Bitcoin Open Interest Falls 50% Amid Year-End Trading Slowdown

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s open interest has declined nearly 50% in late 2025, dropping from over $70 billion to around $35-40 billion as institutions close leveraged positions amid year-end caution. This slowdown in trading activity and volumes signals a defensive market stance, with prices holding steady in a narrow range near $86,400.

-

Bitcoin open interest falls 50%: Institutions unwinding positions has reduced leveraged exposure by over $30 billion across exchanges.

-

Trading volumes ease: Centralized exchanges like Binance see softened participation despite handling significant daily flows.

-

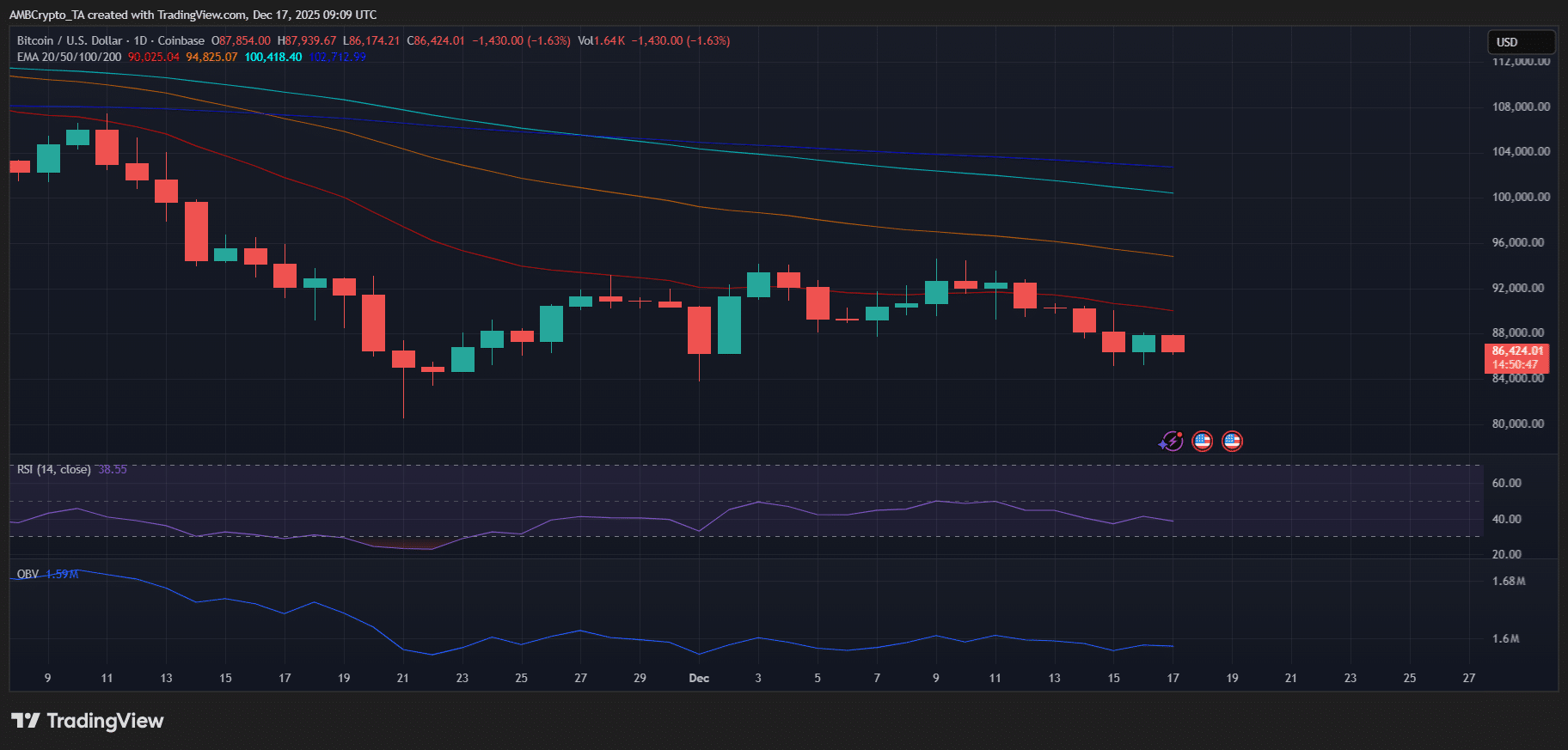

Price stability amid caution: Bitcoin trades at $86,400, below key moving averages, with RSI at 38 indicating limited buying pressure and data from Alphractal showing real position closures.

Explore Bitcoin’s open interest decline in 2025: Why trading slows and what it means for prices. Stay informed on market shifts with our insights—subscribe for updates on crypto trends today. (152 characters)

What is causing Bitcoin’s open interest decline in 2025?

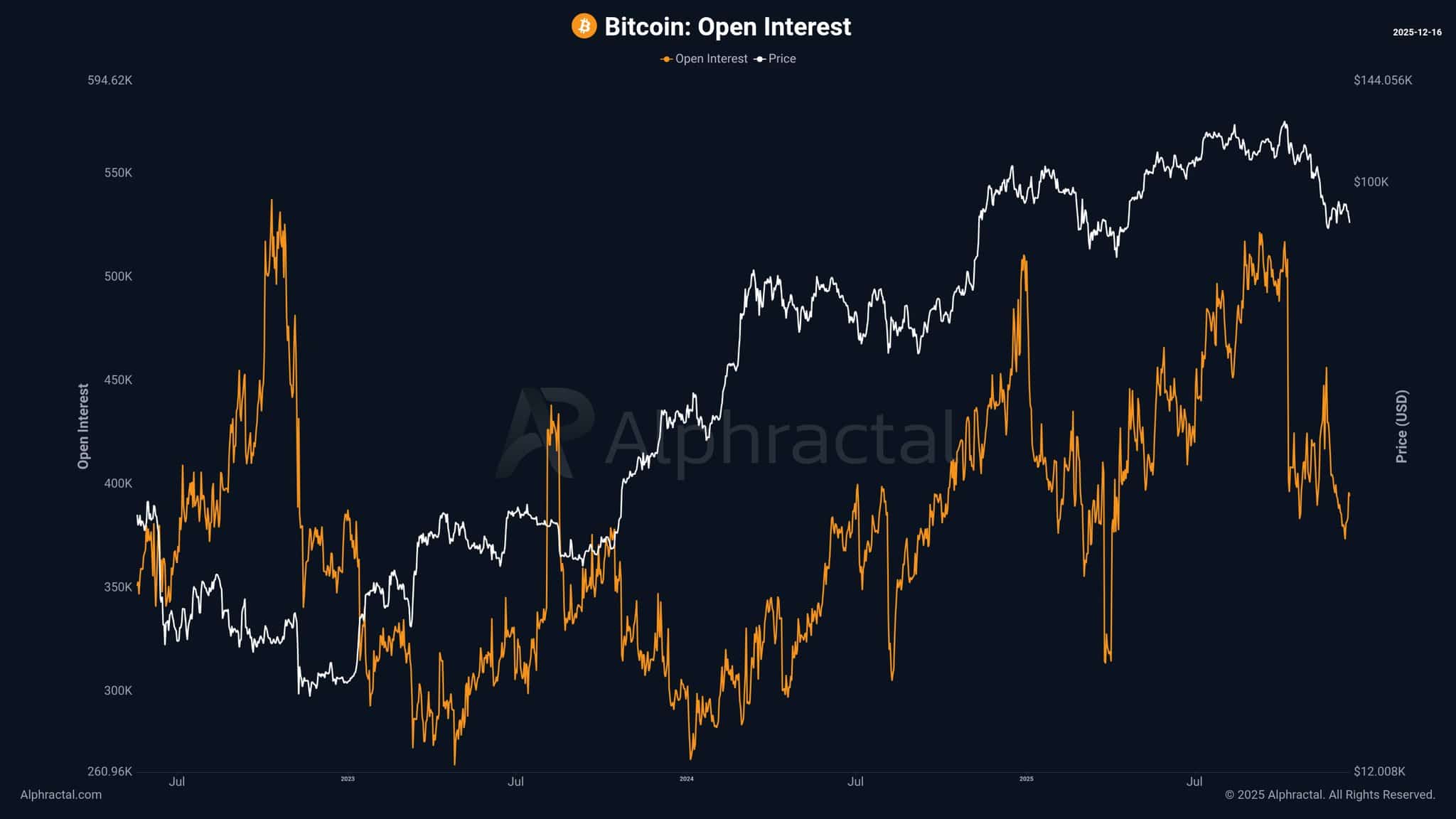

Bitcoin’s open interest decline in 2025 stems primarily from institutional investors reducing leveraged positions as the year draws to a close. Data from Alphractal indicates a sharp drop of nearly 50%, with over $30 billion in positions closed across major exchanges. This reflects a common year-end strategy where market participants de-risk portfolios, leading to quieter trading in futures, spot markets, and ETFs, while prices remain relatively stable in a narrow range.

