Bitcoin Fear Searches at Peak Since 2022

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

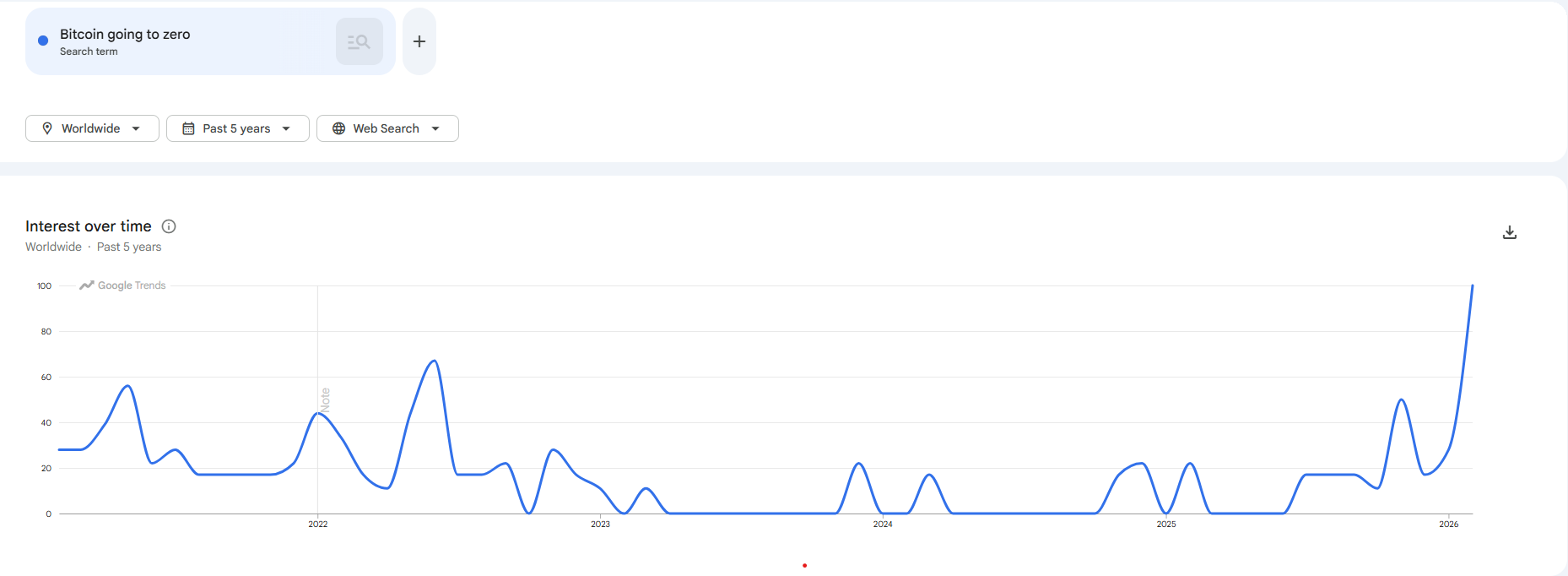

According to Google Trends data, searches for “Bitcoin will go to zero” have reached the highest level in the last five years since the November 2022 FTX panic. This increase coincides with Bitcoin (BTC) falling approximately 50% from its peak of 126,000 dollars on October 6, 2025, to 66,500 dollars. The Bitcoin Fear and Greed Index has dropped to around 9, levels seen after the Terra collapse and FTX. Searches had similarly peaked in 2022 when BTC crashed to 15,000 dollars.

Google searches for “Bitcoin going to zero.” Source: Google Trends

Bitcoin Fear Searches Triggered by Macro Concerns

According to findings from the crypto intelligence platform Perception, which analyzes over 650 crypto media sources, while the fear in 2022 stemmed from exchange collapses, today's fear is fueled by macro concerns and comments from Bloomberg analyst Mike McGlone that “Bitcoin could go to zero.” McGlone has pointed to BTC at 10,000 dollars in recent months and has been frequently quoted in the media. In contrast, sovereign wealth funds like Abu Dhabi and companies like Strategy are accumulating BTC. Media sentiment bottomed out on February 5 and then recovered, while retail fear peaks with a 10-14 day delay.

