Bitcoin Dominance Weakens as TOTAL3 Holds Support, Signaling Potential Altcoin Surge

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

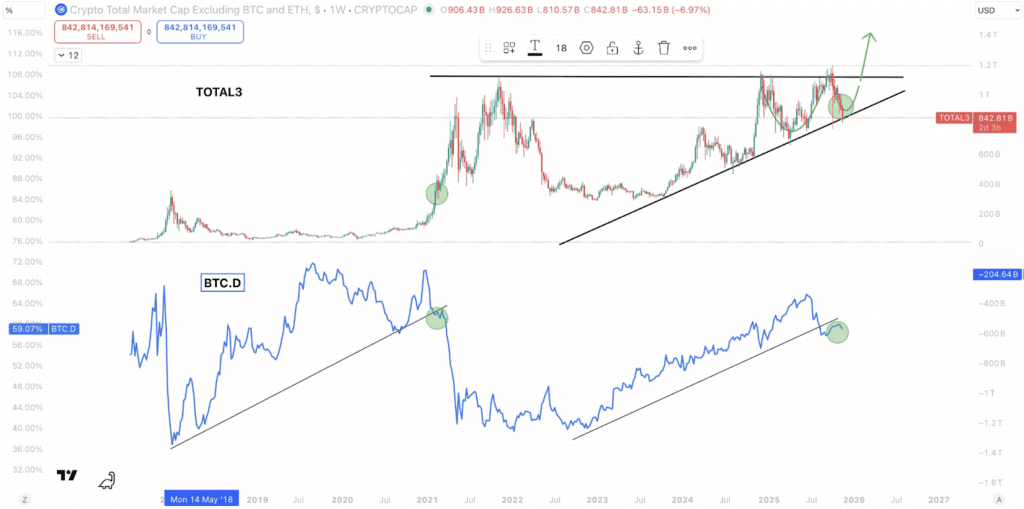

TOTAL3, representing the total market cap of altcoins excluding Bitcoin and Ethereum, is holding firm at its long-term ascending trendline support amid retreating Bitcoin dominance. This setup signals potential liquidity rotation, paving the way for an altcoin market surge with historical rebounds often sparking major rallies in assets like XRP, BNB, and Solana.

-

TOTAL3’s multi-year ascending trendline from mid-2022 remains intact, with each test leading to buyer defenses and subsequent altcoin rallies.

-

Bitcoin dominance (BTC.D) is pulling back from its uptrend, indicating funds shifting toward altcoins for broader market participation.

-

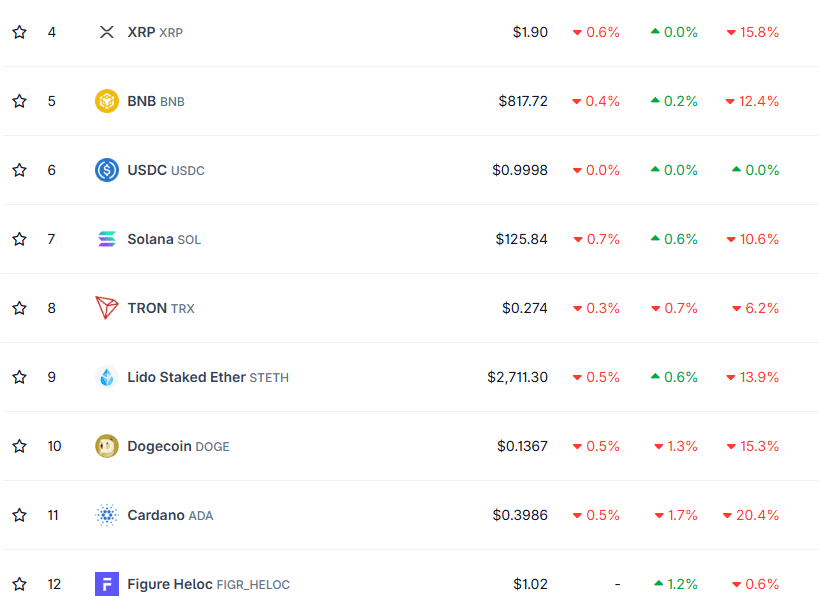

Major altcoins such as XRP at $1.90, BNB at $818.03, and Solana at $125.93 show mild pressures but stable underlying trends, with 10-20% monthly fluctuations highlighting emerging opportunities.

Discover how TOTAL3 crypto market support and declining BTC dominance signal an impending altcoin surge. Explore key trends, asset performances, and strategies for investors in this comprehensive analysis.

What Does TOTAL3’s Long-Term Support Mean for the Altcoin Market?

TOTAL3 crypto market support at its ascending trendline since mid-2022 indicates sustained buyer interest and positions altcoins for potential outperformance against Bitcoin. This level has historically triggered rallies, with the market cap compressing between $1.1 trillion and $1.2 trillion resistance. As Bitcoin dominance weakens, liquidity rotation could drive TOTAL3 toward new highs, benefiting diversified portfolios.

How Is Bitcoin Dominance Influencing Altcoin Momentum?

Bitcoin dominance (BTC.D) has followed an uptrend since early 2023 but is now testing its own ascending support with recent pullbacks. Market data from platforms like CoinGecko shows BTC.D facing rejection at key levels, historically preceding altcoin seasons where dominance drops below 50%. For instance, past cycles saw breakdowns leading to 20-30% shifts in capital toward altcoins. Experts from TradingView analyses, such as those by Sykodelic, emphasize that this weakening—marked by consistent lower highs—frees up over $100 billion in liquidity for TOTAL3 assets. Short-term pressures on individual coins like XRP and Solana reflect broader consolidation, but sustained BTC.D decline could amplify gains across the board. This dynamic underscores the importance of monitoring dominance metrics for timing entries into altcoin positions, as rotations often build over weeks before accelerating.

Source: Sykodelic

The TOTAL3 crypto market, which tracks the combined value of thousands of alternative cryptocurrencies excluding Bitcoin and Ethereum, stands at a pivotal juncture. Formed in mid-2022, its ascending trendline has proven resilient, with multiple bounces reinforcing buyer conviction. Chart patterns reveal green zones where support held firm during dips, each recovery aligning with periods of heightened altcoin activity. Currently, TOTAL3 hovers in a compression phase within a multi-year ascending triangle, a formation known among technical analysts for signaling impending breakouts. Data indicates the market cap has stabilized around $1.1 trillion, testing the lower boundary while eyeing resistance near $1.2 trillion. This setup, as observed in recent market reports, suggests that sustained momentum could propel TOTAL3 higher, echoing patterns from previous cycles where altcoins captured significant market share.

Delving deeper, the interplay between TOTAL3 and broader market indicators provides crucial context. Bitcoin’s dominance, often abbreviated as BTC.D, measures Bitcoin’s share of the total cryptocurrency market cap. Since early 2023, BTC.D has trended upward, but subtle shifts are now evident. Pullbacks from its trendline, as highlighted in analytical charts, point to potential exhaustion. Historical precedents show that when BTC.D encounters resistance—such as the recent plateau— it frequently leads to breakdowns, allowing capital to flow into altcoins. In past instances, these rotations have boosted TOTAL3 by 50% or more over short periods. Current readings place BTC.D approaching a secondary support level, with analysts warning of accelerated declines if breached. This liquidity shift is not merely theoretical; it reflects investor behavior seeking higher returns in undervalued altcoins during Bitcoin’s consolidation phases.

Frequently Asked Questions

What Signals an Imminent Altcoin Market Surge in TOTAL3?

The key signal for an altcoin market surge in TOTAL3 is the confirmation of support at the ascending trendline combined with BTC.D weakening below 52%. Historical data shows rebounds from this level have initiated rallies lasting 2-4 months, with average gains of 30-40% across major altcoins like Solana and BNB, based on market cap analyses from sources like CoinMarketCap.

Is Bitcoin Dominance Decline Good for Altcoins Like XRP and Solana?

Yes, a decline in Bitcoin dominance is typically positive for altcoins including XRP and Solana, as it indicates capital rotation into higher-risk, higher-reward assets. This natural market cycle, often triggered by BTC.D dropping from peaks around 55%, has historically led to 10-20% relative gains in these coins within weeks, making it an ideal time for diversified exposure.

Source: CoinGecko

Turning to individual asset performances, the current landscape reveals a mix of resilience and caution. XRP, trading at approximately $1.90, has experienced a modest daily dip but a more pronounced 15.8% monthly decline, reflecting broader sector pressures. BNB, Ethereum’s primary competitor in the smart contract space, sits at $818.03 following a 12.4% drop over the past month, yet its ecosystem developments continue to attract institutional interest. Solana, known for its high throughput, is priced near $125.93 with a 10.6% monthly loss, but network activity metrics remain robust, suggesting underlying strength. Other notables like TRON and Lido Staked Ether (stETH) exhibit stability, holding steady amid volatility. In contrast, Dogecoin and Cardano have faced steeper declines of 15.3% and 20.4% respectively, underscoring the varied impacts within the altcoin universe.

Amid these movements, outliers like Helium (HNT) provide positive notes, posting a 1.2% weekly gain and emerging as a beacon in the decentralized physical infrastructure narrative. These performances align closely with TOTAL3’s overarching trend, where mild compressions often precede expansions. Investors monitoring these assets through reliable data aggregators can identify entry points, particularly as BTC.D signals intensify. The collective data paints a picture of an altcoin market poised for rotation, with TOTAL3 as the barometer for upcoming shifts.

From a strategic standpoint, the TOTAL3 crypto market’s behavior offers valuable lessons for portfolio management. Maintaining support at critical levels demonstrates market maturity, where speculative fervor gives way to structural buying. As BTC.D retreats, historical correlations suggest altcoins could see accelerated adoption, driven by factors like regulatory clarity and technological upgrades. For instance, Solana’s recent protocol enhancements have bolstered its case for scalability, while BNB’s utility in DeFi continues to expand. XRP’s focus on cross-border payments positions it well for real-world integration. These elements collectively support the narrative of an impending surge, urging investors to assess risk tolerance and diversify accordingly.

Expert commentary from figures in the crypto analytics community, such as those referenced in TradingView publications, reinforces this outlook. One analyst noted, “The alignment of TOTAL3 support with BTC.D weakness is a textbook setup for altcoin leadership, much like the cycles of 2017 and 2021.” Such insights, drawn from years of market observation, highlight the predictive power of these indicators without venturing into unverified predictions.

Key Takeaways

- TOTAL3 Resilience: The ascending trendline since mid-2022 has held through multiple tests, consistently leading to altcoin rallies and signaling strong underlying demand.

- BTC.D Weakness: Pullbacks in Bitcoin dominance from its uptrend indicate liquidity shifts, historically boosting TOTAL3 by enabling capital flows into alt assets like Solana and BNB.

- Asset Monitoring: Track individual performances such as XRP’s $1.90 level for entry opportunities, focusing on monthly trends to anticipate broader surges.

Conclusion

In summary, the TOTAL3 crypto market’s steadfast support amid declining Bitcoin dominance underscores a favorable environment for altcoins, with patterns pointing to liquidity rotation and potential rallies in assets like XRP, BNB, and Solana. As these trends evolve, staying informed through reliable market data will be essential for navigating opportunities. Looking ahead, this setup positions the altcoin sector for renewed momentum, encouraging strategic positioning for long-term growth.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise Seeks SEC Approval for 11 Altcoin Strategy ETFs Including Bittensor

December 31, 2025 at 05:21 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC