Bitcoin May Face Challenges as Gold Surges Amid Escalating Israel-Iran Geopolitical Tensions

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

Geopolitical tensions between Israel and Iran have triggered a $1 billion liquidation in crypto markets, causing Bitcoin to drop nearly 3% while gold surged toward new highs.

-

Gold’s ascent amid escalating Israel-Iran hostilities underscores its enduring role as a safe-haven asset, contrasting sharply with Bitcoin’s increased volatility during periods of uncertainty.

-

Analysts from COINOTAG emphasize that Bitcoin’s inconsistent correlation with equities limits its effectiveness as a reliable safe haven compared to traditional assets like gold.

Geopolitical tensions spark $1B crypto liquidations; Bitcoin falls nearly 3% while gold climbs, reaffirming its safe-haven status amid Israel-Iran conflict.

Gold Nears Record Highs as Israel-Iran Conflict Escalates

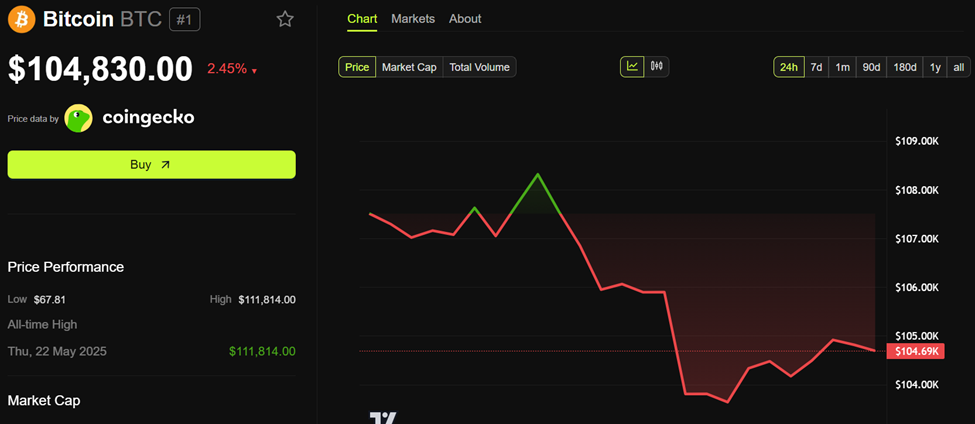

The recent escalation in geopolitical tensions following Israel’s attack on Iran has sent shockwaves through global financial markets, triggering over $1 billion in crypto liquidations. Bitcoin (BTC) experienced a sharp decline, trading near $104,830 and falling almost 3% within 24 hours.

Ethereum (ETH) also suffered a significant drop, plunging approximately 10%, which further intensified the liquidation cascade in crypto markets. In stark contrast, gold prices surged, approaching new highs as investors sought refuge in the traditional safe-haven metal amid rising geopolitical uncertainty.

Market analyst Mary highlighted the critical support levels for gold at $3,420, $3,402, and $3,380, noting that a breakout above $3,440 could propel prices toward the $3,468–$3,493 range during the US trading session. At the time of reporting, gold was trading around $3,422.

The geopolitical backdrop remains tense, with Iran threatening a “lethal” response following Israel’s strikes on its nuclear sites and military leadership. This escalation is compounded by North Korea’s pledge of military support to Iran, intensifying fears of a broader regional conflict.

North Korea’s President Kim Jong Un condemned Israel’s actions, framing the conflict as a fight for freedom and peace, while Beijing criticized Israel’s aggression as a violation of international law. Meanwhile, the US administration, led by former President Trump, has expressed cautious support for Israel, emphasizing the delicate balance amid ongoing nuclear negotiations with Iran.

Geopolitical Alliances and Market Implications

The involvement of key global players such as China, Russia, and North Korea, alongside the US and Israel, underscores the complexity of the conflict and its potential to destabilize markets further. Iran’s affiliation with the Shanghai Cooperation Organization (SCO) adds another layer of geopolitical risk, influencing investor sentiment and asset allocation decisions worldwide.

Trump’s recent statements suggest a nuanced stance, advocating for diplomatic resolution while signaling readiness to defend Israel if Iran retaliates. This uncertainty has heightened market volatility, prompting investors to reassess risk exposure and safe-haven strategies.

Safe-Haven Assets Under Scrutiny Amid Market Volatility

The divergence between gold’s robust performance and Bitcoin’s sharp decline highlights the shifting dynamics of safe-haven assets during periods of acute geopolitical stress. Analysts caution that Bitcoin’s inconsistent correlation with traditional equities limits its utility as a dependable hedge against market downturns.

Mary, a seasoned market analyst, advises traders to exercise stringent risk management, particularly emphasizing the importance of stop-loss orders amid the unstable geopolitical environment.

Marcin Kazmierczak, co-founder and COO of RedStone, shared insights with COINOTAG, noting that Bitcoin’s correlation with equities fluctuates between -0.2 and 0.4. This variability indicates that Bitcoin behaves more like a high-risk asset rather than a consistent safe haven, unlike gold or government bonds.

“Bitcoin can enhance portfolio diversification but does not reliably protect against market crashes,” Kazmierczak explained, reinforcing the notion that digital assets still lack the stability required to supplant traditional safe havens during crises.

Investor Sentiment and Future Outlook

As geopolitical tensions persist, investor preference appears to be shifting back toward historically secure assets like gold. The contrasting price movements of gold and Bitcoin reflect a broader reassessment of risk and safety in portfolio management.

Market participants are urged to monitor developments closely and consider the implications of geopolitical risk on asset allocation, especially given the potential for further escalation and market disruption.

Conclusion

The recent Israel-Iran conflict has underscored gold’s enduring role as a safe-haven asset, with prices nearing record highs amid escalating geopolitical tensions. Conversely, Bitcoin’s sharp decline and volatile correlation with equities highlight its limitations as a reliable hedge during crises. Investors are increasingly favoring traditional assets to mitigate risk, signaling a cautious approach in uncertain times. Maintaining disciplined risk management and staying informed on geopolitical developments remain critical for navigating the evolving market landscape.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Stablecoins Reach 2025 Peaks Led by USDT, Amid Sustained Activity

December 31, 2025 at 07:01 PM UTC

Ethereum Could Target $8,500 as Bullish Momentum Builds Near $4,811

December 31, 2025 at 02:39 PM UTC