Bitcoin ETF Outflows Reach $3.7 Billion in November, Signaling Short-Term Rebalancing

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin ETF outflows reached $3.7 billion in November 2025, driven by short-term profit-taking from long-term holders and leveraged position liquidations, not a decline in institutional interest, according to Bitfinex analysts.

-

Record outflows from major funds like BlackRock’s iShares Bitcoin Trust highlight tactical rebalancing amid market volatility.

-

Long-term Bitcoin holders are selling to lock in profits, contributing to the broader price correction below $90,000.

-

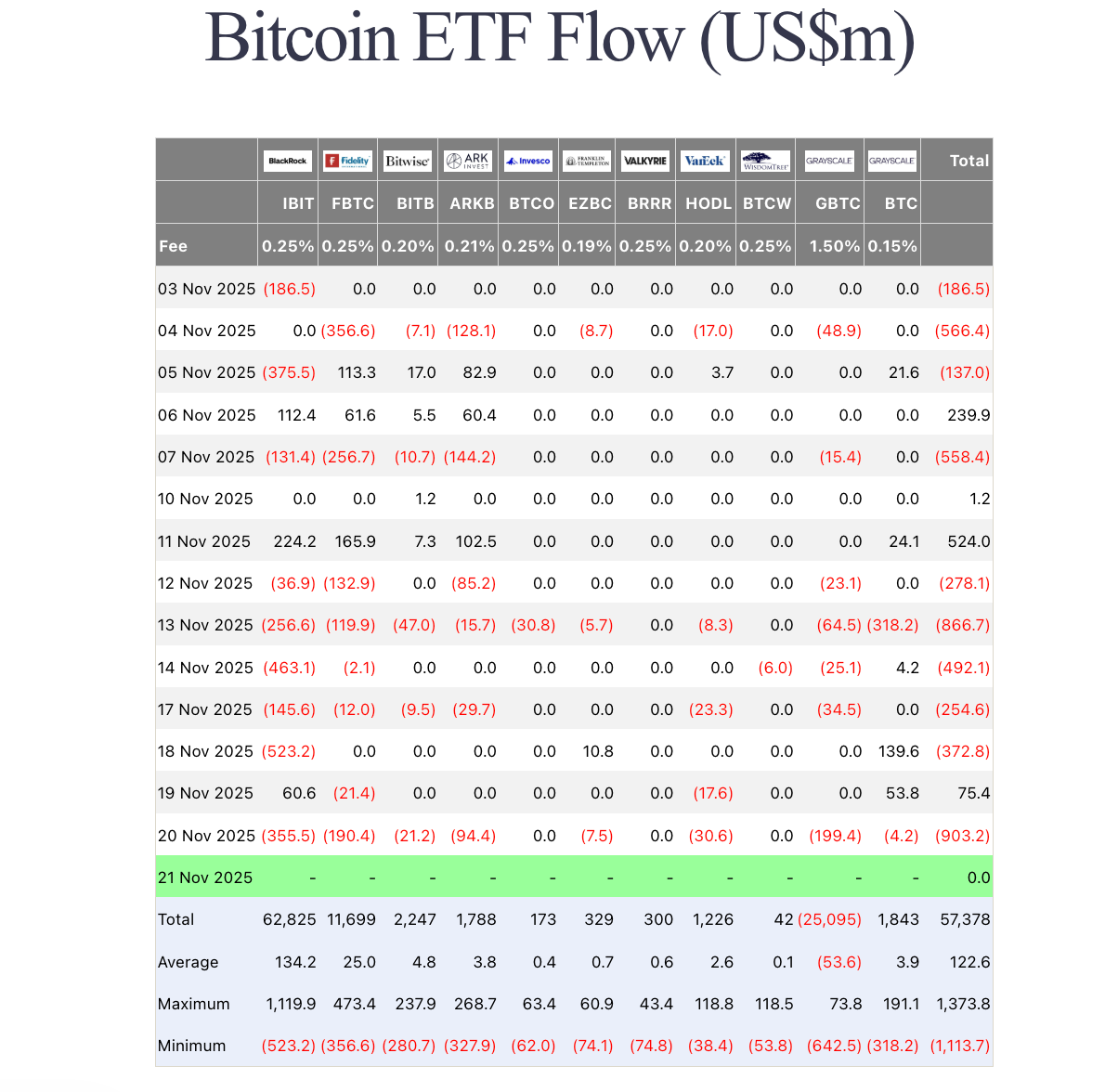

Daily outflows exceeded $900 million on a single day, per data from Farside Investors, amid uncertainty over interest rate decisions.

Bitcoin ETF outflows surge to $3.7B in November 2025: Discover why these record exits signal short-term adjustments, not fading institutional demand. Stay informed on BTC’s resilient long-term outlook and expert insights today.

What Are Causing the Recent Bitcoin ETF Outflows?

