Bitcoin Encounters 3-Year Peak Selling Pressure, Potentially Signaling Market Bottom

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

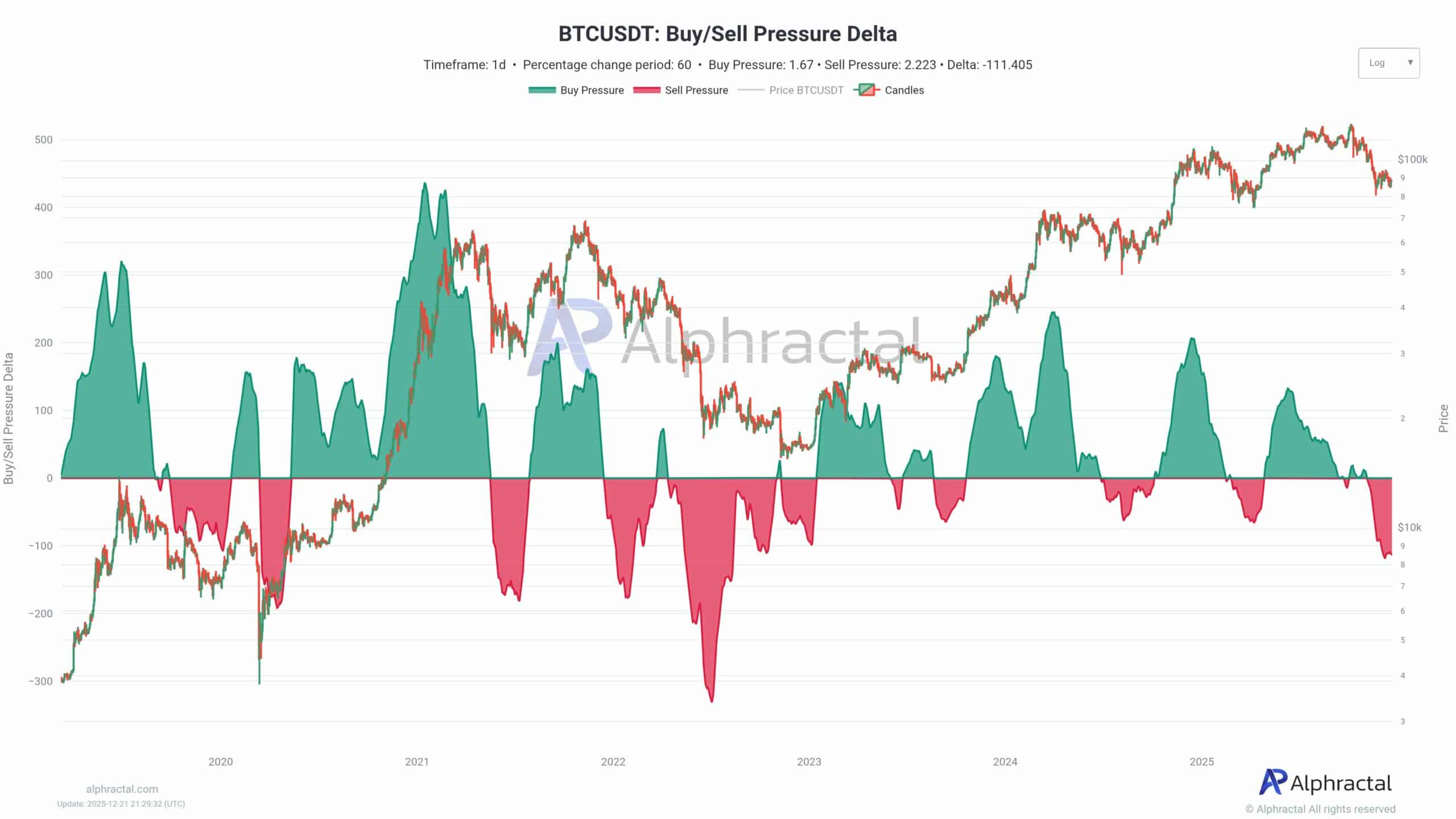

Bitcoin selling pressure has reached its highest level in three years, driven by aggressive market sell orders outpacing buys, according to on-chain data from Alphractal. This intense activity may signal an impending bottom or consolidation, though the market remains risky for new buyers amid overheating indicators.

-

Bitcoin’s buy/sell pressure delta shows unprecedented selling dominance, with market orders pushing prices lower.

