Bitcoin ETF Outflows Suggest Institutional Fatigue Amid Crypto Liquidity Squeeze

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin and Ethereum ETF flows have turned negative for over six weeks, signaling institutional fatigue and liquidity contraction in crypto markets. Data from Glassnode shows sustained outflows, with Bitcoin ETFs losing $142.19 million in a single day, while Ethereum saw mixed but overall weakening demand, impacting prices amid year-end caution.

-

Bitcoin ETF outflows exceed $142 million daily, extending a six-week negative trend per SoSoValue data.

-

Ethereum ETFs record sporadic inflows but maintain a negative 30-day average, reflecting broader caution.

-

Total assets under management for Bitcoin ETFs drop to $114.99 billion, down from summer highs, amid prices hovering around $88,351.

Bitcoin and Ethereum ETF flows signal institutional caution with six weeks of net outflows, contracting liquidity. Discover key trends and impacts on crypto prices—stay informed for smarter investment decisions.

What Are the Current Trends in Bitcoin and Ethereum ETF Flows?

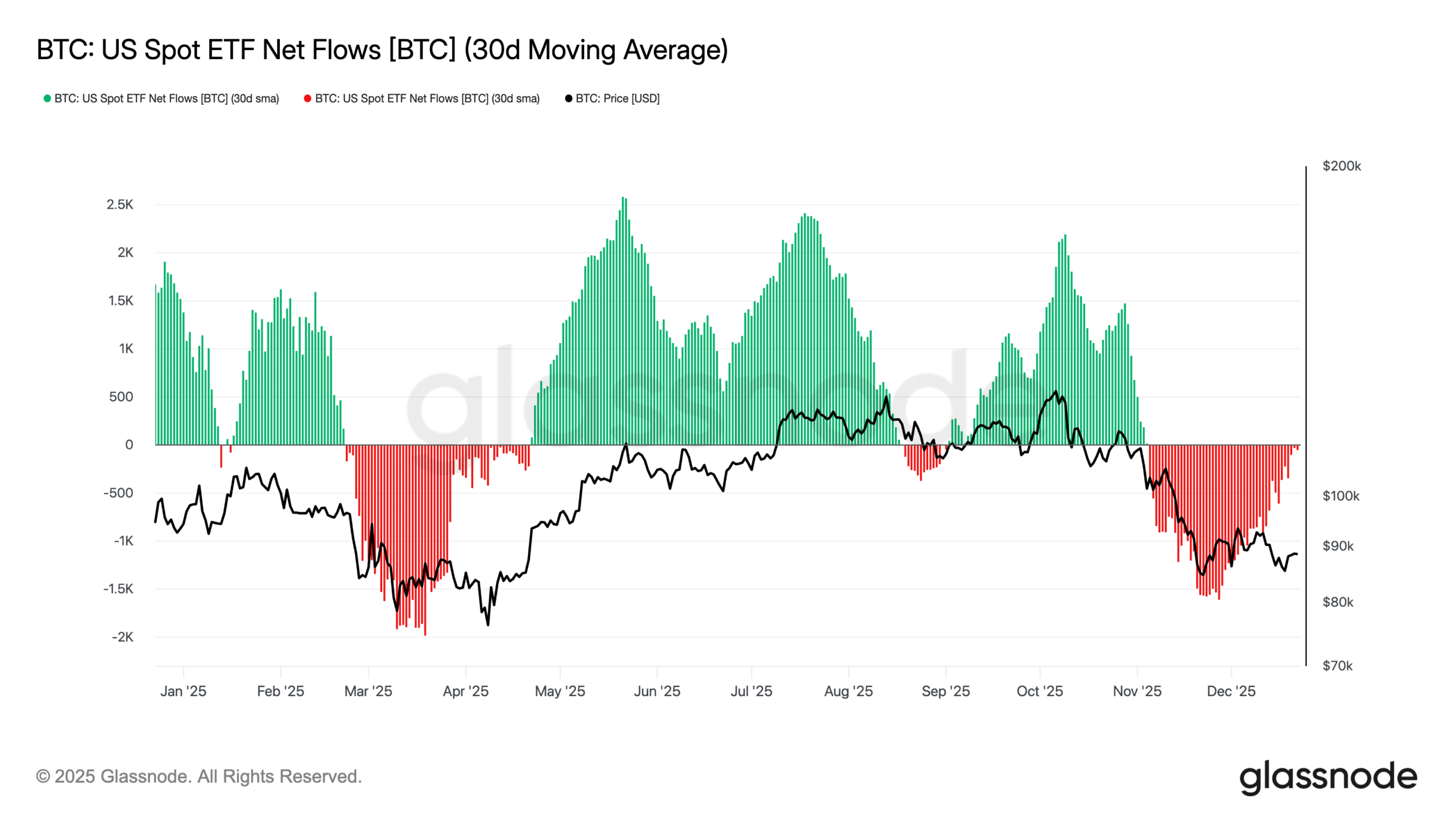

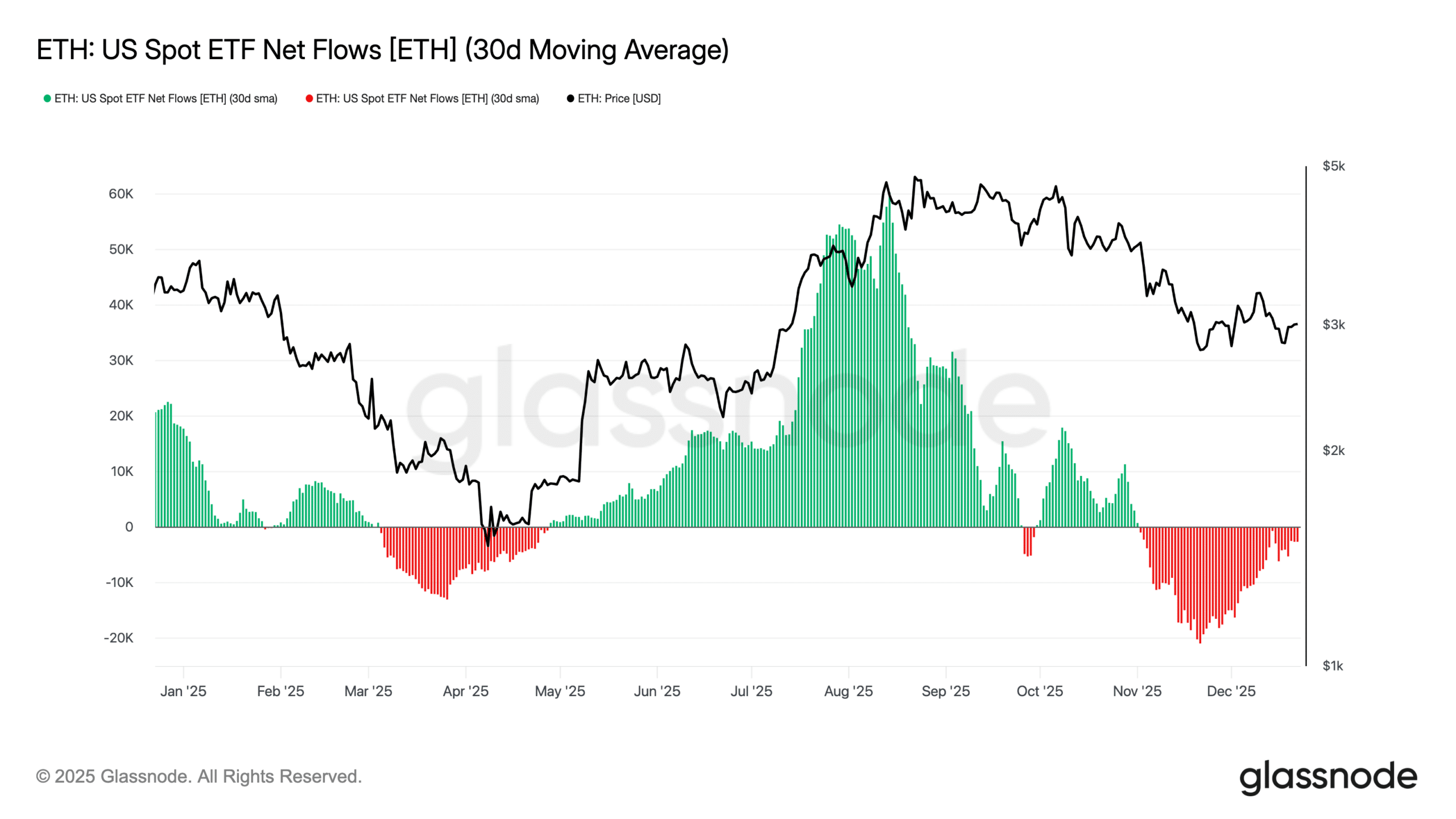

Bitcoin and Ethereum ETF flows have shifted to negative territory, with institutional demand showing signs of exhaustion after a robust earlier period. According to on-chain analytics from Glassnode, the 30-day moving average for both assets’ ETFs flipped negative in early November 2025 and has remained so, driven by year-end rebalancing and reduced risk appetite. This reversal contrasts sharply with the summer surge that propelled Bitcoin above $110,000 and Ethereum over $4,500, highlighting a cooling phase in market liquidity.

Why Have Bitcoin ETF Inflows Turned Negative?

Detailed data from SoSoValue reveals that Bitcoin ETFs experienced a net outflow of $142.19 million on a recent trading day, part of a persistent pattern throughout November and December 2025. This decline aligns with a broader reduction in institutional participation, as evidenced by Glassnode’s metrics showing steady red bars on daily flow charts. The total net assets for Bitcoin ETFs now stand at $114.99 billion, a significant drop from their peak during the July-September inflow wave. Bitcoin’s spot price, currently around $88,351, struggles to breach $90,000, mirroring the waning ETF support. Experts from Glassnode note that such outflows often occur during periods of macroeconomic uncertainty, where allocators prioritize capital preservation over aggressive positioning.

