Bitcoin Nears Historic Crossover: Potential Signals of Market Thaw and Renewal

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin bull market signals are emerging as the cryptocurrency approaches a key technical crossover that has historically marked cycle turning points, with reduced volatility and $732 billion in new capital absorbed, indicating underlying strength despite low social interest.

-

Bitcoin’s approaching crossover on multi-timeframe charts signals potential bull market renewal.

-

Market volatility has halved over the past year, showing increased stability.

-

Institutional investment has driven $732 billion in capital inflows, far surpassing retail participation levels from previous cycles.

Discover Bitcoin bull market signals hidden in current market dynamics, from technical crossovers to sentiment shifts. Stay ahead with insights on volatility and capital flows—explore now for informed crypto strategies.

What Are the Key Bitcoin Bull Market Signals?

Bitcoin bull market signals often appear during periods of low visibility, such as the current lull in social interest. Historically, when Bitcoin’s price action aligns with specific technical crossovers on long-term charts, it has preceded major upward movements. Right now, Bitcoin is nearing such a zone, suggesting the market could be on the cusp of a significant renewal phase, supported by robust on-chain metrics.

How Has Bitcoin’s Market Volatility Evolved Recently?

Bitcoin’s one-year realized volatility has decreased by nearly 50% in this cycle, according to data from Glassnode, reflecting a more mature asset class backed by institutional investors. This reduction contrasts with past cycles where high volatility dominated retail-driven rallies. Short sentences highlight the shift: lower swings mean steadier growth potential. For instance, while retail searches on platforms like Google have hit multi-year lows, on-chain capital inflows remain strong, underscoring resilience.

Frequently Asked Questions

What Does Low Social Interest Mean for Bitcoin’s Bull Market Signals?

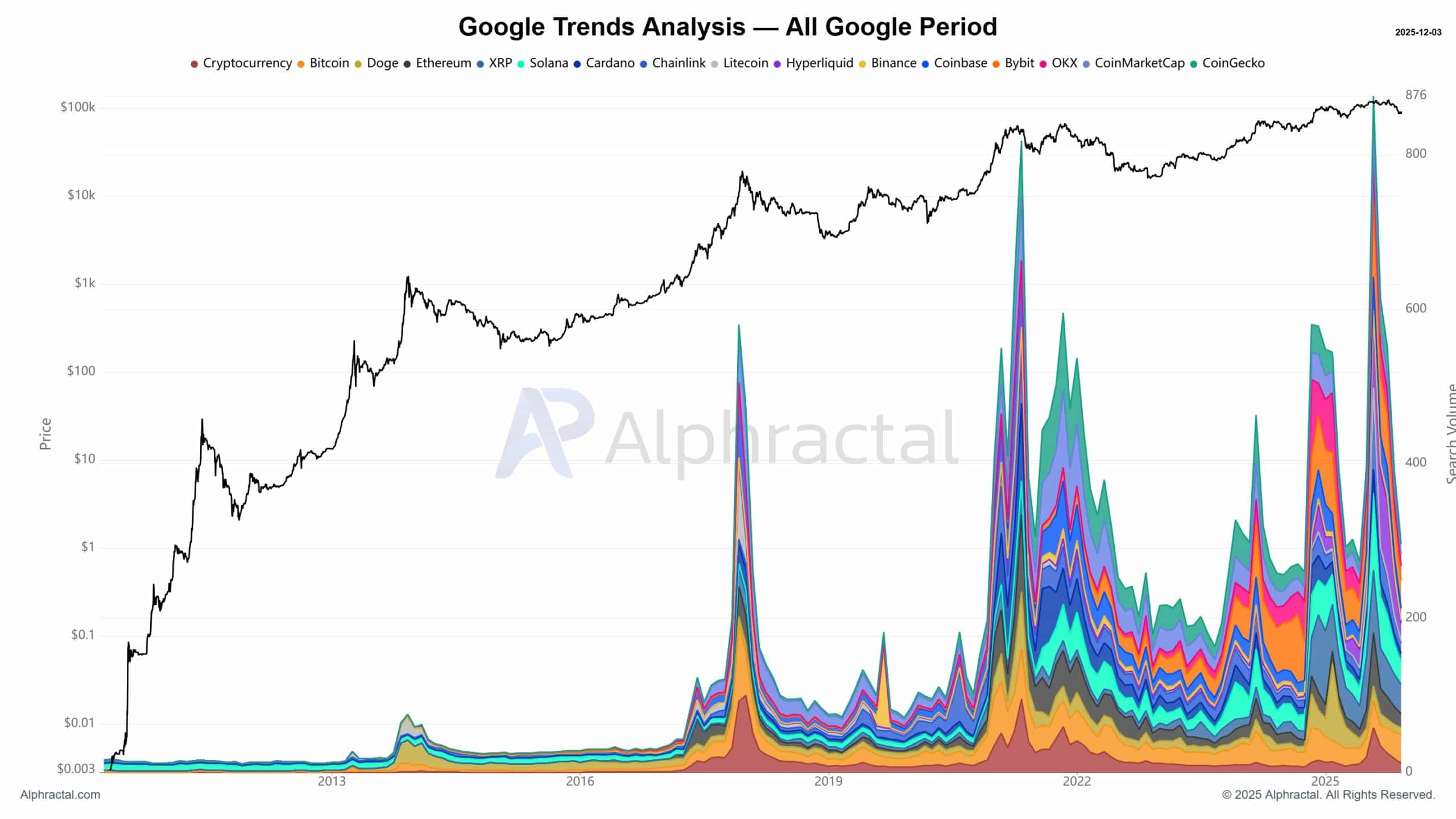

Low social interest, evidenced by reduced Google searches for crypto at multi-year lows and declining visits to sites like CoinMarketCap, typically signals the end of bear phases in Bitcoin cycles. This quiet period allows for accumulation, often leading to sharp recoveries as sentiment flips. Historical patterns show such lulls precede bull markets by months, enabling smarter positioning without crowd noise.

Is Bitcoin’s Current Price Recovery Indicating a Full Bull Market?

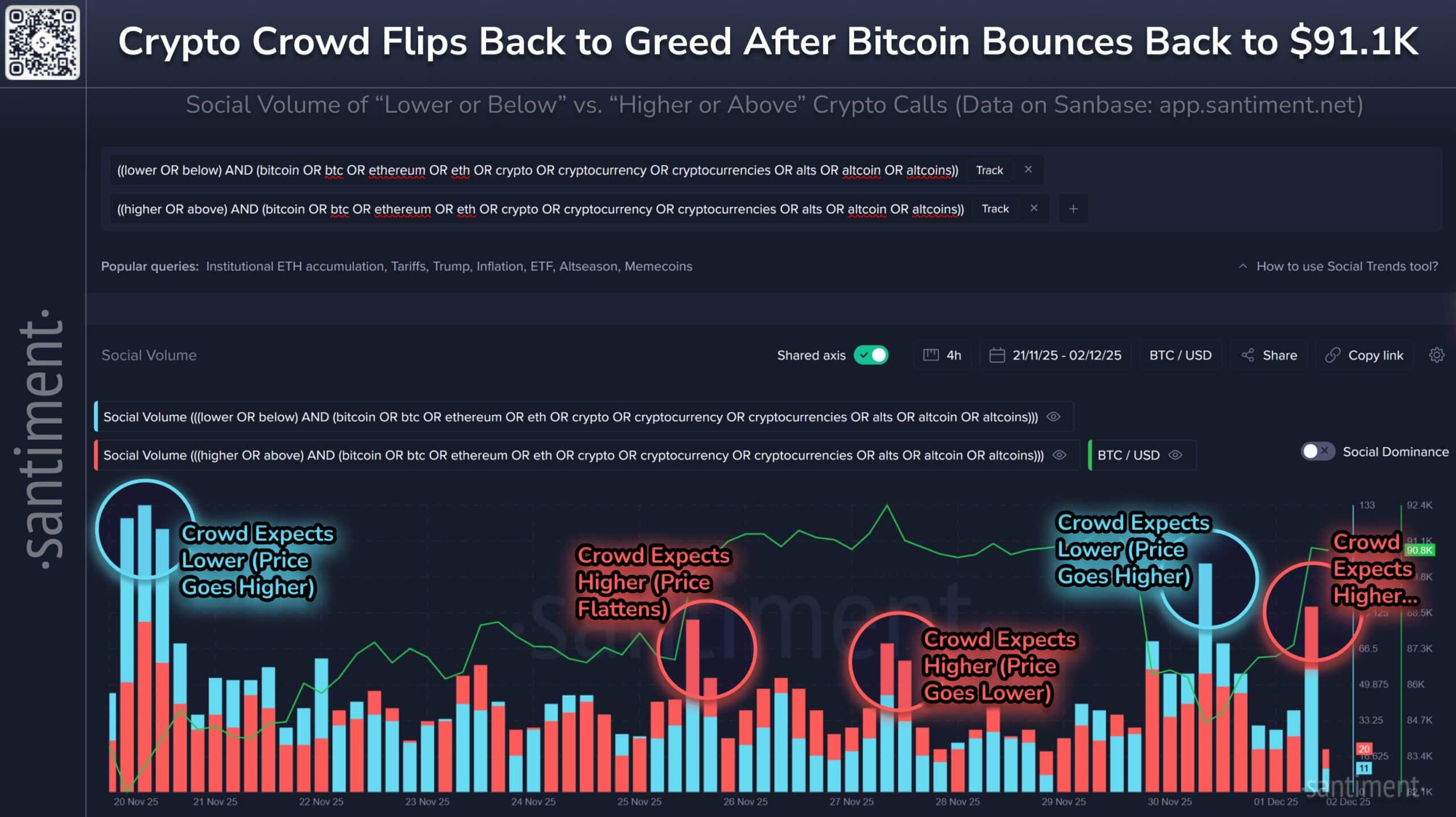

Bitcoin’s recent push back toward $93,000, alongside Ethereum surpassing $3,000, points to early thawing in market sentiment, but it’s not yet a confirmed full bull market. Data from Santiment reveals quick swings from fear to greed, common in transitional phases. Listeners should note that sustained capital absorption and technical crossovers are key confirmations for longer-term uptrends.

Key Takeaways

- Technical Crossover Approaching: Bitcoin is nearing a multi-timeframe crossover that has reliably marked bull market starts in previous cycles, potentially igniting the next renewal phase.

- Declining Volatility: With one-year realized volatility halved and $732 billion in new capital integrated, the market demonstrates greater stability driven by institutional participation.

- Sentiment Shift: Rising prices are flipping social sentiment toward greed, but traders should watch for overextension—use this as a cue to monitor on-chain data closely for entry points.

Conclusion

In summary, Bitcoin bull market signals are becoming evident through technical crossovers, reduced volatility, and substantial capital inflows, even as social interest remains subdued. These factors, drawn from on-chain analyses by sources like Glassnode and Santiment, point to a strengthening foundation for future growth. As the market navigates this transitional period, investors are encouraged to focus on these metrics for strategic decisions, positioning themselves for what could be the dawn of a renewed bullish era in cryptocurrency.

Signs Hidden in Plain Sight

Over multiple market cycles, a specific technical crossover on Bitcoin’s charts has served as a reliable indicator of impending shifts from bear to bull phases. This pattern, observable across various timeframes, has consistently highlighted turning points where accumulation gives way to broader rallies. Currently, Bitcoin’s price trajectory is drawing closer to this critical zone once more, implying that the cryptocurrency market might be nearer to a revitalization than surface-level observations suggest.

A Quiet Market Isn’t Weak Though

Interest in cryptocurrencies, as measured by Google search volumes, has plummeted to levels not seen in years. Similarly, engagement on leading data aggregators like CoinMarketCap and CoinGecko has noticeably diminished. Such periods of subdued social activity have traditionally aligned with extended bear markets, yet they also represent prime windows for value accumulation. These moments of relative silence often precede significant opportunities, allowing early participants to build positions well before mainstream attention resurfaces.

Source: Alphractal

Beneath this apparent calm, however, the cryptocurrency ecosystem reveals signs of underlying fortitude. Bitcoin has successfully integrated approximately $732 billion worth of fresh capital throughout this cycle, a figure derived from comprehensive on-chain tracking. Concurrently, its one-year realized volatility has contracted by almost half, pointing to a more predictable and less erratic price environment.

Source: Glassnode

This evolution signifies a pivot toward sustainability, with institutional entities providing a solid base rather than the more volatile influxes from retail traders seen in earlier periods.

Sentiment Is Turning

As Bitcoin rebounds toward the $93,000 mark and Ethereum climbs above $3,000, broader market sentiment is undergoing a rapid transformation. This price stabilization is drawing renewed optimism from observers, though caution remains warranted given the asset class’s inherent fluctuations.

Metrics from Santiment illustrate the crowd’s emotional volatility, with sentiment oscillating between fear and greed in response to short-term price actions. Blue indicators denote fear, which frequently precedes upward price corrections, whereas red signals greed, often correlating with subsequent pullbacks as enthusiasm peaks.

Source: Santiment

The most recent recovery has tilted sentiment toward greed, which could indicate participants are anticipating further gains. Yet, when viewed alongside technical and on-chain developments, this appears to be an initial indicator of broader market warming rather than isolated hype.

Collectively, these elements suggest that while the prolonged crypto winter persists in some respects, cracks are forming in the ice, heralding potential seasonal change.

Final Thoughts

- Bitcoin’s next major cycle signal is closing in, and the bear market’s final phase may already be underway.

- Volatility is dropping and $732B in new capital has been absorbed.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026