Bitcoin Dominates Amid Altcoin Struggles: Could Fed Liquidity Aid Recovery?

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Altcoins are facing significant challenges, with the market down 36% since early October 2025, while Bitcoin captures most inflows due to its stability. New liquidity from the Federal Reserve, totaling $38 billion over 10 days, may spark recovery if risk appetite returns, potentially benefiting altcoins later.

-

Altcoin market has declined sharply, with smaller tokens dropping 46% in three months.

-

Only 3% of altcoins trade above their 200-day moving average, indicating weak market breadth.

-

Altcoin dominance at a five-year low, as capital shifts to Bitcoin amid low risk tolerance.

Discover why altcoins are struggling in 2025 and how incoming liquidity could change the game for Bitcoin dominance and altcoin recovery—explore key insights now.

What is causing the altcoins market decline?

Altcoins market decline stems from reduced liquidity and investor caution since early October 2025, leading to a 36% drop in Total2 index for altcoins. Smaller tokens have suffered more, falling nearly 46% in three months, as capital flows primarily to Bitcoin for its relative stability and liquidity. This shift highlights broader market stress, with altcoin dominance hitting a five-year low.

How is Bitcoin benefiting from altcoins’ struggles?

Bitcoin has emerged as the safe haven in this environment, attracting the majority of new capital inflows. Investors are prioritizing protection over high-risk opportunities, drawn to Bitcoin’s deeper liquidity and lower volatility compared to altcoins. Data from market analyses, including on-chain metrics shared on X (formerly Twitter), show Bitcoin’s trading volume surging while altcoins experience fleeting rebounds without sustained momentum. For instance, during recent upticks, altcoin volumes remained subdued, underscoring the reluctance to engage with riskier assets. Experts from financial platforms like CoinMarketCap note that this pattern aligns with historical cycles where Bitcoin dominance rises during uncertainty, often preceding altcoin seasons if conditions improve.

Altcoins are having a tough time, with most tokens struggling to keep their heads above water. Meanwhile, Bitcoin continues to soak up all the attention and capital, leaving the rest of the market to just… watch.

However, new liquidity is about to enter the system. Will altcoins benefit?

Alts are drowning deep in troubles

Since early October, the altcoin market has fallen, with Total2 down about 36%. Smaller altcoins have been hit even harder, dropping nearly 46% in just three months.

Source: X

This stress showed up in market breadth, too. Only about 3% of altcoins on Binance traded above their 200-day MA, a historically low level.

Source: X

At the same time, altcoin dominance has fallen to a five-year low! Capital has exited the altcoin market and concentrated elsewhere; primarily in Bitcoin [BTC].

Capital hides in BTC

Altcoins usually do well when liquidity is high and investors are willing to take risks. Right now, neither of this is happening.

Investors seem focused on protecting their capital. They’re avoiding smaller and more unstable parts of the market.

Bitcoin, with its stronger liquidity and all its relatively stable glory, continues to attract most inflows. This reluctance explains why altcoin rallies have been brief and easy to break.

Even during short rebounds, trading volume stays low and follow-through is limited.

A macro catalyst

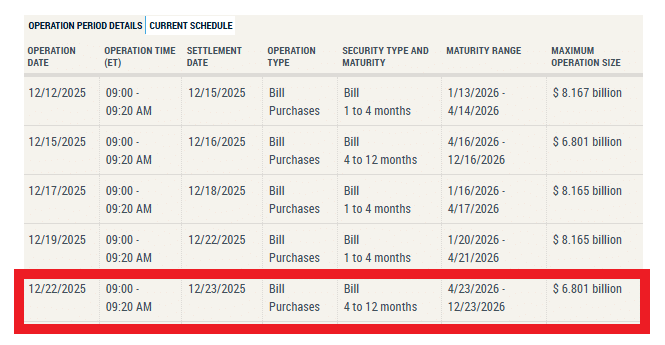

Looking ahead, macro conditions could become a key turning point. The Federal Reserve is set to inject $6.8 billion into markets this week. This will bring total liquidity injections to roughly $38 billion over the past 10 days.

Source: X

If this extra liquidity eases financial conditions, Bitcoin is likely to benefit first. Altcoins may follow, but only if risk appetite returns.

Whether it’ll be continued weakness or a slow recovery for altcoins remains to be seen.

Reports from market observers indicate that 2026 could mark a shift, with Ethereum potentially leading an altcoin resurgence based on historical patterns observed in platforms like Glassnode.

Frequently Asked Questions

What factors are driving the current altcoins market decline in 2025?

The altcoins market decline in 2025 is driven by low liquidity, investor risk aversion, and capital rotation to Bitcoin. Since October, Total2 has dropped 36%, with small-cap altcoins falling 46%. Only 3% trade above the 200-day moving average, per Binance data, signaling broad underperformance.

Will Federal Reserve liquidity injections help altcoins recover?

Federal Reserve liquidity injections, like the recent $6.8 billion addition bringing totals to $38 billion over 10 days, could ease conditions and boost Bitcoin first. For altcoins, recovery depends on renewed risk appetite; historically, such inflows have preceded altseason, but timing varies based on global economic signals.

Key Takeaways

- Altcoins Under Pressure: The market has declined 36% since October 2025, with dominance at five-year lows due to capital flight to Bitcoin.

- Bitcoin’s Dominance: Strong liquidity and stability draw inflows, limiting altcoin rebounds to brief, low-volume spikes.

- Liquidity Catalyst: Fed’s $38 billion injections may spark recovery; monitor risk appetite for altcoin opportunities in 2026.

Conclusion

In summary, the altcoins market decline reflects investor caution amid low liquidity, with Bitcoin benefiting from its stability as dominance grows. Incoming Federal Reserve liquidity could provide a macro catalyst, potentially easing conditions for altcoins if risk tolerance improves. As 2026 approaches, Ethereum and select tokens may signal broader recovery—stay informed to navigate these shifts effectively.