Bitcoin ETF Inflows Surge Amid Cautious BTC Price and Derivatives Activity

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

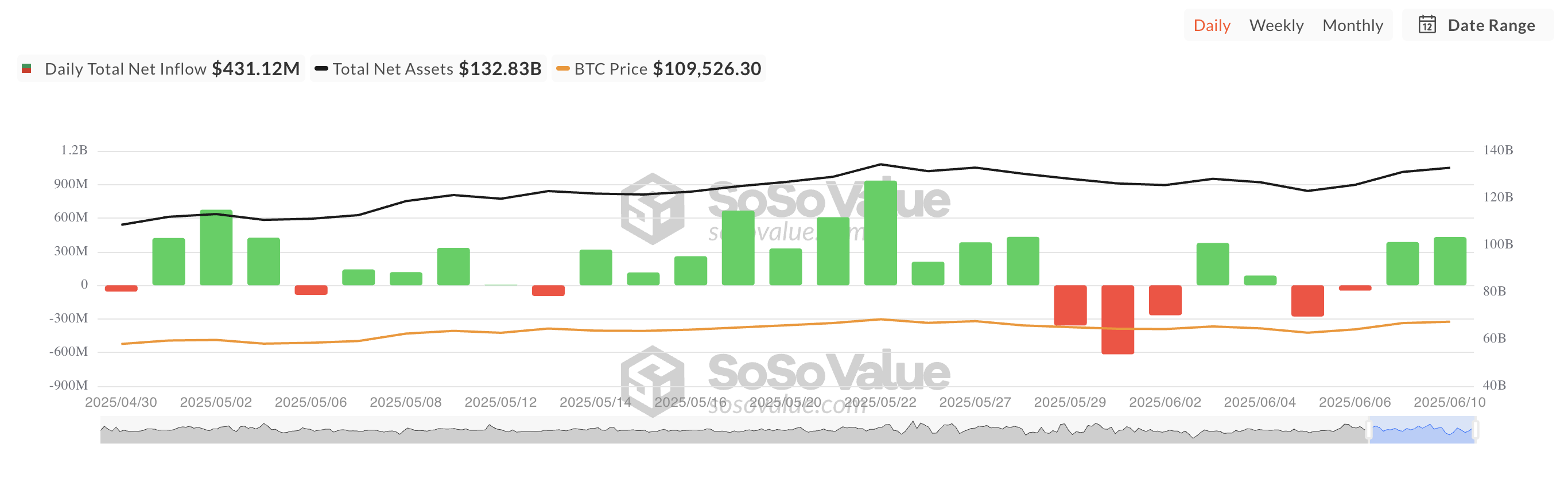

Bitcoin ETFs have attracted $431 million in inflows, marking the largest surge since late May and signaling renewed institutional interest in the crypto market.

-

BlackRock’s IBIT led the inflows with $337 million, while Fidelity’s FBTC contributed $67 million, boosting their cumulative investment figures significantly.

-

Despite these inflows, Bitcoin’s price remains stable amid growing profit-taking and a decline in futures open interest, indicating cautious market sentiment.

Bitcoin ETFs see $431M inflows, led by BlackRock and Fidelity, amid flat BTC price and declining futures interest, signaling mixed institutional sentiment.

Surge in Bitcoin ETF Inflows Highlights Renewed Institutional Confidence

On Tuesday, US-listed spot Bitcoin ETFs experienced a remarkable increase in net inflows, reaching $431.12 million, a 12% rise from the previous day’s $386 million. This surge represents the largest single-day inflow since May 28, underscoring a renewed wave of institutional confidence in Bitcoin as a strategic asset.

The inflows primarily benefited BlackRock’s IBIT, which accounted for a substantial $337 million, pushing its historical net inflows to an impressive $49.11 billion. Fidelity’s FBTC also saw significant inflows of $67.07 million, bringing its total to $11.68 billion. These figures reflect growing institutional appetite for regulated, transparent investment vehicles that provide direct exposure to Bitcoin.

