Bitcoin Exchange Outflows Hint at Long-Term Confidence Despite Price Lag

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin exchange outflows are signaling increased investor confidence despite recent price underperformance against equities. More BTC is being withdrawn from exchanges, reducing liquid supply and indicating long-term holding strategies by large investors, with over 136,000 BTC accumulated by whales in recent months.

-

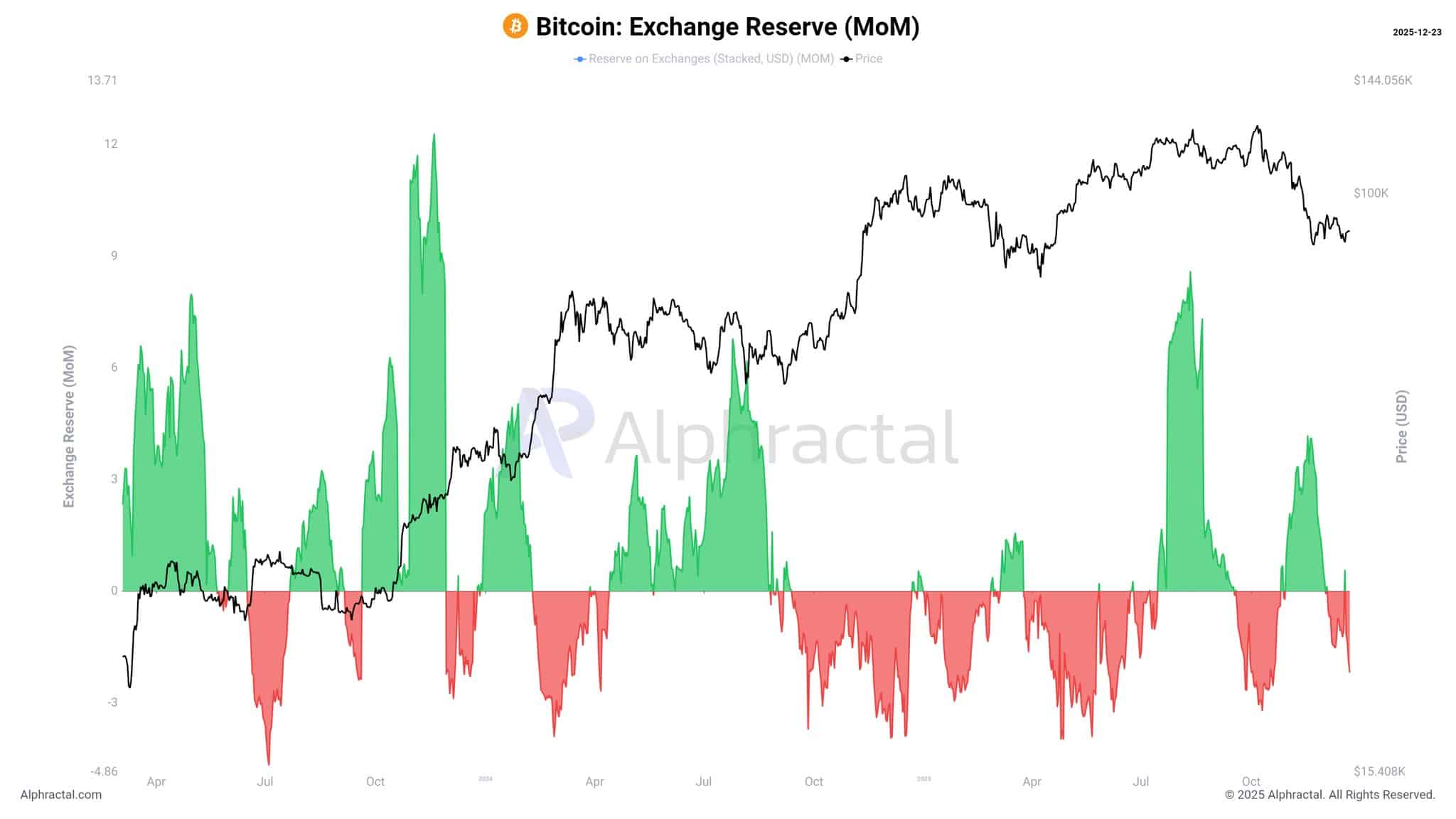

Declining exchange reserves: Monthly Bitcoin outflows have turned negative, showing more withdrawals than deposits even amid weak price action.

-

Whale accumulation: Larger holders have added substantial BTC, reflecting firm belief in future value.

-

Market lag versus equities: Bitcoin has trailed the Nasdaq 100 by nearly 50% this year, but on-chain data suggests potential for stronger recovery.

