Bitcoin Consolidates Near $80K U.S. ETF Cost Basis as Inflows Show Long-Term Strength

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

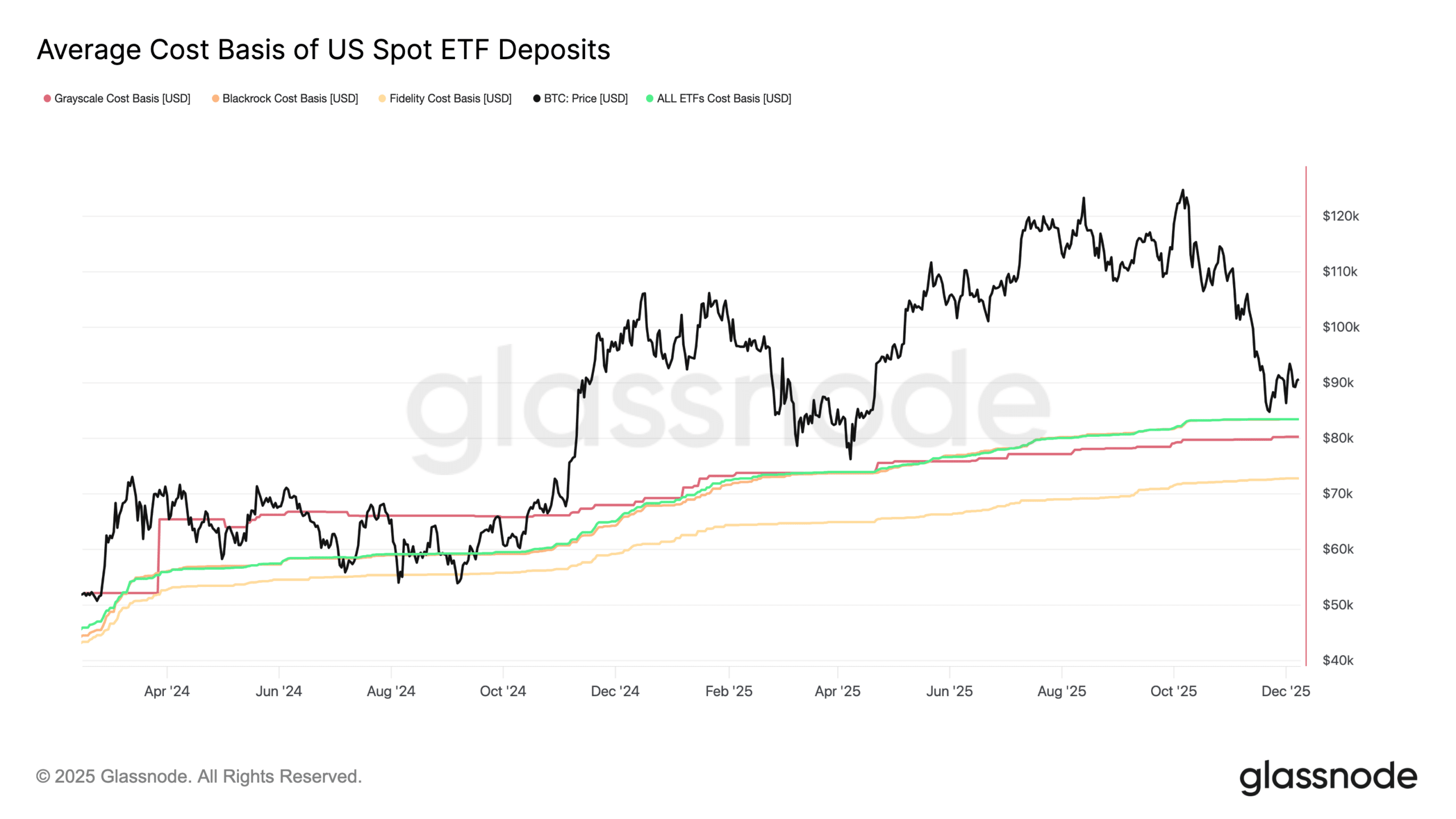

The average cost basis for U.S. spot Bitcoin ETFs has clustered around $80,000, according to Glassnode data, with most holdings still in unrealized profit despite recent price dips. This reflects steady institutional accumulation throughout 2025.

-

ETF cost basis rises to $80,000: Glassnode analysis highlights institutional long-term holding patterns.

