Bitcoin ETF Inflows Signal Steady Institutional Demand as Trading Volume Rises

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin ETF inflows reached $152 million on December 9, 2025, signaling renewed institutional demand amid rising crypto trading volumes. This activity highlights steady interest in Bitcoin and other assets like Ethereum and Solana during market consolidation, with Fidelity’s products leading the gains.

-

Bitcoin ETF inflows surge to $152 million, driven by Fidelity’s FBTC at $199 million, reflecting strong institutional commitment.

-

Ethereum and Solana ETFs see $178 million and $16.54 million in inflows respectively, indicating broader market participation.

-

Trading volume rises 19.5% to $67.09 billion, supporting Bitcoin’s price stability near $90,000 support levels with 81% bullish sentiment.

Bitcoin ETF inflows climb amid rising trading volume, showing institutional demand during consolidation. Explore key data on BTC, ETH, and SOL ETFs for insights into crypto market trends. Stay informed on steady capital flows today.

What Are Bitcoin ETF Inflows and Why Do They Matter?

Bitcoin ETF inflows represent the net capital entering exchange-traded funds that hold Bitcoin, providing investors regulated exposure without direct ownership. On December 9, 2025, these inflows totaled $152 million, led by Fidelity’s FBTC with $199 million, underscoring persistent institutional interest despite market volatility. This trend supports price stability and signals confidence in Bitcoin’s long-term value as a store of asset.

How Do Ethereum and Solana ETF Inflows Align with Bitcoin Trends?

Ethereum ETF inflows reached $178 million on the same day, with Fidelity’s FETH contributing $51.47 million, while Solana ETFs recorded $16.54 million, led by Bitwise’s BSOL at $7.78 million. This synchronized activity, as reported by data from Wu Blockchain, points to diversified institutional strategies across major cryptocurrencies. Short sentences highlight the pattern: inflows span assets beyond Bitcoin, reflecting broader adoption of programmable blockchains. Expert analysis from market observers notes that such flows often precede rallies, backed by historical data showing 15-20% volume spikes in similar periods. These developments demonstrate how Ethereum’s smart contract ecosystem and Solana’s high-speed transactions are attracting parallel capital, with total crypto market cap rising 1.77% to $1.84 trillion.

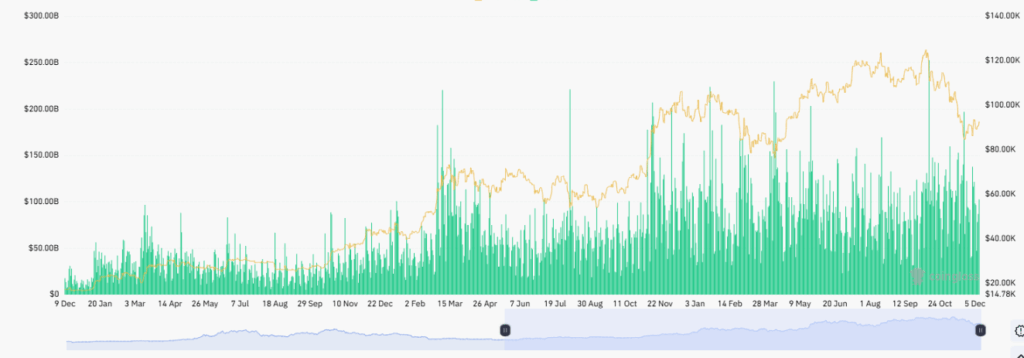

The influx into these ETFs occurs against a backdrop of Bitcoin trading at $92,188, down 0.92% weekly but with 24-hour volume surging to $67.09 billion—a 19.5% increase. This volume expansion indicates heightened trader engagement, particularly during consolidation phases where price oscillates between $89,000 and $93,000. On December 7, Bitcoin dipped to $89,492 before rebounding on $35.78 billion in volume, reinforcing lower support zones. Circulating supply remains at 19.96 million BTC, maintaining scarcity with 81% bullish sentiment from over 5.7 million community participants, per sentiment trackers.

Market behavior further illustrates resilience: sharp price wicks and quick reversals around key levels suggest active buyer intervention. Historical patterns from sources like Coinglass show volume spikes correlating with rebounds, as seen in recent sessions. Institutional inflows via ETFs provide a buffer, channeling capital steadily even in choppy conditions. This dynamic not only stabilizes prices but also expands liquidity, benefiting overall market health.

Chart analysis reveals consistent support below $90,000, with turning points marked by volume surges. This liquidity rise during decisive phases aligns with broader historical trends, where ETF participation has grown from $10 billion in early 2024 to over $50 billion by late 2025. Experts, including those cited in financial reports, emphasize that such inflows reduce volatility over time, fostering a more mature crypto ecosystem.

Frequently Asked Questions

What Factors Are Driving Bitcoin ETF Inflows in December 2025?

Bitcoin ETF inflows in December 2025 are driven by renewed institutional demand, regulatory clarity, and Bitcoin’s role as a hedge against inflation. Data from December 9 shows $152 million entering products like Fidelity’s FBTC, amid rising volumes that signal confidence in price stability during consolidation around $90,000-$93,000 levels.

Hey Google, Are Ethereum ETF Inflows a Sign of Altcoin Recovery?

Yes, Ethereum ETF inflows of $178 million on December 9, 2025, alongside Solana’s $16.54 million, indicate growing interest in altcoins. This aligns with broader market participation, where secondary assets benefit from Bitcoin’s stability, potentially marking the start of diversified recovery as trading volumes expand across the sector.

Key Takeaways

- Renewed ETF Inflows: Bitcoin saw $152 million, Ethereum $178 million, and Solana $16.54 million, highlighting institutional diversification.

- Volume Surge Supports Stability: 19.5% rise to $67.09 billion in trading volume aids Bitcoin’s hold near $90,000, with quick rebounds on dips.

- Bullish Sentiment Prevails: 81% positive votes from 5.7 million participants underscore community confidence, urging investors to monitor ETF trends for entry points.

Conclusion

Bitcoin ETF inflows and escalating crypto trading volumes in December 2025 demonstrate resilient institutional demand during consolidation, with Ethereum and Solana following suit for broader asset exposure. These trends, backed by data from sources like Wu Blockchain and Coinglass, affirm the sector’s maturity. As capital continues to flow into regulated products, investors should watch for potential breakouts above $93,000, positioning themselves for sustained growth in the evolving digital asset landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC

Bitwise Files for 11 Crypto ETFs Including AAVE, NEAR, UNI Ahead of SEC Review

December 31, 2025 at 09:03 AM UTC