Bitcoin Could Plunge Below $50K If Not Quantum-Resistant by 2028, Warns Capriole Founder

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The quantum computing threat to Bitcoin could lead to a price drop below $50,000 by 2028 if the network fails to implement quantum-resistant upgrades, according to Capriole Investments founder Charles Edwards.

-

Bitcoin’s vulnerability stems from its reliance on elliptic curve cryptography, which quantum computers could potentially break.

-

Experts like Charles Edwards urge immediate action to develop post-quantum solutions to safeguard user funds.

-

Historical data shows Bitcoin halvings and market cycles often precede major upgrades, with quantum resistance eyed for 2026 rollout.

Discover the Bitcoin quantum computing threat and why upgrades by 2026 are crucial to prevent a massive bear market. Stay ahead with expert insights on protecting your crypto investments today.

What is the Quantum Computing Threat to Bitcoin?

The quantum computing threat to Bitcoin refers to the potential for advanced quantum computers to crack the cryptographic algorithms securing the Bitcoin network, such as ECDSA for private keys. This could expose wallets and transactions to theft, undermining trust in the cryptocurrency. According to Charles Edwards, founder of quantitative Bitcoin fund Capriole Investments, without quantum-resistant measures in place by 2028, Bitcoin’s price might fall below $50,000, triggering a severe market downturn.

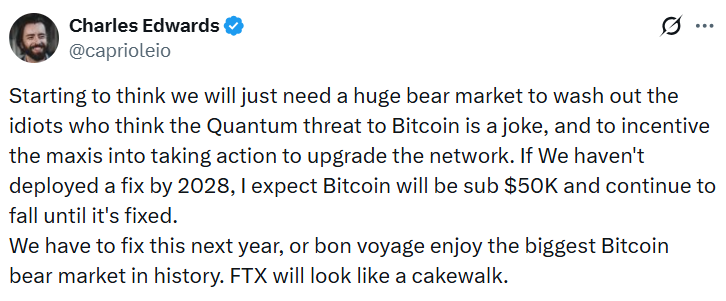

Source: Charles Edwards

The debate around this threat has intensified as quantum technology advances, with proponents arguing it poses an existential risk to blockchain security. Bitcoin’s proof-of-work consensus and SHA-256 hashing are considered more resilient compared to its signature scheme, but the overall ecosystem remains vulnerable. Edwards, in a recent statement shared on X (formerly Twitter), emphasized the need for a “huge bear market” to spur action among Bitcoin maximalists and developers. He stated, “Starting to think we will just need a huge bear market to wash out the idiots who think the Quantum threat to Bitcoin is a joke, and to incentivize the maxis into taking action to upgrade the network.” This highlights the urgency, as delays could lead to irreversible damage.

Quantum computers leverage qubits to perform calculations exponentially faster than classical systems, potentially solving problems like integer factorization and discrete logarithms in minutes—what takes supercomputers years. For Bitcoin, this means deriving private keys from public addresses, allowing malicious actors to drain funds. While current quantum machines, such as those from IBM or Google, are far from this capability, projections suggest scalable systems could emerge within the decade. Edwards predicts, “If we haven’t deployed a fix by 2028, I expect Bitcoin will be sub $50K and continue to fall until it’s fixed.” This warning aligns with broader industry concerns, drawing parallels to past vulnerabilities like the 2010 overflow bug that exposed early Bitcoin flaws.

How Soon Must Bitcoin Implement Quantum-Resistant Upgrades?

The timeline for addressing the quantum computing threat to Bitcoin is tight, with experts like Charles Edwards advocating for a full “quantum patch” rollout by 2026 to avert disaster. He warns that failure to act could result in the “biggest Bitcoin bear market in history,” dwarfing events like the FTX collapse. Supporting data from quantum research labs indicates that fault-tolerant quantum computers with over one million qubits might be feasible around 2030, but conservative estimates push viable threats closer to 2028.

Critics, including some in the financial sector, downplay the immediacy, noting that quantum tech is still nascent and traditional institutions like banks are prime targets first, as they hold larger sensitive data troves. However, Edwards counters that Bitcoin’s decentralized nature and immutable ledger make it uniquely exposed—unlike banks, which can reverse fraudulent transactions or employ multi-factor safeguards. He argues Bitcoin will be “first on the quantum chopping block” because legacy systems are already transitioning to post-quantum cryptography standards outlined by the National Institute of Standards and Technology (NIST).

Source: Charles Edwards

“We have to fix this next year, or bon voyage enjoy the biggest Bitcoin bear market in history. FTX will look like a cakewalk,” Edwards added in his post. To bolster this, he references ongoing research into quantum-safe algorithms like lattice-based cryptography, which could integrate via a Bitcoin soft fork similar to SegWit in 2017. Analyst Willy Woo, a prominent Bitcoin advocate, proposed a temporary mitigation: holding funds in SegWit wallets for about seven years post-quantum breakthrough, as older addresses would be less targeted initially. Conversely, Bitcoin proponent Michael Saylor dismissed quantum fears in July as a “marketing ploy” to hype quantum-themed tokens, underscoring the divide in the community.

Implementing upgrades requires consensus among miners, nodes, and developers, a process that historically takes years—Taproot activation spanned over four. Post-quantum solutions must balance security with efficiency to avoid bloating transaction sizes, which could raise fees and slow adoption. Institutions like the Quantum Economic Development Consortium have simulated attacks, estimating a 25-qubit quantum computer could crack small keys today, scaling dramatically with more qubits. Edwards’ call to action serves as a wake-up for the ecosystem, emphasizing that proactive migration is key to preserving Bitcoin’s value proposition as digital gold.

Frequently Asked Questions

What are the long-term implications of the quantum computing threat for Bitcoin holders?

The quantum computing threat poses risks to Bitcoin holders by potentially compromising private keys, leading to fund theft and eroded confidence. Long-term, without upgrades, mass sell-offs could depress prices below $50,000 by 2028, as predicted by Capriole’s Charles Edwards. Holders should monitor protocol developments and consider quantum-safe wallets for protection, ensuring diversified storage strategies.

Is Bitcoin’s quantum vulnerability a real concern right now, or is it overhyped?

Bitcoin’s quantum vulnerability is a legitimate concern, though not immediate, as scalable quantum computers are years away. Experts like Charles Edwards stress urgency for 2026 upgrades to prevent market crashes, while skeptics view it as overhyped for now. Preparing through community-driven solutions will keep Bitcoin secure against evolving tech threats.

Key Takeaways

- Urgent Upgrade Needed: Bitcoin must deploy quantum-resistant cryptography by 2026 to avoid a predicted price plunge below $50,000 by 2028.

- Expert Warnings: Charles Edwards of Capriole Investments highlights the need for action, criticizing complacency in the community.

- Community Response: Monitor developments like post-quantum algorithms and consider SegWit wallets as interim safeguards for long-term holdings.

Conclusion

The quantum computing threat to Bitcoin underscores the need for swift innovation in cryptography to maintain its security and value. As Charles Edwards warns, delays could trigger unprecedented market volatility, but proactive measures like NIST-approved algorithms offer a path forward. Investors should stay informed on protocol upgrades, prioritizing quantum-resistant practices to future-proof their portfolios in this dynamic landscape.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026