Bitcoin Leads Inflows, Signaling Potential Bullish Path to Six Figures

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin price prediction for December points to a potential push toward $100,000, driven by strong inflows of $160 billion and dominant short liquidations totaling $1.13 billion. On-chain metrics show improving sentiment, with the Fear and Greed Index rising to moderate fear levels, signaling a bullish recovery after recent market dips.

-

Market rebound: Crypto market cap rises 5% weekly, marking the first green close in November after $970 billion losses.

-

Bitcoin leads with 62% of inflows, while altcoin activity cools to mid-summer levels.

-

On-chain data from Glassnode highlights supply clusters at key resistance, with $1.13 billion in short liquidations per CoinGlass, indicating trapped bearish positions and bullish momentum.

Discover the latest Bitcoin price prediction amid market recovery and strong inflows. Explore on-chain signals and expert insights for December’s outlook—stay informed on crypto trends today.

What is the Bitcoin price prediction for December?

Bitcoin price prediction for December suggests a bullish trajectory toward $100,000, supported by recent market inflows and on-chain improvements. After three weeks of declines that erased $970 billion from the total crypto market capitalization, the market has rebounded over 5% this week, adding $160 billion. This shift, led by Bitcoin capturing 62% of inflows, positions it for potential gains as sentiment stabilizes.

How are Bitcoin inflows influencing market sentiment?

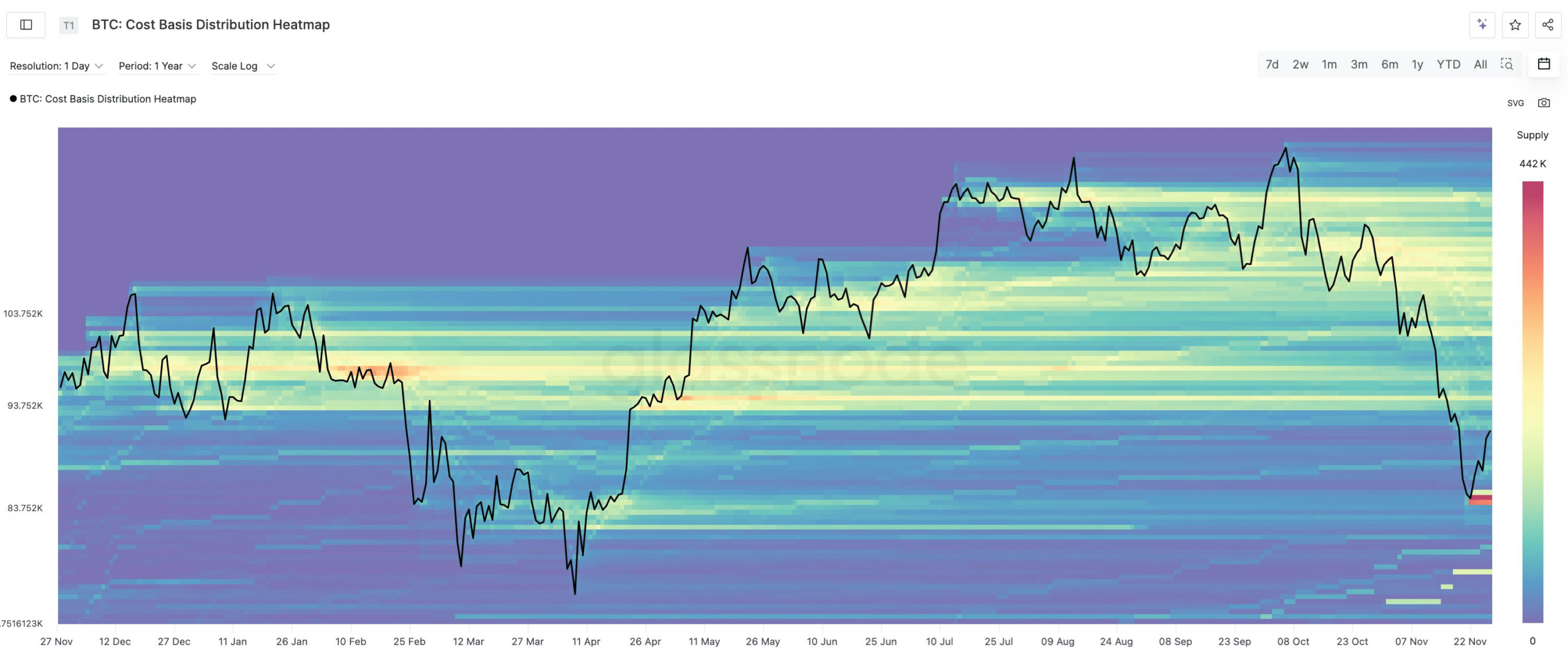

Bitcoin inflows have surged by $160 billion in the last week, accounting for 62% of total crypto investments and driving the market’s 5% uptick. Data from Glassnode indicates this capital influx is occurring amid a broader accumulation phase, where long-term holders are absorbing supply at key levels. The Altcoin Season Index has retreated to mid-July figures, underscoring Bitcoin’s dominance and reducing altcoin volatility. Meanwhile, the Fear and Greed Index climbed 8 points to reach moderate fear territory, reflecting cautious optimism among investors. On-chain metrics, including net realized profit/loss turning positive, show easing realized losses and a rebound in trading activity, creating a less risky environment. Experts note that such inflows often precede breakouts, as they signal institutional interest steadying the market. For instance, analysts from Glassnode emphasize that these clusters of supply—where holders may sell at break-even—must be cleared for sustained upward movement. Supporting statistics reveal four major supply zones identified through on-chain analysis, each representing potential resistance points. If the macro environment remains favorable, with no major disruptions, this Bitcoin-led recovery could accelerate, drawing in more participants and solidifying the bullish Bitcoin price prediction.

Source: Glassnode

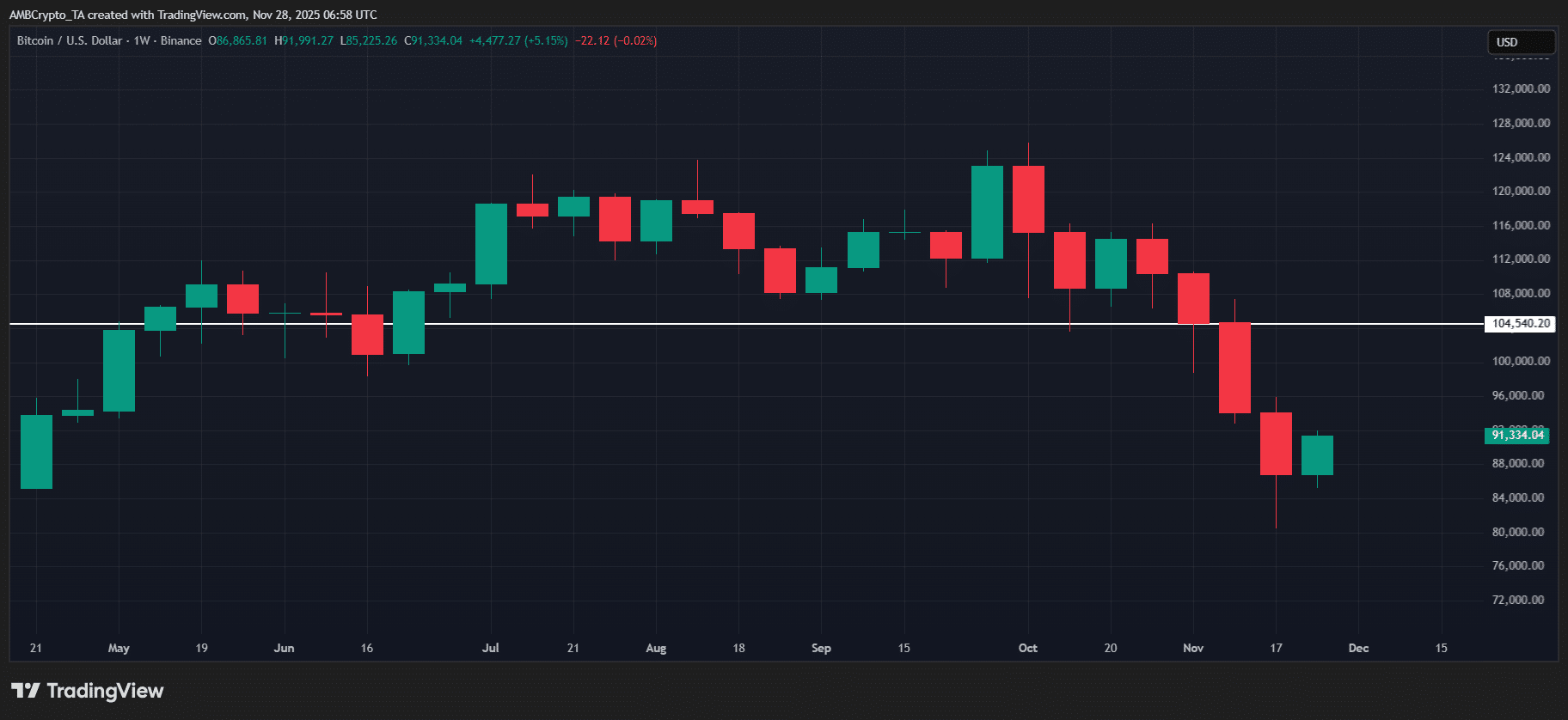

The recovery follows a period of heightened caution, where extreme fear dominated due to consecutive red weekly closes. However, current data points to a pivot, with short positions facing pressure from the rebound. This dynamic is evident in liquidation patterns, where bearish bets are being squeezed out, fostering a more balanced market structure.

Frequently Asked Questions

What factors are driving the latest Bitcoin price prediction toward $100,000?

The Bitcoin price prediction toward $100,000 is fueled by $160 billion in weekly inflows, predominantly into BTC, alongside $1.13 billion in short liquidations as reported by CoinGlass. On-chain rebounds, including positive net realized profit/loss and a rising Fear and Greed Index, indicate supply absorption and shifting sentiment from fear to stability, setting the stage for December gains.

Why has Bitcoin dominated crypto inflows this week?

Bitcoin has dominated crypto inflows this week because investors are seeking its relative stability amid market volatility, capturing 62% of the $160 billion influx. This preference stems from on-chain signals showing accumulation by long-term holders and a decline in altcoin momentum, as tracked by the Altcoin Season Index dropping to mid-July levels, making BTC the focal point for risk-averse capital.

Source: TradingView (BTC/USDT)

Liquidation data underscores this trend, with 61.3% of the $1.13 billion wiped out coming from shorts, reversing prior long-side dominance. This cleanup of bearish positions, combined with improving capitulation metrics, bolsters the case for upward pressure on Bitcoin’s price.

Key Takeaways

- Strong inflows lead recovery: Bitcoin’s 62% share of $160 billion inflows signals investor confidence and market stabilization after November’s downturn.

- Short liquidations boost momentum: $1.13 billion in shorts liquidated, per CoinGlass, traps bears and clears path for bulls to target resistance levels.

- On-chain improvements ahead: Rising Fear and Greed Index and positive profit/loss metrics indicate absorption of supply, urging investors to monitor macro factors for sustained gains.

Conclusion

In summary, the Bitcoin price prediction for December remains optimistic, anchored by robust inflows, on-chain rebounds, and a shift in liquidation dynamics that favor bulls. Bitcoin inflows and Bitcoin price prediction metrics from sources like Glassnode and CoinGlass highlight a market poised for growth, provided resistance clusters are breached. As the year ends, this recovery phase offers opportunities for accumulation—consider tracking these indicators closely to navigate the evolving crypto landscape.