Bitcoin ETFs Experienced $238 Million Weekly Outflow

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

$133 Million Daily Outflow from US Spot Bitcoin ETFs

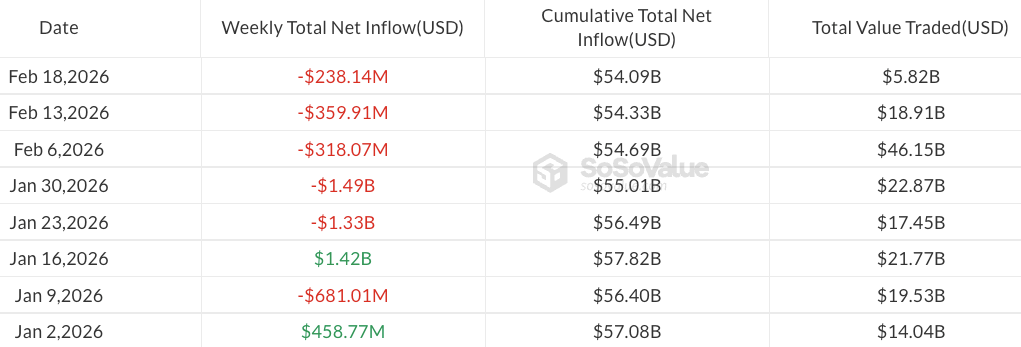

US-listed spot Bitcoin ETF detailed analysis’s experienced a net outflow of 133.3 million dollars on Wednesday, with weekly losses reaching 238 million dollars. BlackRock’s iShares Bitcoin Trust (IBIT) fund recorded the largest outflow of 84 million dollars. Trading volumes fell below 3 billion dollars and remained low. Since the beginning of the year, 2.5 billion dollars in outflows have occurred, while assets under management declined to 83.6 billion dollars. If there is no recovery on Thursday and Friday, it could form the first five-week outflow series since March 2025.

Weekly flows in US spot Bitcoin ETFs in 2026. Source: SoSoValue

Solana ETFs Shine with Six-Day Inflow Series

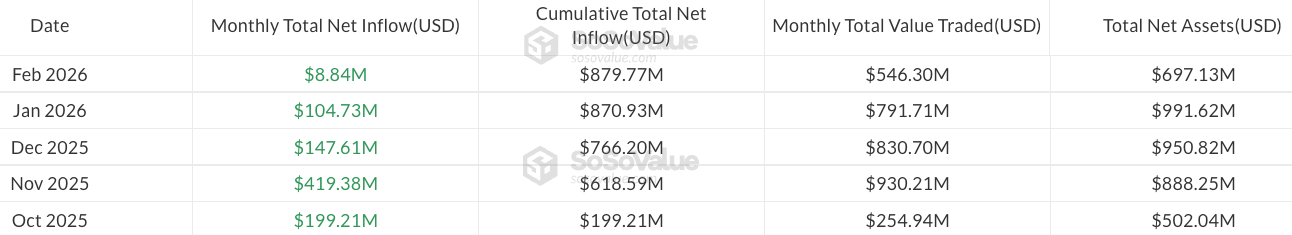

Solana (SOL) ETFs are showing reverse flows; with a six-day inflow series, they have gained 113 million dollars since the beginning of the year, managing a total of 700 million dollars in assets. In contrast, Ether (ETH) and XRP ETFs experienced outflows of 41.8 million and 2.2 million dollars respectively. Solana spot market investor interest signals altcoin rotation despite BTC pressure.

Weekly flows in US spot Solana ETFs in 2026. Source: SoSoValue

Bitcoin Market in Extreme Fear Zone: RSI 34.5 and Support Levels

The market is in the “extreme fear” zone on the Crypto Fear & Greed Index; Bitcoin (BTC) is trading at 67,058 dollars with a 24% decline since the beginning of the year (current: 67,079$, -1.72%). RSI at 34.50 signals oversold conditions, the trend is downward, and Supertrend indicates a bear market. Strong supports: 65,143$ (77/100 score, -2.81% distance), 62,910$ (63/100). Resistances: 67,962$ (near, +1.39%), 77,303$. According to CryptoQuant, the short-term Sharpe ratio has reached historical “generational buy” levels. Monitor BTC futures short positions.

The Crypto Fear & Greed Index. Source: Alternative.me

Institutional Bitcoin Losses: Metaplanet and Hive Examples

Recent news shows Metaplanet reported a net loss of 619 million dollars on BTC valuation but increased its holdings to 35,102 BTC. Bitcoin miner Hive suffered a 91 million dollar loss due to accelerated depreciation, despite rising hash rate. This reflects balance sheet pressure from ETF outflows and price declines; the BIP-360 proposal for post-quantum security anticipates a 7-year transition.