The increased demand for Bitcoin ETFs is widely interpreted as a strategic positioning by institutional investors anticipating potential upside in BTC’s price. Market participants are optimistic about Bitcoin’s ability to reclaim and sustain levels above $110,000, fueled by macroeconomic factors and ongoing adoption trends.

Institutional Flows Contrast with Flat BTC Price and Derivatives Activity

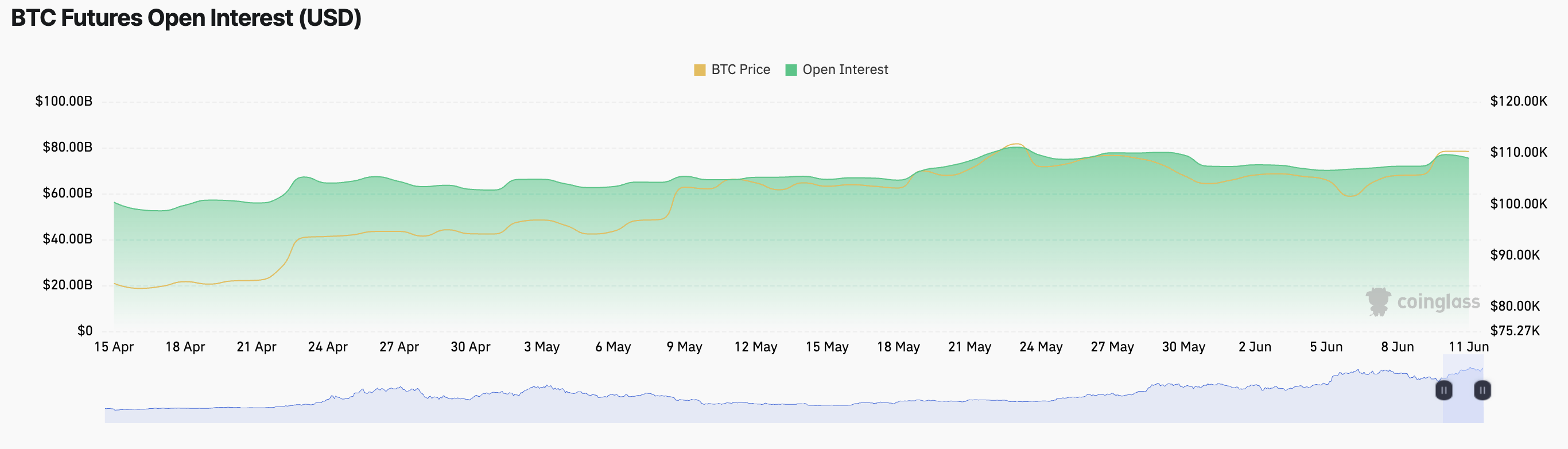

Despite the robust ETF inflows, Bitcoin’s spot price has remained relatively flat, trading around $109,601 with a marginal 0.11% increase over the past 24 hours. This price stability contrasts with the dynamics observed in the derivatives market, where open interest in Bitcoin futures has declined by approximately 1% to $75.33 billion.

Open interest, which measures the total number of outstanding futures and options contracts, serves as a barometer for market activity and trader sentiment. The recent decrease suggests that some traders are engaging in profit-taking by closing long positions established during the recent rally. This behavior introduces a degree of caution into the market, potentially tempering near-term price momentum.

