Bitcoin ETF Inflows Top $500M as Prices Remain Flat, Signaling Potential Shifts

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

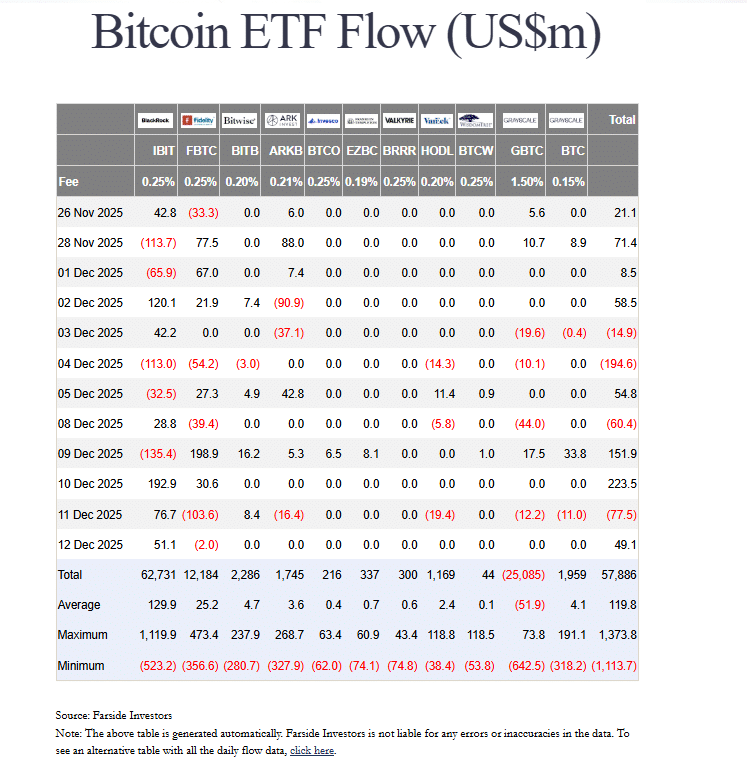

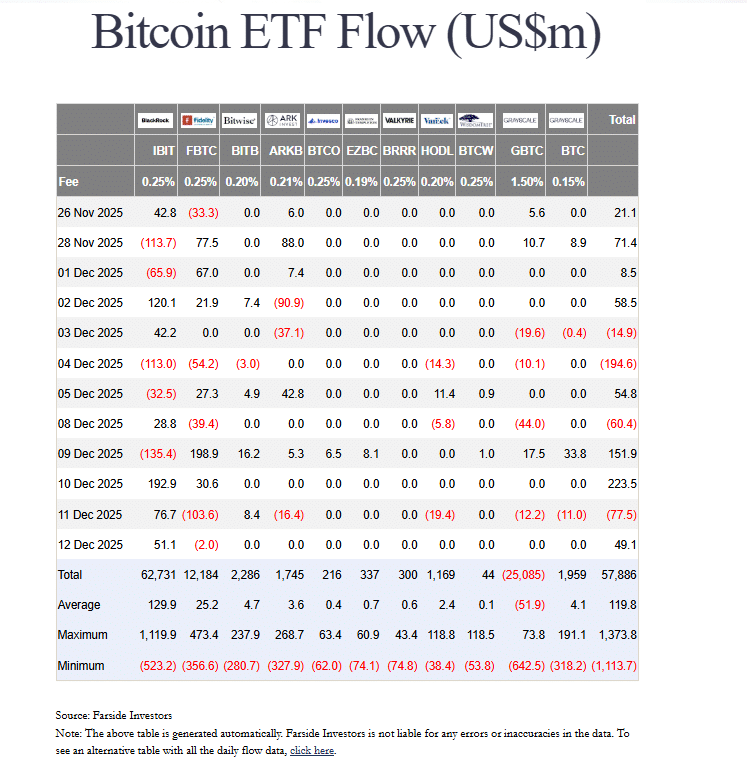

Bitcoin and Ethereum spot ETFs recorded over $500 million in net inflows from December 8 to 12, 2025, led by major providers like BlackRock and Fidelity. Despite this steady capital influx, Bitcoin traded near $89,600 and Ethereum around $3,127, showing minimal price movement as markets absorbed the demand without volatility.

