Bitcoin Short Seller Amasses $24M Unrealized Profits on Hyperliquid After Six Months

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

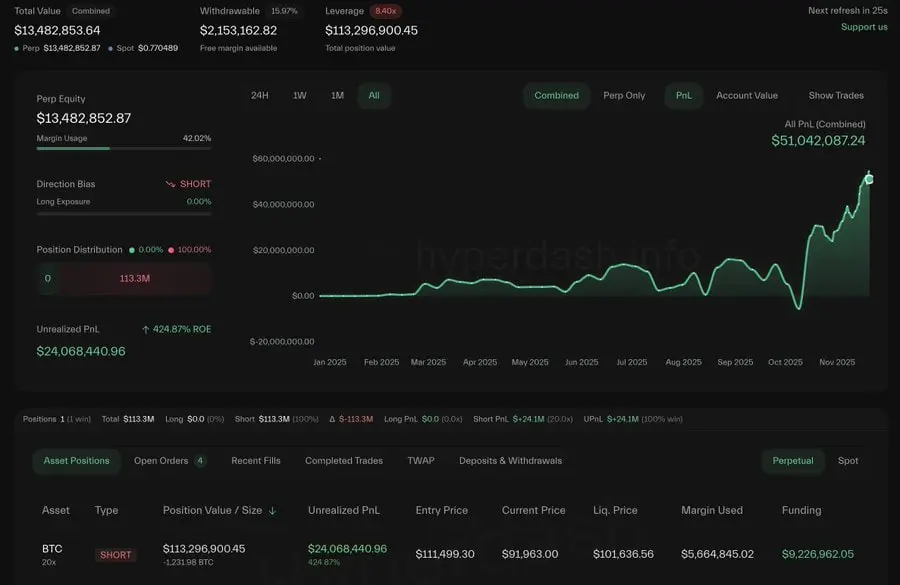

A persistent Bitcoin short seller identified as 0x5D2F has amassed over $24 million in unrealized profits from a leveraged short position on Bitcoin held for more than six months, according to on-chain data. The trader’s 1,232 BTC short, valued at around $113.27 million with 20x leverage, entered at $111,499.30 and benefits from current prices near $91,509.

-

The trader has earned $9.2 million in funding fees alongside unrealized gains, highlighting the rewards of long-term short strategies in volatile markets.

-

On-chain analytics reveal limit orders set for profit-taking between $88,900 and $91,400, signaling a calculated approach rather than impulsive trading.

-

Bitcoin’s 11% decline over the past seven days has boosted the position’s value, but a potential reversal could trigger liquidation at $101,641.11, per tracked data.

Discover how a Bitcoin short seller turned a high-risk bet into $24M unrealized profits on Hyperliquid. Explore on-chain insights and market implications for crypto traders today.

What is the Bitcoin Short Seller’s Position and Strategy?

Bitcoin short seller 0x5D2F maintains a substantial 1,232 BTC short position valued at approximately $113.27 million, entered over six months ago when Bitcoin traded at $111,499.30. This 20x leveraged trade on Hyperliquid’s perpetual market has yielded over $24 million in unrealized profits as Bitcoin’s price dipped to $91,509. The strategy includes preset limit orders for taking profits in the $88,900 to $91,400 range, demonstrating a disciplined, long-term bearish outlook amid market fluctuations.

Short trader address (0x5D2F) trading activities. Source: Lookonchain

Short trader address (0x5D2F) trading activities. Source: LookonchainThis position not only reflects confidence in Bitcoin’s downward trajectory but also capitalizes on funding rate mechanisms, where short sellers receive payments from long positions in perpetual futures. As of the latest on-chain observations, the trader has accumulated an additional $9.2 million in such fees, underscoring the financial incentives of sustained short exposure in a leveraged environment.

The broader context of this trade aligns with recent Bitcoin price action, which has seen an 11% drop over the last seven days. Despite recoveries to $91,801, the unrealized gains remain substantial, positioning this as one of the largest tracked shorts on Hyperliquid. On-chain data from platforms like Lookonchain provide transparency into these activities, allowing market participants to monitor high-stakes positions in real time.

How Does Hyperliquid’s Transparent Model Affect Whale Trading?

Hyperliquid’s fully on-chain and transparent ledger model offers unparalleled visibility into user positions, enabling traders to track major bets like this Bitcoin short seller’s strategy. This setup democratizes access to whale activity, as anyone can observe leverage levels, entry points, and potential liquidation thresholds without proprietary tools.

Supporting data from Hypurrscan and similar analytics show that such transparency has influenced market dynamics. For instance, a previous whale with a $449 million 40x leveraged short position faced coordinated long entries aimed at triggering liquidation, ultimately leading to the account’s closure with a near-zero balance. That case held $2.7 million in unrealized profits and a liquidation price of $86,088, illustrating the risks amplified by public visibility.

Jeffrey Yan, co-founder of Hyperliquid, has emphasized this model’s benefits, stating it creates a “democratized venue for whale watching,” where on-chain users can anticipate high-leverage events. Experts note that while this fosters strategic trading, it also heightens volatility, as seen in minor rallies triggered by attempts to liquidate exposed shorts. In the current ecosystem, Bitcoin’s recovery from $88,000 to $91,801—up 0.28%—and Ethereum’s climb from $2,800 to $3,027 exemplify how these positions interplay with broader sentiment.

Liquidated address of the 40x leveraged whale. Source: Hypurrscan

Liquidated address of the 40x leveraged whale. Source: HypurrscanAnalysts from on-chain tracking services highlight that Hyperliquid’s design encourages informed decision-making but demands caution. The platform’s native token, HYPE, has bucked recent bearish trends, rising 7.33% monthly and 2.92% in the last 24 hours to $39.26. This resilience points to growing adoption of transparent DeFi protocols amid crypto’s evolving landscape, where short sellers like 0x5D2F leverage data for edge.

Delving deeper, the mechanics of funding fees in perpetual markets reward persistent shorts during contango phases, where longs pay shorts to balance the order book. For 0x5D2F, these payments have compounded returns, turning a high-risk position into a profitable venture. However, the 20x leverage amplifies downside: a Bitcoin rebound above $101,641.11 could force liquidation, potentially injecting $113.27 million back into the market and sparking volatility.

Historical parallels, drawn from reports on similar trades, reinforce the strategy’s viability. Whales have navigated social media-driven liquidations by timing exits, preserving gains before reversals. This underscores the blend of technical analysis and on-chain vigilance essential for success in leveraged Bitcoin short positions.

Frequently Asked Questions

What are the risks of a 20x leveraged Bitcoin short position?

A 20x leveraged Bitcoin short position amplifies both profits and losses, with liquidation occurring if prices rise to the threshold, such as $101,641.11 for this trade. On-chain data shows that market reversals can trigger forced closures, wiping out gains and incurring fees, as evidenced by past whale liquidations on Hyperliquid holding positions over $400 million.

How do funding fees benefit Bitcoin short sellers on platforms like Hyperliquid?

Funding fees on Hyperliquid allow Bitcoin short sellers to earn periodic payments from long positions when the market favors shorts, as in bearish phases. For this whale, these fees have added $9.2 million to unrealized profits over six months, providing passive income that sustains the position through price swings and enhances overall returns.

Key Takeaways

- Long-term short strategies yield significant rewards: Holding a Bitcoin short for over six months has netted $24 million in unrealized profits plus $9.2 million in fees for trader 0x5D2F.

- Transparency drives market interactions: Hyperliquid’s on-chain model exposes whale positions, enabling real-time monitoring but also inviting liquidation hunts, as seen in a prior $449 million short case.

- Risk management is crucial: Set limit orders and awareness of liquidation levels, like $101,641.11 here, help traders navigate volatility—consider diversifying to mitigate reversal impacts.

Conclusion

The saga of this Bitcoin short seller on Hyperliquid exemplifies how on-chain transparency and leveraged trading can generate substantial returns amid market dips, with over $24 million in unrealized profits from a six-month position. As Ethereum and HYPE tokens show recovery signs, the crypto ecosystem continues to reward strategic bearish plays. Traders should monitor these developments closely for insights into future volatility, and explore similar platforms to refine their own short position tactics.