Source: Glassnode

The pattern of outflows began accelerating after mid-October, when the last significant inflows provided a brief lift. Since then, intermittent positive days have been overshadowed by consistent withdrawals, underscoring a strategic retreat by institutional players. This dynamic has contributed to heightened volatility in Bitcoin’s price action, as ETF flows traditionally act as a key barometer for broader market sentiment.

Ethereum ETFs Show Mixed Short-Term Flows but a Weakening Trend

While Ethereum ETFs posted $84.59 million in inflows on a recent day, this isolated positive stands in stark contrast to the overarching negative trajectory. Glassnode’s 30-day simple moving average for Ethereum ETF net flows remains in the red, indicating that recent activity lacks the volume to counteract the six-week outflow streak. Assets under management for these products have fallen to $18.20 billion, retreating from August’s highs during a period of heightened enthusiasm post-ETF launches.

Source: Glassnode

Ethereum’s price, trading at approximately $2,976, reflects this softening demand, with liquidity thinning across exchanges and on-chain transfers. Analysts from SoSoValue emphasize that Ethereum’s ETF performance is particularly tied to network upgrades and DeFi activity, both of which have seen tempered growth amid the current outflow environment. Short-term inflows, while notable, fail to alter the 30-day negative average, pointing to sustained institutional hesitation.

Liquidity Contraction and Year-End De-Risking

The convergence of on-chain data and ETF metrics paints a clear picture of reduced exposure in the crypto sector. Institutions have dialed back positions, risk appetite has cooled, and the robust inflow cycle from earlier in 2025 has dissipated entirely. This shift is largely driven by annual portfolio rebalancing, tighter global liquidity conditions, and the normalization following the initial excitement over ETF approvals.

- Institutional allocators prioritize stability as year-end approaches.

- Macro factors, including interest rate expectations, dampen aggressive bets.

- Previous high-inflow periods often precede temporary pauses, as seen in historical cycles.

Glassnode researchers observe that such patterns are not uncommon, with temporary retreats allowing for reassessment before renewed engagement. In 2025, ETFs have emerged as the primary conduit for institutional capital into cryptocurrencies, making their flow dynamics a critical indicator for market health. The ongoing contraction underscores a prudent approach rather than outright abandonment, with potential for stabilization as external pressures ease.

What This Means for BTC and ETH Now

Bitcoin and Ethereum prices exhibit high sensitivity to ETF activity, and the current outflows constrain upward potential. With assets under management shrinking and daily flows predominantly negative, both assets are likely to consolidate in narrow ranges until fresh demand materializes. Positive developments in regulation or macroeconomic policy could reverse this, reigniting inflows and supporting price recovery.

- Limited upside due to persistent outflows limits bullish momentum.

- Sideways trading persists as liquidity remains subdued.

- Catalysts like favorable policy shifts may prompt institutional re-entry.

This phase represents a cyclical cooling, not a fundamental shift away from digital assets. As ETFs continue to dominate liquidity provision in 2025, monitoring their flows will be vital for anticipating movements in Bitcoin and Ethereum ETF trends into 2026.

Frequently Asked Questions

How Long Have Bitcoin and Ethereum ETF Outflows Lasted?

Bitcoin and Ethereum ETF outflows have persisted for more than six weeks, starting in early November 2025. Glassnode data confirms the 30-day moving average stayed negative throughout, with SoSoValue reporting consistent daily withdrawals totaling hundreds of millions, reflecting institutional caution amid market volatility.

What Impact Do Negative ETF Flows Have on Crypto Prices?

Negative ETF flows directly pressure crypto prices by reducing available liquidity and signaling lower institutional confidence. For Bitcoin around $88,351 and Ethereum at $2,976, this leads to price stagnation or declines, as seen in recent failures to break key resistance levels like $90,000 for Bitcoin.

Key Takeaways

- Institutional Fatigue Evident: Six weeks of negative Bitcoin and Ethereum ETF flows indicate a temporary de-risking, not market rejection, per Glassnode and SoSoValue insights.

- Liquidity Impact Significant: Outflows have slashed Bitcoin ETF assets to $114.99 billion and Ethereum’s to $18.20 billion, correlating with price retreats from summer highs.

- Watch for Reversal Signals: Positive macro or regulatory news could spark inflows, essential for Bitcoin and Ethereum recovery in early 2026—monitor flows closely for entry points.

Conclusion

In summary, the prolonged negative trends in Bitcoin and Ethereum ETF flows highlight institutional caution and liquidity tightening as 2025 draws to a close. With outflows dominating and prices stabilizing at lower levels, the market awaits catalysts to restore momentum. Investors should track these dynamics vigilantly, as a return to positive flows could herald a robust rebound—position yourself with informed strategies for the opportunities ahead.