Bitcoin Sharpe Ratio Hints at Potential New Bull Market

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin’s accumulation phase is intensifying after a downtrend from its $126,000 all-time high in October 2025, with the Sharpe Ratio indicating a potential new bull market. Exchange reserves have dropped to 2.7 million BTC, signaling reduced selling pressure and investor confidence in future gains.

-

Bitcoin Sharpe Ratio hits levels seen before the 2021 bull run, suggesting up to eight months of upside potential.

-

Wholecoiner inflows to major exchanges like Binance have fallen to yearly lows, reflecting decreased selling activity.

-

Net inflows reached $1.39 billion last week, the highest in nearly three weeks, driven by long-term holder accumulation.

Discover Bitcoin bull market signals as accumulation resumes amid easing selling pressure. Explore Sharpe Ratio insights and holder trends for 2025 recovery prospects. Stay informed on crypto shifts today.

Is a Bitcoin bull market coming?

The Bitcoin bull market appears to be on the horizon, as indicated by key on-chain metrics showing a shift from selling to accumulation. After Bitcoin’s price declined from its October 2025 all-time high of $126,000, recent data reveals easing pressure and renewed investor interest. This pattern mirrors historical setups that preceded significant rallies, potentially offering substantial upside if trends hold.

What does the Bitcoin Sharpe Ratio reveal about market trends?

The Bitcoin Sharpe Ratio, a measure of risk-adjusted returns, has climbed to levels that historically signaled the onset of bull markets, including the strong 2021 cycle. According to data from CryptoQuant, this metric currently positions Bitcoin outside high-risk zones, providing room for growth over the next eight months before potential overextension. Analysts note that such readings often correlate with sustained price appreciation, as investors weigh volatility against rewards. In the current environment, with macroeconomic factors like interest rate stability influencing crypto, this ratio underscores a favorable outlook for Bitcoin’s recovery. Supporting this, exchange reserves have declined to 2.7 million BTC, indicating that holders are withdrawing assets to secure wallets rather than preparing to sell. This behavior reduces available supply on trading platforms, which could amplify price movements if demand rises. Experts from on-chain analysis firms emphasize that maintaining this trajectory avoids the bearish phases typically triggered by elevated risk levels.

Source: CryptoQuant

While the potential for further downside exists if support levels break, current indicators point to stabilization. The ratio’s alignment with past bull cycles provides a data-driven foundation for optimism, though market participants should monitor broader economic cues.

Frequently Asked Questions

What are the signs of Bitcoin accumulation in 2025?

Signs of Bitcoin accumulation in 2025 include declining exchange reserves to 2.7 million BTC and reduced wholecoiner inflows to platforms like Binance, averaging 5,200 BTC weekly. These metrics show investors shifting holdings to private wallets, minimizing sell-off risks and building positions for potential rallies.

How are long-term Bitcoin holders influencing the current market?

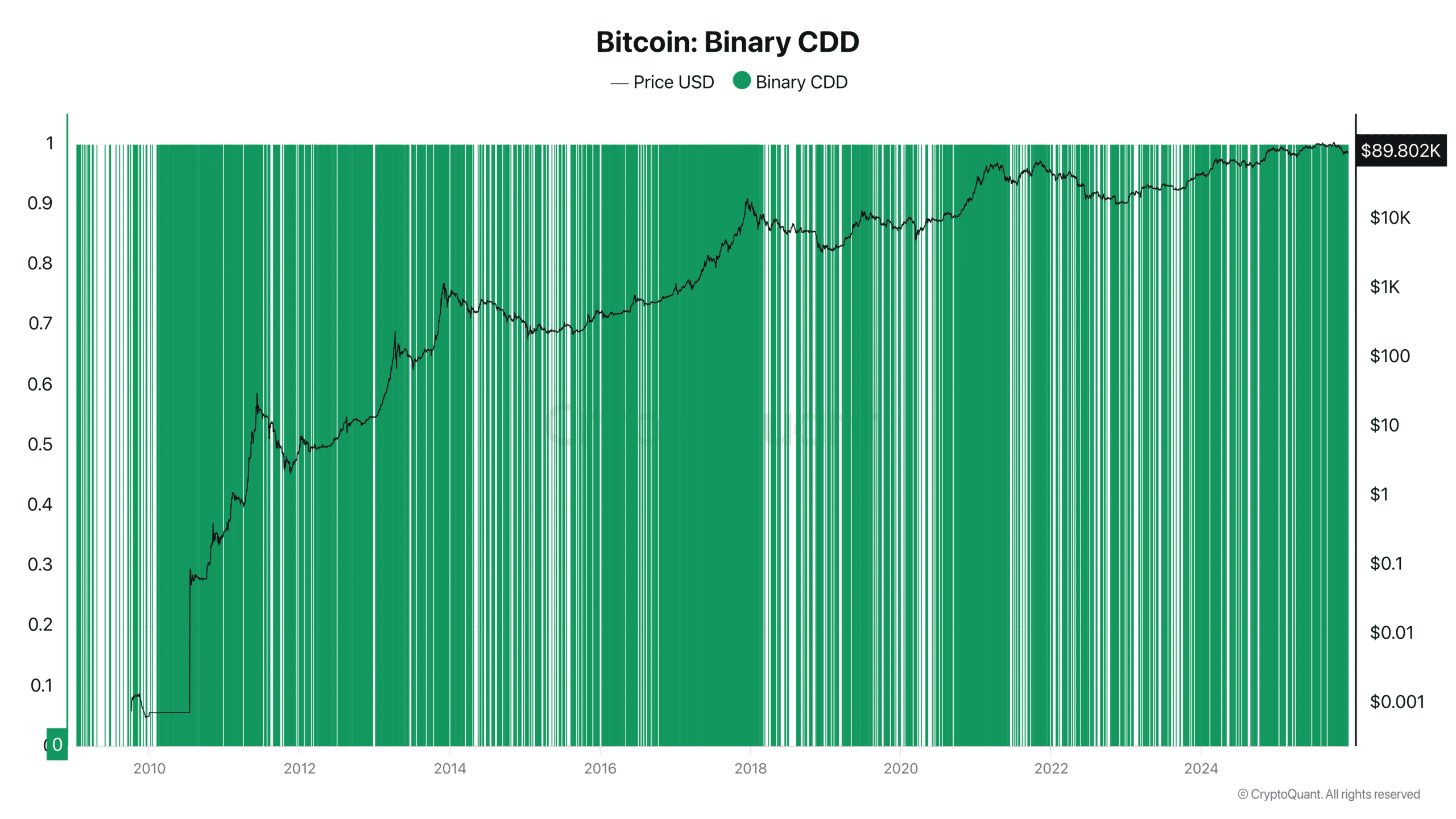

Long-term Bitcoin holders, who have retained assets for over 155 days, are not selling, as evidenced by the Binary Coin Days Destroyed metric at zero. This stability from experienced investors supports ongoing accumulation and helps maintain the market’s bullish structure amid recent volatility.

Key Takeaways

- Accumulation resumption: Bitcoin’s shift from downtrend to buying signals a possible eight-month rally, backed by favorable Sharpe Ratio readings.

- Reduced selling pressure: Exchange reserves at 2.7 million BTC and low wholecoiner activity indicate holders are securing assets off-platforms.

- Long-term holder confidence: With Coin Days Destroyed at zero, veteran investors are holding firm, fostering a stable foundation for recovery.

Source: CryptoQuant

Netflow metrics further bolster this view, with a $9.7 million net buy at the week’s start and $1.39 billion in total accumulation—the strongest in almost three weeks. These inflows highlight a bullish sentiment among traders, contrasting earlier rotations into stable assets.

What long-term investors are doing

Long-term Bitcoin holders play a pivotal role in market dynamics, often acting as a stabilizing force during volatile periods. Defined as those holding for more than 155 days, their inactivity in selling provides clarity on sustained confidence. Recent data shows minimal movement from this group, reinforcing accumulation narratives.

Source: CryptoQuant

The Binary Coin Days Destroyed (CDD) indicator, which tracks when old coins move, has dropped to zero. This absence of activity means long-term holders are not contributing to selling pressure, allowing the market’s rally potential to remain intact. On-chain analysts from firms like CryptoQuant observe that such low CDD levels typically precede periods of price appreciation, as they reflect unwavering commitment from foundational investors. Factors like diversified exchange usage may influence wholecoiner trends, but overall netflows confirm positive accumulation across the ecosystem.

Conclusion

In summary, the Bitcoin bull market signals are strengthening through metrics like the Sharpe Ratio and declining exchange reserves, while long-term holder behavior underscores reduced risks. With accumulation trends pointing to a potential eight-month upside window, investors may find opportunities in this evolving landscape. As 2025 progresses, monitoring these indicators will be essential for navigating crypto’s next phase—consider positioning accordingly for emerging rallies.