-

Bitcoin ETFs attracted $291 million in inflows, with BlackRock’s IBIT and Fidelity’s FBTC at the forefront.

-

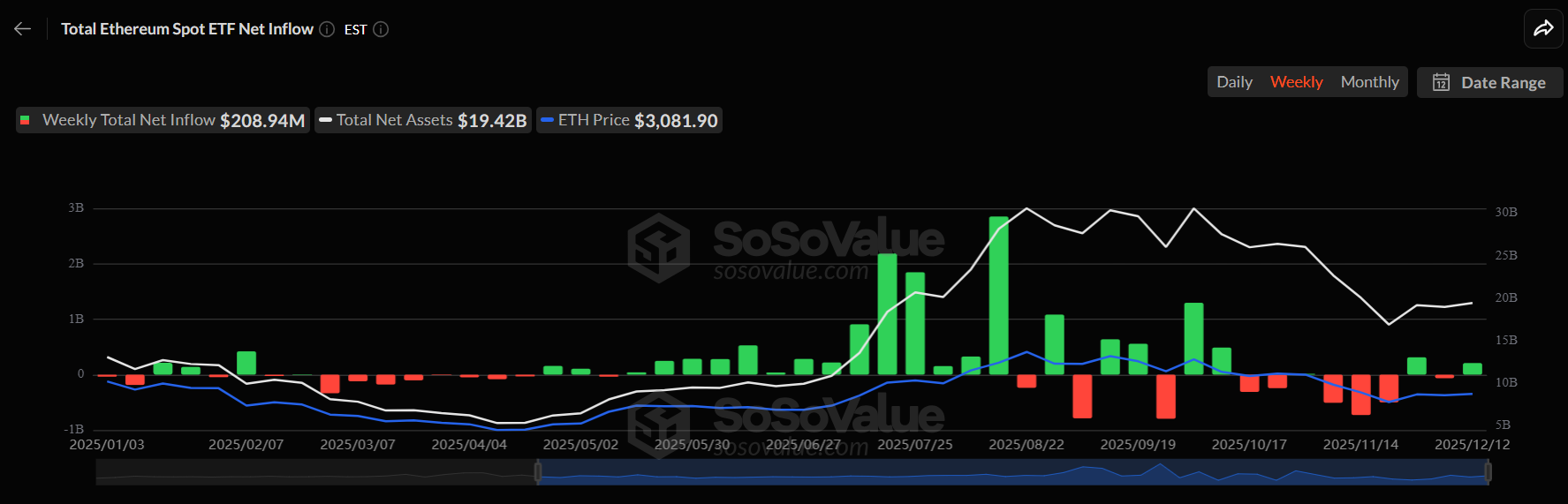

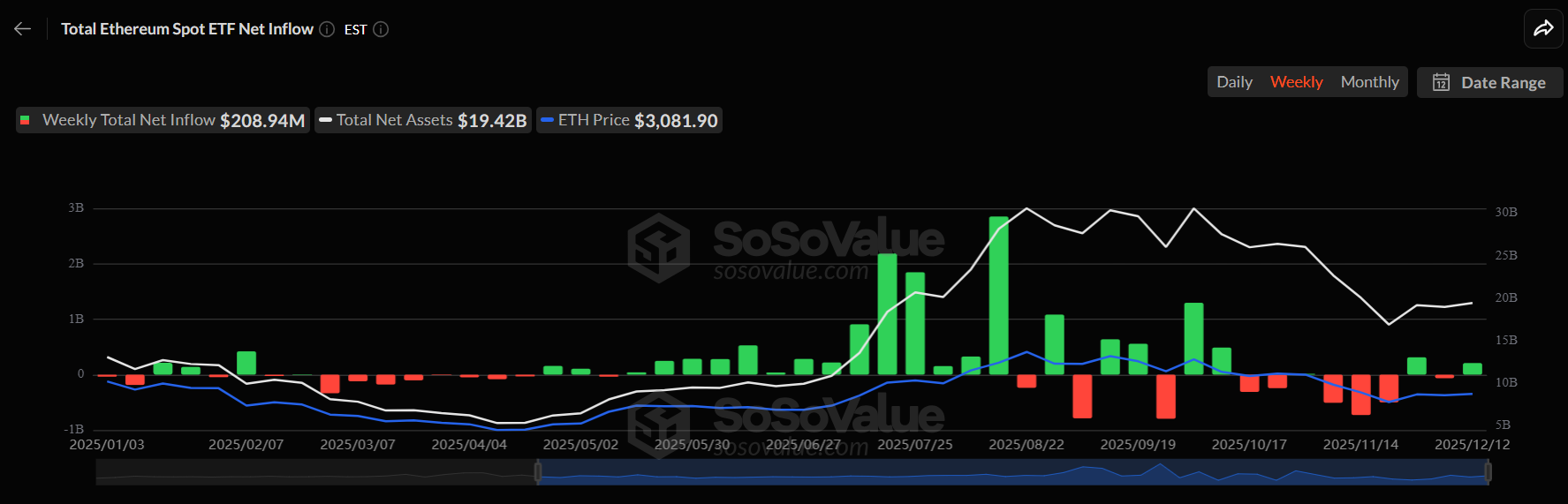

Ethereum ETFs saw $209 million in net inflows, maintaining steady accumulation.