-

Daily net outflows reached $60.48 million on December 8, per SoSoValue, amid price consolidation.

-

Cumulative inflows hit $57.56 billion, representing 6.5% of Bitcoin’s market cap in ETF assets.

Discover the latest on Bitcoin ETF cost basis at $80,000 and its impact on market dynamics. Explore institutional inflows and price trends for informed crypto investment decisions today.

What is the current average cost basis for U.S. spot Bitcoin ETFs?

Bitcoin ETF cost basis for U.S. spot products now averages around $80,000, based on Glassnode’s on-chain metrics. This figure clusters deposits from major providers, with Grayscale at a slightly higher level and Fidelity marginally below. Despite a recent market pullback, the majority of ETF-held Bitcoin remains in unrealized profit, underscoring resilient institutional positioning.

How have recent Bitcoin ETF inflows influenced this cost basis?

Glassnode data indicates the cost basis has steadily climbed throughout 2025 due to consistent institutional inflows, rather than short-term trading. Cumulative net inflows stand at $57.56 billion, pushing total ETF assets to $118.50 billion—equivalent to about 6.5% of Bitcoin’s total market capitalization. This accumulation strategy demonstrates long-term commitment from investors, as evidenced by SoSoValue’s ETF dashboard, which reported modest daily outflows of $60.48 million on December 8 during a consolidation phase.

The shift toward institutional balance sheets reshaping Bitcoin’s price structure is clear. Unlike retail-driven volatility or futures leverage, ETF holders are prioritizing accumulation over speculation. Experts note that this level of engagement signals maturing market infrastructure, with on-chain metrics showing reduced sensitivity to short-term price swings.

New Glassnode data reveals the average cost basis of U.S. spot Bitcoin ETF deposits is now clustered around $80,000, with Grayscale slightly higher and Fidelity marginally lower.

Despite the recent market pullback, this indicates that most ETF-held Bitcoin remains in unrealized profit territory.

The cost basis for ETFs has steadily increased throughout the year, reflecting continuous institutional inflows and long-term accumulation rather than short-term speculative repositioning.

Source: Glassnode

Frequently Asked Questions

What does the $80,000 Bitcoin ETF cost basis mean for long-term holders?

The $80,000 average cost basis for U.S. spot Bitcoin ETFs signals strong unrealized profits for institutions, even amid consolidation. Glassnode metrics show this level supports bid pressure during dips, encouraging sustained accumulation over liquidation, as seen in 2025’s inflow trends.

Are Bitcoin ETF outflows signaling a market reversal?

No, recent outflows of $60.48 million on December 8 represent temporary cooling, not a reversal. SoSoValue data confirms cumulative inflows of $57.56 billion remain robust, with ETF assets at 6.5% of Bitcoin’s market cap, pointing to enduring institutional demand.

Fresh ETF dashboard figures from SoSoValue show – $60.48m in daily net outflows on 8 December, a modest reversal during a period of price consolidation.

However, cumulative inflows remain substantial at $57.56 billion, and total net assets held by U.S. spot ETFs now stand at $118.50 billion—about 6.5% of Bitcoin’s market cap.

That scale suggests Bitcoin’s price structure is increasingly shaped by institutional balance sheets, rather than only retail sentiment or futures leverage.

Key Takeaways

- Cost Basis at $80,000: Glassnode data positions most ETF Bitcoin in profit, bolstering institutional resilience.

- Modest Outflows Amid Strength: Daily nets of -$60.48 million on December 8 contrast with $57.56 billion total inflows, per SoSoValue.

- Institutional Influence Grows: ETFs hold 6.5% of Bitcoin’s market cap, stabilizing prices through long-term holding.

Conclusion

The Bitcoin ETF cost basis around $80,000, as tracked by Glassnode, highlights the deepening role of institutions in stabilizing Bitcoin’s market amid 2025’s dynamics. With substantial inflows and assets nearing 6.5% of total market cap, recent outflows appear as healthy consolidation rather than weakness. Investors should monitor price action near this threshold for potential support, positioning for continued growth in the ETF landscape.

