Bitcoin Dips Below $100K: Whales and Institutions May Stabilize Market

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s price has dipped below $100,000 amid retail selling pressure, with analysts pointing to whales and institutional investors as key players to stabilize the market and potentially drive recovery in 2025. On-chain data shows reduced whale activity, but structural fundamentals remain strong for long-term holders.

-

Retail investors are offloading Bitcoin holdings, transferring assets to larger whales and institutions during the current dip below $100,000.

-

Bitcoin futures data indicates declining whale participation, with retail transactions dominating but failing to sustain upward momentum.

-

Options pricing suggests a 30% chance of Bitcoin closing above $100,000 by year-end, with support levels at $85,000 and deeper demand around $75,000-$80,000, per CoinMarketCap data.

Discover why Bitcoin is struggling below $100,000 in 2025 and how whales and institutions could end the sell-off. Explore on-chain insights and expert analysis for informed investment decisions—stay ahead in crypto markets today.

What is Causing Bitcoin’s Price to Dip Below $100,000 in 2025?

Bitcoin’s price dip below $100,000 stems primarily from retail investors selling off holdings amid market uncertainty, with on-chain metrics revealing a shift in ownership to whales and institutional buyers. Analysts from CryptoQuant note that this redistribution could stabilize prices, as larger holders typically provide long-term support. While short-term volatility has risen, fundamental adoption trends suggest resilience in the broader ecosystem.

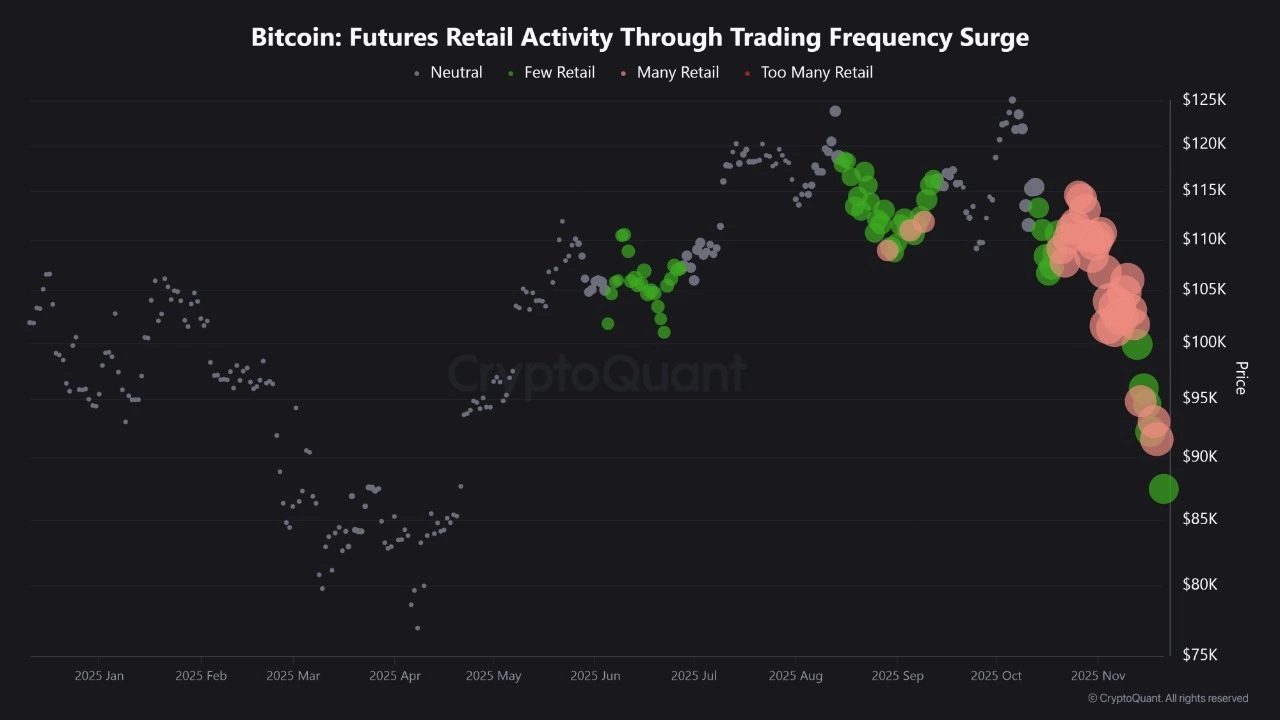

Bitcoin futures trading activity level tracked through trading frequency surges. Source: CryptoQuant

Bitcoin futures trading activity level tracked through trading frequency surges. Source: CryptoQuantHow Are Whales Responding to Retail Selling in the Bitcoin Market?

Whales, defined as large Bitcoin holders with significant influence, are showing signs of fatigue in absorbing retail sales, according to CryptoQuant’s analysis of Bitcoin futures metrics. The average order size in futures trading has decreased, signaling reduced participation from these major players, while retail-driven transactions continue to dominate. This imbalance has led to a neutral market environment with lower overall activity compared to recent months.

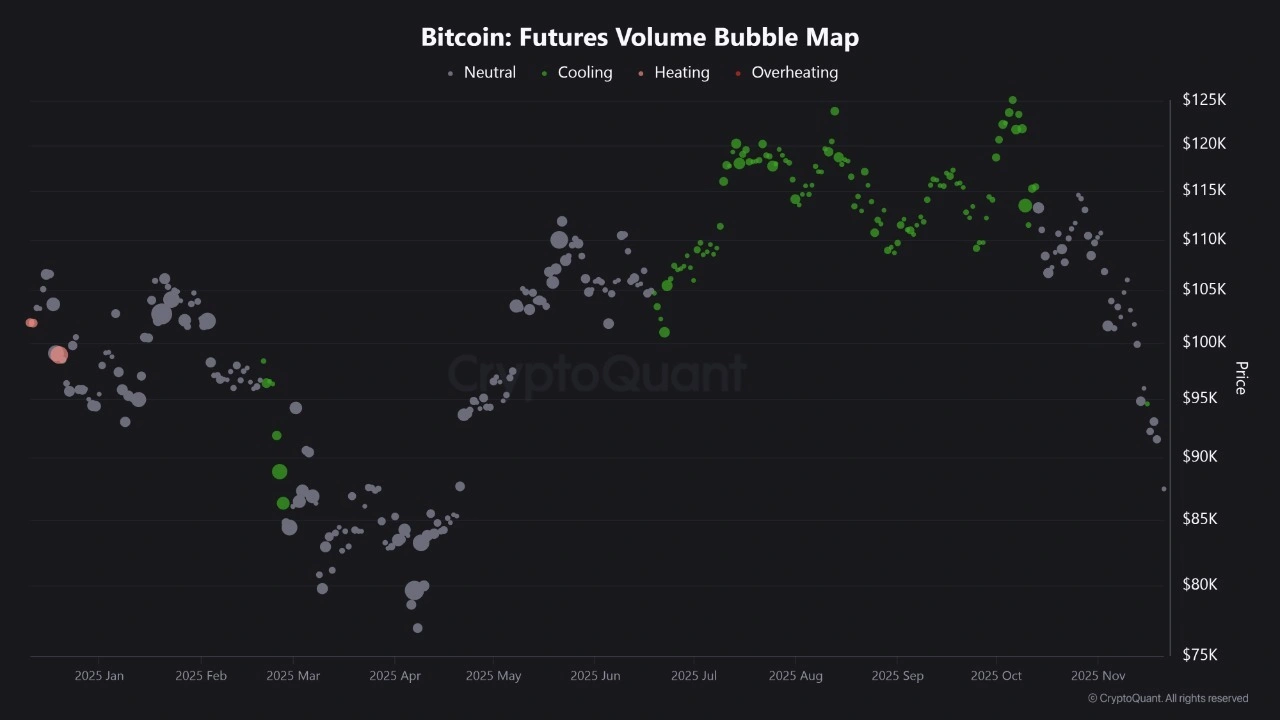

The Futures Volume Bubble Map from CryptoQuant further illustrates this trend, highlighting pockets of low engagement across trading volumes. As the analyst explains, “The market has shifted from a cooling phase to a neutral environment, characterized by even lower trading activity compared to two months ago.” This decline in futures engagement offers limited backing for an immediate bullish reversal, emphasizing the need for stronger institutional inflows to counter the selling pressure.

Despite these challenges, historical patterns show that whales often capitalize on dips to accumulate, potentially setting the stage for price recovery. Data from Derive.xyz indicates that both short-term and long-term volatility have increased over the past two weeks, with 30-day implied volatility rising from 41% to 49% and six-month volatility climbing from 46% to 49%. Dr. Sean Dawson from Derive.xyz notes that this parallel surge is unusual and points to traders hedging against sustained macro uncertainty, which could prolong the dip below $100,000 unless positive catalysts emerge.

Bitcoin futures volume bubble map. Source: CryptoQuant

Bitcoin futures volume bubble map. Source: CryptoQuantTimothy Misir from BRN Research describes the current juncture as a critical crossroad for Bitcoin, where multiple factors—including regulatory developments, macroeconomic indicators, and adoption rates—will dictate the trajectory. Meanwhile, Ethereum’s market mirrors Bitcoin’s caution, with a 50% probability of closing the year below $2,900, as per options pricing on CoinMarketCap. This correlated gloom underscores broader cryptocurrency market dynamics in 2025.

Institutions remain a beacon of hope, with firms like 21Shares affirming that core fundamentals are intact. The selling appears to be a redistribution from short-term retail holders to more committed long-term ones, a process that has historically preceded recoveries. 21Shares identifies $98,000 to $100,000 as key resistance, $85,000 as initial support, and $75,000 to $80,000 as deeper demand zones if breached. Their analysis, based on on-chain flows and historical precedents, suggests that once this reshuffling completes, upward momentum could resume.

Broader market context reveals that Bitcoin’s struggle below $100,000 is not isolated. Global economic pressures, including interest rate expectations and geopolitical tensions, are influencing investor sentiment. Yet, metrics from CryptoQuant’s Futures Retail Activity Through Trading Frequency Surge show retail participation has dwindled to “few” active traders, indicating exhaustion on the sell-side. This reduced liquidity from both whales and retail could create a vacuum that institutions fill, potentially stabilizing prices and fostering a rebound.

Expert insights reinforce this view. Dawson from Derive.xyz emphasizes that the macro environment lacks bullish drivers heading into year-end, but structural shifts—like increasing ETF inflows and corporate treasury allocations—could alter the narrative. BRN Research’s Misir adds that Bitcoin’s resilience in past cycles positions it well for 2025, provided whales step up accumulation efforts.

Frequently Asked Questions

What is the probability of Bitcoin surpassing $100,000 by the end of 2025?

According to options pricing data from CoinMarketCap, there is currently a 30% probability that Bitcoin will close above $100,000 by year-end, reflecting tempered optimism amid ongoing volatility. This assessment factors in retail selling and whale activity, but institutional demand could improve odds if support levels hold firm.

Why are Bitcoin whales showing reduced activity during this market dip?

Bitcoin whales are demonstrating lower participation due to declining average order sizes in futures trading, as reported by CryptoQuant, amid a neutral market with subdued activity. This fatigue follows intense accumulation phases, but analysts expect larger entities to re-engage once retail selling eases, supporting potential stabilization.

Key Takeaways

- Retail Selling Dominance: Smaller investors are driving the Bitcoin price below $100,000, offloading to whales and institutions, which signals a healthy redistribution but short-term pressure.

- Volatility Surge: Both short- and long-term implied volatility have risen sharply, indicating macro hedging and uncertainty, per Derive.xyz data, which could extend the dip without new catalysts.

- Institutional Support Key: Firms like 21Shares highlight intact fundamentals and key support at $85,000—monitor for whale accumulation to confirm recovery potential and act on dips strategically.

Conclusion

Bitcoin’s current dip below $100,000 highlights the interplay between retail selling and whale activity, with institutional investors poised as the stabilizing force in 2025 markets. As on-chain data from CryptoQuant and volatility insights from Derive.xyz illustrate, this phase of redistribution may pave the way for renewed strength once resistance at $100,000 is tested. Investors should focus on long-term fundamentals, tracking support levels and accumulation signals for the next bull cycle—position yourself wisely for emerging opportunities in the evolving crypto landscape.