-

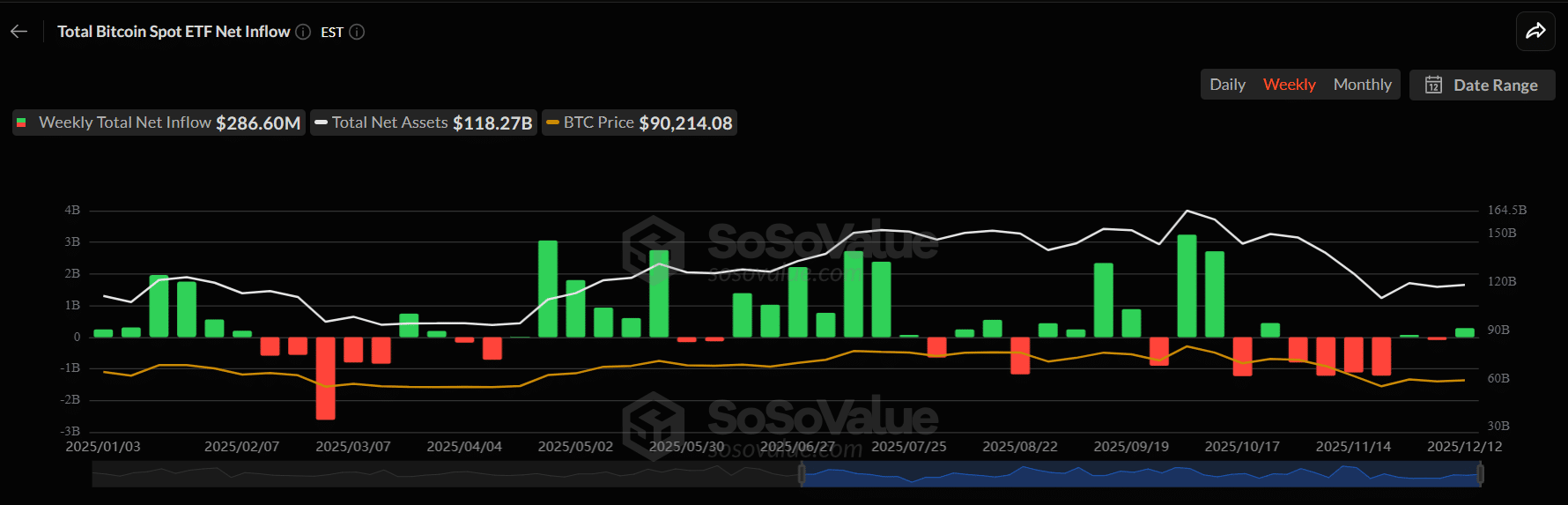

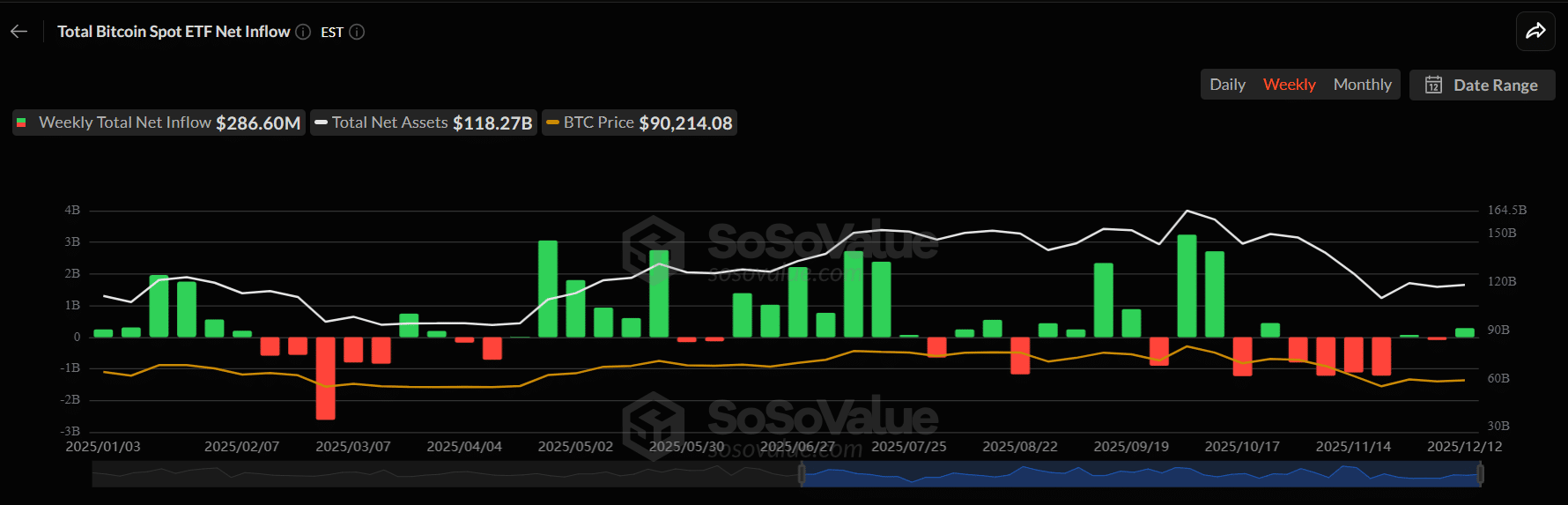

Total assets under management reached $118.3 billion for Bitcoin ETFs and $19.4 billion for Ethereum ETFs, per data from Farside Investors and SoSoValue.

Bitcoin and Ethereum ETF inflows hit $500M+ in December 2025 despite flat prices. Discover why steady demand isn’t sparking rallies yet. Stay informed on crypto trends for smart investing—explore more insights today!

What caused Bitcoin and Ethereum ETF inflows to surge despite stagnant prices?