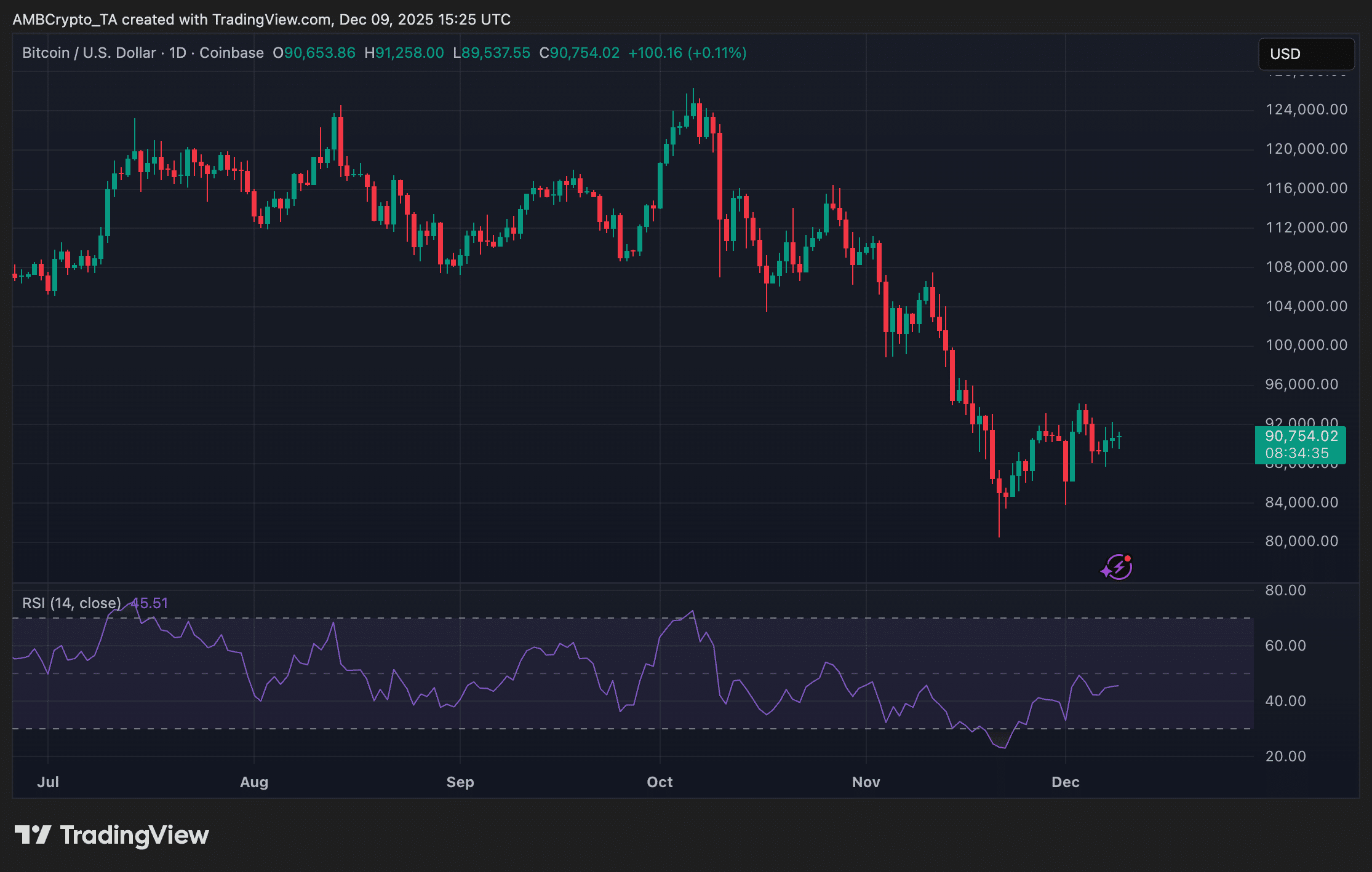

Bitcoin is trading near $90,700 at press time, only a short distance above the ETF cost basis zone. The current price action exhibits sideways movement following last month’s steep decline, with the RSI near neutral levels.

If Bitcoin tests the $80K region again, that would bring the price directly into the institutional breakeven layer. This level has historically attracted structural bid support.

Source: TradingView

Conversely, a decisive move back above $95K would pull the price away from that threshold and restore the margin cushion for ETFs.

Institutional holders have built up a large supply base at relatively high prices.

If Bitcoin continues to consolidate near those levels without triggering heavy outflows, it reinforces the idea that U.S. ETFs are functioning as long-horizon holders rather than fast-moving capital.