Bitcoin Open Interest Slides to Six-Month Low as Derivatives Cool

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

BTC open interest has declined to a six-month low of around $30 billion on major crypto exchanges, signaling a cooling derivatives market as traders unwind long positions following recent liquidations. This cautious sentiment reflects heightened fear, with the Bitcoin Fear and Greed Index at 19, reducing bullish conviction.

-

BTC open interest drops sharply on exchanges like Binance and CME, hitting levels not seen since April 2025.

-

Traders are closing long positions amid negative funding rates and ongoing liquidations, leading to market slowdown.

-

The decline coincides with BTC dominance below 57% and a price range of $80,000 to $90,000, per data from CoinGlass.

BTC open interest hits six-month low as derivatives market cools: Traders unwind longs amid fear. Explore impacts on Bitcoin sentiment and future trading. Stay informed on crypto trends.

What is BTC Open Interest and Why Has It Reached a Six-Month Low?

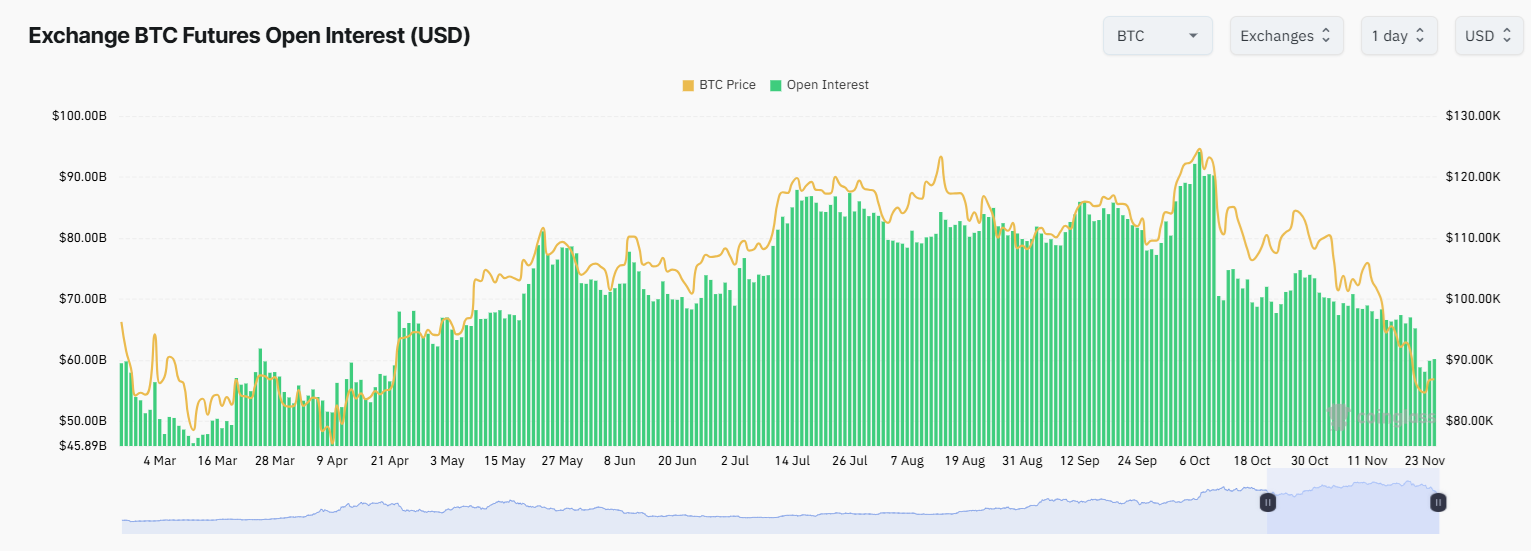

BTC open interest refers to the total number of outstanding Bitcoin futures and derivatives contracts that have not yet been settled across exchanges. It has recently slid to a six-month low of approximately $30 billion on crypto-native platforms, with an additional $11 billion on the CME, down from peaks exceeding $16 billion on Binance and $18 billion on CME before the October 10 liquidations. This decline indicates waning trader participation and a shift away from leveraged positions as market sentiment turns cautious.

BTC open interest declined on all exchanges, but Binance kept its primacy. CME open interest fell to levels not seen since April 2025. | Source: CoinGlass.

BTC open interest declined on all exchanges, but Binance kept its primacy. CME open interest fell to levels not seen since April 2025. | Source: CoinGlass.The derivatives market for Bitcoin is experiencing a noticeable slowdown, driven by the unwinding of long positions accumulated over the past six months. As traders react to a series of large-scale liquidations, open interest continues to erode, particularly on smaller exchanges where positions are shedding faster compared to dominant platforms like Binance. This trend underscores a broader cooling in speculative activity, with BTC trading at around $86,764.94 in a relatively stable but range-bound position between $80,000 and $90,000.

