Bitcoin Heading for Worst Q1 Performance Since 2018

BTC/USDT

$25,688,978,986.00

$71,632.08 / $68,176.47

Change: $3,455.61 (5.07%)

-0.0000%

Shorts pay

Contents

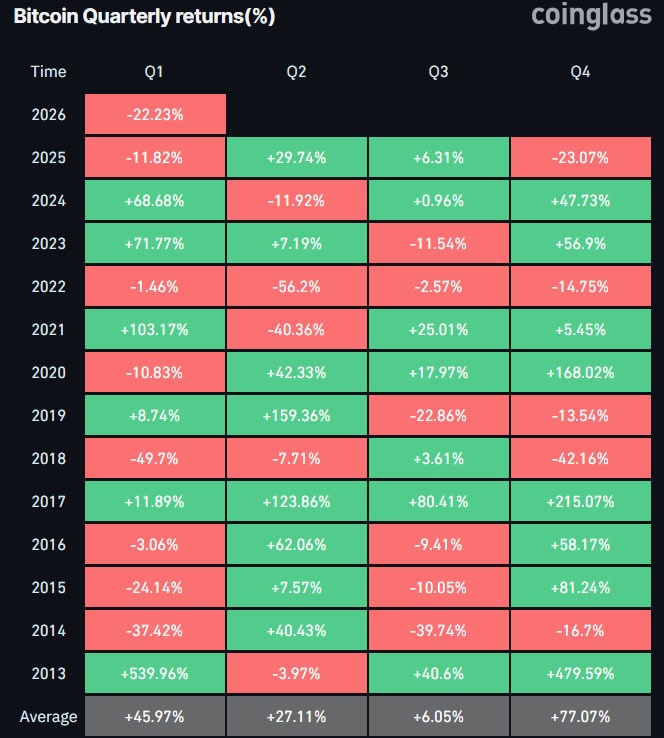

Bitcoin (BTC) has declined by 22.3% since the beginning of the year, falling from $87,700 to $68,000, heading towards its worst first-quarter performance in eight years. According to CoinGlass data, this is recorded as the worst since the 49.7% drop in the 2018 bear market. BTC has lost value in seven of the last 13 first quarters; most recently 11.8% in 2025 and 10.8% in 2020.

Bitcoin Faces Risk of Historic Decline in January and February

With a 10.2% drop in January and 13.4% so far in February, BTC faces the risk of seeing consecutive red January and February months for the first time in history; it needs to surpass $80,000. Ether (ETH) is showing the third-worst performance with a 34.3% loss, as in one out of three of the last nine quarters. LVRG Research director Nick Ruck describes the decline as a regular correction phase due to global economic uncertainties. BTC is trading at $68,400, down 2.76% in the last 24 hours (CoinGecko, February 16, 2026).

Bitcoin on track for its worst Q1 since 2018. Source: CoinGlass

Technical Indicators Confirm BTC Decline

RSI at 35.53 approaching the oversold region, the trend is downward, and Supertrend is giving a bear signal. There is resistance above EMA 20 ($73,253). Strong supports: S1 $65,118 (72/100 score, 4.78% away), S2 $60,000 (70/100). Resistances: R1 $68,876 (0.72%), R2 $72,125 (5.47%). Investors can follow BTC detailed analysis.

Positive Reversal in Weekly Candle and ETF Options

In the latest development, Bitcoin's weekly candle chart has turned positive; 1 day 12 hours left to weekly close with an 8% rise from the low. NYSE American has approved listing options for commodity-based and multi-crypto ETFs; this could increase liquidity. BTC futures volume should be monitored.

ETH Foundation Change Could Affect the Market

Tomasz Stanczak is leaving the Ethereum Foundation at the end of February 2026; Bastian Aue and Hsiao-Wei are the new co-chairs. ETH's 34% drop could deepen with this uncertainty. Check the ETH analysis page for details.