Bitcoin Economist Questions Zcash Privacy Value Versus Anti-Debasement Demand

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Saifedean Ammous, author of The Bitcoin Standard, criticized Zcash as a “shitcoin” due to its trusted setup and questioned the demand for privacy in money compared to resistance to debasement in Bitcoin. This sparked debates on whether privacy features outweigh Bitcoin’s auditability and hard money principles.

-

Saifedean Ammous highlights Bitcoin’s superiority in preventing debasement over Zcash’s privacy tools.

-

Zcash uses zero-knowledge proofs for shielded transactions, but its initial trusted setup raises trust issues.

-

Privacy advocates argue that non-private money like Bitcoin can be tracked and seized by authorities, citing examples from real-world events.

Discover Saifedean Ammous’s critique of Zcash privacy vs Bitcoin’s hard money in this debate. Explore expert opinions and implications for crypto users seeking secure, private transactions. Read now for key insights.

What Did Saifedean Ammous Say About Zcash Privacy?

Saifedean Ammous, a prominent Bitcoin advocate and economist, recently questioned the value of privacy-focused cryptocurrencies like Zcash in comparison to Bitcoin’s core strength as hard money resistant to debasement. In an exclusive interview, he described Zcash as a “shitcoin” primarily due to its reliance on a trusted setup ceremony during its 2016 launch, which required participants to generate cryptographic parameters without malicious interference. Ammous argued that the demand for privacy in money might be overstated, emphasizing that people prioritize monetary stability over anonymity features.

How Does Zcash’s Privacy Mechanism Work Compared to Bitcoin?

Zcash introduces advanced privacy through zk-SNARKs, zero-knowledge succinct non-interactive arguments of knowledge, enabling users to conduct shielded transactions that conceal sender, receiver, and amount details on the public blockchain. This contrasts with Bitcoin’s transparent ledger, where all transactions are visible and auditable, fostering trust in its fixed 21 million supply but exposing users to potential surveillance. According to blockchain data, Zcash’s shielded pool allows for verifiable privacy without compromising the network’s integrity, as explorers confirm the total supply remains intact despite privacy layers. Experts note that while Bitcoin’s transparency aids in preventing double-spending and builds community trust, Zcash’s approach addresses growing concerns over financial privacy in an era of increasing regulatory scrutiny. For instance, during the 2022 Canadian trucker protests, authorities traced Bitcoin donations via public addresses, underscoring vulnerabilities in non-private systems. Ammous, however, contends that such privacy comes at the cost of auditability, potentially eroding confidence in Zcash’s token supply, with only a fraction of transactions currently using shielded features as per on-chain analytics from 2025.

Frequently Asked Questions

What Is the Trusted Setup in Zcash and Why Does Saifedean Ammous Criticize It?

The trusted setup in Zcash involved a 2016 ceremony where developers generated secret parameters for zk-SNARKs, destroying them afterward to prevent forgery. Saifedean Ammous criticizes this as it requires blind trust in participants, contrasting Bitcoin’s trustless, decentralized verification. This setup, repeated in later iterations like Powers of Tau, aims to mitigate risks but still fuels debates on centralization in privacy coins.

Why Is Privacy Important in Cryptocurrencies Like Zcash Over Bitcoin?

Privacy in cryptocurrencies like Zcash protects users from surveillance, theft, and censorship by hiding transaction details, which is crucial for financial sovereignty. Unlike Bitcoin’s public blockchain, Zcash’s shielded transactions ensure that even if visible, they reveal no personal data, making it harder for governments or hackers to seize funds. This feature supports everyday use in privacy-sensitive scenarios, aligning with voice search queries on secure digital money.

Key Takeaways

- Privacy vs. Hard Money Debate: Saifedean Ammous prioritizes Bitcoin’s resistance to inflation over Zcash’s anonymity, arguing that debasement protection drives real demand in a $300 trillion market.

- Expert Perspectives: Figures like Mert Mumtaz call the choice a false dichotomy, advocating for both qualities, while Barry Silbert notes Bitcoin’s historical privacy focus among maximalists.

- Evolving Solutions: Ammous suggests layer-2 protocols on Bitcoin can provide needed privacy without on-chain compromises, urging users to explore these for balanced security.

Conclusion

The debate ignited by Saifedean Ammous on Zcash underscores a fundamental tension in cryptocurrencies between privacy innovations and the unyielding principles of hard money like those in Bitcoin. As Zcash experiences renewed interest in 2025, with its market cap briefly exceeding $10 billion and topping search rankings, it highlights the ongoing evolution of digital assets toward user-centric features. Industry leaders, from Zcash co-founder Zooko Wilcox to Bitcoin proponents, emphasize that true financial freedom requires both auditability and privacy safeguards. Looking ahead, advancements in layer-2 solutions and protocol upgrades may bridge these divides, empowering users to choose tools that align with their needs in an increasingly digital economy—stay informed as this discourse shapes the future of crypto.

Economist Saifedean Ammous sparked fierce debate on social media after questioning the importance of privacy-focused cryptocurrencies like Zcash versus Bitcoin.

Bitcoin advocate Saifedean Ammous ignited lively debate between Bitcoiners and privacy advocates after he questioned the perceived importance of privacy as a key characteristic of money in an exclusive interview with Cointelegraph.

“This is the question. How much demand is there for money that does not get debased versus how much demand is there for money that allows you to maintain your privacy?” Ammous said.

Ammous, the author of The Bitcoin Standard, described Zcash as a “shitcoin” and raised concerns about the initial launch of the project, which involved a trusted setup ceremony in 2016 to generate the cryptographic parameters for its privacy features.

“The whole thing is built on a trusted setup, where you have to trust a bunch of people who started the whole thing. I’m not in any mood to get into these kind of stupid games,” Ammous said.

While admitting that he did not have in-depth knowledge of Zcash’s protocol, Ammous also questioned whether the privacy features of Zcash would limit the ability of people to trust the total supply of ZEC tokens:

“As I understand, the anonymity benefits come at the expense of the auditability benefits.”

Zcash features the ability to use shielded and unshielded ZEC to make transactions. Shielded ZEC is used in transactions that are encrypted and private, hiding the sender, receiver, and amount from the public blockchain. This privacy is achieved using zero-knowledge proofs, which allow the network to verify transactions as valid without revealing sensitive details.

Despite Ammous’s concerns, shielded and unshielded Zcash pools are publicly verifiable on several blockchain explorers.

Privacy vs Hard Money

Several key figures from the cryptocurrency industry weighed in on an X post that featured Ammous’ comments on Zcash and the role of privacy in the use of money.

So, what do hardcore Bitcoiners actually think about Zcash? 🤔

To quote @saifedean – “Zcash is a shitcoin.”

Honestly, I expected that answer. But what he said about privacy and money was even more interesting 👇

“This is the question. How much demand is there for money that… pic.twitter.com/4rDQWzcTcj

— Gareth Jenkinson (@gazza_jenks) November 27, 2025

Helius co-founder Mert Mumtaz described Ammous’s question about monetary debasement versus privacy as a “false dichotomy:”

“You should have money that is not debased and is private. That’s zcash. Further, you just can’t have money that’s free from the state unless it’s private. If it can be seen, it can be seized.”

Digital Currency Group founder and CEO Barry Silbert said that privacy still remains a core concern for Bitcoin supporters:

“I’m old enough to remember when all hardcore Bitcoiners cared about privacy. Fortunately, many still do.”

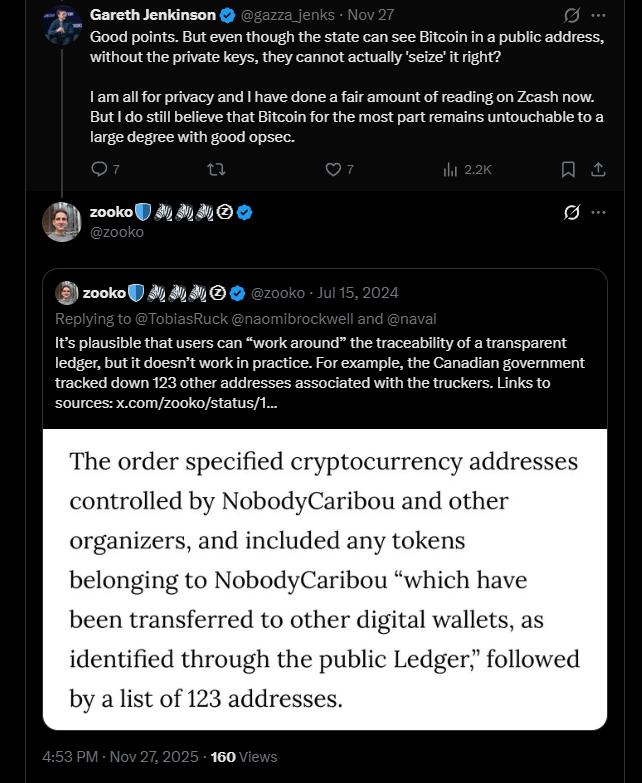

Zcash co-founder Zooko Wilcox also commented on the thread, highlighting the fact that the Canadian government had managed to track down Bitcoin addresses linked to striking truckers due to the transparent nature of Bitcoin’s blockchain.

Source: Gareth Jenkinson

X users continued to comment and debate over the merits of privacy in money and the fundamental differences between Zcash and Bitcoin.

Ammous conceded that privacy in blockchains is an evolving phenomenon. When it comes to Bitcoin, the professor believes that some of the privacy features that BTC users might want can be entrusted to layer-2 protocols and platforms.

“On the issue of privacy, it’s interesting how it’ll evolve. One unpopular opinion I have is that onchain privacy is very difficult and continues to get more difficult. That’s not necessarily a bad thing because people can get the privacy they want on second layers and I don’t think it compromises it.”

Related: What’s behind the surge in privacy tokens as the rest of the market weakens?

Ultimately, Ammous’s academic background remains rooted in the belief that hard money is essential for prosperity and economic growth.

“I think people would rather have hard money that is not private, over easy money that is private. The narrative that people want privacy in their money, I think is massively overblown in order to produce marketing for shitcoins,” he said.

Ammous added that money, by “its nature, is an anti-private technology,” given that any exchange typically leaves breadcrumbs of information, especially in a digital world.

“So it’s very difficult to make money into something that is private and onchain, it’s always going to be difficult. But what people really want is resistance to debasement. That’s the thing that actually has a $300 trillion total addressable market.”

Zcash has seen a resurgence in interest as 2025 draws to a close. The privacy-enabling cryptocurrency climbed to the top of Coinbase’ search rankings in November and the price of ZEC saw a 10x surge in recent months, briefly surpassing $10 billion in total market capitalization.

Magazine: When privacy and AML laws conflict: Crypto projects’ impossible choice