Bitcoin ETF outflows in November 2025 have surpassed $3.7 billion, primarily due to short-term tactical rebalancing by investors rather than a fundamental shift away from the asset. Analysts at Bitfinex attribute these movements to long-term holders taking profits and the unwinding of highly leveraged positions, exacerbated by market uncertainty surrounding potential December interest rate adjustments. This reflects temporary market dynamics, with the structural appeal of Bitcoin as a store-of-value remaining strong.

Bitcoin ETF flows for November. Source: Farside Investors

How Do Short-Term Price Movements Impact Institutional Bitcoin Demand?

Short-term price movements, such as Bitcoin’s drop below $90,000, have prompted outflows from ETFs as investors adopt a risk-off stance amid broader market corrections. Bitfinex analysts emphasize that these outflows do not indicate lower institutional demand or structural issues in the Bitcoin market. Instead, they stem from profit-taking by long-term holders and the flushing out of leveraged positions, with data from Farside Investors showing single-day outflows topping $900 million. Expert Vincent Liu, chief investment officer at Kronos Research, notes that ETF investors are typically long-term oriented and resilient to short-term noise. Eric Balchunas, senior ETF analyst at Bloomberg, points to direct holders—whales and original Bitcoin enthusiasts—as key sellers, preserving ETF channels’ integrity. Bitfinex further asserts that the spot ETF pathway remains robust, positioning Bitcoin for sustained institutional adoption despite the current drawdown. Supporting this, the firm’s report highlights Bitcoin’s firm fundamentals as a store-of-value asset, backed by growing corporate treasury integrations and regulatory clarity in major markets.

The outflows reflect short-term price movements, not lower institutional demand or structural issues in the Bitcoin market, analysts said.

The record outflows from Bitcoin exchange-traded funds (ETFs) represent short-term, “tactical” rebalancing rather than institutional flight from BTC, according to analysts at crypto exchange Bitfinex.

Long-term Bitcoin (BTC) holders taking profit and selling their coins, and highly-leveraged positions flushing out of the markets, are the root causes of the billions of dollars in ETF outflows and the broader market crash, Bitfinex analysts said.

The uncertainty of a December interest rate cut has also shifted investors to a risk-off outlook, Bitfinex said.

“This does not derail the longer-term move towards institutionalization. The spot ETF channel remains intact, and the outflow likely reflects tactical rebalancing rather than a wholesale exit from the asset class.”

Bitfinex said the structural thesis for Bitcoin remains “firm,” and that Bitcoin is positioned for continued institutional adoption as a store-of-value asset with strong long-term fundamentals. The ongoing drawdown is a short-term price movement, they added.

Related: BlackRock leads near $3B Bitcoin November ETF exodus with record $523M outflows

Bitcoin ETFs Bleed Billions of Dollars and Post Record Outflows as Market Panic Deepens