How has trading volume been affected by this slowdown?

The decline in Bitcoin’s open interest has coincided with a noticeable slowdown in trading volumes, affecting both centralized exchanges and ETFs. On centralized platforms, overall participation has softened, even as Binance maintains dominance with daily volumes exceeding $50 billion. ETF trading has also trended lower, reaching around $39 billion in recent sessions. This reduction follows a pattern observed in previous years, where holiday periods prompt reduced activity. Supporting data from market analytics firms like Alphractal highlights that the drop is driven by actual position unwinding rather than mere price fluctuations, fostering a more conservative market environment. Short-term indicators, such as the On-Balance Volume (OBV) trending downward, further underscore thinning participation as traders adopt a wait-and-see approach ahead of potential catalysts.

Source: Alphractal

Bitcoin’s market dynamics in late 2025 illustrate a broader trend of risk aversion among large players. As open interest plummets, the leverage ratio—a key metric for assessing market speculation—has also decreased significantly. According to insights from financial analysts at firms like Glassnode, this deleveraging process helps stabilize the market but can lead to prolonged periods of low volatility. For instance, historical data shows similar patterns at year-end 2024, where open interest contracted by 40% before rebounding in the new year. Experts emphasize that while this phase may feel stagnant, it often sets the stage for renewed momentum once fiscal books close and fresh capital inflows resume.

Spot market volumes have mirrored this caution, with daily aggregates on major platforms dipping below $100 billion for several sessions. This is a stark contrast to the frenzied activity seen mid-year when Bitcoin surged past $90,000. Institutional flows into ETFs, tracked by providers like BlackRock and Fidelity, have slowed to a trickle, with net inflows turning neutral. Bloomberg data corroborates this, noting that spot ETF volumes have halved from their November peaks. Such developments underscore the interconnectedness of futures and spot trading, where reduced leverage in derivatives directly impacts overall liquidity.

Source: Alphractal

The chart above visualizes the correlation between open interest and price stability, confirming that the current decline is tied to deliberate position closures by sophisticated traders. As we approach the holidays, this “breather” could extend into early 2026, but market observers remain optimistic about underlying fundamentals like institutional adoption and regulatory clarity.

Frequently Asked Questions

What does the Bitcoin open interest decline mean for 2025 price predictions?

The Bitcoin open interest decline in 2025 indicates reduced speculation and a shift toward stability, potentially limiting short-term upside but preventing sharp corrections. Data from Alphractal shows over $30 billion in positions closed, aligning with year-end de-risking. This could lead to a consolidation phase before new inflows drive recovery in the new year.

Why are Bitcoin trading volumes dropping during the 2025 holiday season?

Bitcoin trading volumes are dropping during the 2025 holiday season due to institutional profit-taking and position reductions as firms close fiscal years. Volumes on centralized exchanges have softened to around $191 billion daily, while ETFs see $39 billion, reflecting a cautious approach that prioritizes balance sheet health over aggressive trading, as noted by market analysts.

Key Takeaways

- Open Interest Reduction: A nearly 50% drop signals deleveraging and lower risk exposure, stabilizing Bitcoin in the $80,000-$90,000 range.

- Volume Slowdown: Trading activity across spot, futures, and ETFs has eased, with centralized volumes at $191 billion and ETFs at $39 billion, typical for year-end.

- Price Outlook: At $86,400, Bitcoin hovers below key averages; monitor RSI and OBV for signs of renewed momentum post-holidays.

Source: TradingView

Conclusion

In summary, Bitcoin’s open interest decline in 2025 and the accompanying trading volume slowdown reflect a strategic pause by institutions navigating year-end obligations. With prices drifting sideways at $86,400 and indicators like RSI signaling restraint, this period of caution underscores the maturity of the crypto market. Looking ahead, anticipate potential rebounds as 2026 brings fresh opportunities—consider reviewing your portfolio strategies to align with these evolving dynamics.