Bitcoin exchange outflows signal growing confidence amid price lag versus stocks. Discover how whale buying and reduced supply could drive future gains—explore key indicators now.

What Are Bitcoin Exchange Outflows Indicating in the Current Market?

Bitcoin exchange outflows are a key on-chain metric showing investors withdrawing BTC from trading platforms to secure storage, often signaling a shift toward long-term holding rather than short-term selling. This trend has persisted despite Bitcoin’s price not matching the gains in equities like the Nasdaq 100, where BTC has lagged by nearly 50% year-to-date. Data from analytics platforms such as Alphractal reveals monthly exchange reserves turning negative, with more BTC leaving than entering, which typically reduces available supply and supports price stability over time.

How Is Whale Accumulation Shaping Bitcoin’s Supply Dynamics?

Large investors, known as whales, have been actively increasing their positions, accumulating over 136,000 BTC during the same period of outflows. This behavior contrasts with smaller holders reducing their exposure, suggesting that institutional and high-net-worth players view current price levels as attractive entry points. According to on-chain analysis from Alphractal, such whale buying reduces the circulating supply on exchanges, which historically precedes bullish cycles by limiting immediate selling pressure. Experts note that this dynamic fosters greater market confidence, as whales’ actions often influence broader sentiment. For instance, David Schassler, Head of Multi-Asset Solutions at VanEck, stated, “Today’s weakness reflects softer risk appetite and temporary liquidity pressures, not a broken thesis.” If this trend continues, it could position Bitcoin for outperformance relative to traditional assets in the coming year, especially as liquidity conditions improve.

Frequently Asked Questions

What Causes Bitcoin to Leave Exchanges During Price Lags?

Bitcoin outflows from exchanges during price underperformance often stem from investors opting for self-custody to avoid selling pressure. On-chain data from Alphractal shows this reduces liquid supply, with withdrawals exceeding deposits monthly. This strategy signals long-term optimism, as holders secure assets against potential volatility, potentially setting the stage for future rallies in 2026.

Why Are Whales Buying More Bitcoin Despite Market Uncertainty?

Whales are accumulating Bitcoin because they see current prices as undervalued compared to its long-term potential, especially versus equities. Data indicates over 136,000 BTC added by large holders recently, per Alphractal metrics. This natural accumulation pattern, spoken aloud, highlights how big players drive supply tightness, boosting confidence even when daily prices fluctuate.

Key Takeaways

- Exchange Reserves Decline: Negative monthly flows mean less BTC available for trading, tightening supply and supporting price floors.

- Whale Confidence: Accumulation of 136,000 BTC by large investors underscores belief in Bitcoin’s enduring value over short-term dips.

- Future Outperformance Potential: Lagging equities now could lead to stronger gains later if liquidity rebounds, as per VanEck insights.

Conclusion

In summary, Bitcoin exchange outflows and whale accumulation are clear indicators of underlying strength in the market, even as prices lag behind equities. With reserves declining and large holders adding significant positions, these trends point to reduced supply and sustained confidence. As liquidity improves, Bitcoin could see enhanced performance in 2026—investors should monitor on-chain metrics closely for emerging opportunities.

Bitcoin’s price hasn’t kept up with equities, but something important is happening.

More BTC is being moved off exchanges, which often means people plan to hold it rather than sell. Smaller investors are stepping away, and big investors are buying.

The market may not be as uncertain as it looks.

BTC is leaving exchanges

Monthly changes in Bitcoin exchange reserves have turned negative, meaning more BTC is being withdrawn than deposited. This trend has stayed consistent even with weak price action.

Source: Alphractal

When coins leave exchanges, investors are choosing to hold rather than trade in the short term. On its own, this doesn’t guarantee a price rally.

Outflows can occur during both bullish and cautious periods. However, when withdrawals persist, they reduce liquid supply and signal confidence in Bitcoin’s long‑term value.

Fewer wallets, greater confidence

That looks like weak belief, but here’s what’s interesting. Larger holders have been buying, adding more than 136,000 BTC over the same period.

Smaller participants are stepping away, and whales are increasing exposure. This doesn’t change prices right away, but it usually shows firm long-term confidence.

Lag today, gains tomorrow

That underperformance becomes clearer when compared to equities.

According to David Schassler, Head of Multi Asset Solutions, VanEck, Bitcoin has lagged the Nasdaq 100 by nearly 50% this year. But that gap may matter more going forward than it does today.

“Today’s weakness reflects softer risk appetite and temporary liquidity pressures, not a broken thesis.”

If liquidity improves, Bitcoin could respond better than stocks in 2026.

Final Thoughts

- Bitcoin supply is tight as exchange balances fall.

- Whales added 136K BTC, so there’s long-term confidence despite the boredom right now.