-

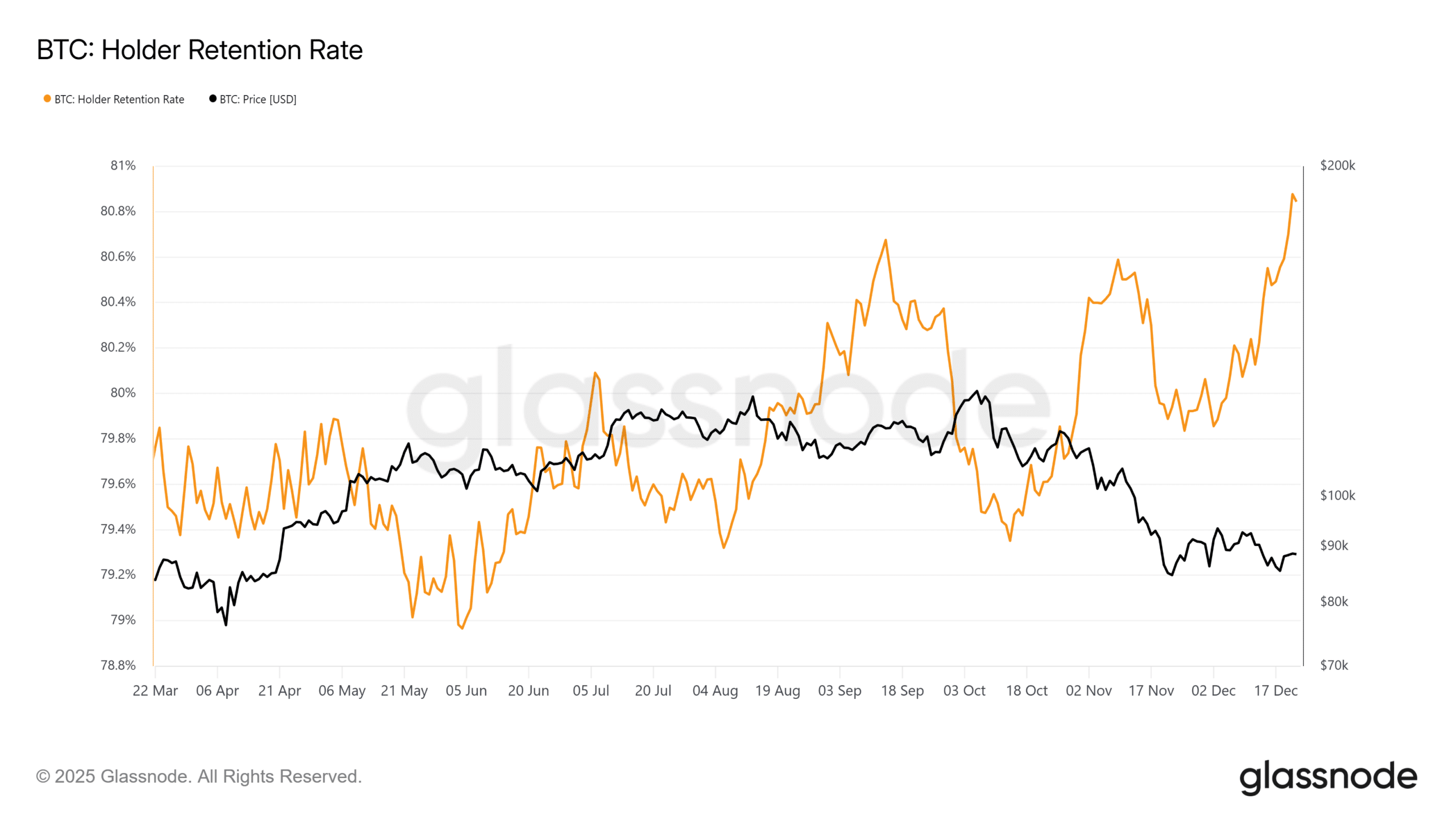

The holder retention rate is rising, indicating growing long-term confidence among investors despite short-term fears.

