Bitcoin Eyes Recovery Rally as Cathie Wood Maintains $1.5M Bull Target

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s recovery in November 2025 pushed the price above $90,000, driven by expectations of U.S. interest rate cuts and returning market liquidity after the government shutdown ended. ETF holders regained profits as BTC surpassed their $89,600 cost basis, signaling renewed investor confidence amid broader crypto market gains.

-

Bitcoin reclaims $90,000: After four weeks of declines, BTC surged past key levels, boosting ETF profitability.

-

Crypto markets rebound with rising odds of Federal Reserve rate cuts, up 46% in a week to 85% probability.

-

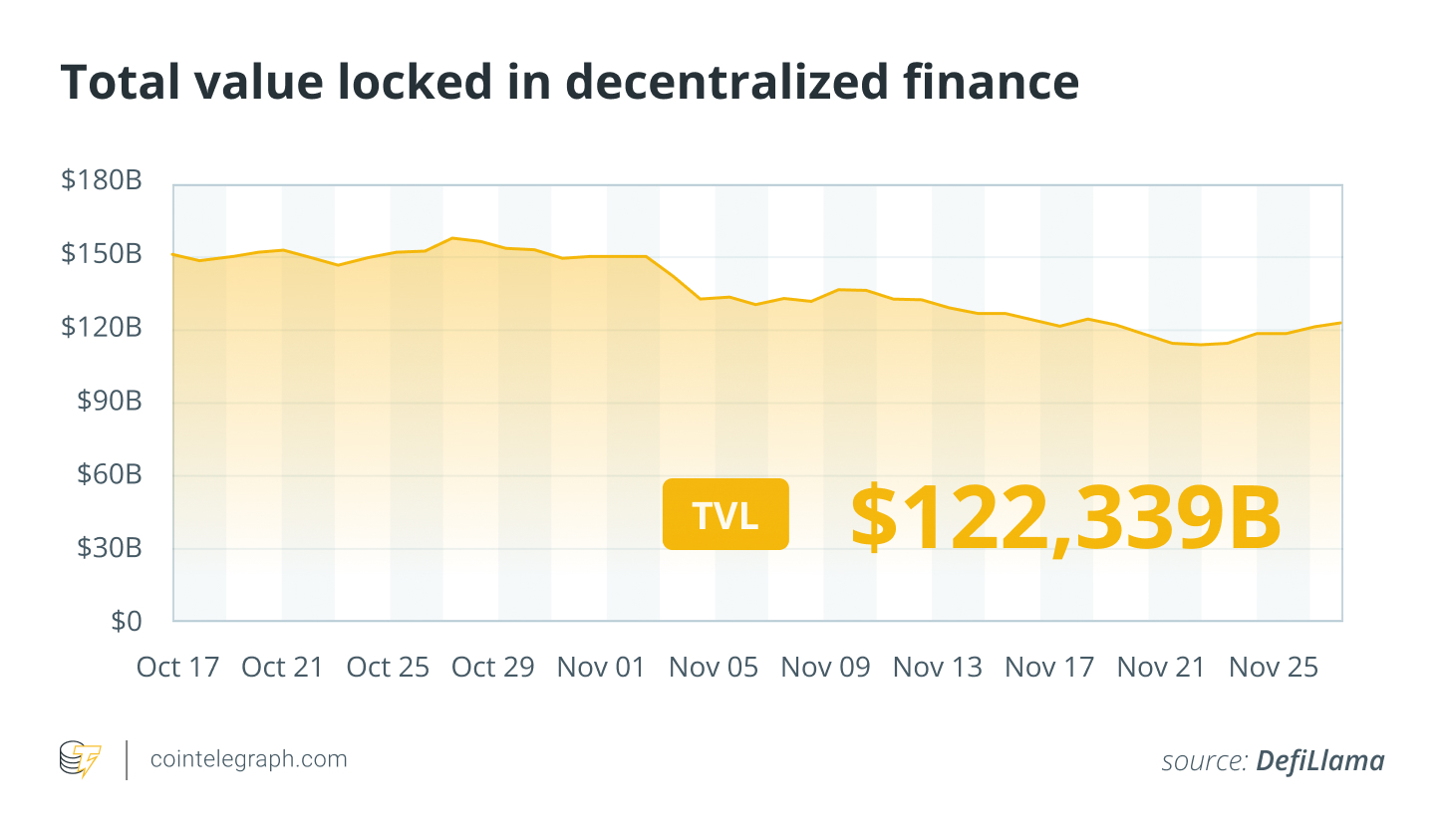

DeFi advancements include UK tax reforms and new funding, with total value locked showing steady growth per DefiLlama data.

Explore Bitcoin’s 2025 recovery amid rate cut hopes and liquidity influx. Discover DeFi innovations like UK tax overhauls and institutional funds. Stay ahead in crypto with key insights and market analysis.

What is driving the Bitcoin recovery in November 2025?

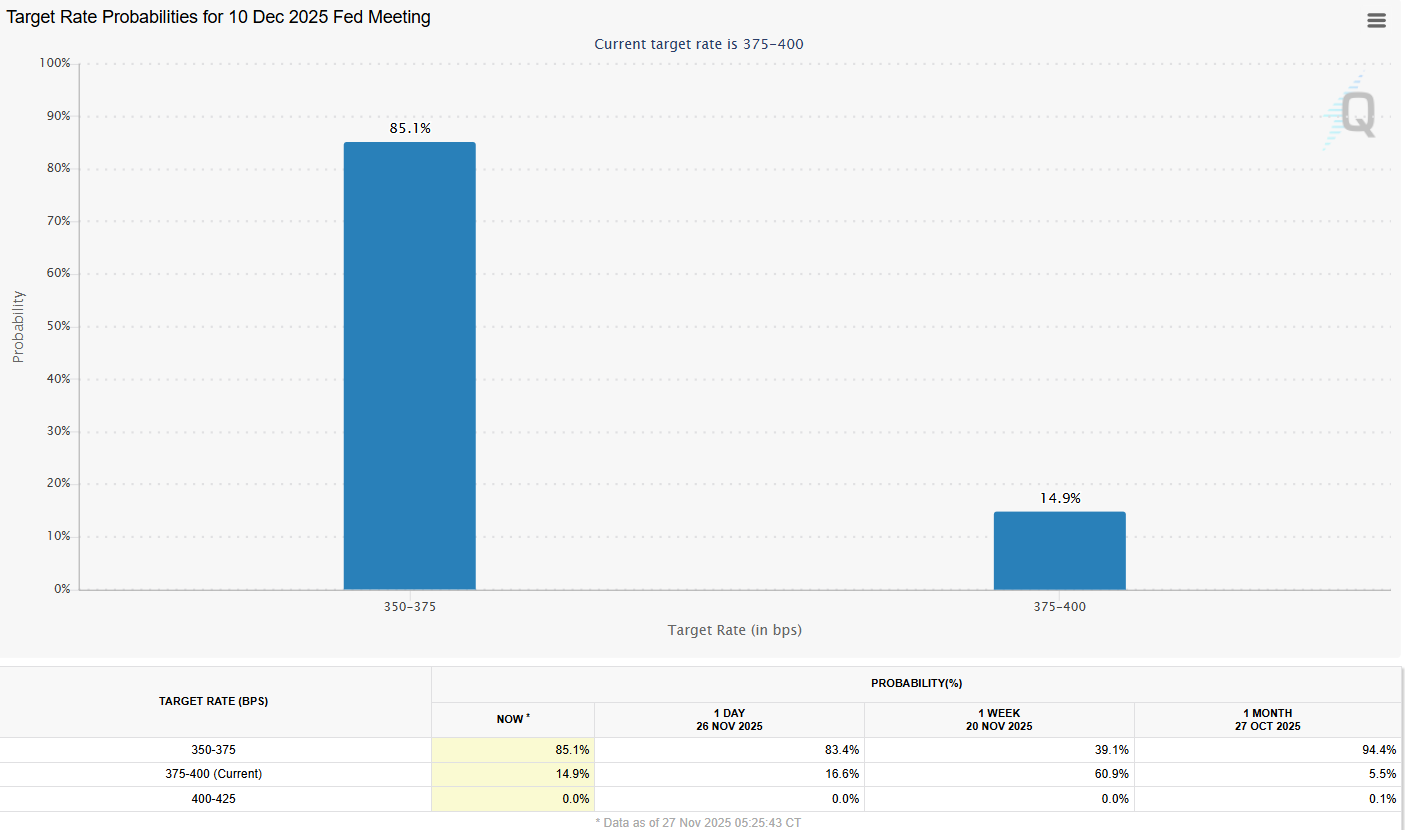

Bitcoin recovery in November 2025 stems from heightened expectations of U.S. interest rate cuts and improved liquidity following the end of the government shutdown. The cryptocurrency surpassed the $90,000 mark on Wednesday, relieving Bitcoin ETF holders who returned to profitability above their $89,600 flow-weighted cost basis. This upturn follows four weeks of declines, with markets now pricing in an 85% chance of a 25 basis point cut at the Federal Reserve’s December 10 meeting, up from 39% the prior week, based on CME Group’s FedWatch tool data.

Interest rate cut probabilities. Source: CMEgroup.com

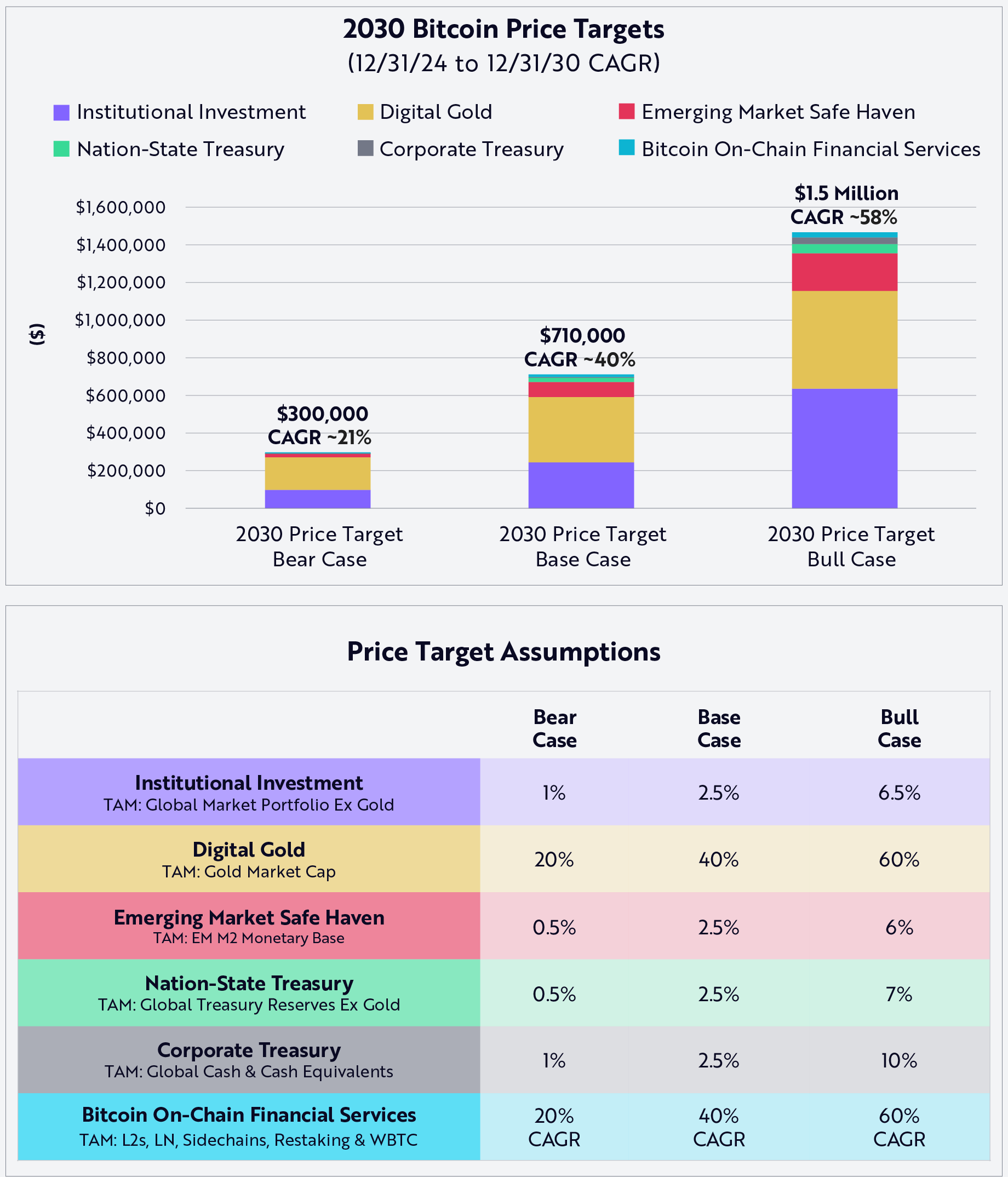

Despite this progress, Bitcoin faces its weakest November performance in seven years, down approximately 17% for the month, contrasting with historical averages of 41% gains as reported by blockchain data provider CoinGlass. Investor sentiment received a further lift from statements by Cathie Wood of ARK Invest, who reaffirmed the firm’s $1.5 million Bitcoin bull market prediction.

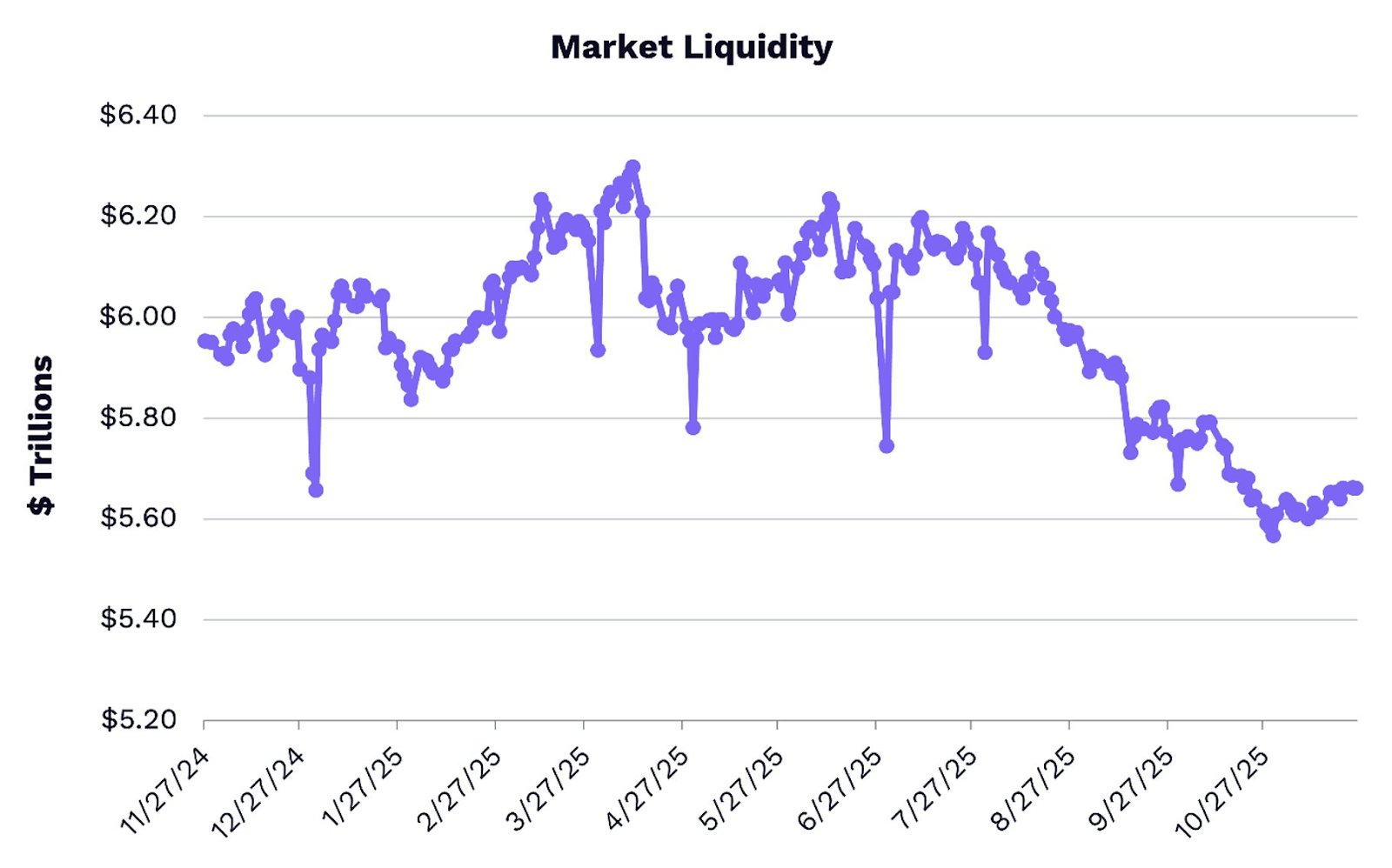

How are liquidity improvements supporting the Bitcoin recovery?

Returning liquidity post-government shutdown has injected $70 billion into markets already, with projections of another $300 billion over the next five to six weeks as the Treasury General Account stabilizes, according to ARK Invest analysis. This influx, combined with the Federal Reserve’s planned shift from quantitative tightening to easing on December 1, is poised to lower borrowing costs and stimulate activity. Cathie Wood noted in a recent statement that these conditions could reverse recent market drawdowns, easing the liquidity squeeze affecting cryptocurrencies and AI sectors.

Source: ARK Invest

Wood emphasized during a webinar that while stablecoins have captured some of Bitcoin’s safe-haven role, gold’s stronger-than-expected appreciation keeps ARK’s $1.5 million bull case intact for 2030, alongside a $300,000 bear case. “With liquidity returning, quantitative tightening ending December 1st, and monetary policy turning supportive, we believe conditions are building for markets to potentially reverse recent drawdowns,” ARK stated.

Webinar by Cathie Wood, the CEO and chief investment officer of ARK Invest. Source: Ark-funds.com

Frequently Asked Questions

What impact will UK DeFi tax reforms have on crypto users?

The UK’s proposed DeFi tax framework introduces a “no gain, no loss” approach for activities like token lending, borrowing, and liquidity provision, deferring capital gains taxes until tokens are sold. This eases the current 18-32% tax burden on deposits, providing clarity and aligning treatment with economic realities, as welcomed by industry experts at Relay and Aave.

How is institutional interest shaping DeFi’s future?

Institutional adoption in DeFi is accelerating through initiatives like DWF Labs’ $75 million fund targeting scalable projects on Ethereum, BNB Smart Chain, Solana, and Base. Focusing on dark-pool DEXs, money markets, and yield products, this support addresses demands for robust infrastructure, as highlighted by DWF’s Andrei Grachev, marking DeFi’s entry into an institutional phase.

Source: DWF Labs

Key Takeaways

- Bitcoin’s rebound signals optimism: Surpassing ETF cost bases amid rate cut expectations, BTC’s recovery highlights shifting monetary policy influences.

- DeFi regulatory progress: UK’s tax overhaul reduces barriers for users, fostering innovation in lending and liquidity pools with deferred taxation.

- Institutional capital influx: Funds like DWF’s $75 million target growth areas; monitor Enlivex’s $212 million RAIN investment for prediction market trends.

Conclusion

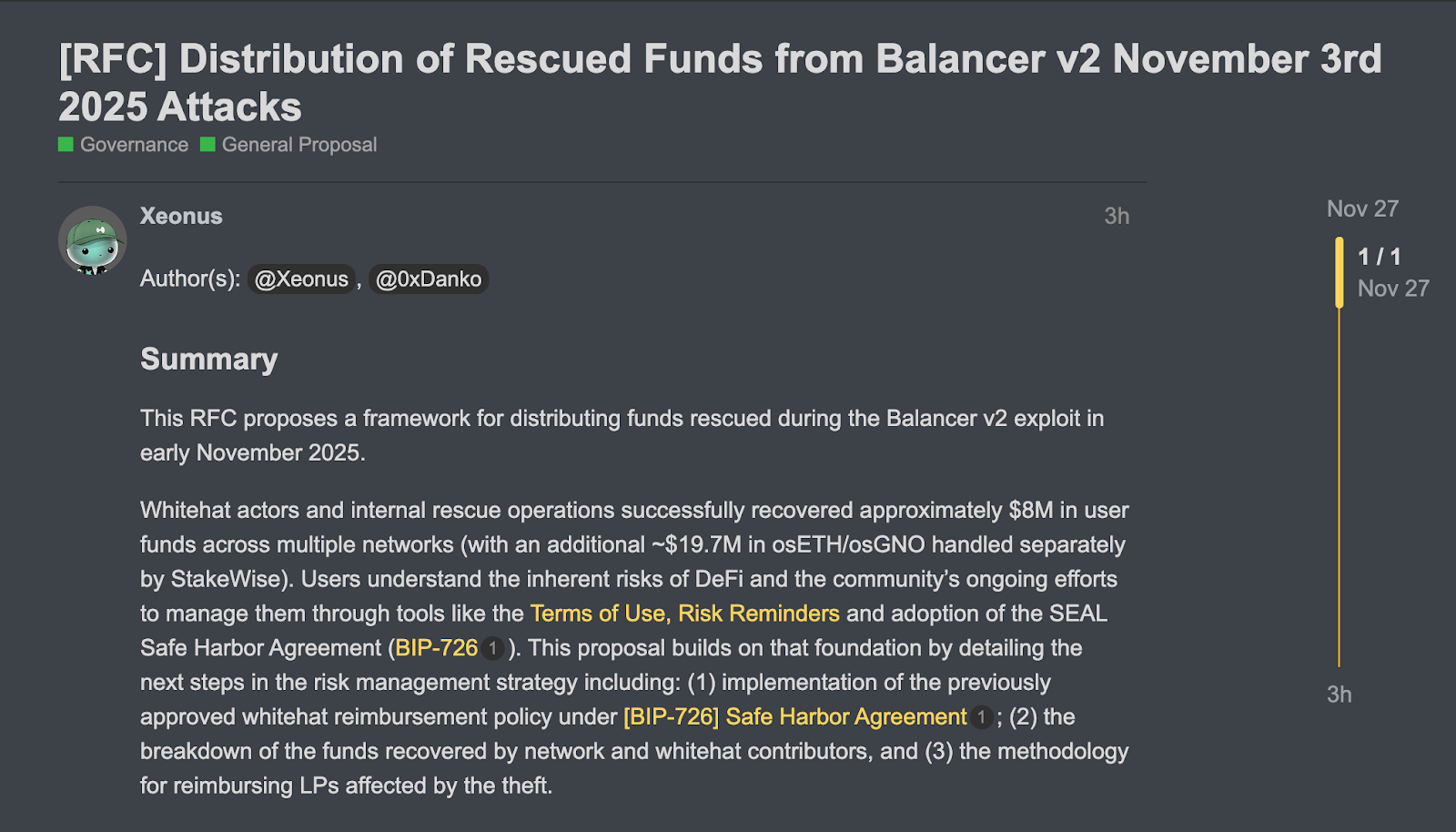

The Bitcoin recovery in late 2025, fueled by anticipated rate cuts and liquidity boosts, underscores a turning point for cryptocurrency markets despite November’s challenges. Complementary DeFi developments, from UK’s supportive tax framework to institutional funding and hack recovery efforts like Balancer’s $28 million reimbursement proposal, demonstrate maturing infrastructure. As liquidity normalizes and policies evolve, investors should prepare for potential year-end rallies, staying informed on these dynamics for strategic positioning.

Balancer community proposal to distribute recovered funds. Source: Balancer

Balancer’s plan prioritizes non-socialized, in-kind reimbursements to affected liquidity pools, addressing the sophisticated $116 million exploit through pro-rata distributions via Balancer Pool Tokens. Meanwhile, Nasdaq-listed Enlivex Therapeutics is pivoting with a $212 million raise to acquire RAIN tokens, betting on decentralized prediction markets’ growth potential under executive chairman Shai Novik’s leadership.

Total value locked in DeFi. Source: DefiLlama

Overall, the DeFi sector shows resilience, with top cryptocurrencies like SPX6900 up 43% and Kaspa’s KAS rising 39% weekly, per Cointelegraph Markets Pro and TradingView data, pointing to sustained momentum into year-end.