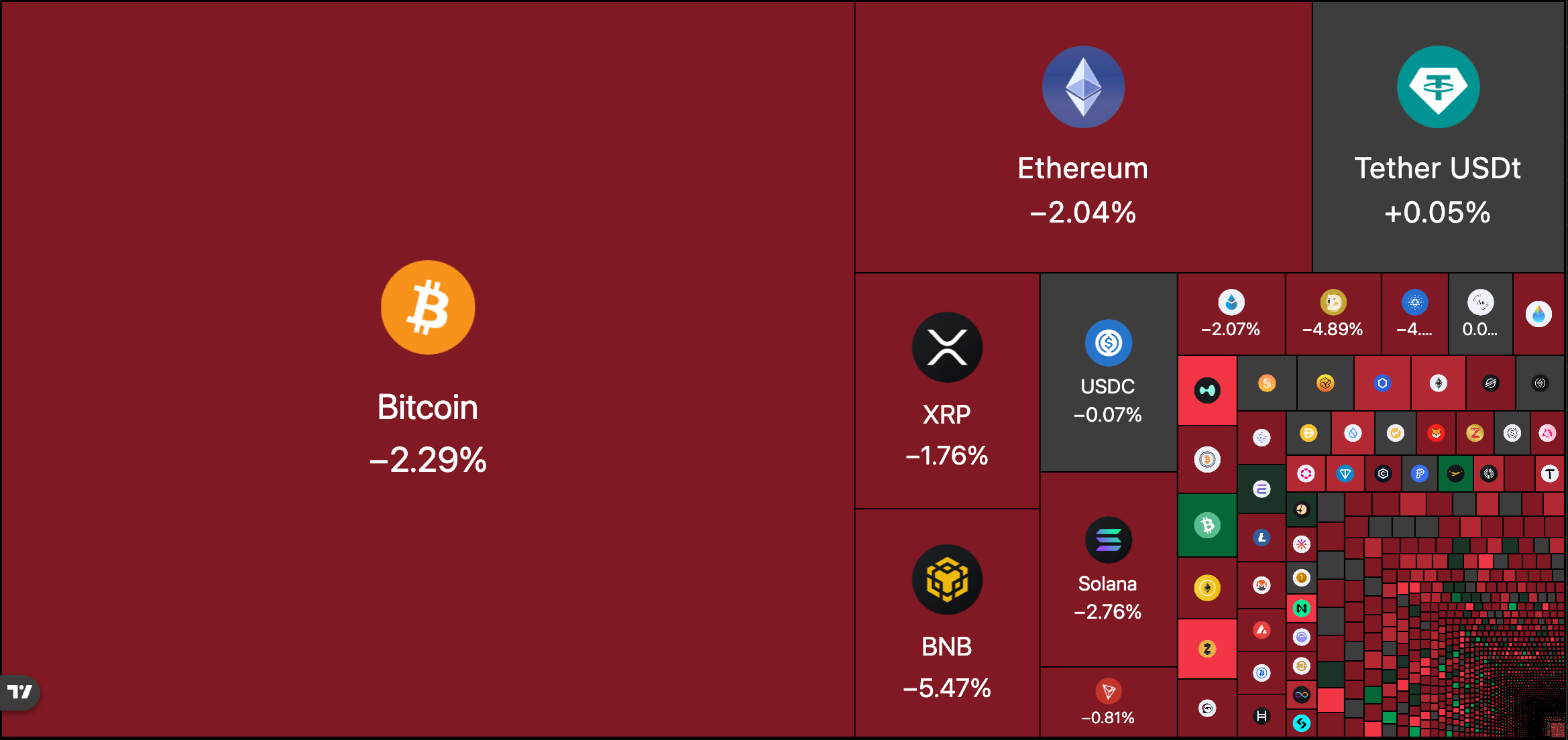

Bitcoin ETF outflows have topped $3.7 billion in November 2025, as losses from October’s crypto market crash extended into the month, sparking investor fears of the beginning of a bear market. These figures underscore heightened volatility, with the majority of the crypto market continuing to experience significant declines well into November, according to data visualized on TradingView platforms.

The majority of the crypto market continues to bleed well into the month of November. Source: TradingView

BlackRock’s iShares Bitcoin Trust (IBIT) ETF led the outflows, with over $2.47 billion in redemptions so far in November. The Bitcoin ETFs posted some of the worst daily outflows on record in November. Single-day outflows crossed $900 million on Thursday, according to Farside Investors.

The average ETF investor is now underwater following BTC’s crash below $90,000. However, this does not mean that ETF investors will panic sell, Vincent Liu, chief investment officer at quantitative trading company Kronos Research, told Cointelegraph.

The price of Bitcoin plunges below the $90,000 level. Source: TradingView

Bitcoin ETF investors tend to be long-term holders and ignore short-term market noise and price movements, Liu said.

Long-term Bitcoin whales and OGs who hold the asset directly rather than through an investment vehicle are responsible for most of the selling, according to senior Bloomberg ETF analyst Eric Balchunas.

Magazine: Sharplink exec shocked by level of BTC and ETH ETF hodling: Joseph Chalom

Frequently Asked Questions

What Is Driving the $3.7 Billion Bitcoin ETF Outflows in November 2025?

The $3.7 billion in Bitcoin ETF outflows during November 2025 stems from profit-taking by long-term holders and the liquidation of leveraged positions amid market corrections. Bitfinex analysts clarify this as tactical rebalancing influenced by interest rate uncertainties, not a sign of waning institutional commitment to Bitcoin’s long-term potential.

Will Bitcoin ETF Outflows Signal the Start of a Bear Market?

Bitcoin ETF outflows in this context represent short-term adjustments due to price volatility and risk aversion, rather than the onset of a prolonged bear market. As Vincent Liu from Kronos Research explains, ETF holders focus on extended horizons, and Bitfinex maintains that Bitcoin’s institutional adoption trajectory remains on course despite temporary pressures.

Key Takeaways

- Outflows Are Tactical: November’s $3.7 billion Bitcoin ETF outflows reflect short-term rebalancing and profit-taking, not a retreat from institutional demand, per Bitfinex analysis.

- Long-Term Holders Lead Selling: Direct Bitcoin whales and early adopters are primary sellers, allowing ETF structures to sustain their role in mainstream adoption.

- Fundamentals Hold Firm: Investors should monitor interest rate developments while recognizing Bitcoin’s enduring appeal as a store-of-value asset for future growth.

Conclusion

In summary, the record Bitcoin ETF outflows of $3.7 billion in November 2025 highlight short-term market dynamics driven by profit realization and leverage unwinding, as detailed by experts at Bitfinex and Bloomberg. While immediate pressures from price drops below $90,000 and rate cut uncertainties persist, the core thesis for institutional Bitcoin adoption stays robust. Looking ahead, stakeholders are encouraged to view these events as opportunities to reinforce long-term strategies in the evolving crypto landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Stablecoins Reach 2025 Peaks Led by USDT, Amid Sustained Activity

December 31, 2025 at 07:01 PM UTC

Ethereum Could Target $8,500 as Bullish Momentum Builds Near $4,811

December 31, 2025 at 02:39 PM UTC