-

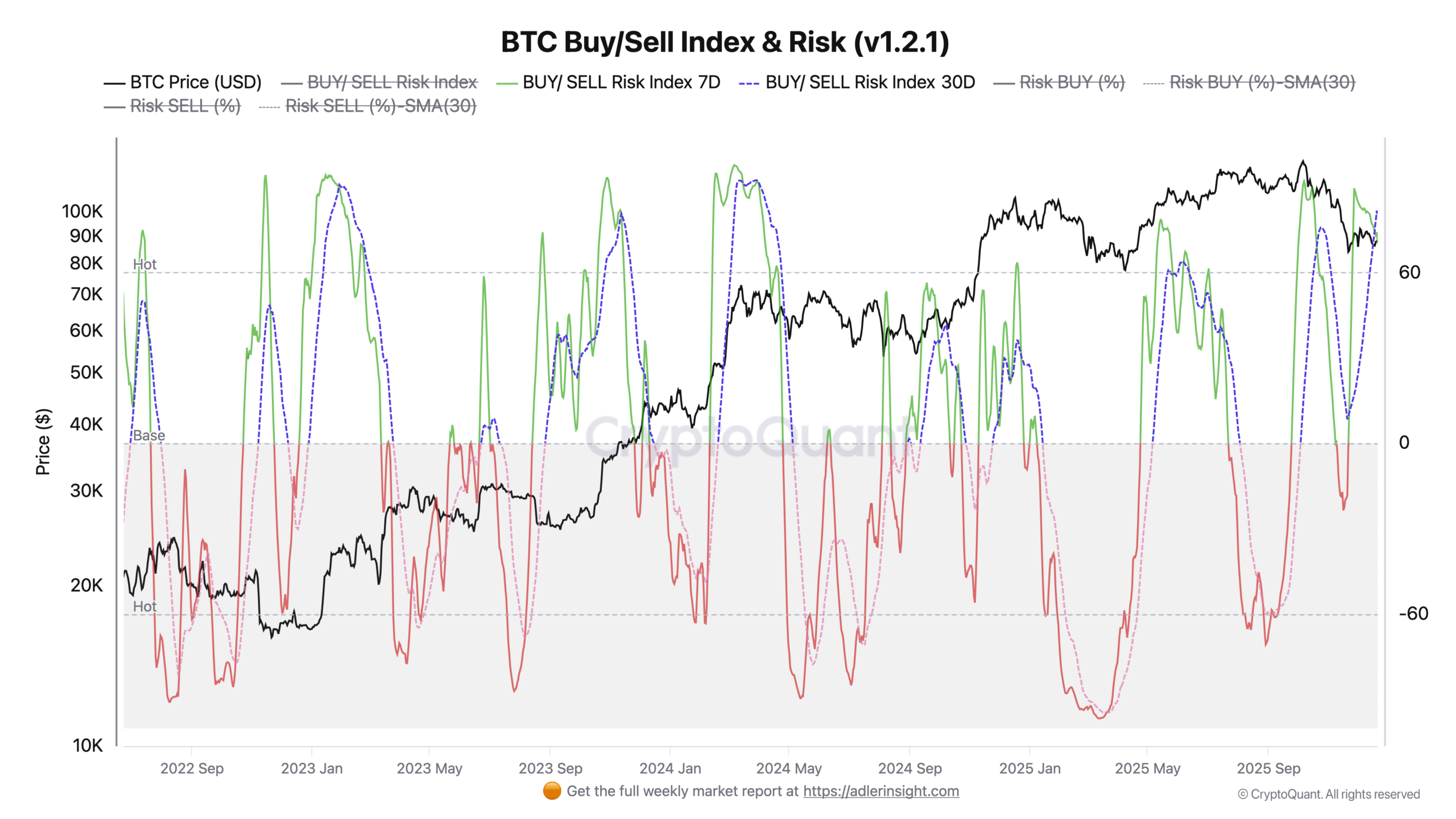

Buy/sell index metrics reveal a high-risk environment, with 7-day and 30-day values signaling potential for sustained declines if buying doesn’t intensify.

Discover the latest on Bitcoin selling pressure: On-chain metrics reveal intense activity but potential for stabilization. Stay informed on crypto trends and secure your portfolio today.

What Is Driving the Current Bitcoin Selling Pressure?

Bitcoin selling pressure is intensifying due to a sharp decline in the buy/sell pressure delta, marking the strongest such episode in three years. On-chain analyst Joao Wedson, founder and CEO of Alphractal, highlighted this trend through data shared on X, where market sell orders significantly outnumber buys, directly impacting price movements. While this reflects aggressive selling, it often precedes market stabilization rather than prolonged downturns.