Bitcoin and Ethereum ETF inflows surged to more than $500 million net between December 8 and 12, 2025, reflecting growing institutional interest in these assets as long-term holdings. This capital came from established providers, with Bitcoin ETFs pulling in $291 million and Ethereum ETFs adding $209 million, according to Farside Investors data. However, prices remained range-bound, with Bitcoin hovering near $89,600 and Ethereum at $3,127, as the market digested the Federal Reserve’s anticipated rate cut without broader risk-on momentum.

Source: Farside Investors

Ethereum ETFs followed a similar pattern, posting $209 million in weekly inflows, with BlackRock’s ETHA and Fidelity’s FETH leading the demand.

Source: CoinMarketCap

How did market conditions contribute to flat Bitcoin and Ethereum prices amid ETF inflows?

Bitcoin traded near $89,600, marking a 2.16% weekly decline, while maintaining a market capitalization of approximately $1.78 trillion. Ethereum held steady around $3,127, with a negligible 0.23% drop and a market value of about $377 billion. These movements occurred as the broader cryptocurrency market absorbed consistent ETF buying without triggering significant volatility. Traders remained cautious following the Federal Reserve’s rate cut, which markets had anticipated, preventing a rally. Bitcoin faced resistance at the $92,000 to $94,000 level, capping upward potential, while Ethereum oscillated between $3,100 and $3,200. Data from CoinMarketCap highlights this stabilization, with no aggressive selling or buying pressure evident. Institutional investors appear focused on accumulation for long-term positions rather than short-term trades, as noted by analysts tracking ETF flows. This shift underscores a maturing market where demand builds quietly, supported by steady inflows from products like BlackRock’s offerings, which accounted for a substantial portion of the week’s activity. Overall, the lack of immediate price reaction suggests that ETF demand is decoupling from spot market dynamics, fostering a more predictable environment for holders.

The pattern indicates that the cryptocurrency sector is evolving, with ETF vehicles providing a structured entry point for capital that does not always translate to instant price surges. Experts from financial research firms emphasize that such inflows represent committed ownership rather than speculative bets, which could lead to more resilient asset performance over time.

Frequently Asked Questions

What were the top performers in Bitcoin and Ethereum ETF inflows for December 2025?

BlackRock’s IBIT led Bitcoin ETF inflows with significant contributions, followed closely by Fidelity’s FBTC, totaling $291 million for the week. For Ethereum, BlackRock’s ETHA and Fidelity’s FETH drove $209 million in net inflows, based on reports from Farside Investors, highlighting institutional preference for these established funds.

Why are Bitcoin and Ethereum ETF inflows not boosting prices right now?

Bitcoin and Ethereum ETF inflows are building long-term positions amid cautious market sentiment after the Federal Reserve’s rate cut. Prices stay flat due to anticipated policy moves and resistance levels, with Bitcoin at $89,600 and Ethereum at $3,127, allowing steady accumulation without volatility, as observed in recent trading data.

Source: SoSoValue

Bitcoin spot ETFs now hold about $118.3 billion in total net assets, while Ethereum ETFs sit near $19.4 billion, so there’s strong capital commitment.

Source: SoSoValue

Key Takeaways

- Strong ETF Inflows: Over $500 million entered Bitcoin and Ethereum spot ETFs in early December 2025, signaling robust institutional demand.

- Price Stability: Bitcoin and Ethereum prices held flat due to market anticipation of Fed actions and technical resistance levels.

- Long-Term Shift: Focus on accumulation over speculation could build a foundation for future price appreciation as assets grow.

Conclusion

Bitcoin and Ethereum ETF inflows demonstrated resilience in December 2025, amassing over $500 million despite subdued price action around $89,600 for Bitcoin and $3,127 for Ethereum. This trend, backed by data from Farside Investors and SoSoValue, reflects a market prioritizing steady capital commitment amid cautious sentiment. As institutional participation deepens, investors should monitor ongoing flows for signs of broader momentum, positioning portfolios for potential shifts in the evolving cryptocurrency landscape.