Bitcoin Short-Term Traders Endure Peak Losses as ETFs Show Modest Inflows Amid 2026 Optimism

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Bitcoin traders are facing the highest unrealized losses of this cycle, with short-term holders underwater by 20-25% for over two weeks. Analysts note that spot Bitcoin ETFs contributed only up to 3% of recent selling pressure, signaling limited impact from institutional outflows amid broader market dynamics.

-

Short-term Bitcoin holders endure 20-25% unrealized losses, the steepest in the current bull cycle.

-

CryptoQuant data highlights capitulation among traders holding BTC for one to three months, potentially creating accumulation opportunities.

-

Bitcoin ETFs saw $58 million in net inflows on Tuesday, recovering from November’s $3.48 billion outflows, per Farside Investors.

Discover how Bitcoin unrealized losses are pressuring traders in 2025, yet ETFs play a minor role in selling. Explore recovery signs and expert insights for smarter crypto investing today.

What Are Bitcoin Unrealized Losses and Their Impact on Traders?

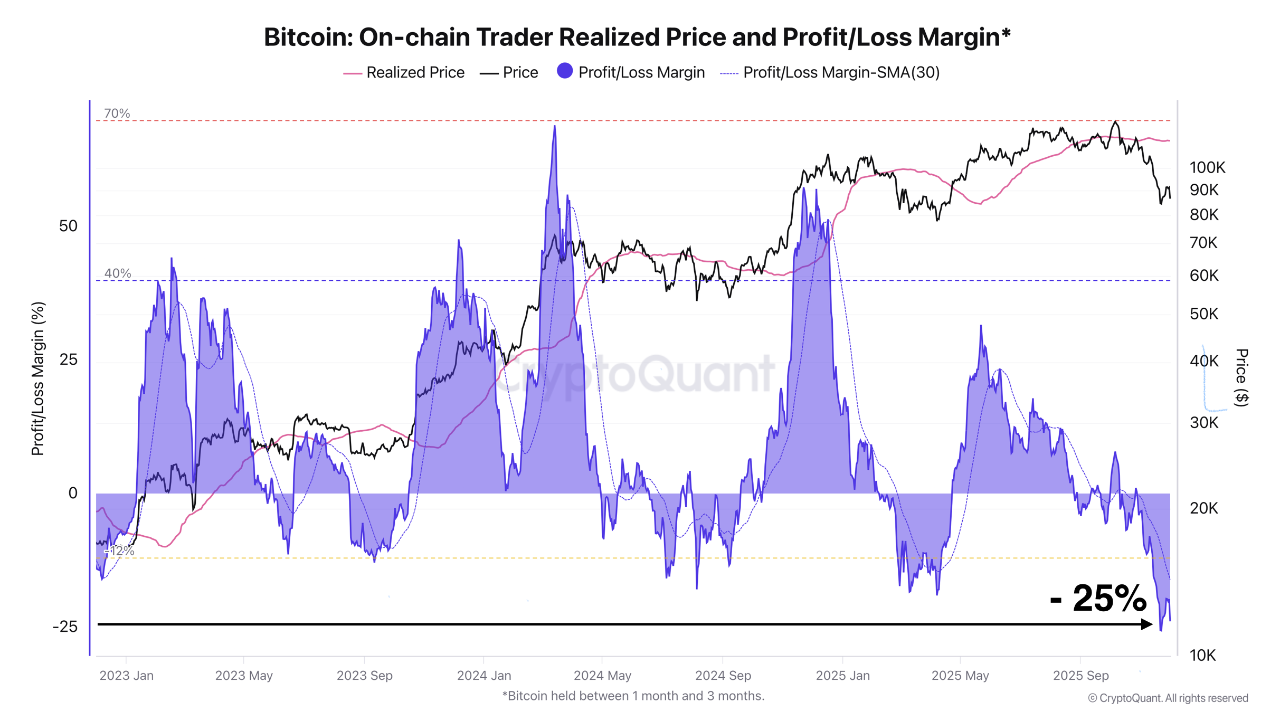

Bitcoin unrealized losses refer to the paper declines in value for holdings that have not yet been sold, affecting short-term traders the most during market corrections. In the current cycle, these losses have reached 20% to 25% for holders of one to three months, persisting for over two weeks and marking the highest pain threshold observed so far. According to analyst Darkfrost from CryptoQuant, this level of distress often precedes capitulation, which can signal prime accumulation opportunities as the market stabilizes.

Bitcoin onchain trader realized price and profit/loss margin. Source: CryptoQuant

These unrealized losses stem from Bitcoin’s price dipping below key support levels, forcing traders to confront potential further declines. Short-term holders, who entered positions recently, are particularly vulnerable as they lack the long-term perspective that cushions more established investors. Darkfrost emphasized in his analysis that recovery for this group requires Bitcoin to surpass its realized price of approximately $113,692, a threshold that could restore confidence and encourage holding rather than selling.

Broader market sentiment remains mixed, with some traders locking in losses to mitigate risks, while others view the downturn as a temporary correction in an ongoing bull market. Historical patterns suggest that such periods of high unrealized losses often coincide with bottoms, paving the way for rebounds. For instance, similar capitulation events in past cycles have led to significant price recoveries, underscoring the cyclical nature of cryptocurrency markets.

Financial institutions like Grayscale continue to express optimism. In a recent statement, Grayscale indicated that Bitcoin’s current drawdown suggests a local bottom, potentially leading to a robust recovery in 2026. This perspective challenges traditional four-year cycle theories, proposing instead a more fluid trajectory influenced by institutional adoption and macroeconomic factors. Such views from established players help temper the immediate pressure felt by retail and short-term traders.

The psychological toll of unrealized losses cannot be understated. Traders monitoring their portfolios daily face heightened stress, which can lead to impulsive decisions. Educational resources from platforms like CryptoQuant stress the importance of risk management strategies, such as dollar-cost averaging, to navigate these phases without panic selling.

How Much Did Bitcoin ETF Selling Pressure Contribute to the Recent Decline?

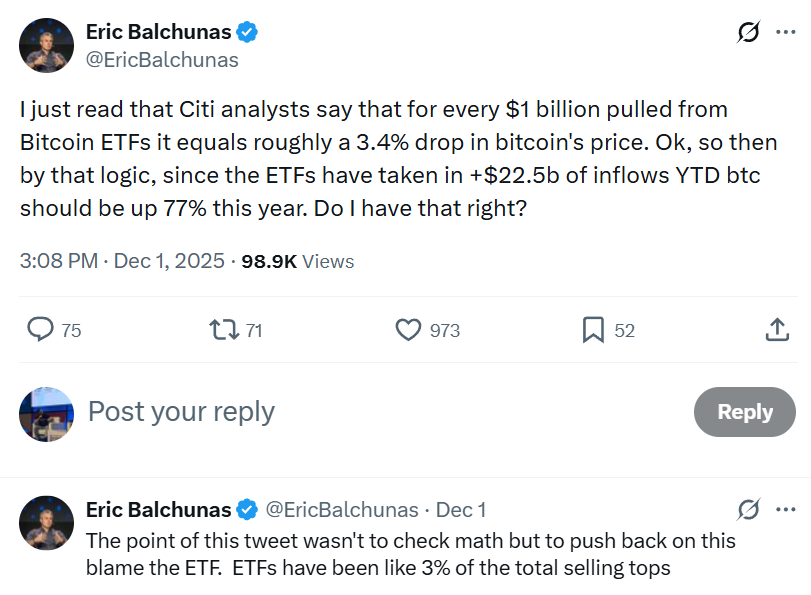

Spot Bitcoin exchange-traded funds (ETFs) have been scrutinized for their role in recent price pressures, but data reveals they accounted for only a minor fraction of the selling activity. Bloomberg ETF analyst Eric Balchunas noted that ETFs represented about 3% of total selling tops, far less than initial concerns suggested. He pointed out that with $22.5 billion in year-to-date inflows, the logic of equating ETF outflows directly to price drops—like Citi analysts’ estimate of a 3.4% decline per $1 billion pulled—does not fully explain Bitcoin’s performance.

Source: Eric Balchunas

This limited impact highlights that broader market forces, such as macroeconomic uncertainties and retail trader behavior, drive most of the volatility. Balchunas’s observation aligns with on-chain metrics showing that ETF flows, while significant, are dwarfed by overall trading volumes in the crypto ecosystem. For context, November marked the second-worst month for Bitcoin ETFs with $3.48 billion in cumulative outflows, yet the funds have since rebounded with five consecutive days of positive inflows.

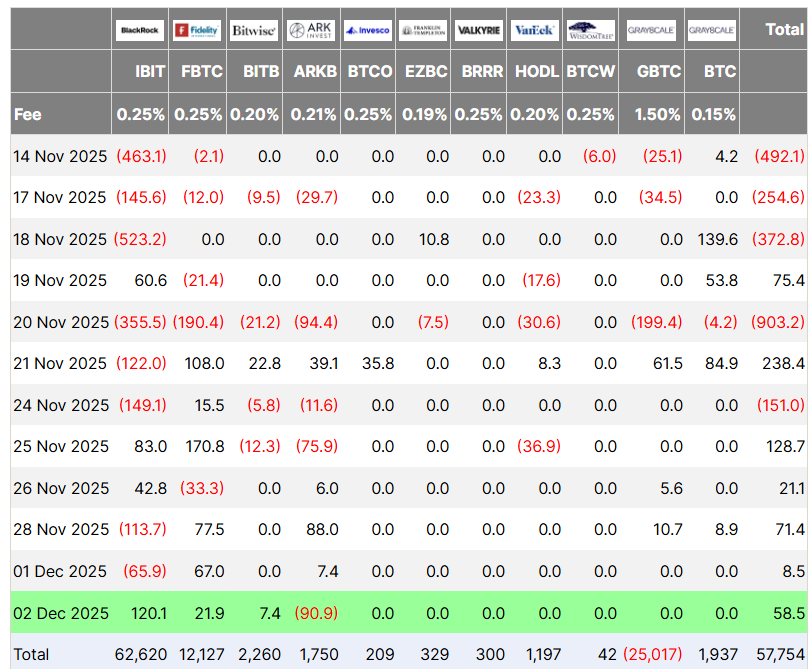

On Tuesday, Bitcoin ETFs recorded $58 million in net positive inflows, according to data from Farside Investors. This uptick comes as Bitcoin’s price edges above the $89,600 flow-weighted cost basis for ETF investors, allowing average holders to break even on paper. Such developments indicate growing institutional confidence, potentially stabilizing prices and reducing the selling pressure on short-term traders.

In comparison, other U.S. crypto funds showed varied performance. Spot Ether ETFs experienced $9.9 million in outflows, while Solana ETFs saw $13.5 million in net negative flows on the same day, per Farside Investors. These figures underscore the diverse dynamics within the ETF landscape, where Bitcoin remains the focal point due to its market dominance.

Experts like Balchunas emphasize that while ETF inflows have been a net positive for Bitcoin’s adoption, their outflows do not warrant panic. Institutional investors, with longer horizons, are less prone to knee-jerk reactions compared to retail participants. This resilience is evident in projections from firms like Grayscale, which foresee Bitcoin’s integration into traditional portfolios accelerating despite short-term hurdles.

Regulatory clarity and increasing acceptance by major financial entities further bolster the case for ETFs as a stabilizing force rather than a primary driver of declines. