Bitcoin Decline Signals Potential Memecoin and NFT Slump to 2025 Lows

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Memecoins and NFTs have plunged to their lowest valuations in 2025, with the memecoin market cap dropping to $39.4 billion—a 66% decline from January highs—while NFTs hit $2.78 billion, down 43% in a month, amid broader crypto market losses totaling $800 billion.

-

Memecoin Sector Decline: The combined market capitalization of memecoins fell to $39.4 billion on Friday, shedding over $5 billion in 24 hours despite rising trading volume.

-

NFT Market Slump: Non-fungible tokens reached their lowest valuation since April at $2.78 billion, reflecting reduced demand for digital collectibles.

-

Broader Crypto Impact: The total cryptocurrency market cap decreased from $3.77 trillion to $2.96 trillion in three weeks, with Bitcoin and Ether posting 14.7% and 16% weekly losses, respectively.

Memecoins and NFTs plunge to 2025 lows amid crypto market crash: Discover key losses, top performers, and market insights in this detailed analysis.

What Is Causing the 2025 Plunge in Memecoins and NFTs?

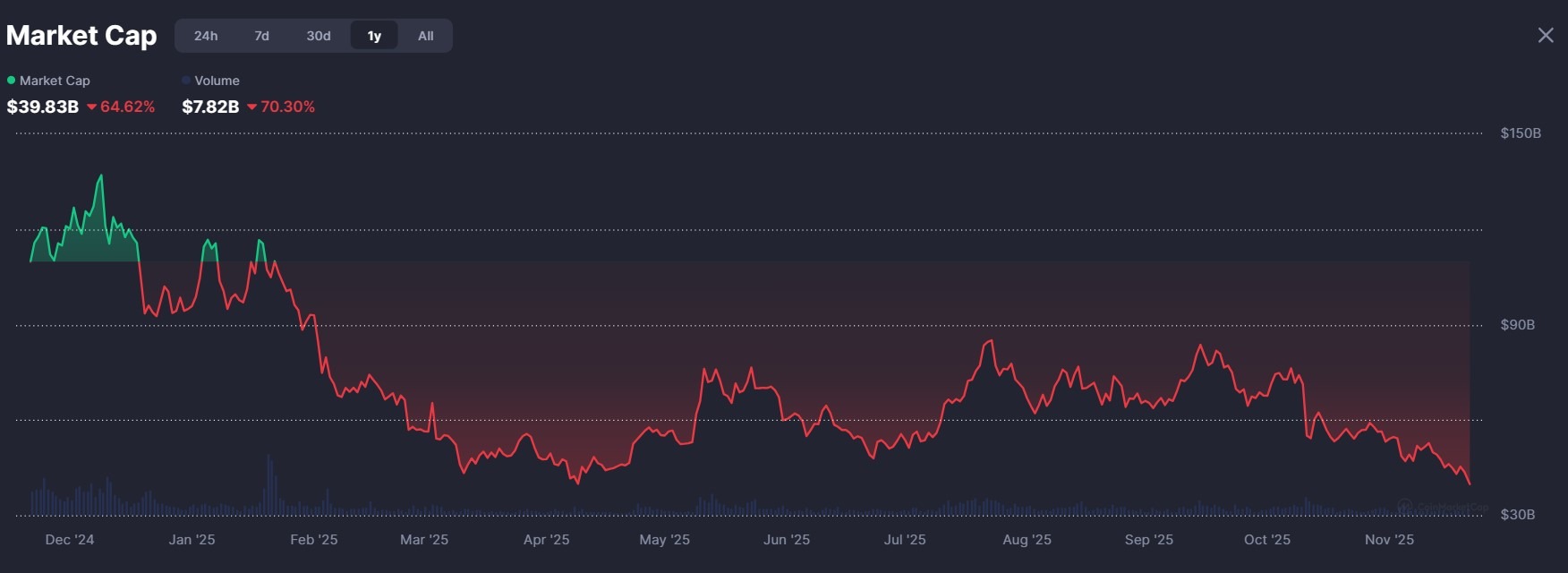

Memecoins and NFTs have experienced a sharp decline in 2025, driven by a broader pullback in speculative crypto assets as investor risk appetite wanes. The memecoin sector’s market capitalization dropped to $39.4 billion on Friday, according to CoinMarketCap data, marking a significant reversal from its January peak of $116.7 billion. This 66.2% drawdown aligns with a $800 billion wipeout in the overall crypto market, from $3.77 trillion on November 1 to $2.96 trillion, as traders shift away from high-volatility investments.

Memecoin market capitalization one-year chart. Source: CoinMarketCap

How Have Top Memecoins Performed in This Decline?

