Bitcoin May Benefit from Global Trade Tensions as Analysts Predict Major Revaluation Opportunities

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

As global trade tensions escalate, Bitcoin is emerging as a vital asset, particularly as U.S. tariffs provoke significant capital flight and market volatility.

-

Market experts are forecasting a substantial revaluation of Bitcoin, driven by a rebuild in liquidity and shifting investor sentiment away from dollar-centric assets.

-

Bitcoin is increasingly seen as a hedge against geopolitical risks, solidifying its evolution from a speculative tool to a viable monetary alternative.

Amid rising global trade tensions, Bitcoin is becoming a strategic asset as analysts predict a significant revaluation driven by shifting liquidity patterns.

Bitcoin Positioned for a Major Revaluation Amidst Global Economic Shifts

The recent imposition of tariffs by the Trump administration has inadvertently turned Bitcoin into a competitive asset. MV Global, a leading venture capital firm, highlights that the current spike in U.S. tariffs has reached historic highs, evoking conditions seen last in the 1930s. This upheaval has resulted in over $10 trillion in global equity losses, igniting investor interest in alternative assets such as Bitcoin.

“The resulting capital flight is reshaping investment flows across asset classes,” noted MV Global, emphasizing the profound impact of these economic conditions.

With liquidity gradually rebuilding, analysts are optimistic about a significant reevaluation in the market, positioning Bitcoin at the forefront.

This outlook is supported by the recent upward trend in MV Global’s Global Economy Index, which typically signals impending asset reflation. This metric encompasses tracking cross-border capital flows and prevailing monetary conditions, further indicating potential for Bitcoin as an investment.

“Liquidity is quietly rebuilding across major economies. As the Global Economy Index turns upward, historical patterns suggest Bitcoin and equities may be on the cusp of a major revaluation,” highlighted MV Global.

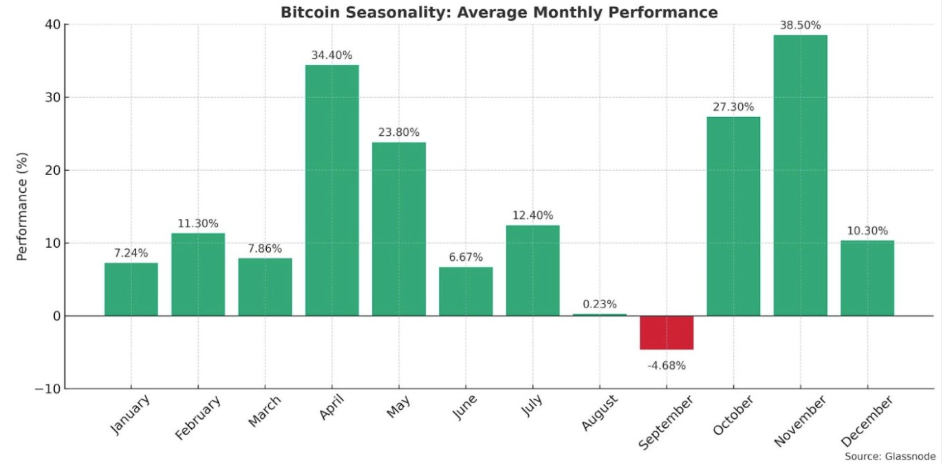

Indeed, Bitcoin has already outperformed traditional markets, reflecting its average return of over 34.4% in April—a month historically favorable due to macroeconomic instability and the resultant capital flight.

Based on these observations, analysts assert that the current market conditions echo historic periods where investors migrated from dollar-denominated assets in pursuit of decentralized alternatives.

Shifts in Investor Sentiment Towards Bitcoin as a Strategic Asset

Tomas Greif, chief of product strategy at Braiins Mining Ecosystem, shares insights aligning Bitcoin’s volatility with major equity indexes, suggesting that traditional investment strategies should be reassessed.

“If you previously thought Bitcoin was too volatile, you may want to re-evaluate your passive investment strategies for retirement,” remarked Greif, pushing for a shift in how investors approach cryptocurrency.

According to Mathew Sigel, head of digital assets research at VanEck, the current macroeconomic landscape may accelerate Bitcoin’s transition from a speculative asset to a functional hedge against monetary risks.

“Bitcoin is evolving from a speculative asset into a functional monetary tool—particularly in economies looking to bypass the dollar and reduce exposure to U.S.-led financial systems,” Sigel stated, reflecting a broader trend in the market.

This evolution coincides with a recent report from U.S. Crypto News, which posited that Bitcoin is establishing itself as a hedge against traditional finance risks, further validating its growing importance.

As economies increasingly distance themselves from traditional U.S. monetary influence, Bitcoin holds potential for becoming a prominent alternative reserve or settlement asset. Notably, developments such as Russia considering a Ruble-pegged stablecoin illustrate the shift away from USD dominance.

In light of equity markets facing turbulence and liquidity reallocating, Bitcoin’s resilience could significantly redefine how investors manage geopolitical risks and uncertainties.

Conclusion

In summary, as trade tensions mount and liquidity patterns shift, Bitcoin is gaining recognition as both a strategic asset and a hedge against geopolitical turmoil. Its potential to redefine investment strategies could reshape the future financial landscape, urging investors to consider its role in their portfolios seriously. The coming months may reveal Bitcoin’s true capabilities as a functional monetary tool amid ongoing market evolution.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/8/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/7/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/6/2026

DeFi Protocols and Yield Farming Strategies

2/5/2026