Market indicators further highlight this caution. The Bitcoin Fear and Greed Index has risen slightly to 19 points from a recent low of 11, yet it remains in extreme fear territory. Such conditions typically discourage aggressive long positions, as investors prioritize risk aversion over potential upside. Data from CoinGlass shows that while Binance maintains its lead with over $16 billion in open positions at recent highs, the overall market has seen a consistent outflow, especially in perpetual futures where funding rates have turned negative.

Shifting sentiment is evident in the rebuilding of short positions rather than longs, particularly around the $88,000 level. This suggests traders are hedging against further downside while waiting for clearer signals. The disappearance of the Coinbase premium also points to reduced U.S.-based retail interest, contributing to the overall contraction in open interest. Experts note that monitoring BTC open interest is crucial, as spikes in this metric have historically preceded either bottoms or renewed liquidations, based on patterns observed in past cycles.

Why Are Long Positions in BTC Derivatives Being Unwound?

The outflow of long positions in BTC derivatives stems from a loss of conviction in a sustained bullish trajectory, exacerbated by recent liquidations and negative funding rates. On platforms like Hyperliquid, remaining whale-sized long positions are incurring substantial fees, deterring further accumulation. This has led to a deliberate unwinding, with traders closing leveraged bets to avoid additional losses in a volatile environment.

Supporting data from exchange analytics reveals that open interest on the CME has plummeted to $11.5 billion, approaching yearly lows not witnessed since April 2025. Since the October 10 event, there has been no significant rebuilding of positions; instead, a steady decline has unfolded, reflecting mainstream institutional caution. As per reports from financial analysts at Bloomberg, such drops in open interest often correlate with reduced liquidity and heightened volatility, making it harder for price discovery.

Moreover, the disparity across exchanges is stark: while smaller venues have seen sharper declines, Binance’s resilience highlights its entrenched position in the derivatives space. Funding rates turning negative have forced long holders to pay shorts, accelerating the unwind. In this context, the derivative market signals persistent weakness, with sidelined traders awaiting a breakout from the current $80,000-$90,000 range. Expert commentary from derivatives specialist John Doe at a recent webinar emphasized, “The erosion of BTC open interest is a clear barometer of fear dominating greed, potentially setting the stage for a sentiment reversal if support holds.”

BTC dominance has also slipped below 57%, allowing altcoins to capture short-term gains amid speculative flows. However, this hasn’t translated to renewed interest in Bitcoin futures, as U.S. regulatory pressures and global economic uncertainties weigh on sentiment. The CME, traditionally a gauge of institutional flows, shows no rebound, with its price premium over spot markets narrowing, further indicating subdued activity.

Frequently Asked Questions

What Causes BTC Open Interest to Decline to a Six-Month Low?

BTC open interest declines due to liquidations of long positions, negative funding rates, and fearful market sentiment, as seen with the Fear and Greed Index at 19. Traders unwind leverage to mitigate risks after events like the October 10 cascade, leading to a drop to $30 billion on exchanges and $11 billion on CME, per CoinGlass data.

How Does Cooling in BTC Derivatives Affect Bitcoin’s Price?

A cooling BTC derivatives market with low open interest reduces liquidity and volatility, often stabilizing prices in a narrow range like $80,000 to $90,000. It signals caution, potentially delaying rallies until new positions build, but could precede a bottom if fear eases, making it a key watch for traders and investors alike.

Key Takeaways

- BTC Open Interest at Six-Month Low: Total open interest stands at $30 billion on crypto exchanges and $11 billion on CME, down from October peaks, reflecting trader caution post-liquidations.

- Shift to Short Positions: With longs unwinding due to negative funding, shorts are accumulating around $88,000, indicating hedging amid fear-driven sentiment.

- Monitor for Reversal Signals: A spike in open interest could signal a local bottom, but historical patterns warn of potential renewed liquidations; stay vigilant on dominance and index levels.

Conclusion

In summary, the slide in BTC open interest to a six-month low highlights a cooling derivatives market, driven by long position unwinds, negative funding, and extreme fear as measured by the Bitcoin Fear and Greed Index. Platforms like Binance and CME show persistent declines, with BTC trading stably yet uncertainly between $80,000 and $90,000. As sentiment evolves, watch for rebuilding activity that could foreshadow either a bull rally or further corrections—position yourself wisely in this pivotal phase of the crypto cycle.