Bitcoin Futures Liquidations Hit Cycle Highs, Signaling Potential Volatility Surge

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Crypto futures liquidations have reached their highest sustained levels in the current market cycle, averaging $68 million in long positions and $45 million in short positions daily, according to Glassnode and Fasanara Digital. This surge reflects increased leverage amid stable prices, amplifying market volatility.

-

Crypto futures liquidations now average $68 million for longs and $45 million for shorts per day, up sharply from $28 million and $15 million in the previous cycle.

-

Higher open interest across major venues heightens risks during price swings, driven by institutional and retail participation.

-

Macro events like FOMC decisions trigger liquidation spikes exceeding historical norms, with 2025 data showing 2.4 times more activity than prior years.

Crypto futures liquidations hit record highs in 2025, flushing out billions amid rising leverage. Discover key drivers and risks for traders navigating this volatile landscape—stay informed to protect your positions.

What Are the Highest Sustained Levels of Crypto Futures Liquidations in 2025?

Crypto futures liquidations have escalated to unprecedented sustained levels this cycle, with daily averages reaching $68 million in long positions and $45 million in short positions, as detailed in the joint report from Glassnode and Fasanara Digital. This marks a significant jump from the prior cycle’s figures of $28 million for longs and $15 million for shorts. Even during periods of relative price stability, leveraged traders face amplified losses, underscoring the market’s growing sensitivity to leverage.

Why Have Crypto Futures Liquidations Increased Significantly?

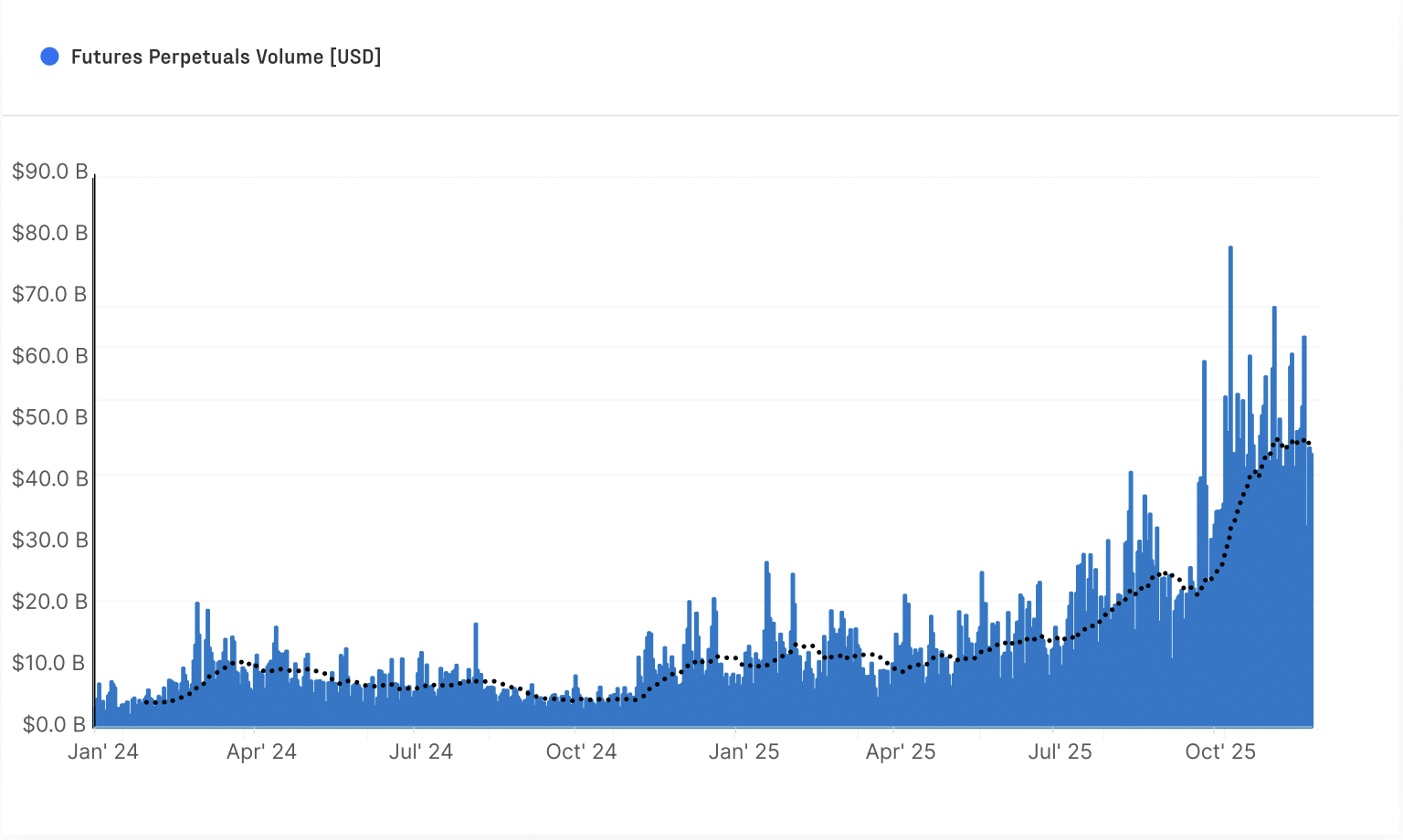

The surge in crypto futures liquidations stems from a structural evolution in trading dynamics. Open interest has ballooned on major futures platforms, fueled by institutional investors, ETF inflows, and retail speculation. This expansion means more capital is at stake, leading to quicker unwinding when prices fluctuate even modestly.

According to the Glassnode and Fasanara Digital analysis, futures turnover has hit multi-year peaks, making the market more reflexive. Sharp moves now cascade through over-leveraged positions, often independent of spot market trends. For instance, Bitcoin and Ethereum spot prices may remain calm, yet derivatives markets exhibit violent intraday swings driven by liquidation chains.

Historical data from the report highlights that liquidation volumes in 2025 are 2.4 times higher than comparable periods in previous cycles. This intensification occurs despite lower overall volatility, pointing to leverage as the primary amplifier. Experts from Fasanara Digital emphasize that “crowded positioning around key levels exacerbates these events, turning minor dislocations into major market reactions.”

Furthermore, the integration of automated trading strategies and broader participation has shortened reaction times. When traders align on similar leverage ratios, a single catalyst—like a macroeconomic announcement—can trigger outsized liquidations. The report notes that such episodes now cluster around events like Federal Open Market Committee (FOMC) meetings, where uncertainty prompts rapid deleveraging.

Higher Open Interest Magnifies Risk Across Major Venues

The rise in liquidations mirrors a broader shift in market behavior. Open interest— the total value of outstanding futures contracts—has grown aggressively, incorporating diverse players from institutions to retail users. This influx, partly tied to spot ETF approvals and steady capital inflows, has positioned the derivatives market as a volatility powerhouse.

Source: Glassnode Fasanara report

With futures volumes at record highs, the ecosystem reacts swiftly to over-leveraging. Traders positioned against momentum face swift liquidations, contributing to the daily averages observed. Glassnode data illustrates how this environment sustains higher baseline activity, even absent dramatic price shifts.

Macro Events Trigger More Frequent Crypto Liquidation Spikes

Macroeconomic developments are key triggers for liquidation surges. The Glassnode and Fasanara report identifies patterns where spikes align with policy announcements, such as FOMC rate decisions. These events heighten uncertainty, prompting leveraged positions to unwind en masse.

In 2025, several such instances have surpassed historical volatility thresholds. The report quantifies that liquidation volumes during these periods can double or triple daily norms, reflecting faster market corrections. This clustering indicates a maturing yet fragile derivatives landscape, where external factors dominate short-term dynamics.

Spot markets often decouple from these futures-driven events, remaining stable while derivatives exhibit hypersensitivity. Leverage, not fundamental buying or selling, thus accounts for a growing portion of intraday fluctuations. Fasanara Digital analysts observe that “this divergence highlights the embedded risks in high-open-interest environments, where cascades amplify minor triggers.”

Stable Spot Prices Hide Growing Derivatives Instability

Throughout much of the quarter, Bitcoin and Ethereum have traded with subdued volatility in spot markets. Yet, liquidation activity has ramped up, manifesting as abrupt price wicks and reversals. These movements stem from cascading liquidations, where forced sales or buys propel prices in rapid succession.

The sustained elevation in liquidations signals deeper leverage penetration compared to past cycles. Minor price deviations now risk triggering disproportionate responses, particularly when positions cluster. The report from Glassnode and Fasanara underscores that this instability persists regardless of broader market calm, driven by structural leverage growth.

A More Reflexive Market as Leverage Rises

Institutional involvement, algorithmic trading, and ETF-linked activities are transforming market composition. Liquidations increasingly dictate near-term price paths, as noted in the joint analysis. While the futures sector has scaled impressively, its leverage sensitivity endures as a volatility source.

Glassnode metrics reveal that daily liquidation persistence at current levels—far above cycle averages—points to ongoing adaptation needs for participants. As capital flows evolve, these dynamics could intensify, emphasizing prudent risk management in derivatives trading.

Frequently Asked Questions

What Causes the Surge in Daily Crypto Futures Liquidations?

The increase in crypto futures liquidations results from expanded open interest and heightened leverage among traders. Daily averages now hit $68 million for longs and $45 million for shorts, per Glassnode and Fasanara Digital data, due to institutional inflows and retail participation amplifying risks during even mild price moves.

How Do Macro Events Impact Crypto Liquidation Spikes?

Macro events like FOMC announcements trigger sharp crypto futures liquidations by sparking uncertainty that unwinds crowded positions. In natural terms, these spikes often exceed past volatility patterns, leading to quick market corrections as leveraged trades cascade, even if spot prices stay steady—this makes futures more reactive to global economic shifts.

Key Takeaways

- Rising Daily Liquidations Amplify Volatility: Leverage now fuels a larger portion of market swings, with 2025 averages 2.4 times higher than prior cycles, urging traders to monitor open interest closely.

- Macro Catalysts Drive Spikes: Events such as policy decisions cluster liquidations, exceeding historical bands and highlighting the need for diversified strategies amid uncertainty.

- Derivatives Sensitivity Persists: Despite spot stability, futures instability from leverage calls for adjusted risk parameters to navigate reflexive market reactions effectively.

Conclusion

In summary, crypto futures liquidations have achieved their highest sustained levels in the 2025 cycle, averaging substantial daily volumes as detailed by Glassnode and Fasanara Digital. This trend, driven by surging open interest and macro sensitivities, reveals a more leveraged market prone to reflexive dynamics. As institutional and ETF influences grow, traders should prioritize robust risk controls to mitigate amplified volatility—positioning for long-term stability in this evolving landscape.