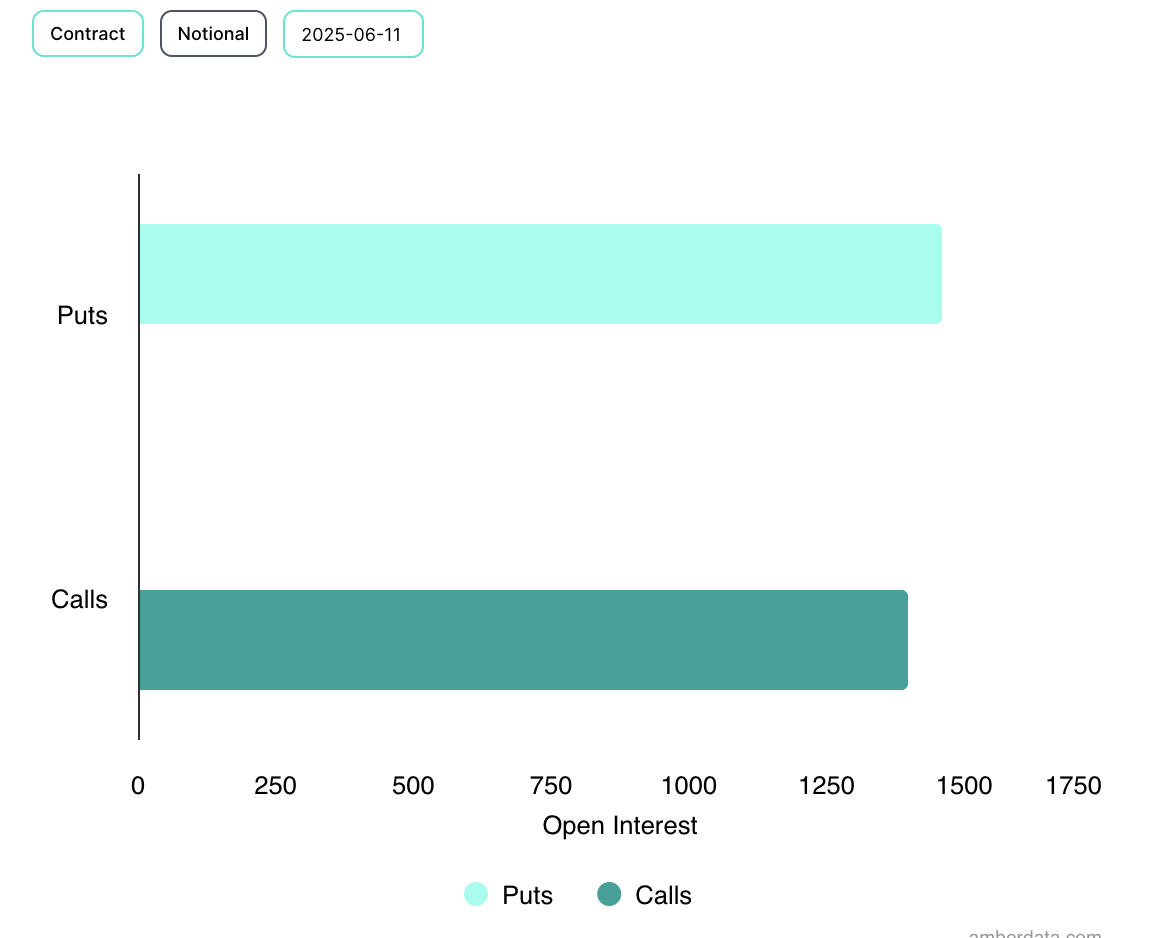

Additionally, the options market exhibits a subtle shift towards bearish sentiment, evidenced by rising demand for put options. This trend indicates that some investors are hedging against potential downside risks, further reinforcing the notion of a cooling phase despite the bullish inflows into ETFs.

Balancing Bullish ETF Demand with Cautious Derivatives Signals

The juxtaposition of strong ETF inflows against subdued price action and declining futures open interest highlights a nuanced market environment. Institutional investors appear confident in Bitcoin’s long-term prospects, as reflected in their increased allocation to ETFs. However, the derivatives market signals a more measured approach, with traders managing risk amid profit-taking and hedging activities.

This divergence suggests that while the macro outlook for Bitcoin remains constructive, short-term volatility and consolidation phases are likely as the market digests recent gains. Investors should monitor key indicators such as futures open interest and options positioning to gauge evolving sentiment and potential price trajectories.

Conclusion

Bitcoin ETFs have demonstrated significant inflows, led by major players like BlackRock and Fidelity, reaffirming institutional interest in the crypto asset class. However, the flat BTC price coupled with declining futures open interest and increased put option demand signals a cautious market stance in the near term. This dynamic underscores the importance of balancing optimism with prudent risk management as Bitcoin navigates its next phase of price discovery.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC