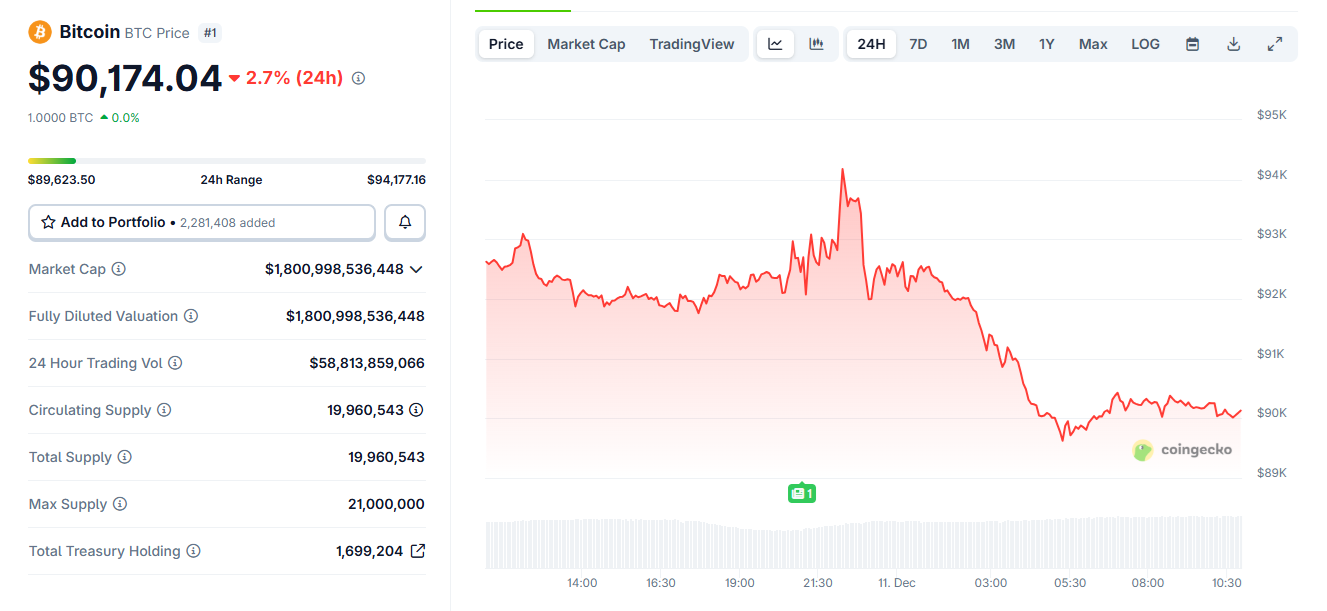

Bitcoin Dips Below $91K as Asian Session Support Weakens

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin experienced a sharp price drop below $91,000 on Thursday due to unexpected weakness in the Asian trading session, which has traditionally provided strong buying support since October. This shift highlights potential short-term volatility as BTC struggles to maintain gains above $94,000 amid low market sentiment.

-

Asian sessions historically drove BTC gains, contributing to bullish momentum over the past months.

-

Thursday’s downturn saw BTC fall to $90,084, breaking recent recovery patterns without panic selling.

-

The Fear and Greed Index stands at 29, with volatility at 2.47%, signaling ongoing market caution and possible liquidations totaling $175 million for BTC longs.

Discover why Bitcoin’s price dropped below $91,000 amid Asian session weakness. Explore key factors, market patterns, and what it means for BTC’s path to $100K. Stay informed on crypto volatility—read now for expert insights.

What Caused Bitcoin’s Recent Price Drop Below $91,000?

Bitcoin’s price drop below $91,000 on Thursday stemmed primarily from a surprising lack of support during the Asian trading session, which has been a reliable pillar of buying pressure since October. This session, typically bustling with repositioning activity across cryptocurrencies, failed to sustain the recent rebound above $94,000, leading to a 2.7% decline to $90,084. The move reflects fragile market recovery, with Bitcoin’s dominance slipping to 59.6% as altcoins like ETH and SOL also retreated.

BTC slid during Asian hours, an anomaly after a streak of sessions posting robust gains and bullish sentiment. | Source: CoinGecko.

BTC slid during Asian hours, an anomaly after a streak of sessions posting robust gains and bullish sentiment. | Source: CoinGecko.The absence of typical Asian buying did not trigger widespread panic, as trading volumes remained steady. However, it underscores the challenges in Bitcoin’s climb toward $100,000, with indicators like the Fear and Greed Index at a subdued 29 points and volatility hovering near its annual peak of 2.47%. These factors point to a market still grappling with uncertainty following broader economic signals, including the Federal Reserve’s recent interest rate cut.

Bitcoin had reached an intraday high of $94,490 the previous day, but the gains evaporated quickly. This pattern of short-lived rallies has become more pronounced, as regional trading dynamics influence overall sentiment. While European and U.S. sessions have often introduced selling pressure, the Asian market’s role in counterbalancing that has been crucial. Thursday’s deviation from this norm raises questions about evolving global trader behavior and its impact on price stability.

How Has the Asian Trading Session Influenced Bitcoin’s Performance?

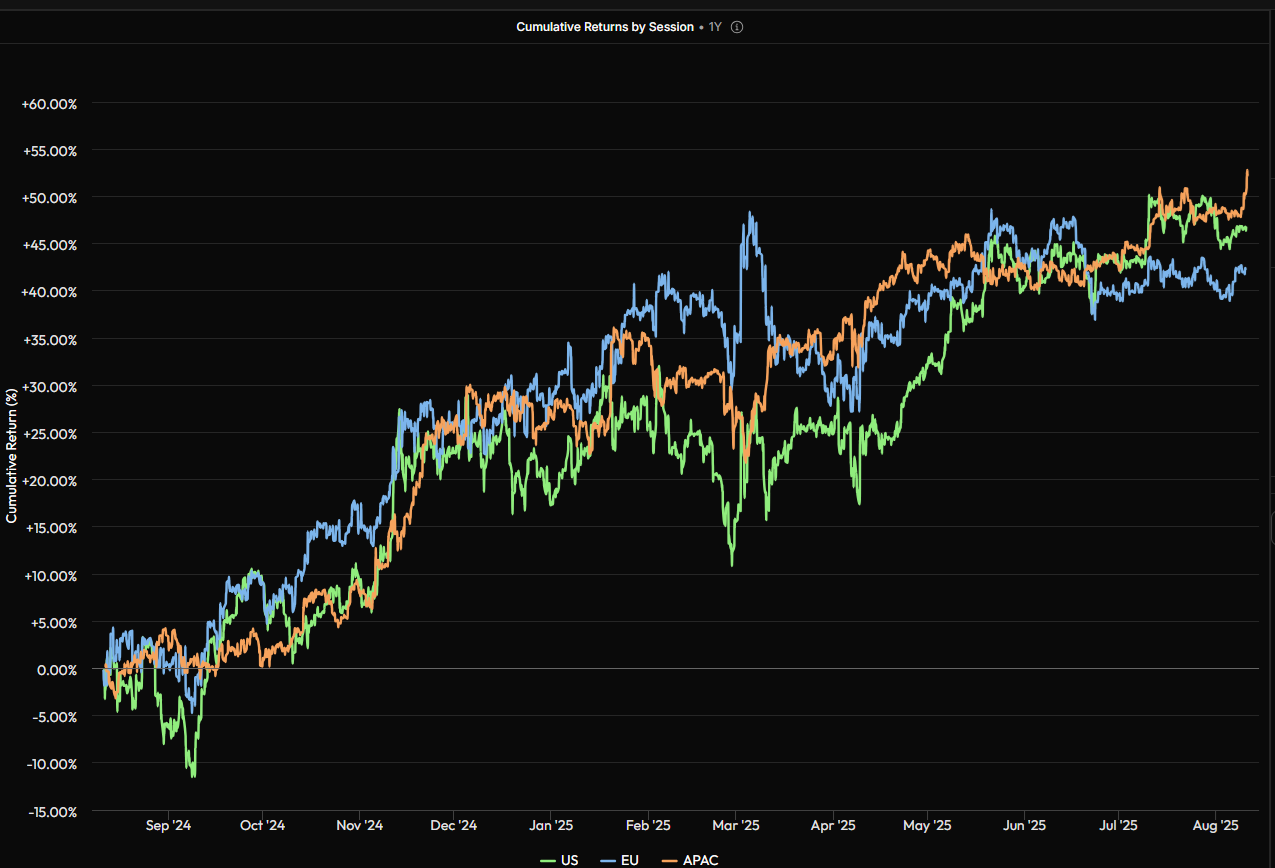

The Asian trading session has been instrumental in Bitcoin’s upward trajectory throughout 2025, consistently delivering gains that offset losses from other regions. Data from market analysis platforms, such as those tracking hourly performance, show that since August, Asian hours accounted for the majority of daily advances, with buying activity peaking during high-volume periods used for portfolio adjustments. In contrast, U.S. and European sessions frequently registered drawdowns, contributing to a predictable daily volatility cycle.

BTC posted the most gains during Asian trading hours, while European and US markets logged daily losses in most cases, creating a daily trading pattern for the leading coin. | Source: Sharpe.AI.

BTC posted the most gains during Asian trading hours, while European and US markets logged daily losses in most cases, creating a daily trading pattern for the leading coin. | Source: Sharpe.AI.This regional disparity is not unique to Bitcoin but affects the broader crypto ecosystem, where Asian markets serve as a hub for institutional and retail repositioning. For instance, over the past three months, Asian sessions have dominated bullish moves, even as U.S. markets occasionally sparked breakouts. Experts from financial analytics firms note that this pattern has shaped trader expectations, with many positioning for weakness during non-Asian hours. A shift like Thursday’s could signal changing investor confidence, potentially leading to heightened scrutiny of global flows.

Supporting data indicates that Bitcoin’s resilience in Asian hours stems from factors like regional economic recoveries and increased adoption in emerging markets. Quotes from market strategists emphasize that “Asian liquidity has been the unsung hero of BTC’s bull run,” highlighting how it absorbs shocks from Western policy announcements. Without this support, short-term dips become more pronounced, as seen in the recent liquidations exceeding $175 million in BTC long positions and $377 million across major assets.

Looking deeper, the session’s influence extends to sentiment indicators. The Fear and Greed Index’s low reading aligns with historical observations during periods of Asian underperformance, while elevated volatility metrics suggest traders are bracing for further tests of key support levels around $90,000. Maintaining this level will be critical, as failure could amplify downward pressure from correlated assets.

Frequently Asked Questions

What triggered the $175 million in Bitcoin long liquidations?

The $175 million in Bitcoin long liquidations followed the price drop below $91,000 during the Asian session, catching leveraged positions off guard after a brief recovery above $94,000. This event, part of $377 million total across assets, was driven by fragile support and steady volumes, not panic selling, according to on-chain data from analytics providers.

Can Bitcoin recover from this Asian session weakness quickly?

Bitcoin can potentially recover if U.S. and European sessions introduce bullish momentum to counter the Asian dip, as has happened in past cycles. The current hold above $90,000, combined with low Fear and Greed readings, suggests room for rebound, but sustained gains depend on renewed regional buying and favorable economic narratives from the Fed’s rate environment.

Key Takeaways

- Asian Session’s Historical Role: It has provided consistent buying support for Bitcoin since August 2025, offsetting losses from U.S. and European markets in a clear daily pattern.

- Current Volatility Indicators: With the Fear and Greed Index at 29 and volatility at 2.47%, the market remains cautious, amplifying the impact of Thursday’s 2.7% drop.

- Implications for $100K Goal: Traders should monitor $90,000 support closely, as shifts in regional sentiment could lead to further liquidations or a renewed push higher—consider diversifying positions accordingly.

Conclusion

Bitcoin’s price drop below $91,000 highlights the critical role of the Asian trading session in providing support, a pattern that defined much of 2025’s performance amid broader Bitcoin price volatility. As regional dynamics evolve, with U.S. narratives potentially countering weakness, the path to $100,000 remains viable but demands vigilance on key levels like $90,000. Investors are advised to track sentiment shifts and liquidity flows for informed decisions in this interconnected global market.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC