Bitcoin Faces Potential Pressure Near $100,000 Amid Political Fallout and Liquidation Surge

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

Bitcoin’s recent plunge to $101,579 marks a significant market correction triggered by nearly $1 billion in liquidated crypto positions, underscoring heightened volatility in digital assets.

-

The downturn is compounded by a high-profile political clash between Elon Musk and President Trump, injecting uncertainty and prompting widespread investor caution.

-

According to COINOTAG sources, analysts caution that Bitcoin may breach the critical $100,000 support level if liquidation pressures persist and market sentiment deteriorates further.

Bitcoin drops to $101,579 amid $1B liquidations and political tensions between Elon Musk and Trump, raising concerns over the $100,000 support level in crypto markets.

Bitcoin Faces Intense Selling Pressure as $1 Billion in Crypto Positions Liquidate

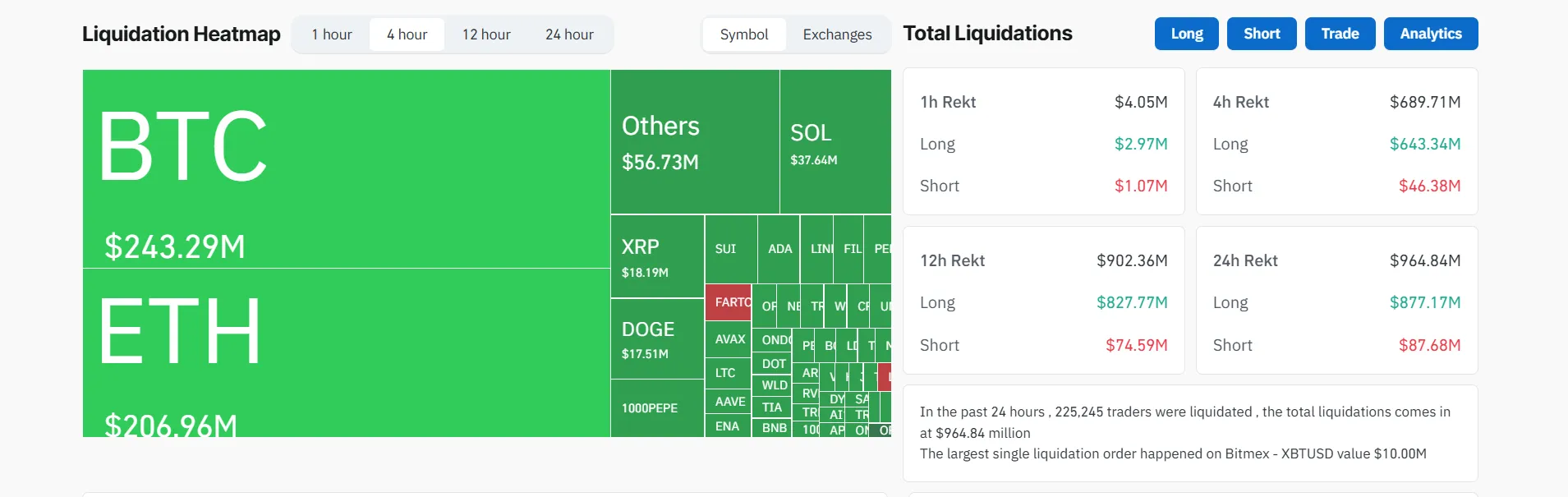

Bitcoin’s price decline to $101,579 represents a 3.5% drop within 24 hours and a 4.5% decrease over the past week, driven by the liquidation of nearly $1 billion in leveraged crypto positions across leading exchanges. This sharp correction highlights the market’s sensitivity to leverage and external shocks. Long positions accounted for the majority of liquidations, with over $877 million wiped out, signaling a rapid unwinding of bullish bets. Ethereum also faced significant liquidations, amounting to over $200 million, reflecting broad-based selling across major cryptocurrencies.

Political Turmoil Between Elon Musk and President Trump Amplifies Market Volatility

The recent market turbulence coincides with an escalating feud between Elon Musk and former President Donald Trump. Musk’s public criticism of Trump’s $1.6 trillion “One Big Beautiful Bill Act,” particularly its impact on national debt and electric vehicle subsidies, has intensified tensions. Trump’s retaliatory threats to sever federal contracts with Musk’s companies—including Tesla, SpaceX, and Starlink—have reverberated through both equity and crypto markets, with Tesla’s stock plunging 15%. This unprecedented political conflict has unsettled investors, prompting a rapid reduction in crypto exposure amid fears of broader economic repercussions.

Crypto Liquidations Heatmap. Source: Coinglass

Technical Analysis: Bitcoin’s Crucial $100,000 Support Under Threat

Bitcoin currently hovers just above the psychologically significant $100,000 support level, a threshold that traders closely monitor. A decisive breach below this level could catalyze further algorithmic selling and trigger additional liquidations, particularly given the dominance of overleveraged long positions in the market. Analysts suggest that if the liquidation trend continues, Bitcoin may retest the $95,000–$98,000 range before stabilizing. Market indicators such as the daily Relative Strength Index (RSI) are signaling downward momentum, although some technical analysts anticipate a potential reversal within the coming week.

Broader Implications: Crypto Markets Entwined with Political and Economic Dynamics

The Musk-Trump confrontation exemplifies the increasing intersection of cryptocurrency markets with geopolitical and domestic political developments. Traders are recognizing that Bitcoin’s price volatility is influenced not only by traditional on-chain metrics and macroeconomic factors but also by high-profile political disputes and legislative risks. This evolving landscape underscores the need for investors to consider a wider array of risk factors when navigating digital asset markets. Until political tensions subside or new positive catalysts emerge, Bitcoin’s near-term outlook remains precarious, demanding cautious positioning from market participants.

Conclusion

Bitcoin’s recent price decline and the liquidation of nearly $1 billion in leveraged positions highlight the fragility of crypto markets amid external shocks. The unprecedented political feud between Elon Musk and President Trump has injected additional uncertainty, complicating an already volatile environment. With Bitcoin teetering near the critical $100,000 support level, traders must remain vigilant as further downside risks loom. This episode serves as a reminder that cryptocurrency markets are increasingly susceptible to political and economic crosscurrents, necessitating a comprehensive approach to risk management and market analysis.