Bitcoin Futures Climb After CME 10-Hour Trading Halt Sparks Trader Concerns

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The Chicago Mercantile Exchange halted trading for approximately 10 hours due to a cooling issue at its Illinois data center, disrupting derivatives markets and sparking trader frustration. Service resumed fully on Friday, allowing Bitcoin futures to climb from $90,940 to over $93,000.

-

Trading disruption lasted from Thursday into Friday, affecting global derivatives traders during low-volume holiday periods.

-

CME attributed the halt to a technical cooling failure at the CyrusOne facility, preventing new trades and locking positions.

-

Bitcoin futures rebounded strongly post-restoration, rising 2.5% to exceed $93,000 amid broader market recovery from $80,522 lows.

CME trading halt due to data center cooling issue disrupts Bitcoin futures for 10 hours, drawing trader backlash. Explore impacts and recovery in this analysis. Stay informed on crypto derivatives. (152 characters)

What Caused the Recent CME Trading Halt?

CME trading halt occurred because of a cooling system failure at the CyrusOne data center in Illinois, as announced by the Chicago Mercantile Exchange, the world’s leading derivatives marketplace. This technical glitch suspended operations from Thursday evening until Friday afternoon, impacting various futures contracts including those for Bitcoin. The interruption prevented price discovery and trapped traders in existing positions, leading to widespread industry complaints.

Trading was halted for about 10 hours before being restored on Friday, sparking a public backlash from derivatives and commodities traders.

The Chicago Mercantile Exchange (CME), the world’s largest financial derivatives exchange, halted trading for about 10 hours from Thursday into Friday, causing an outcry from traders before service was restored.

Trading halted due to a “cooling issue” at the CyrusOne data center in Illinois, a US state, according to an announcement from the CME. Trading was fully restored, and trading for all markets resumed at 1:30 pm UTC on Friday, the CME said in an update.

Source: CME Group

Meanwhile, traders voiced their discontent with the critical failure, which locked some users in their positions, prevented others from placing new trades, and halted price discovery.

How Did Traders React to the CME Trading Halt?

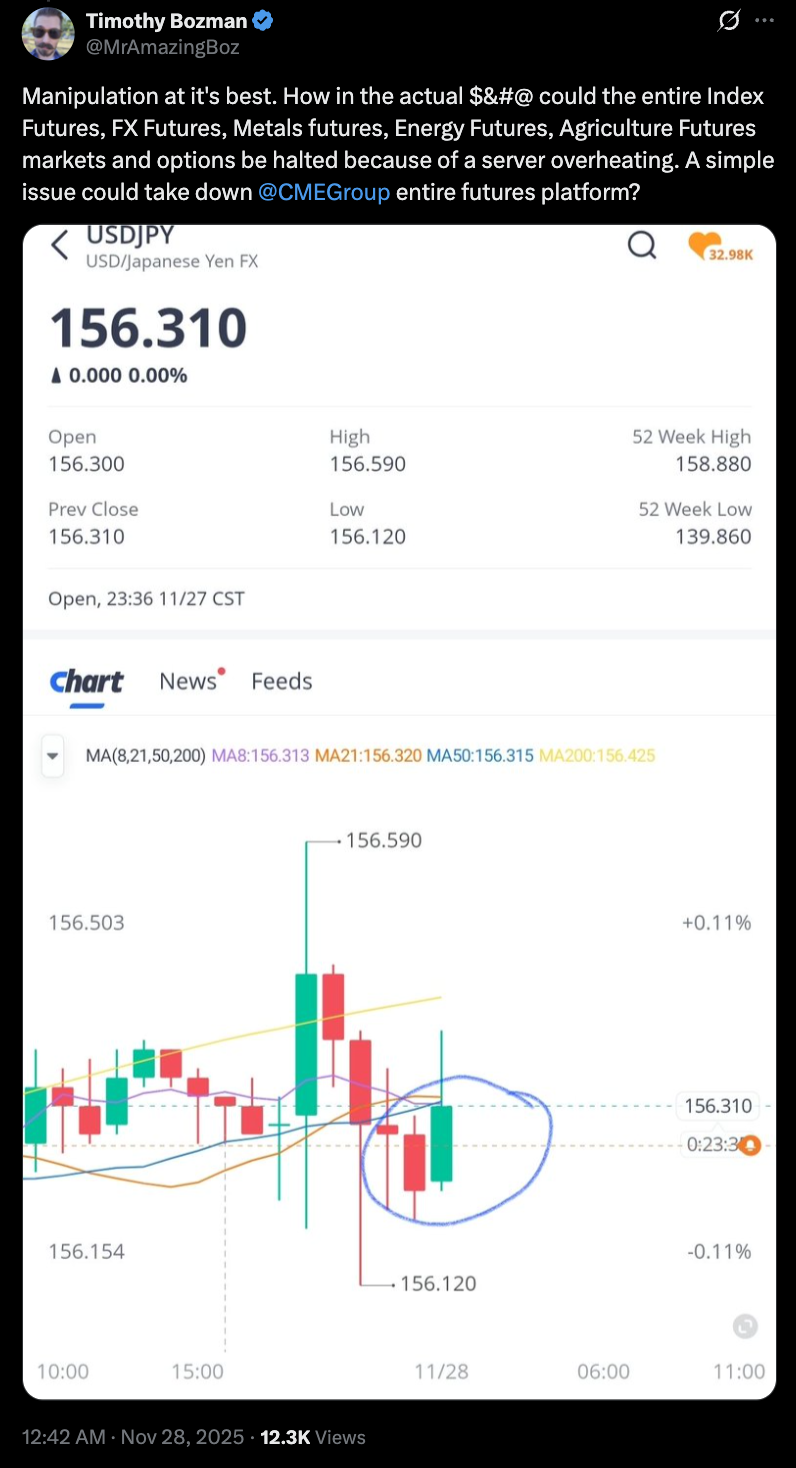

Market participants expressed significant frustration over the CME trading halt, with many highlighting the timing during Thanksgiving and low liquidity in Asian sessions. Stock trader Timothy Bozman publicly criticized the exchange, questioning how a basic cooling problem could dismantle the entire futures platform and labeling it potential market manipulation. Social media posts echoed these sentiments, with one user noting the halt’s convenience on a holiday, suggesting directional market influences; another pointed to the suspension occurring just before silver futures reached a record $54, amplifying suspicions among commodities traders.

Source: Timothy Bozman

“Very convenient that this happens in Asia on Thanksgiving Day, when there’s already low volume. Sounds like you’re trying to manipulate the markets quickly in a certain direction,” another X user said.

The backlash from traders continued even after the issue was fixed, with many saying that trading halted minutes before silver futures contracts hit an all-time high of $54, further fueling speculations.

Related: What Bitcoin CME gaps are and how they influence price movements

Bitcoin Futures Contracts Continue to Climb After Market Halt

Bitcoin futures rebound from the recent low. Source: TradingView

The CME does not publish regular trading data for Thanksgiving Day, which occurred on Thursday this year. However, Bitcoin futures contracts closed on Wednesday at $90,355 and opened at $90,940 on Friday, according to data from TradingView.

Bitcoin futures prices continued to climb on Friday, rising to over $93,000 at the time of this writing, as BTC rebounds from the local bottom of $80,522.

Analysts say BTC faces resistance at $95,000, but if the cryptocurrency can reclaim $95,000 as support, it could bounce back into the $100,000 territory.

The recent dip to just over $80,000 marked the market’s lowest point, according to investor and analyst Arthur Hayes, who said that easing liquidity conditions will take BTC to higher levels in 2026, warning that another short-term drop might also occur in the meantime.

Magazine: Stop piling into leveraged Bitcoin ETFs and consider this instead

Frequently Asked Questions

What Was the Duration and Impact of the CME Trading Halt on Bitcoin Futures?

The CME trading halt lasted roughly 10 hours, from late Thursday to 1:30 pm UTC on Friday, affecting Bitcoin futures by suspending new orders and locking positions. This disrupted price movements during a key rebound phase, but post-restoration, futures surged from $90,940 to over $93,000, reflecting resilient market demand according to TradingView data.

How Might Technical Failures Like the CME Cooling Issue Affect Crypto Derivatives Trading?

Technical failures such as the recent cooling issue at CME’s data center can interrupt crypto derivatives trading by halting executions and delaying market data feeds, as experienced during the 10-hour outage. This underscores the need for robust infrastructure, with exchanges like CME emphasizing quick recovery to minimize long-term volatility in assets like Bitcoin futures.

Key Takeaways

- Technical Reliability Matters: The CME trading halt highlights vulnerabilities in data center operations, urging exchanges to enhance cooling and backup systems for uninterrupted derivatives trading.

- Trader Sentiment Drives Backlash: Frustrations over timing and potential manipulation, voiced by figures like Timothy Bozman, illustrate how outages erode trust in major platforms like CME.

- Bitcoin Resilience Post-Halt: Despite the disruption, Bitcoin futures climbed above $93,000, signaling strong recovery potential toward $95,000 resistance as liquidity improves.

Conclusion

The CME trading halt due to a cooling failure at the Illinois data center exposed operational risks in derivatives markets, including Bitcoin futures, while trader reactions underscored demands for greater transparency. As trading resumes and BTC pushes toward $95,000 support, improved infrastructure will be crucial for sustaining market confidence. Investors should monitor liquidity trends for 2026 upside, preparing for possible short-term dips as advised by experts like Arthur Hayes.