Bitcoin Leads Slowed November Inflows for Digital Asset Treasuries Amid Stock Declines

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Digital asset treasuries saw $1.32 billion in inflows in November 2025, the lowest this year, led by Bitcoin’s $1.06 billion surge despite Ether’s $37 million outflows, signaling a slowdown in corporate crypto adoption.

-

Bitcoin treasury companies dominated with $1.06 billion inflows, boosted by major purchases from Strategy and Metaplanet.

-

XRP recorded $214 million in inflows, highlighting growing interest in alternative digital assets.

-

Ether experienced $37 million outflows, even as BitMine continued accumulating, per DefiLlama data.

Discover how digital asset treasuries’ November 2025 inflows dropped to $1.32 billion amid stock sell-offs—explore Bitcoin’s lead and future trends for investors. Stay informed on crypto treasury strategies today.

What Were the Key DAT Inflows in November 2025?

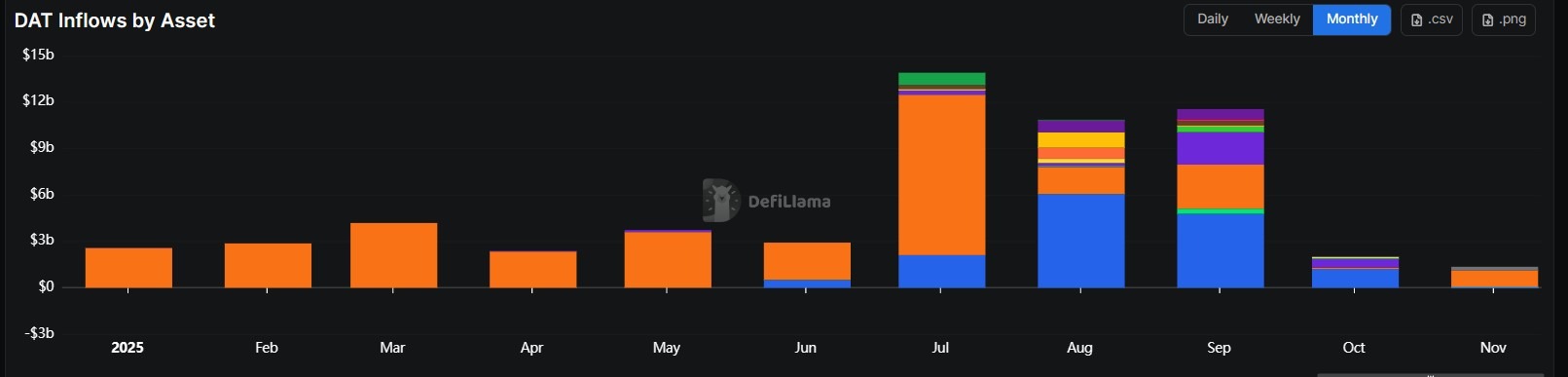

Digital asset treasuries (DATs) recorded $1.32 billion in inflows during November 2025, marking the sector’s slowest month this year and a significant decline from previous periods. This figure, sourced from DefiLlama data, reflects a 34% drop from October’s $1.99 billion and an 88% decrease from September’s $11.55 billion, indicating a cooling in corporate enthusiasm for crypto holdings.

How Did Bitcoin and Ether Perform in DAT Inflows?

Bitcoin DATs spearheaded the inflows with $1.06 billion, primarily fueled by Strategy’s acquisition of $835 million in Bitcoin on November 17 and Metaplanet’s $130 million purchase on November 25. These moves underscore continued corporate confidence in Bitcoin as a treasury reserve asset. In contrast, Ether saw outflows of approximately $37 million, a reversal from its leadership in prior months, though BitMine Immersion Technologies persisted in building its Ether stack. DefiLlama reports highlight XRP’s strong showing at $214 million in inflows, diversifying the sector’s focus beyond Bitcoin and Ether.

DAT inflows in 2025. Source: DefiLlama

Why Did DAT Stocks Face a Steep Sell-Off in November?

The slowdown in inflows coincided with a sharp correction in DAT-related equities, as major players underperformed amid broader market volatility. Google Finance data indicates Strategy, the largest DAT by holdings, declined 35.23% over the month, closing at $171.42 from an opening of $264.67 on November 3. This drop occurred despite a brief mid-month rally, reflecting investor concerns over sustained crypto exposure.

Metaplanet, a prominent Japanese Bitcoin accumulator, also slid 20.67%, falling from 450 Japanese yen ($2.89) to $2.29. Ether-focused firms were hit hard too: BitMine Immersion Technologies dropped 32.48% to $28.94 from $42.86, while SharpLink Gaming shed 26.66% to $9.60 from $13.09. Solana-oriented Forward Industries endured the steepest fall at 43%, declining to $7.86 from $13.91, with CoinGecko estimating unrealized losses of $712.52 million on its Solana holdings. These trends, drawn from Strategic Solana Reserve data, illustrate the risks of concentrated digital asset strategies in volatile markets.

Strategy’s stock drops 35% in one month. Source: Google Finance

Amid the downturn, Strategy’s chairman Michael Saylor reaffirmed commitment on social media, stating he “won’t back down” from the company’s Bitcoin strategy. This resolve comes as the firm considers selling Bitcoin only as a last resort if market net asset value drops or capital becomes unavailable, according to CEO statements.

How Is the DAT Sector Evolving Toward Differentiation?

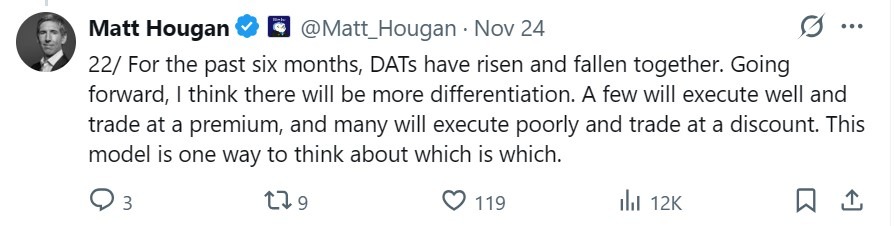

The DAT landscape is shifting from synchronized movements to greater divergence, as noted by Bitwise chief investment officer Matt Hougan. Over the past six months, DAT stocks have largely risen and fallen together, but Hougan anticipates a phase of sharper differentiation ahead. Companies with coherent strategies and strong execution will likely command premiums, while others face discounts.

Source: Matt Hougan

Hougan emphasized that this evolution will reward firms demonstrating real value in their digital asset management. For instance, Bitcoin whale Metaplanet remains “underwater” on holdings but eyes further BTC accumulation, as detailed in Asia Express analysis. This outlook suggests investors should scrutinize individual DAT performance rather than treating the sector as a monolith. Overall, November’s data from DefiLlama and market trackers like Google Finance and CoinGecko paint a picture of maturation in corporate crypto adoption, balancing opportunity with heightened scrutiny.

Frequently Asked Questions

What Caused the Slowdown in Digital Asset Treasury Inflows in November 2025?

The $1.32 billion inflows in November 2025 for digital asset treasuries represented a slowdown due to a cooling corporate treasury boom, per DefiLlama data. This followed peaks of $11.55 billion in September and $1.99 billion in October, influenced by broader market corrections and reduced aggressive buying.

How Are Bitcoin Treasury Companies Performing Compared to Ether Ones This Month?

Bitcoin treasury companies led with $1.06 billion inflows in November 2025, driven by purchases from Strategy and Metaplanet, while Ether treasuries saw $37 million outflows despite ongoing accumulation by BitMine. This contrast highlights Bitcoin’s enduring appeal as a stable treasury asset in uncertain times.

Key Takeaways

- Slowest Inflows of 2025: DATs hit $1.32 billion in November, down sharply from prior months, signaling a pause in crypto treasury expansion.

- Bitcoin’s Dominance Persists: $1.06 billion inflows, led by corporate buys, outpaced other assets like XRP’s $214 million gain.

- Stock Volatility Ahead: Major DAT equities fell up to 43%, urging investors to focus on execution and strategy for long-term gains.

Conclusion

In November 2025, digital asset treasuries experienced a notable slowdown with $1.32 billion in inflows, dominated by Bitcoin treasury companies despite Ether’s outflows and widespread stock declines. As the sector matures, differentiation based on strategic execution will define winners, per insights from experts like Matt Hougan of Bitwise. Investors should monitor evolving DAT trends closely, positioning for potential recoveries as corporate adoption rebounds in the coming months.