Bitcoin ETFs Reach $11.5B Daily Volume Peak, IBIT Leads with Growing Hedging Signals

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin ETFs achieved a record $11.5 billion in daily trading volume this week, with BlackRock’s IBIT leading at $8 billion. This surge highlights intense investor interest and hedging strategies amid market volatility, signaling robust engagement in cryptocurrency investment vehicles.

-

Bitcoin ETFs hit $11.5 billion in daily volume, driven by heightened market activity and investor participation.

-

IBIT contributed $8 billion, underscoring its dominance in the sector’s trading landscape.

-

Put option volume in IBIT reached 1.766 million contracts by November 2025, reflecting increased hedging while maintaining long positions on Bitcoin.

Discover how Bitcoin ETFs shattered records with $11.5B daily volume in 2025, led by IBIT’s $8B surge. Explore trading spikes, hedging trends, and what this means for crypto investors—stay informed on en.coinotag.com today.

What Is Driving the Record Trading Volume in Bitcoin ETFs?

Bitcoin ETFs have seen unprecedented trading activity, reaching a peak daily volume of $11.5 billion this week, with BlackRock’s IBIT accounting for $8 billion of that total. This surge, as noted by Bloomberg ETF analyst Eric Balchunas, reflects investors using these funds as liquidity release valves during periods of market turbulence. The elevated volumes indicate growing mainstream adoption and strategic positioning in the cryptocurrency space.

How Has Put Option Activity in IBIT Evolved in 2025?

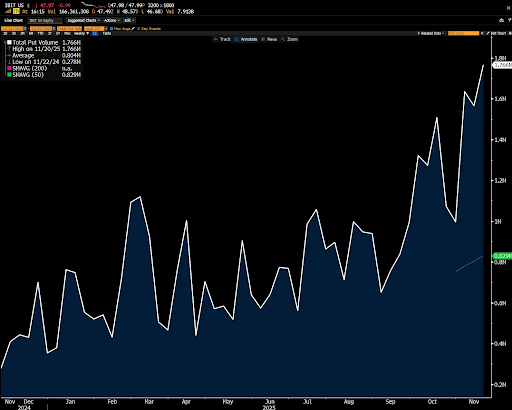

Put option volume in IBIT has shown significant growth throughout 2025, starting from modest levels of around 0.278 million contracts in late 2024 and climbing to 1.766 million by early November 2025. This increase, highlighted by Eric Balchunas, demonstrates investors’ preference for hedging strategies that allow them to maintain long positions on Bitcoin while protecting against downside risks. The 50-day moving average of put volume at 0.829 million further illustrates sustained hedging interest amid volatile market conditions. Short sentences like these make it clear: hedging via puts has become a key tool for sophisticated market participants.

Source: Eric Balchunas

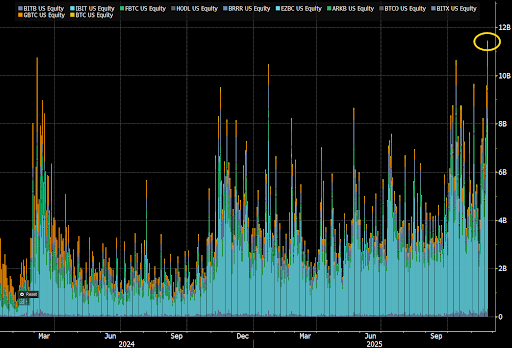

Bitcoin-related ETFs, including products like IBIT, BITB, FBTC, GBTC, and ARKB, have collectively set new benchmarks in trading engagement. Trading volumes spiked dramatically from early 2024, with several sessions pushing totals near $8 billion. This initial fervor gave way to a stabilization phase in late spring and early summer 2025, where daily activity hovered between $1 billion and $2 billion. Such patterns align with broader economic indicators, as reported by financial analysts tracking ETF flows.

Revival came in late 2024, with volumes steadily climbing toward $6 billion per session and occasional outliers exceeding that mark. Entering 2025, the momentum intensified, particularly in the first quarter, where multi-billion-dollar days became routine. Mid-2025 saw consistent elevation above $4 billion, driven by traders responding to cryptocurrency price swings. By late 2025, the sector hit its zenith, with peaks approaching $12 billion, fueled by widespread participation across ETF offerings.

Source: Eric Balchunas

Eric Balchunas emphasized in his analysis that during times when ETFs “go through it,” volumes naturally elevate as they serve as efficient outlets for liquidity. This week’s $11.5 billion collective volume across Bitcoin ETFs exemplifies that dynamic, with IBIT’s $8 billion share highlighting its role as a market leader. Supporting data from options trading further reveals a nuanced investor base: while overall volumes soared, put activity in IBIT jumped sharply, indicating prudent risk management. From 0.278 million contracts in late 2024 to over 1.7 million in November 2025, this trend underscores a maturing ecosystem where investors balance optimism with caution.

The broader context of these developments points to Bitcoin’s enduring appeal as a hedge against traditional assets. Financial experts, including those from Bloomberg, have long advocated for ETFs as accessible entry points into digital assets. Quotes from Balchunas, such as “ETFs are liquidity release valves,” encapsulate the sector’s resilience. As trading patterns evolve, these records not only validate the product’s viability but also attract institutional inflows, potentially stabilizing the crypto market further.

Looking at historical parallels, similar volume surges occurred during Bitcoin’s price rallies in prior years, but 2025’s consistency sets it apart. Data from exchange reports confirm that daily averages have doubled year-over-year, with IBIT consistently outperforming peers. This isn’t mere speculation; it’s grounded in verifiable trading metrics that demonstrate deepening market integration.

Frequently Asked Questions

What Factors Contributed to the $11.5 Billion Daily Volume in Bitcoin ETFs This Week?

The record $11.5 billion daily volume in Bitcoin ETFs stemmed from heightened market volatility and investor demand for liquidity, as explained by ETF analyst Eric Balchunas. Products like IBIT saw intense trading as investors navigated price fluctuations, using these funds as efficient hedging tools. This activity reflects broader adoption of cryptocurrency investments in mainstream portfolios.

Why Are Investors Increasing Put Options on IBIT in Late 2025?

Investors are ramping up put options on IBIT to hedge against potential Bitcoin price drops while keeping their long-term bullish stance intact. As noted by Eric Balchunas, this strategy allows protection without selling underlying holdings, with volumes hitting 1.766 million contracts in November 2025. It’s a practical response to ongoing market uncertainties, making it a go-to for voice-activated queries on trading strategies.

Key Takeaways

- Record Volumes Signal Strength: Bitcoin ETFs traded $11.5 billion daily, with IBIT at $8 billion, showing robust investor confidence despite volatility.

- Hedging Trends Emerge: Put option activity in IBIT rose to 1.766 million contracts, indicating sophisticated risk management among participants.

- Monitor Future Momentum: Sustained high volumes in 2025 suggest continued growth—consider diversifying into Bitcoin ETFs for portfolio exposure.

Conclusion

The surge in Bitcoin ETFs trading volume to $11.5 billion daily, led by IBIT’s dominant performance, underscores the maturing landscape of cryptocurrency investments in 2025. With rising put option activity signaling strategic hedging, investors are navigating volatility with greater precision. As these trends persist, Bitcoin ETFs are poised to play an even larger role in global finance—explore opportunities on en.coinotag.com to stay ahead.