Bitcoin Faces Pressure Below $80,000 Amid Growing Recession Fears Following Trump’s Comments on Economic Outlook

BTC/USDT

$25,688,978,986.00

$71,632.08 / $68,176.47

Change: $3,455.61 (5.07%)

-0.0000%

Shorts pay

Contents

-

Bitcoin dipped below $80,000 following President Trump’s recession comments, igniting investor panic and a 3% decline in BTC price.

-

Since December 2024, approximately $1.3 trillion has been wiped from crypto markets, reflecting a stark correlation with a $5 trillion loss in Wall Street stocks amidst growing economic unease.

-

Institutional investors are significantly scaling back their exposure to risk assets like Bitcoin and technology stocks as recession concerns deepen.

Bitcoin’s price has dipped due to recession fears spurred by President Trump’s comments, leading to significant declines across the crypto market.

Bitcoin Drops Abruptly as Recession Fears Trigger Investor Panic

In a recent interview on Fox News, President Trump hinted at potential economic turbulence, stating, “disruption” is necessary for economic rebuilding. His statements have contributed to heightened uncertainty among investors, leading to a notable sell-off across risk assets, including Bitcoin.

Trump’s Recession Remarks Amplify Market Anxiety

Trump’s nuanced approach to the economy includes acknowledging potential short-term challenges, which has shifted sentiment among investors. As reported by The Kobeissi Letter, “the decline accelerated today” in response to fears that markets are reacting to President Trump’s inclination to embrace necessary reforms amid a potential recession.

BTC Price Performance. Source: COINOTAG

As a result of these developments, Bitcoin’s value fell below the psychological threshold of $80,000, trading at $79,856 at the time of writing. This 3% drop since the week started aligns with the Federal Reserve’s cautious warnings about economic recession, compounding bearish sentiment across cryptocurrencies.

Correlation Between Bitcoin and Traditional Stock Markets Amid Economic Fears

The response in traditional markets has been equally severe, with the S&P 500 losing approximately $5 trillion in market valuation over the past few weeks, while crypto markets have lost around $1.3 trillion since December 2024. Bitcoin’s price, often seen as an indicator of risk appetite, has plummeted by 35% in just three months.

This downturn parallels a broad shift in investment strategies, as institutional investors pull back from high-risk assets, including tech stocks. In fact, exposure to the “Magnificent Seven” tech stocks has reached its lowest levels since April 2023, reflecting investors’ diminishing confidence in speculative assets amidst a climate of recession fears.

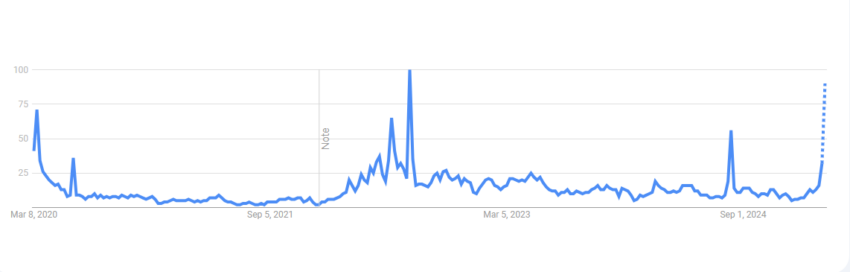

Adding to the turmoil, major stocks like Tesla have faced drastic drops, showcasing a general retreat from high-risk trades. Bitcoin’s strong correlation with macroeconomic conditions is evident, as spikes in Google Trends for “US recession” signal heightened market volatility.

US Recession Fears Searches. Source: Google Trends

Moreover, prediction markets such as Kalshi have increased the probability of a US recession to 40%. These markets are often considered more reflective of real-time investor sentiments compared to traditional economic forecasts.

As highlighted by startup investor Rushabh Shah, “the prediction markets can often be more accurate than traditional economic models, reflecting real-time sentiments and information from traders.” Despite divergent views on the potential for looser monetary policy to potentially benefit Bitcoin in the long run, the current landscape remains fraught with uncertainty.

Conclusion

In summary, Bitcoin’s recent struggles illustrate the tangible impact of macroeconomic fears on the crypto market. As recession concerns loom, traders and investors must prepare for ongoing volatility. While some potential stimulus measures may offer hope for recovery, cautious strategies will dominate as long as uncertainty prevails in both cryptocurrency and traditional financial markets.