Bitcoin Short-Term Capitulation May Signal Potential Market Bottom as Volatility Rises

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin capitulation among short-term holders has reached its highest level since the FTX crash, with recent data showing significant realized losses as prices dipped below $92,000. This selling pressure from newer investors could indicate a local market bottom, potentially paving the way for recovery in the volatile crypto landscape.

-

Short-term BTC holders drove the largest capitulations in 2025, absorbing unrealized losses amid price drops to the $80,000 range.

-

Long-term holders remain resilient, with limited losses and an average realized price at a record $54,622, highlighting market maturity.

-

Volatility has spiked to 2.49%, nearing a one-year high, as miner pressures and fearful sentiment add to short-term uncertainty, per Glassnode metrics.

Explore Bitcoin capitulation trends in 2025: Short-term holders face massive losses amid volatility spikes. Discover signals of a potential market bottom and key takeaways for investors. Stay informed on BTC’s resilient recovery path.

What is Bitcoin Capitulation and Why Does It Matter in 2025?

Bitcoin capitulation refers to the mass selling by investors, often short-term holders, who exit positions at a loss during sharp price declines, leading to realized losses across the market. In 2025, this phenomenon has intensified, with the biggest wave since the FTX collapse, as BTC prices fluctuated from highs near $94,000 to lows under $85,000. This capitulation, driven by newer wallets absorbing previously unrealized losses, signals exhaustion in selling pressure and could mark a turning point for bullish momentum.

How Are Short-Term BTC Holders Contributing to Recent Market Capitulation?

Short-term Bitcoin holders, defined as those acquiring BTC within the past few months, have been the primary drivers of the recent capitulation wave. According to Glassnode data, these wallets recorded the largest realized losses since 2022, with cohorts from late 2025 facing substantial hits during the dip to the $80,000 range. This contrasts with long-term holders, who accumulated at lower prices and showed minimal losses, maintaining an average realized price of $54,622—an all-time high that underscores their steadfast approach. Expert analysis from on-chain metrics firm Newhedge indicates that while whales distributed older holdings near peaks earlier in the year, it was these short-term buyers who capitulated under pressure, selling to cut losses without major liquidity disruptions like those in past crashes.

The current market drawdown echoes the FTX aftermath but lacks the systemic failures of big players, pointing to a more isolated retail-driven event. In September 2025, short-term holders initially held firm through unrealized losses, but accelerating price slides forced capitulation at lower levels. Notably, not all such holders sold at a net loss; the average short-term holder realized price stands above $104,000, suggesting a mix of strategic traders still positioning for gains. This dynamic reveals a maturing market where short-term volatility tests newer entrants, while veterans weather the storm.

Frequently Asked Questions

What Causes Bitcoin Capitulation Among Short-Term Holders?

Bitcoin capitulation among short-term holders is typically triggered by rapid price drops that turn unrealized gains into losses, prompting panic selling to minimize further damage. In 2025, factors like heightened volatility and de-leveraging events have amplified this, with Glassnode reporting peaks in realized losses during dips below $85,000, as these investors, often retail-driven, lack the long-term conviction of established holders.

Is Bitcoin Volatility Signaling a Market Bottom in 2025?

Yes, the recent spike in Bitcoin volatility to 2.49%—its highest in nearly a year—often aligns with local bottoms, as historical patterns show recovery following such turbulent periods. With the fear and greed index at 28, indicating widespread caution, and miner hash ribbons flashing distress signals, this volatility serves as a reminder of BTC’s unpredictable nature, though it frequently precedes upturns as selling exhausts.

Key Takeaways

- Short-Term Capitulation Peaks: The largest BTC realized losses since FTX highlight short-term holders’ role in absorbing market pressure, potentially clearing the path for stabilization.

- Long-Term Resilience: Holders with lower acquisition costs maintain minimal losses, with an average realized price at $54,622, demonstrating the benefits of patience in volatile cycles.

- Volatility as Opportunity: Rising to 2.49% near one-year highs, BTC’s turbulence, coupled with miner challenges, often coincides with bottoms—investors should monitor for recovery signals.

Conclusion

In summary, the 2025 Bitcoin capitulation led by short-term holders marks a critical phase of market cleansing, with realized losses echoing past downturns but supported by robust long-term holding and controlled volatility. As BTC navigates fearful sentiment and miner pressures, these events reinforce the asset’s maturity. Investors should view this as a potential bottoming signal, staying vigilant for renewed momentum and positioning accordingly for the next upward cycle.

BTC Short-Term Capitulation May Signal a Market Bottom

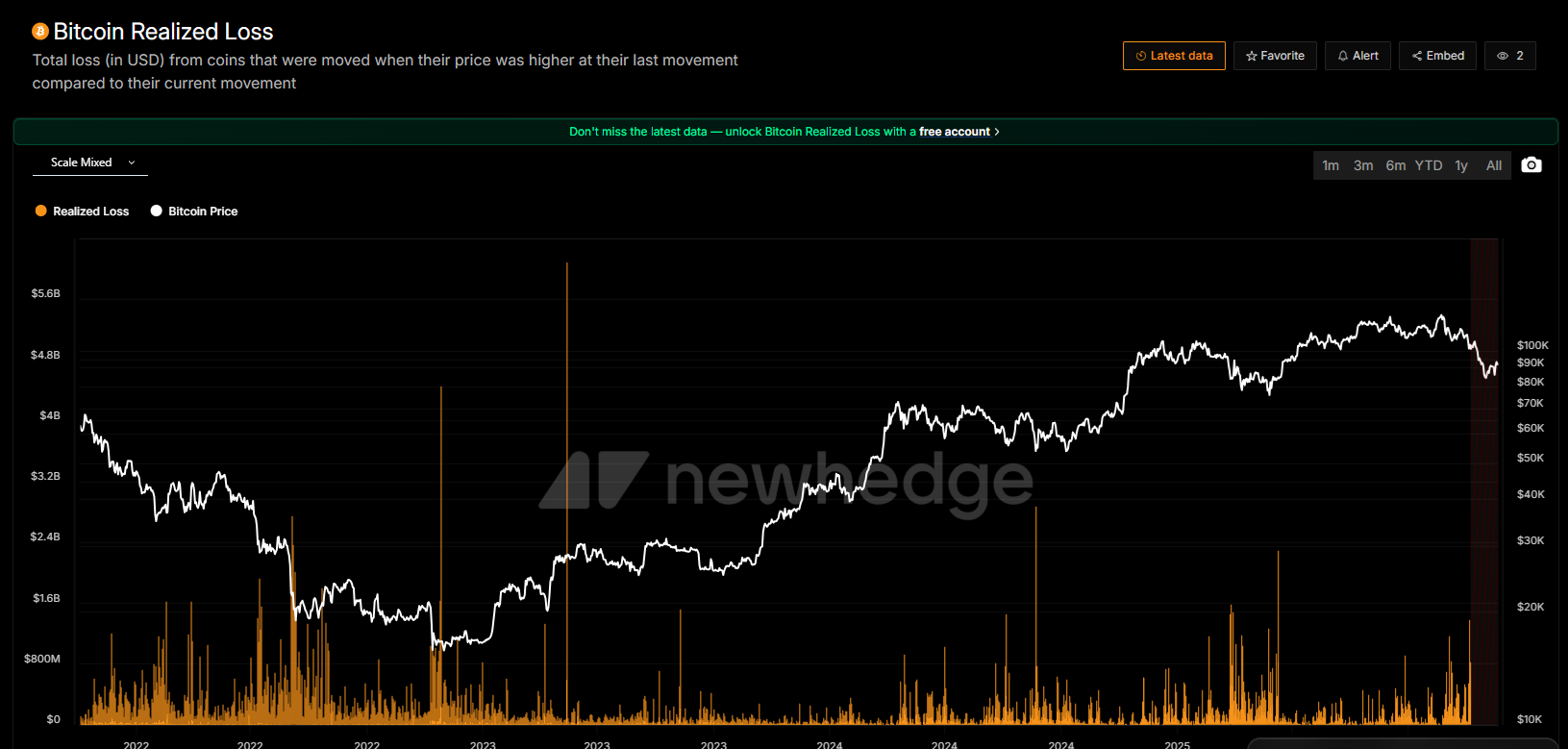

Bitcoin has recently oscillated between a local high of $94,000 and a drop below $92,000, exhibiting shaky short-term momentum despite signs of recovery. This capitulation, particularly from short-term holders, is interpreted by analysts as an indicator of a local bottom, similar to the August 2025 event where massive realized losses preceded an upturn. During the slide from October peaks, selling intensified only at lows under $85,000, with retail investors capitulating while whales had already offloaded near highs. The figure below illustrates this trend, showing BTC entering a phase of elevated realized losses, historically linked to price bottoms followed by rebounds, according to on-chain data from Newhedge.

BTC entered another period of rising realized losses. Historically, capitulations are linked to local price bottoms, often followed by a recovery. | Source: Newhedge

BTC entered another period of rising realized losses. Historically, capitulations are linked to local price bottoms, often followed by a recovery. | Source: NewhedgeShort-term holders’ average position shows a slight net gain, with realized prices over $104,000, indicating that not all sales were desperate; some represent tactical moves by active traders. This selective capitulation helps flush out weak hands, potentially strengthening the market foundation.

Bitcoin Volatility Increases Close to One-Year Peak

Bitcoin’s volatility has surged to 2.49%, approaching the highest levels in the past 12 months and signaling entry into a more unpredictable trading environment. Throughout much of 2025, BTC volatility hovered below 2%, reflecting a more stable, mature phase, but recent de-leveraging has reignited panic waves. The fear and greed index at 28 underscores this cautious mood, with additional pressures from miners operating under distress—the first such instance since August.

The hash ribbon indicator, a reliable on-chain metric, has activated after months of profitable mining, historically aligning with local market bottoms or heightened volatility periods. Glassnode insights suggest this combination could lead to further short-term turbulence, but it also presents opportunities for accumulation by resilient investors. As BTC trades amid these factors, the market’s response will determine whether this volatility catalyzes a broader recovery or prolongs uncertainty.

Comments

Other Articles

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Bitwise’s Bitcoin-Topped Crypto Index Fund Shifts to NYSE Arca Amid Institutional Inflows

December 9, 2025 at 06:27 PM UTC

Dogecoin ETFs Hit Lowest Trading Volume Since Launch, Hinting at Fading Interest

December 9, 2025 at 12:54 PM UTC