Market orders, unlike limit orders, execute immediately and drive volatility. The delta’s negative values underscore how sellers are overwhelming the order book, contributing to recent price dips below $85,000. Alphractal’s analysis, based on blockchain transaction flows, provides a clear view of this imbalance, helping traders gauge sentiment without relying on off-chain noise.

Source: Joao Wedson on X

Wedson remains optimistic, noting that such extreme selling intensity is rarely sustainable. Historical patterns suggest it could indicate a near-term bottom, followed by a period of sideways trading as the market digests the pressure. Investors should monitor these metrics closely, as they offer insights into underlying network activity that traditional price charts may overlook.

How Does Bitcoin’s Holder Retention Rate Influence Selling Pressure?

Despite the surge in Bitcoin selling pressure, the holder retention rate has been climbing steadily over recent months, per data from Glassnode. This metric measures the percentage of Bitcoin addresses that retain a balance over 30 consecutive days, calculated by dividing persistent holders by the total addresses with any balance in the period. A rising rate, currently above 70% in key cohorts, signals stronger long-term holding behavior and investor conviction.

Glassnode’s on-chain studio reveals that this uptrend counters short-term panic selling, as more addresses avoid realizing losses by holding through volatility. For context, during previous bear phases, retention rates dipped below 50%, leading to capitulation. Experts like those at Glassnode emphasize that this resilience could mitigate the impact of current sell-offs, potentially fostering accumulation if prices stabilize around $80,000-$85,000.

Supporting this, blockchain analytics show reduced churn among long-term holders, who control over 70% of the supply. This diamond-hand approach reduces available liquidity for sellers, limiting downside momentum. However, short-term traders must remain cautious, as external factors like macroeconomic shifts could still amplify pressure.

Source: Glassnode

Is the Bitcoin Market Still Risky Amid This Selling Pressure?

The broader Bitcoin market regime continues to pose risks for buyers, even as selling pressure peaks. Crypto analyst Axel Adler Jr. analyzed the buy/sell index across 1-day, 7-day, and 30-day periods, noting elevated values that indicate overheating. The 1-day index sits at around 43 following last week’s drop to $84,400, but longer-term readings exceed 60, suggesting caution.

This index, derived from transaction volume and order flow, highlights how aggressive buying or selling can lead to unsustainable rallies or drops. Adler Jr. warns that the structure favors short positions during gains, as long trades unwind quickly, preventing lasting uptrends. In financial terms, this creates a “sell the news” dynamic, where bounces are viewed as profit-taking opportunities rather than bullish signals.

Historical data from similar regimes shows that when 30-day indices climb above 70, correction phases often follow, with average drawdowns of 15-20%. Traders using tools like those from Adler Jr.’s analysis recommend scaling out on rebounds, preserving capital for deeper support levels. Overall, while on-chain holders provide a buffer, the risk-reward skew remains tilted toward sellers until buying volume surges.

Source: Axel Adler Jr

Frequently Asked Questions

What Causes Extreme Bitcoin Selling Pressure in 2025?

Extreme Bitcoin selling pressure in 2025 stems from imbalanced market orders where sells dominate buys, as tracked by Alphractal’s delta metric. Factors include profit-taking after rallies, macroeconomic uncertainties, and whale distributions. This has led to a three-year high in selling intensity, though on-chain data suggests it’s nearing exhaustion.

How Can Investors Navigate Bitcoin’s Current Market Regime?

To navigate Bitcoin’s current market regime, focus on holder retention trends from Glassnode, which show increasing stability. Avoid chasing short-term bounces, as buy/sell indices indicate high risk for buyers. Instead, wait for confirmed accumulation phases, using on-chain signals to time entries around key support levels like $80,000.

Key Takeaways

- Peak Selling Intensity: Bitcoin’s selling pressure is at a three-year high, but unsustainable levels often precede bottoms and consolidation, per Alphractal data.

- Rising Holder Confidence: Glassnode metrics reveal growing retention rates, countering sell-offs and supporting long-term price floors through reduced supply churn.

- Risk Management Essential: Monitor buy/sell indices as advised by Axel Adler Jr.; sell rallies and protect gains to navigate the overheated regime.

Conclusion

In summary, the surge in Bitcoin selling pressure highlights a critical juncture, with the buy/sell delta reaching extremes and holder retention rates offering a counterbalance of optimism. Sources like Alphractal and Glassnode underscore the market’s resilience amid volatility, while the buy/sell index warns of ongoing risks. As 2025 progresses, expect potential consolidation; investors should prioritize on-chain insights to position for the next phase of growth.