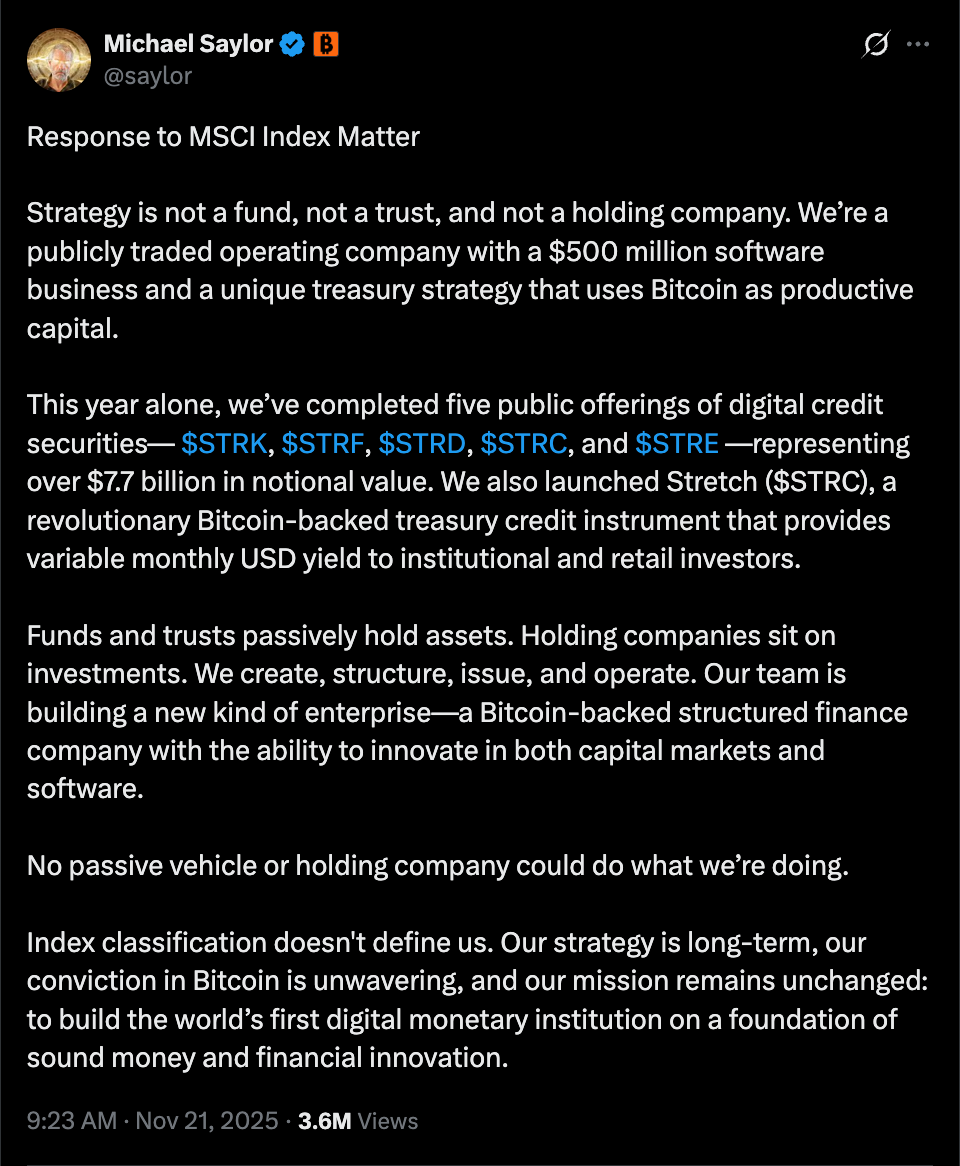

MSCI’s updated listing criteria would bar companies with more than 50% of their balance sheet in cryptocurrencies from inclusion in its indexes. This change, affecting entities like MicroStrategy, could result in substantial outflows from passive investment funds that track these indexes. According to analysts, such exclusions might compel these firms to either divest crypto holdings to meet the threshold or forfeit billions in passive inflows, exacerbating market volatility. For instance, MicroStrategy, which joined the Nasdaq 100 in December 2024, benefits from these flows; losing them could pressure its stock and, by extension, Bitcoin’s price due to correlated selling.

Expert insights from financial reports indicate that index exclusions have historically led to 5-10% immediate drops in affected stocks, based on past cases with high-risk sectors. MicroStrategy’s founder, Michael Saylor, countered the policy by emphasizing that his company operates as a Bitcoin-backed structured finance entity, not merely a passive holder. He stated, “MicroStrategy is not a fund, not a trust, and not a holding company,” highlighting its active role in issuing and managing Bitcoin-related instruments. This perspective underscores the operational differences that the community argues MSCI overlooks.

Source: Fred Krueger

The tension escalated on Sunday as Bitcoin supporters voiced frustration online. Real estate investor Grant Cardone announced he withdrew $20 million from Chase, JP Morgan’s banking arm, citing credit card issues amplified by the index news. Similarly, Bitcoin advocate Max Keiser called to “crash JP Morgan and buy MicroStrategy and BTC,” fueling the boycott momentum across social platforms.

JP Morgan’s research note, which first shared details of MSCI’s forthcoming policy—once known as Morgan Stanley Capital International—sparked the outrage. The note outlined how crypto-heavy treasuries no longer align with traditional index standards, potentially isolating these firms from mainstream institutional capital.

Frequently Asked Questions

Why is MicroStrategy at risk from MSCI’s index changes?

MicroStrategy faces exclusion because over 50% of its balance sheet consists of Bitcoin holdings, exceeding MSCI’s new threshold for treasury composition. This could strip it of index status, leading to sell-offs by funds required to hold only qualifying assets. As a result, the company might need to reduce its crypto exposure to retain passive investment benefits, a move that could dilute its Bitcoin strategy.

What does the JP Morgan boycott mean for Bitcoin investors?

The boycott encourages Bitcoin supporters to shift funds away from JP Morgan toward crypto-friendly alternatives, signaling broader resistance to perceived anti-Bitcoin stances in traditional banking. It highlights growing tensions between legacy finance and digital assets, potentially boosting awareness of Bitcoin’s role in corporate treasuries while pressuring banks to adapt to crypto integration.

Source: Michael Saylor

Key Takeaways

- MSCI’s Policy Shift: Targets crypto treasury firms with heavy Bitcoin exposure, set for implementation in January 2026, to maintain index standards.

- Community Response: High-profile figures like Grant Cardone and Max Keiser are leading calls to boycott JP Morgan, citing its role in amplifying the exclusion news.

- Market Implications: Potential forced sell-offs could drive down Bitcoin prices; investors should monitor corporate treasury adjustments for volatility cues.

Conclusion

The Bitcoin community’s boycott of JP Morgan over MSCI’s crypto treasury exclusion reflects deepening divides between traditional finance and digital assets. With companies like MicroStrategy at the forefront, this development could reshape how crypto integrates into corporate balance sheets. As passive flows hang in the balance, stakeholders should prepare for increased scrutiny—consider diversifying holdings and staying updated on regulatory shifts in the evolving crypto landscape.