Bitcoin May See Demand Rebound or Deeper Accumulation Phase After Seasonal Slump

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s November 2025 performance has defied historical trends, closing down significantly and marking only the second such occurrence in recent years. Analysts from Bitfinex indicate potential paths forward include renewed demand or extended accumulation, with whale activity showing early signs of recovery.

-

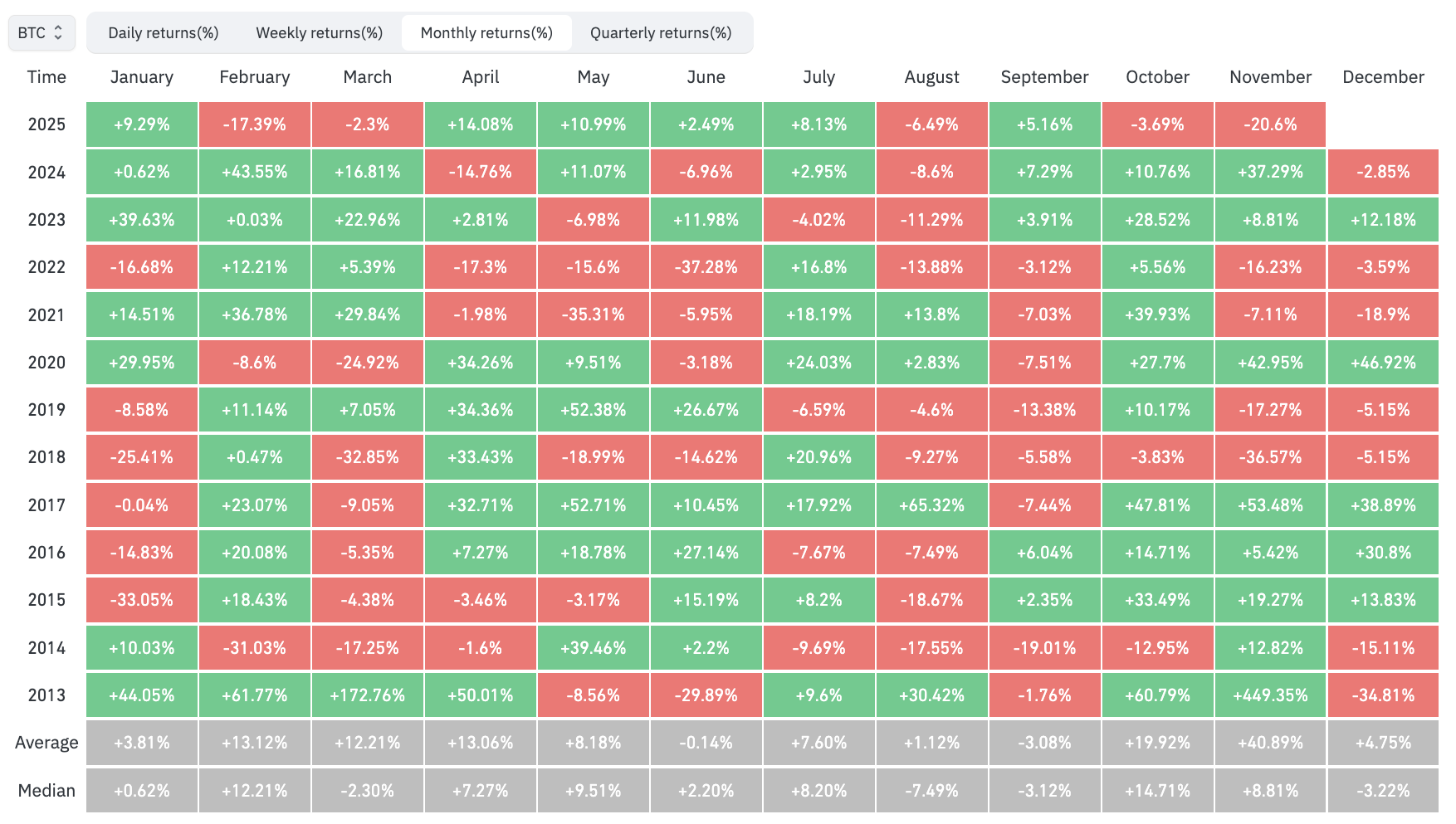

Bitcoin historically averages 40.82% returns in November, but 2025 saw a 20.60% decline year-to-date in the month.

-

October 2025 also underperformed, dropping 3.69% against an average of 19.92%.

-

Whale wallets holding at least 100 BTC increased by 0.47% since mid-November, per Santiment data.

