Bitcoin Plunges Below Support: Whale Distribution Raises Capitulation Risks

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

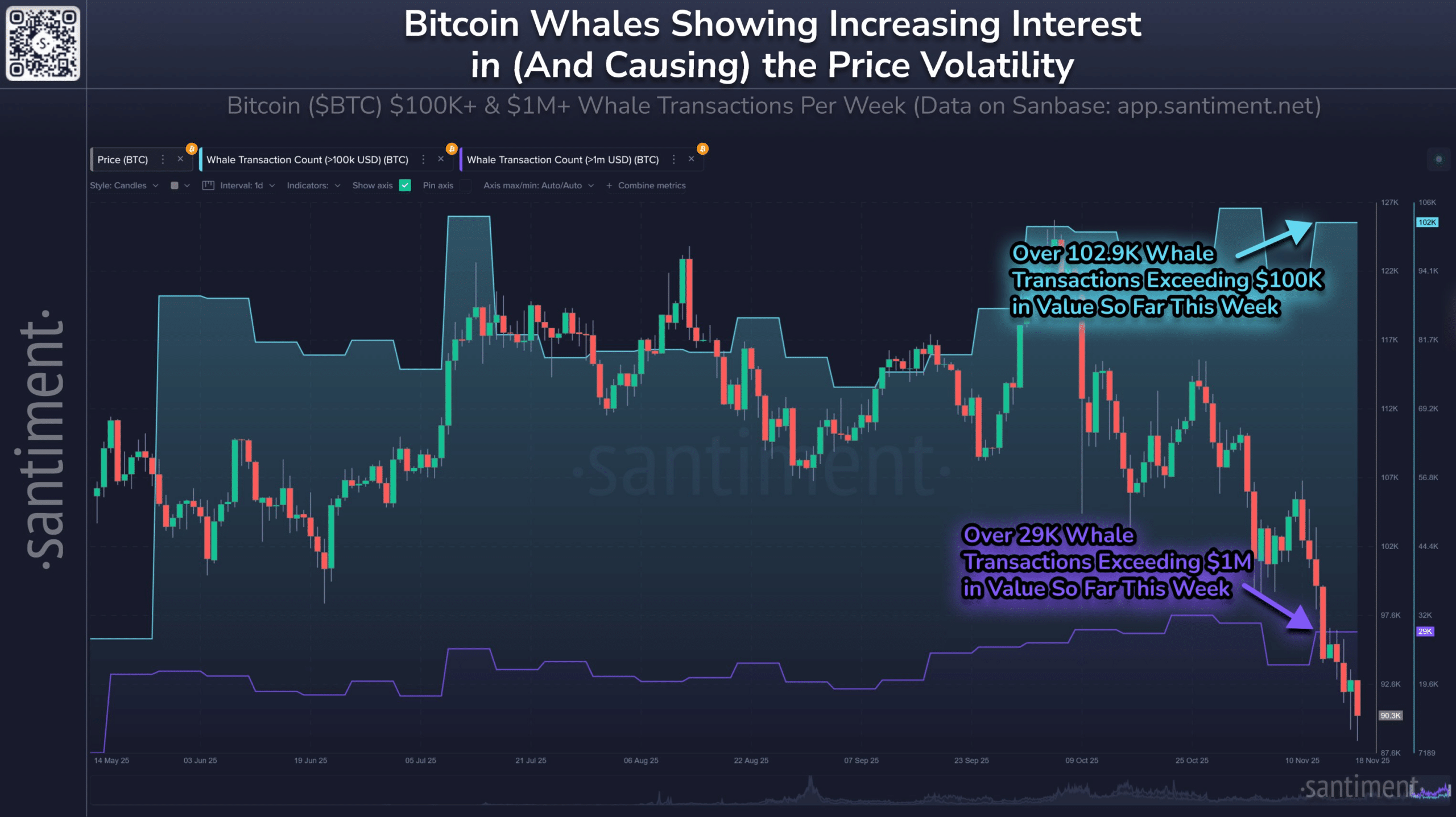

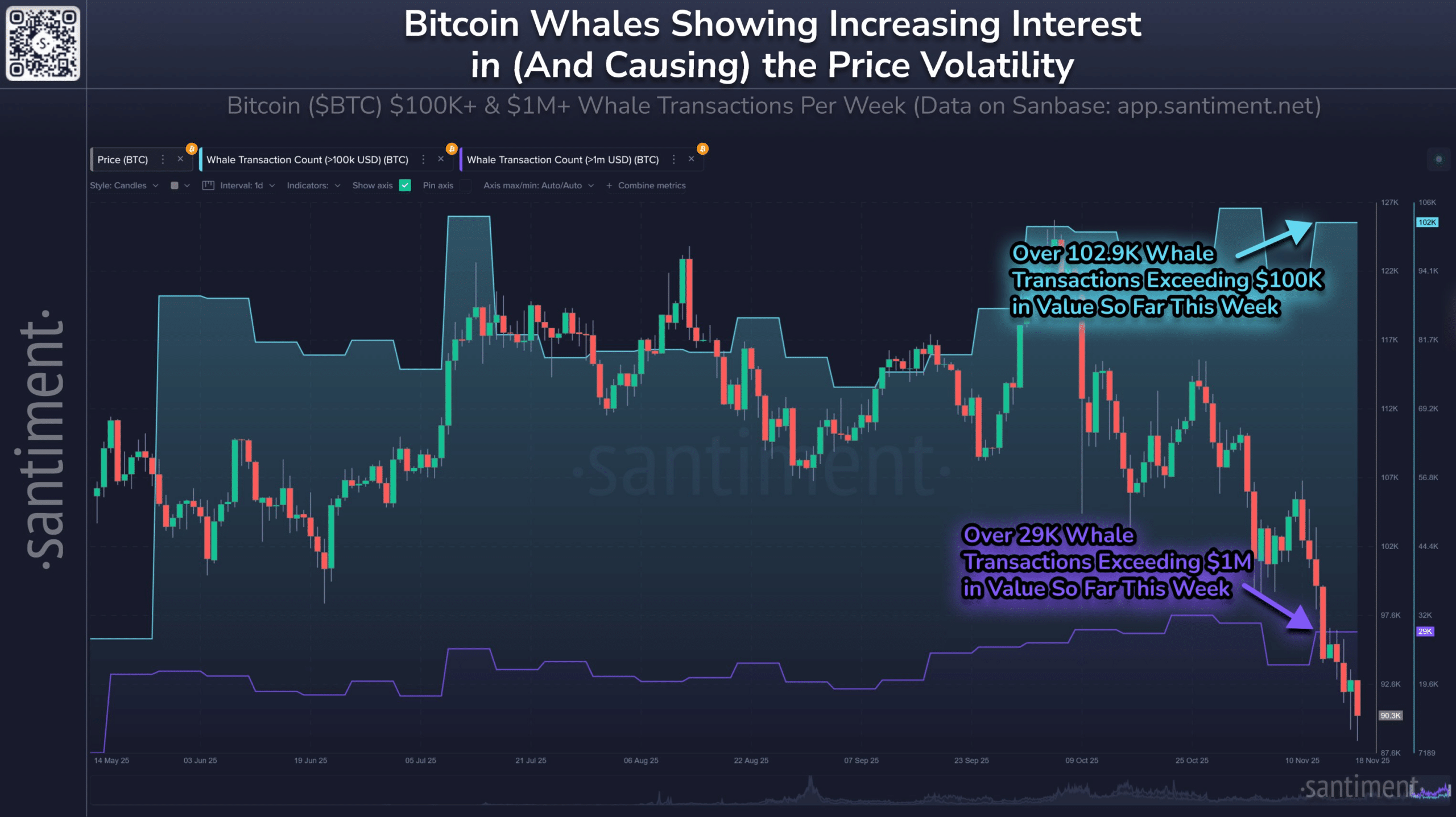

Bitcoin’s key support level at $82,000 is under pressure as the cryptocurrency plunges nearly 30% from its all-time high of $126,000. Whale activity has surged this week, with over 102,900 transactions exceeding $100,000, indicating distribution among long-term holders. Holding above this level is crucial to avoid a deeper bear market reminiscent of 2022.

-

Bitcoin support level at $82K faces critical test amid four weeks of declines and thinning profitability for holders.

-

Whale transactions hit 2025 highs, with more than 29,000 moves over $1 million signaling profit-taking.

-

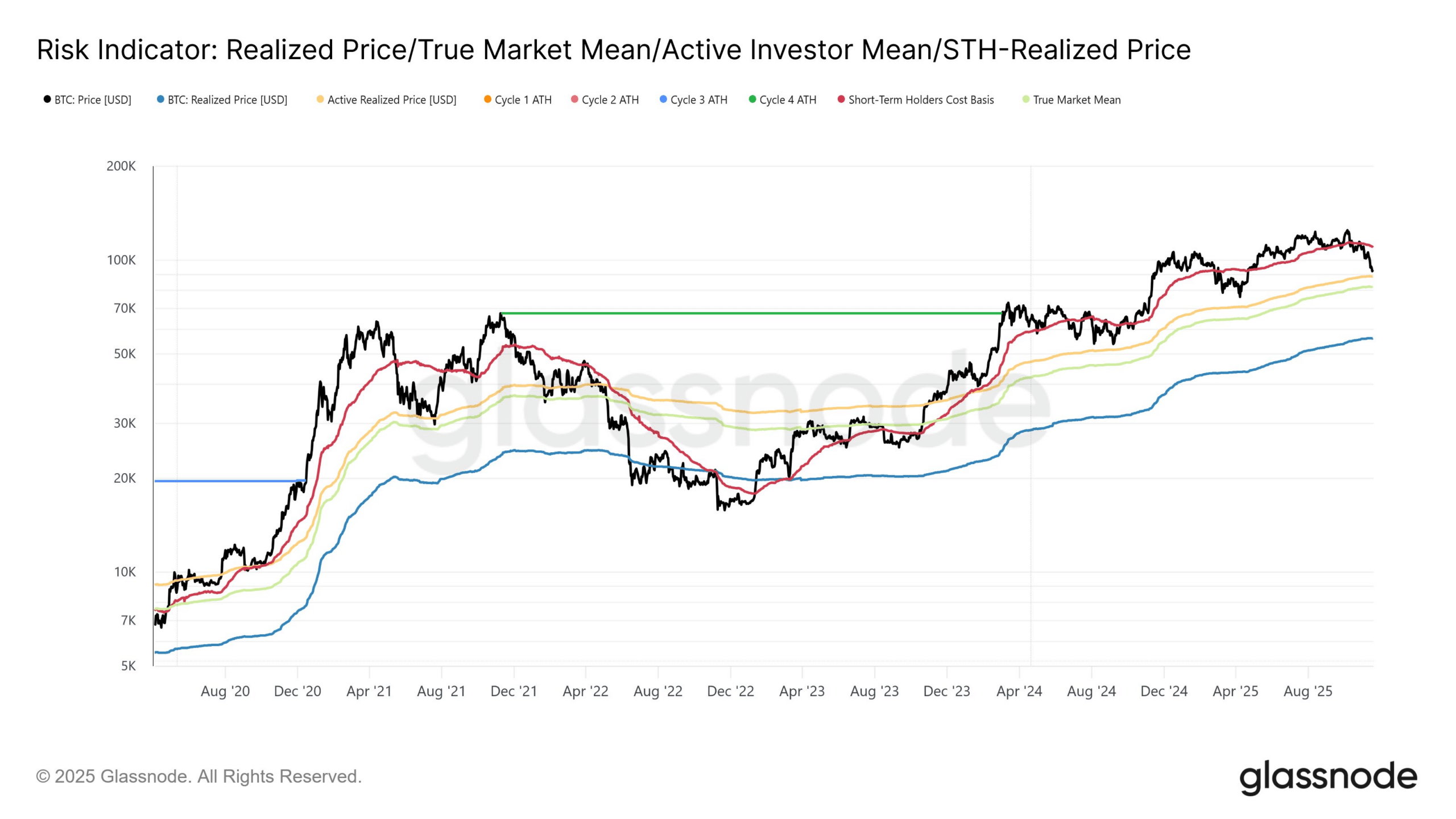

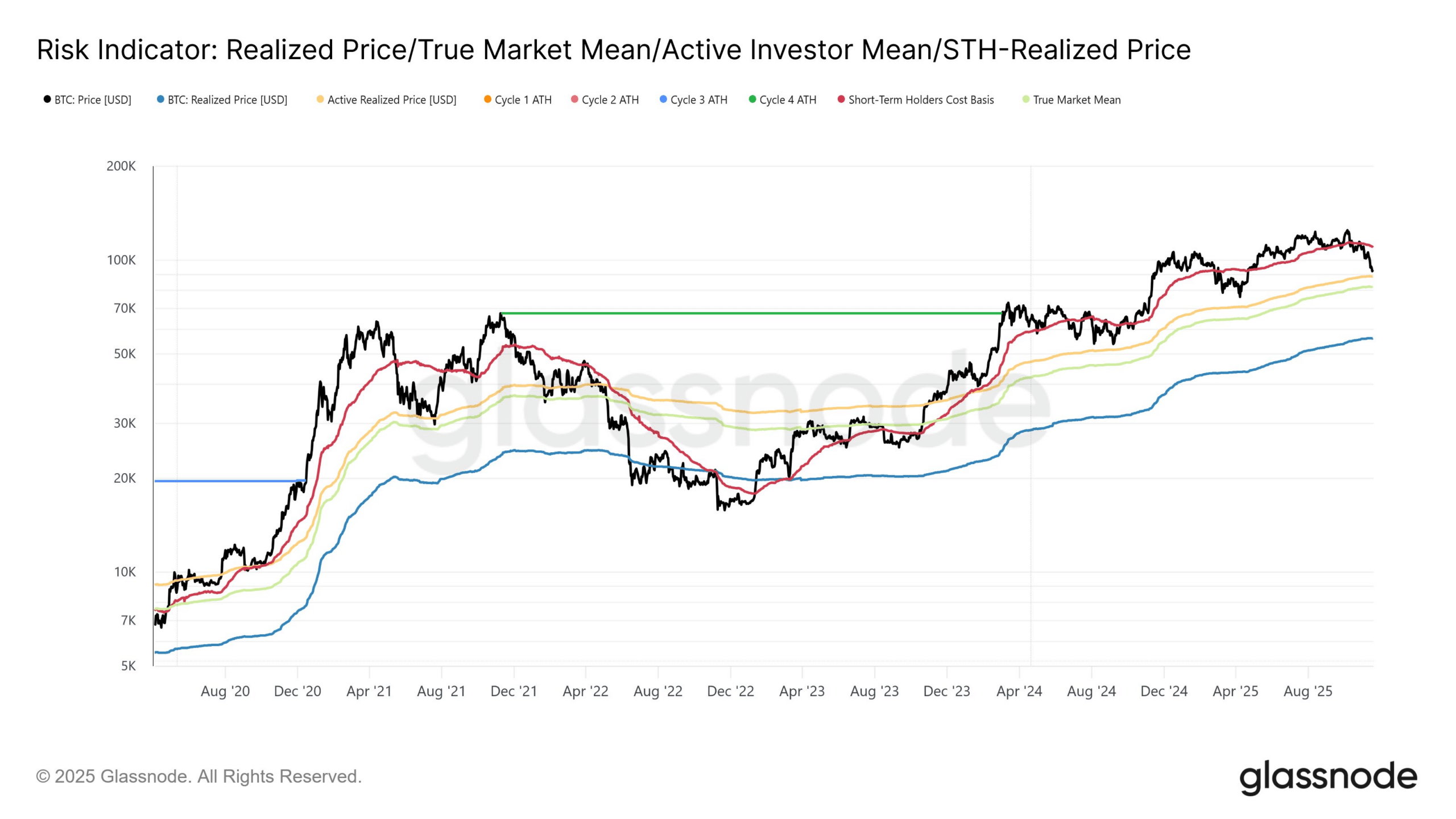

On-chain data from Glassnode shows short-term holder capitulation if prices break below $109K cost basis.

Bitcoin support level tested as BTC plunges below $90K. Whale distribution rises amid thinning profits. Discover on-chain insights and what it means for investors—stay informed on BTC’s next move today.

What is the current Bitcoin support level and why does it matter?

The Bitcoin support level currently stands at $82,000, a critical threshold derived from the True Market Mean on-chain metric. This level represents a fair value zone where buyers historically absorb selling pressure, and holding above it could prevent further downside. As Bitcoin has plunged nearly 30% from its $126,000 peak, breaching this support risks triggering widespread capitulation among both short-term and long-term holders, potentially echoing the 2022 bear market dynamics.

How is whale activity influencing Bitcoin’s price plunge?

Whale activity has intensified as Bitcoin plunges, with Santiment reporting over 102,900 transactions exceeding $100,000 and 29,000 surpassing $1 million this week—the most active period for large Bitcoin holders in 2025. Long-term holders, or Bitcoin OGs, are increasingly distributing their holdings, as evidenced by a notable whale transferring 2,499 BTC to an exchange like Kraken, according to on-chain trackers. The Long-Term Holder Market Value to Realized Value (LTH MVRV) ratio has fallen to 1.4 from a high of 3.4 in early October, indicating shrinking profitability cushions and logical profit-taking amid the decline. This distribution lacks counterbalancing bid-side support, prolonging the current indecision in the market. Expert analysis from on-chain platforms suggests that without renewed buying interest, the sell-side pressure could intensify, especially as short-term holders face similar stresses below their $109,000 cost basis.

Frequently Asked Questions

What happens if Bitcoin breaks below the $82,000 support level?

If Bitcoin breaks below the $82,000 support level, it could signal the first major bear trend since May 2022, leading to capitulation from short-term and long-term holders. On-chain metrics like the True Market Mean would confirm weakened fair value zones, potentially driving prices deeper into a prolonged downtrend as selling accelerates.

Why are Bitcoin whales distributing holdings now?

Bitcoin whales are distributing holdings due to thinning profit margins, with the LTH MVRV dropping sharply from recent highs. As prices fall below key cost bases, even veteran holders are securing gains, contributing to increased transaction volumes and market pressure during this volatile period.

Key Takeaways

- Critical Support at $82K: Bitcoin must hold this True Market Mean level to avert a full bear cycle, as failure could mirror 2022’s downturn.

- Record Whale Activity: Over 102,900 large transactions this week highlight distribution trends among long-term holders taking profits.

- On-Chain Stress Signals: Short-term holder capitulation looms below $109K, urging investors to monitor active participant cost bases closely.

Conclusion

As Bitcoin’s support level at $82,000 comes under intense scrutiny amid plunging prices and heightened whale distribution, on-chain metrics from sources like Glassnode and Santiment underscore the fragility of current market dynamics. Long-term holders’ thinning profitability, coupled with absent buyer support after four weeks of declines, heightens risks of further volatility. Investors should remain vigilant, tracking these indicators closely, as stabilizing above key zones could pave the way for recovery in the evolving cryptocurrency landscape.

Key Takeaways

What happens as Bitcoin plunges toward key support?

As Bitcoin plunges below its support level, holding above $82K is critical. Falling below this level could trigger capitulation from both STHs and LTHs.

Why is whale activity this week significant?

This week, whale moves are leaning more toward distribution, showing that even Bitcoin OGs are taking profits as Bitcoin plunges.

The spotlight is now on Bitcoin’s [BTC] buyer side.

The logic is simple: As BTC plunges further from its ATHs, holding support becomes crucial. With profits being squeezed and BTC sitting on a key cost basis, sell-side pressure is likely to build as weak hands shake out.

However, the lack of an immediate rebound is reinforcing buyer indecision.

Despite four consecutive weeks of declines, strong buying interest has yet to emerge.

With mounting pressure, data suggests that Bitcoin must hold its current level; otherwise, a repeat of the 2022 bear market could be looming.

Whale activity ramps up as Bitcoin plunges below support

Bitcoin OG whales aren’t dodging the downside this cycle.

On-chain, the Long-Term Holder (LTH) MVRV has dropped to nearly 1.4, at press time, from the early-October peak of 3.4, tracking closely with the broader market as Bitcoin plunges nearly 30% from its $126K all-time high.

Simply put, LTHs’ profitability cushion is thinning out fast.

Adding to this, Santiment flags this week as “the most active Bitcoin whale week of 2025.” So far, there have been over 102.9K whale transactions exceeding $100K and more than 29K transactions exceeding $1 million.

Source: Santiment

At the same time, as Bitcoin plunges below $90K with a 1.6% weekly dip, whale activity appears to be tilting toward distribution. Supporting this, Lookonchain flagged a BTC OG whale moving all 2,499 BTC into Kraken.

In short, with long-term holders seeing their profits shrink, selling BTC is becoming a logical play. As a result, even as Bitcoin plunges deeper into the red, bid-side support remains absent, keeping any rebound at a standstill.

That said, a confirmed bear phase isn’t here yet.

Notably, Glassnode data highlights a key support level that Bitcoin needs to hold to avoid triggering a full-blown downtrend. However, if bid-side support remains weak, could a deeper slide become inevitable?

On-chain metrics show where investors are getting hurt

Unsurprisingly, a STH shakeout is playing out as expected.

From an on-chain perspective, as Bitcoin plunges below the short-term holder (STH) cost basis of $109K, the STH NUPL is dropping into the capitulation zone, putting more pressure on BTC’s ability to HODL support.

At press time, Glassnode data revealed stress in two key on-chain metrics: the Active Investors Mean stood at $88.6K, while the True Market Mean was at $82K.

A break below would confirm the first major bear trend since May 2022.

Source: Glassnode

For context, these metrics represent Bitcoin’s “fair value” zones.

In other words, prices where buyers step in to absorb the selling pressure. The Active Investors Mean tracks the average cost basis of “active” participants, while the True Market Mean reflects the broader cost basis.

However, as Bitcoin plunges and bid-side support weakens, these zones are coming under pressure. If they fail, it could indicate capitulation from both STHs and LTHs, raising the risk of a deeper, prolonged bear cycle.

In short, holding above $82K is now more important than ever for Bitcoin.