Bitcoin Drop May Cut Satoshi Nakamoto’s Holdings by $43B, Limiting Crypto Influence

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Satoshi Nakamoto’s Bitcoin holdings have suffered $43 billion in unrealized losses after Bitcoin’s price dropped from $126,000 to $86,000, reducing the value from $137 billion to $95 billion. This impacts the mysterious creator’s wealth ranking amid market volatility.

-

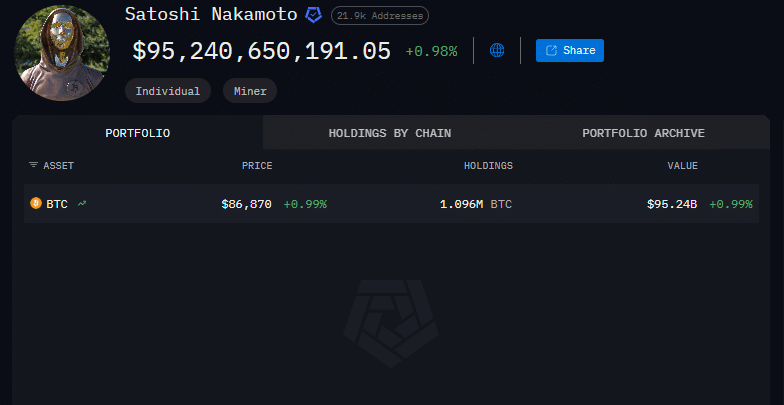

Satoshi Nakamoto holds 1.096 million BTC, unchanged for years, now valued at $95 billion post-drop.

-

Bitcoin’s 30% decline in Q4 2025 erased significant paper gains for early holders like Satoshi.

-

At current prices, Satoshi ranks as the 18th wealthiest individual globally, per Bloomberg Billionaires Index data.

Discover how Satoshi Nakamoto’s Bitcoin losses reached $43B amid the 2025 crypto dip. Explore impacts on wealth and politics—stay informed on BTC trends today.

How much did Bitcoin’s price drop cost Satoshi Nakamoto?

Satoshi Nakamoto, the pseudonymous creator of Bitcoin, has incurred approximately $43 billion in unrealized losses due to the recent Bitcoin price decline. With holdings of 1.096 million BTC untouched for years, the value peaked at $137 billion when BTC hit $126,000 in October 2025. Now, at $86,000 per BTC, the portfolio stands at $95 billion, highlighting the volatility inherent in cryptocurrency markets.

What is the current status of Satoshi Nakamoto’s Bitcoin holdings?

Satoshi Nakamoto’s wallet addresses remain dormant, holding exactly 1.096 million BTC as tracked by on-chain analytics firms like Arkham Intelligence. This quantity has not changed since the early days of Bitcoin’s development. The recent 30% price correction from quarterly highs has slashed the portfolio’s market value significantly, dropping it below the $100 billion threshold. According to Arkham data, this positions Satoshi as the 18th-richest person worldwide, surpassing figures like Mukesh Ambani at $92.5 billion but trailing Michael Dell at $97 billion, based on Forbes’ real-time rankings.

Source: Arkham

The anonymous founder’s wealth trajectory underscores Bitcoin’s transformative potential, yet also its risks. Even with these losses, the holdings represent a staggering accumulation from Bitcoin’s inception, mined at negligible cost. Market observers note that such dormant wallets bolster confidence in Bitcoin’s scarcity model, as no sales have occurred despite fluctuations.

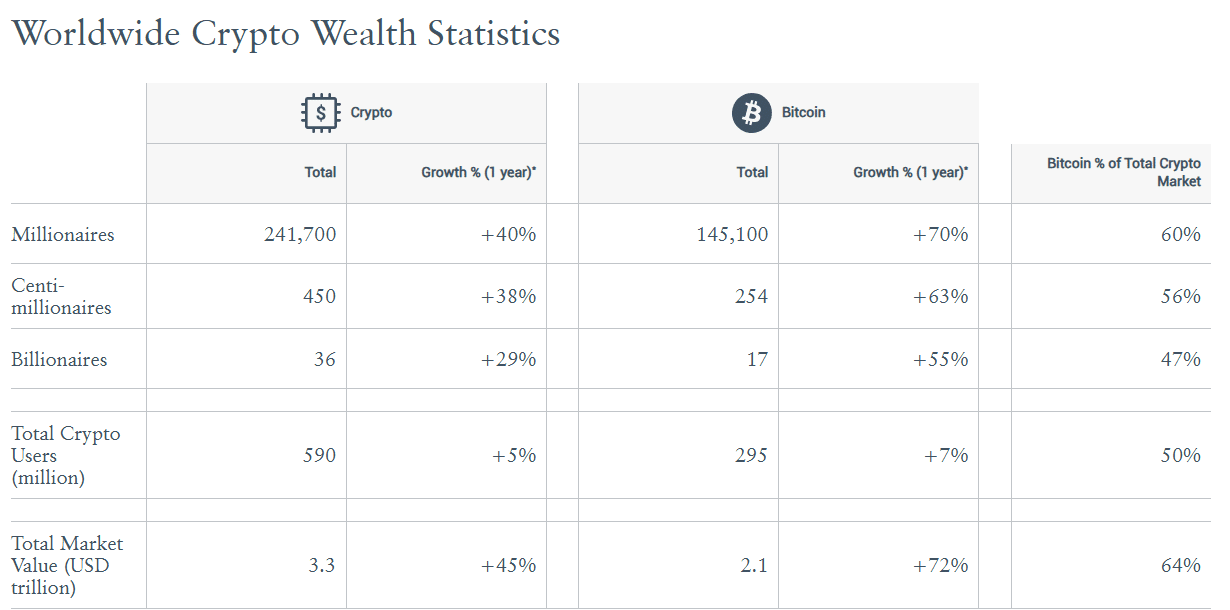

A year of extreme wealth creation in cryptocurrency

Bitcoin’s performance in 2025 has been remarkable, up over 400% from the 2022 cycle lows of $16,000 during the crypto winter. This surge has minted numerous fortunes, with the Henley & Partners Crypto Wealth Report estimating 241,000 crypto millionaires as of June 2025, when BTC traded around $110,000. More than half, or 145,000, owe their millionaire status directly to Bitcoin investments, marking a 70% year-over-year increase in BTC-based wealth.

The report further highlights that around 17 individuals became billionaires and 254 centi-millionaires through BTC holdings alone. However, the Q4 drawdown has tempered these gains, with unrealized losses affecting many who have not sold. For long-term holders like Satoshi, this volatility tests resolve but also reaffirms Bitcoin’s role in wealth creation over multi-year cycles.

Source: Henley & Partners

Source: Henley & Partners Crypto Wealth Report

This wealth boom has spurred broader adoption, with institutional players and high-net-worth individuals increasingly viewing Bitcoin as a portfolio staple. Yet, corrections like the current one remind investors of the asset’s sensitivity to macroeconomic factors, including interest rates and regulatory shifts.

Wealth and political influence in the crypto space

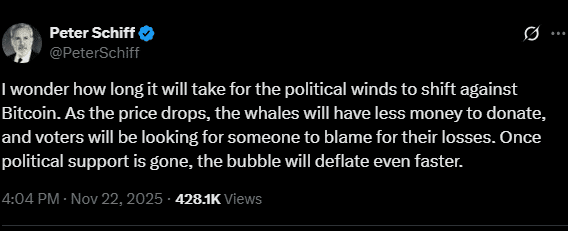

Bitcoin’s rising value has amplified the political clout of crypto advocates. Figures such as the Winklevoss twins, founders of the Gemini exchange, have ramped up support for pro-crypto politicians ahead of the U.S. midterm elections. Their donations and endorsements aim to foster favorable regulations that could sustain Bitcoin’s growth trajectory.

However, prominent Bitcoin critic Peter Schiff has cautioned that prolonged market downturns might diminish such influence. Schiff argues that significant losses could reduce campaign funding from crypto donors, potentially stalling legislative progress. “Once political support is gone, the bubble will deflate even faster,” he stated in a recent commentary on social media platform X.

Source: X

On-chain data provider Glassnode emphasizes key support levels for Bitcoin, including the True Market Mean at $81,300 and the Realized Price at $56,000. Breaching these could signal deeper corrections, while holding above might pave the way for recovery. The interplay between market dynamics and policy remains crucial, as a supportive regulatory environment could mitigate losses and bolster long-term confidence.

Source: Glassnode

Frequently Asked Questions

How many Bitcoins does Satoshi Nakamoto still own?

Satoshi Nakamoto controls approximately 1.096 million BTC across known wallet addresses, a figure unchanged since around 2010. This stash, mined in Bitcoin’s early phases, equates to about 5.2% of the total supply and has never been moved, as confirmed by blockchain explorers and analytics platforms.

What factors are driving Bitcoin’s recent price drop affecting Satoshi Nakamoto’s wealth?

Bitcoin’s slide to $86,000 stems from macroeconomic pressures like rising interest rates and profit-taking after the October peak. This natural correction in a bull cycle has led to widespread unrealized losses for holders, including Satoshi Nakamoto, but historical patterns suggest potential rebounds if global risk appetite improves.

Key Takeaways

- Satoshi Nakamoto’s unrealized losses: The $43 billion drop underscores Bitcoin’s volatility, yet the holdings remain a testament to the network’s enduring value.

- Crypto wealth surge: 2025 has created 241,000 millionaires via Bitcoin, per Henley & Partners, though corrections erase short-term gains.

- Political implications: Market downturns may curb crypto donors’ influence, as warned by Peter Schiff, highlighting the need for sustained policy support.

Conclusion

Satoshi Nakamoto’s Bitcoin losses of $43 billion amid the 2025 price correction reflect the high-stakes nature of cryptocurrency investments, while the overall year’s gains affirm its wealth-building power. As on-chain metrics from Glassnode indicate, monitoring key levels will be vital for recovery prospects. Investors should stay vigilant on regulatory developments and macroeconomic trends to navigate future volatility in the Bitcoin ecosystem.