Explore Bitcoin’s unusual November 2025 slump and expert forecasts on demand resurgence. Discover key indicators for investors amid shifting seasonal patterns. Stay informed on BTC trends today.

What is Bitcoin’s Performance in November 2025?

Bitcoin’s performance in November 2025 has broken from its traditional bullish pattern, with the cryptocurrency experiencing a notable decline of 20.60% from the month’s start. This marks a deviation from the asset’s historical average return of 40.82% for November, as reported by CoinGlass data. Analysts at Bitfinex highlight that such underperformance follows a similarly weak October, raising questions about the reliability of seasonal trends in the current market environment.

October and November have typically been the two strongest months for Bitcoin. Source: CoinGlass

At the time of publication, Bitcoin is trading at $87,305, according to CoinMarketCap.

In the current quarter, historic seasonality metrics have failed to hold up, according to Bitfinex analysts. This unusual trend has left many market participants reevaluating their strategies, as Bitcoin’s price has dipped below key support levels. The asset’s trajectory now hinges on broader economic factors and investor sentiment, potentially signaling a shift in how seasonal patterns influence cryptocurrency valuations.

How Has Bitcoin Whale Activity Evolved Recently?

Bitcoin whale interest, referring to large holders with significant influence on market dynamics, is showing tentative signs of revival amid the November downturn. Santiment reports that the number of wallets holding at least 100 Bitcoin rose by 0.47%, or 91 wallets, since November 11. This uptick contrasts with earlier capitulation among holders who purchased at peaks around $106,000 and $118,000, where buying pressure was unusually intense, leading to losses as prices fell.

Bitfinex analysts note this is only the third time since early 2024 that Bitcoin’s price has breached the lower band of the short-term holders’ cost-basis model. Short-term holders, defined as those with positions under 155 days, face an average realized price of $86,787 based on CoinGlass metrics. Such data underscores the pressure on recent buyers, with deeper capitulation possible if demand does not materialize soon. Expert commentary from trading analyst Merlin The Trader emphasized low sentiment combined with expected bullish seasonality as a potential setup for recovery, though current realities have tempered optimism.

Bitcoin has declined by 7.17% over the past 12 months. Source: CoinMarketCap

The resurgence in whale accumulation could stabilize prices, but analysts caution that without a meaningful influx of broader demand, Bitcoin may enter a prolonged accumulation phase. This phase would involve sideways trading as the market digests recent volatility. Historical precedents suggest that such periods often precede upward movements, but the absence of traditional November strength adds uncertainty. Bitfinex’s analysis points to two primary outcomes: a swift demand rebound or an extended consolidation, both of which could reshape end-of-year expectations for the cryptocurrency.

Frequently Asked Questions

What Factors Are Driving Bitcoin’s Weak November 2025 Performance?

Bitcoin’s weak November 2025 performance stems from a combination of failed seasonal expectations and heightened selling pressure from overextended positions. Bitfinex reports indicate that excessive buying at higher levels around $106,000 led to capitulation, while broader market froth contributed to the 20.60% monthly drop. External economic signals and reduced retail interest have further amplified the deviation from historical 40.82% average gains.

Will Bitcoin Recover Demand Before December 2025 Ends?

Bitcoin may see a recovery in demand as whale accumulation picks up, with Santiment noting a recent 0.47% increase in large-holder wallets. While December historically delivers modest 4.75% returns since 2013, current indicators like rising short-term holder costs suggest potential stabilization. Investors should monitor on-chain metrics closely for signs of broader participation driving prices higher.

Key Takeaways

- Seasonal Trends Under Pressure: Bitcoin’s November 2025 decline of 20.60% challenges the asset’s average 40.82% historical gains, signaling evolving market dynamics.

- Whale Activity as a Bullish Signal: A 0.47% rise in wallets holding 100+ BTC since mid-November points to accumulating interest among major players.

- Future Paths Ahead: Markets face either demand resurgence or deeper accumulation; tracking short-term holder costs around $86,787 will provide key insights for positioning.

Conclusion

Bitcoin’s November 2025 performance has notably diverged from seasonal norms, with a significant price drop and emerging whale interest shaping the outlook. As Bitfinex analysts outline, the cryptocurrency stands at a crossroads between renewed demand and prolonged accumulation, influenced by short-term holder dynamics and historical December trends averaging 4.75% returns. Investors are advised to stay vigilant with on-chain data from sources like CoinGlass and Santiment, positioning for potential year-end opportunities while navigating this period of uncertainty.