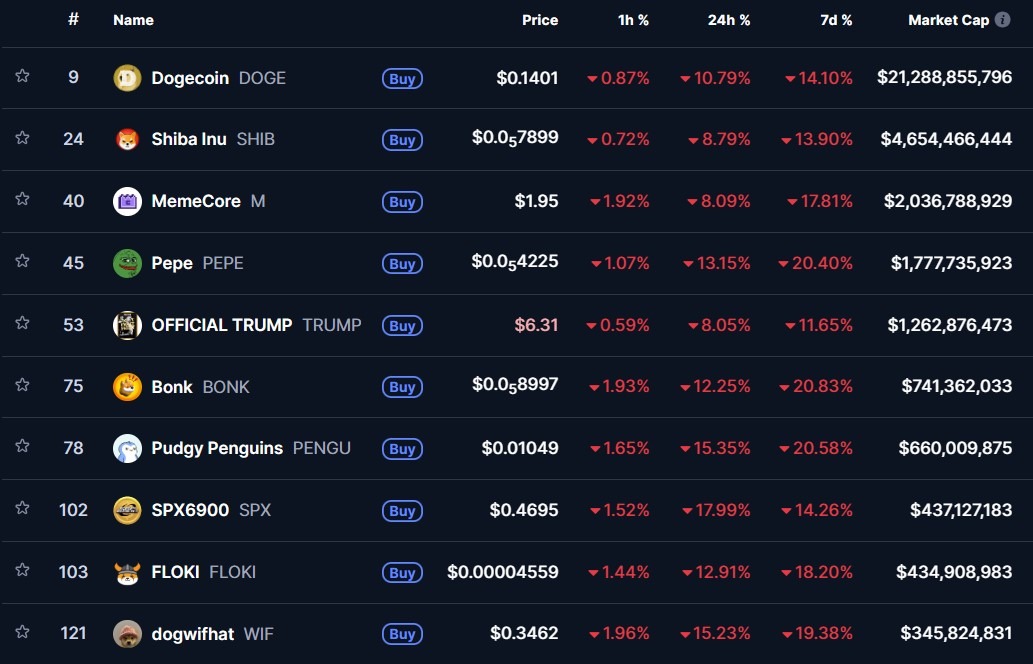

The top memecoins by market capitalization have bled across all timeframes, with double-digit losses signaling diminished sector enthusiasm. Dogecoin (DOGE) and Shiba Inu (SHIB) recorded declines of 14.10% and similar figures over the past week, while more volatile tokens like Pepe (PEPE), Bonk (BONK), and Floki (FLOKI) suffered drops exceeding 20%. Seven-day losses ranged from 11% for less affected assets to over 20% for the hardest-hit, based on CoinMarketCap metrics.

United States President Donald Trump’s Official Trump (TRUMP) memecoin saw the mildest weekly drop at 11.65%, followed closely by SPX6900 at 14.26%. In contrast, Bonk, Pudgy Penguins (PENGU), Pepe, and Dogwifhat (WIF) each lost around 20%, highlighting the uneven but widespread pressure on speculative plays. This broad sell-off, despite a 40% surge in trading volume, underscores a risk-off sentiment among traders, as noted by market analysts tracking on-chain activity.

Trading volume increases often precede volatility spikes, but in this case, they coincided with sharp capitulation. For instance, the memecoin sector’s $5 billion loss in 24 hours reflects liquidations and profit-taking after earlier gains. Experts from platforms like CoinGecko emphasize that such reversals are common in bull cycles when overextended positions unwind, drawing parallels to past crypto winters without predicting future trends.

Top 10 memecoins by market capitalization. Source: CoinMarketCap

Frequently Asked Questions

What Are the Biggest Losers Among Top Memecoins in 2025?

The most significant weekly declines in the memecoin sector hit Bonk, Pudgy Penguins, Pepe, and Dogwifhat, each dropping about 20% over seven days, according to CoinMarketCap. These losses reflect heightened sensitivity to market sentiment shifts, with smaller-cap tokens amplifying broader crypto downturns through leveraged trading and retail outflows.

Why Is the NFT Market at Its Lowest Since April 2025?

The NFT market capitalization has fallen to $2.78 billion, a 43% drop from $4.9 billion a month ago, as demand for digital collectibles cools amid economic uncertainty and rising interest rates. Collections like Hyperliquid’s Hypurr NFTs led the decline with a 41.1% loss, while only Infinex Patrons gained 11.3%, per CoinGecko data. This trend points to a maturing market favoring utility over hype.

Key Takeaways

- Memecoin Market Cap Reversal: From a $116.7 billion peak in January to $39.4 billion now, representing a 66.2% drawdown and highlighting the volatility of hype-driven assets.

- NFT Sector Weakness: Valuations at $2.78 billion mark the lowest since April, with most top collections down 20-40% monthly, except outliers like Infinex Patrons up 11.3%.

- Broader Market Context: Crypto’s total cap loss of $800 billion in three weeks, with BTC at $82,778 and ETH at $2,688, suggests a temporary correction—monitor on-chain metrics for recovery signals.

NFT market capitalization in 2025. Source: CoinGecko

Conclusion

The 2025 plunge in memecoins and NFTs underscores the inherent risks of speculative assets within the crypto ecosystem, with memecoin valuations at $39.4 billion and NFT markets at $2.78 billion reflecting a broader $800 billion sector correction. As Bitcoin and Ether stabilize post-losses, investors should prioritize diversified strategies and await clearer regulatory signals. Stay informed on evolving trends to navigate future opportunities in digital assets effectively.

Both memecoins and NFTs have plunged to their weakest levels since early 2025, with traders pulling back from speculative assets across the board. This downturn, tracked by data from CoinMarketCap and CoinGecko, reveals a market recalibration after months of exuberance. The memecoin sector’s rapid $5 billion loss in 24 hours, even as volumes rose 40%, indicates profit realization and reduced leverage. Similarly, the NFT space’s 43% monthly decline points to waning collector interest, with top collections like Moonbirds and CryptoPunks down 32.7% and 27.1%, respectively.

Bitcoin’s 14.7% weekly drop to $82,778 and Ether’s 16% fall to $2,688 exemplify the interconnected nature of crypto markets, where blue-chip assets influence altcoin and derivative sectors. Analysts observe that such corrections often follow overheated rallies, as seen in the memecoin peak on January 5. For NFTs, the shift away from pure speculation toward projects with real-world utility, like Infinex Patrons’ 11.3% gain, may define long-term survivors.

Market participants should note the resilience of certain assets, such as Autoglyphs’ mere 1.9% loss among NFTs, which held steady amid the storm. Overall, this period serves as a reminder of crypto’s cyclical volatility, informed by historical data from platforms like CoinMarketCap. As the ecosystem matures, focus on fundamentals could drive selective recoveries, though no immediate rebound is guaranteed based on current indicators.