Quantum Threats and 7-Year Transition with BIP-360

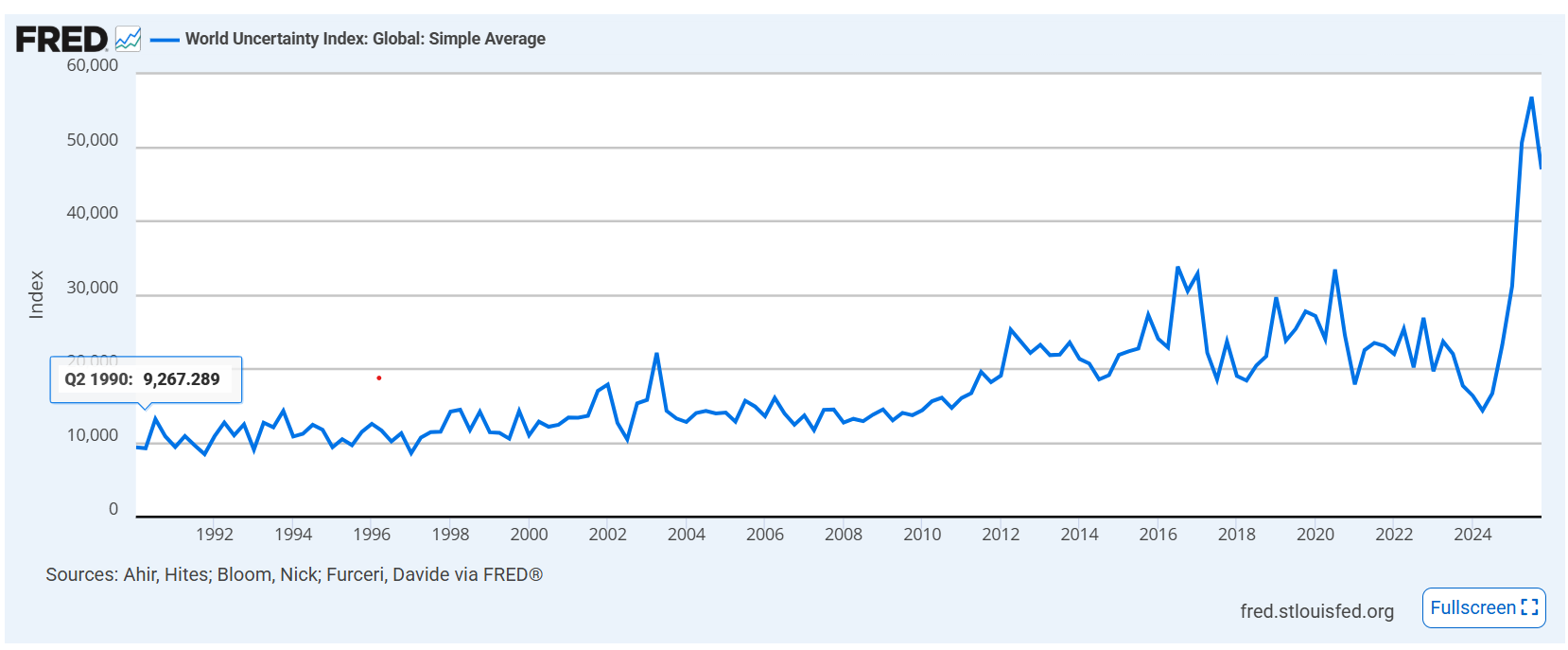

The World Uncertainty Index has broken records surpassing the 2008 crisis and 2020 COVID shock; quantum fears are amplifying price drops. According to Ethan Heilman, co-author of BIP-360, Bitcoin's transition to post-quantum security will take 7 years. This news is fueling retail investors' fears of "going to zero."

World Uncertainty Index. Source: FRED

Institutional Resilience: Metaplanet and Hive Examples

Institutional resilience continues in the sector. Metaplanet reported a net loss of 619 million dollars in Bitcoin valuation but increased its holdings to 35,102 BTC. Bitcoin mining company Hive, despite a 91 million dollar loss due to accelerated depreciation, increased its hash rate. These developments emphasize long-term BTC accumulation. For more details, check BTC detailed analysis.

BTC Technical Analysis: Strong Supports at RSI 33

Current BTC price is at 66,158 dollars, down -1.97% in 24 hours. RSI 33.03 (Oversold), downtrend and bearish Supertrend dominant. EMA 20: 71,613$. Supports: 65,146$ (strong, 81% score), 60,000$. Resistances: 70,639$ (69% score), 77,302$. Follow BTC futures. Short-term 65K is critical.