Bitcoin Decline Triggers $640 Million in Liquidations Amid Global Yield Pressures

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

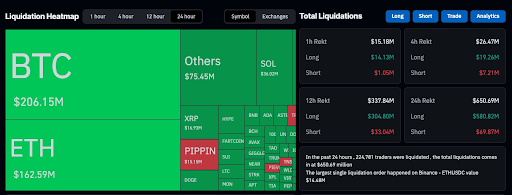

Bitcoin liquidations exceeded $640 million in a single day as the cryptocurrency’s price dropped sharply from $91,500 to $85,610, wiping out leveraged long positions amid surging selling volume and rising global yields.

-

Bitcoin’s sudden 5% decline triggered over 218,000 trader liquidations, with long positions accounting for $565 million in losses.

-

Global market pressures, including Japan’s two-year yield surpassing 1%, prompted institutions to sell risk assets like Bitcoin.

-

Selling volume spiked, breaking key support levels and accelerating a cascade of stop-loss orders and leveraged closures, per Coinglass data.

Bitcoin liquidations hit $640M amid a sharp price drop in December 2025, driven by global yields and heavy long exposure. Discover the key factors and market impacts—stay informed on crypto volatility today.

What Caused the $640 Million Bitcoin Liquidations in December 2025?

Bitcoin liquidations surged to over $640 million following a rapid price decline from weekend stability around $91,500 to $85,610 on exchanges like Binance. This drop, occurring in just four hours on Monday, erased recent gains and triggered widespread closures of leveraged positions. Analysts attribute the event to a spike in selling volume and external pressures like rising global yields, without a single clear catalyst.

How Did Long Positions Dominate the Liquidation Wave?

The liquidation event heavily impacted long traders, who held optimistic positions betting on continued upside. Data from Coinglass indicates that long liquidations totaled $565.56 million over 24 hours, compared to just $74.78 million for shorts. This imbalance reflects the market’s prior bullish lean, with over 218,000 traders affected as prices broke below key support levels. In the final 12 hours alone, $546.80 million in long positions were wiped out, accelerating the downturn through cascading stop-loss triggers. Experts from The Kobeissi Letter noted that structural fragility in the derivatives market amplified the speed of these closures, though broader Bitcoin fundamentals remained intact.

Bitcoin’s sharp decline triggered over $640 million in liquidations, with long traders absorbing most losses as global market pressure grew.

- Bitcoin’s sudden decline from weekend stability caused a rapid liquidation wave, clearing leveraged long positions as selling volume surged sharply on Monday.

- Coinglass recorded over 218,000 liquidated traders in 24 hours, with long positions dominating losses amid fast market movement and broken support areas.

- Rising global yields pressured risk assets, with institutions selling Bitcoin as stop-loss triggers and leveraged closures accelerated the downward momentum.

Bitcoin began the week with renewed volatility as the asset slipped from weekend stability and moved sharply lower. The sudden decline erased earlier gains and created widespread liquidations across leveraged positions within a short period.

Market Breaks After Weekend Stability

During the weekend, Bitcoin traded around the $91,500 mark, with some attempts by traders to break through resistance at the $93,000 level. The price then settled into a period of uncertainty as traders awaited an indication of which way the market was going to move in the final days of the month. On Monday, Bitcoin’s stability ended when it dropped almost 5% in four hours to $85,610 on Binance.

The decline followed the asset’s first green weekly close in four weeks, recorded at $90,360. Market watchers observed that this reversal emerged despite the absence of a clear positive or negative catalyst. The Kobeissi Letter later noted that a spike in selling volume created a fast shift in momentum. They stated that the pressure accelerated as leveraged positions unwound.

Analysts also suggested that structural market fragility contributed to the scale of the drop. Despite this, they stated that the move did not show a change in the broader fundamentals. The rapid shift created immediate stress across the derivatives market as traders reacted to the volatility.

The $640 million in Bitcoin liquidations underscores the risks of high leverage in volatile markets. As institutions adjusted portfolios amid higher borrowing costs signaled by Japan’s yields, the event highlighted interconnected global financial influences on cryptocurrency pricing.

Frequently Asked Questions

What triggered the massive Bitcoin liquidations in late 2025?

The primary trigger was a sharp 5% price drop from $91,500 to $85,610 in four hours, fueled by surging selling volume and broken support levels. Over 218,000 traders faced closures, with long positions hit hardest at $565 million, according to Coinglass reports on December 1, 2025.

Why did rising global yields impact Bitcoin prices and liquidations?

Rising global yields, such as Japan’s two-year yield exceeding 1%, increased borrowing costs and prompted institutions to offload risk assets like Bitcoin. This selling pressure broke technical supports, triggering stop-losses and over $640 million in liquidations, as explained by market commentator 0xNobler.

Data from Coinglass showed that more than 218,000 traders experienced liquidations within one day. Total losses reached $640.34 million as price pressure intensified. A large share of the liquidations occurred in the final 12 hours, amounting to $579.11 million.

Long exposure accounted for $546.80 million within that same period. Short trades contributed $32.31 million in liquidations. Over the full 24-hour window, long liquidations reached $565.56 million, while shorts accounted for $74.78 million. This wide difference reflected how heavily traders had leaned toward upside continuation.

Long Liquidations Dominate the Downturn

Key Takeaways

- Leverage Risks Amplified Losses: Over $565 million in long liquidations showed how leveraged positions can cascade during sudden drops, affecting 218,000 traders.

- Global Yields Influence Crypto: Japan’s yield rise above 1% led institutions to sell Bitcoin, breaking supports and fueling the $640 million event.

- Monitor Fundamentals Amid Volatility: Despite the downturn, analysts affirm no fundamental shifts, advising traders to track volume and yield indicators for future moves.

Broader Conditions Add Pressure to Bitcoin

0xNobler pointed to rising global yields as one factor shaping sentiment. Japan’s two-year yield moved above 1%, suggesting higher borrowing costs. According to the commentary, institutions reacted by selling risk assets, including Bitcoin, during the session. The move lowered support levels and triggered a wave of stop-loss orders.

🚨 WHY IS BITCOIN DUMPING?

JAPAN’S 2-YEAR YIELD JUMPED ABOVE 1%, SIGNALING HIGHER BORROWING COSTS AND PRESSURING GLOBAL MARKETS.

LARGE INSTITUTIONS STARTED SELLING RISK ASSETS, INCLUDING $BTC.

THE DROP BROKE SUPPORT, TRIGGERED STOP-LOSSES, AND FORCED LONG LIQUIDATIONS. pic.twitter.com/QJ4Z71bEED

— 0xNobler (@CryptoNobler) December 1, 2025

As the market shifted, technical levels failed to hold during the decline. The break in support fueled cascading liquidations that expanded with each hour. Traders with high leverage saw positions closed rapidly as the market pushed downward.

The downturn unfolded without any single news driver. Analysts noted that structural weakness and an overloaded long market created the conditions for an accelerated drop. As the session ended, liquidation totals and volume spikes reflected the broad pressure across the crypto market.

Conclusion

The $640 million Bitcoin liquidations in December 2025 exemplify how external factors like rising global yields can intersect with internal market dynamics, such as heavy long exposure, to drive sharp volatility. While the event tested trader resilience, it did not alter core Bitcoin fundamentals, with experts from Coinglass and The Kobeissi Letter emphasizing ongoing strength. As yields stabilize and sentiment recovers, investors should prepare for continued fluctuations—consider diversifying strategies to navigate future crypto market pressures effectively.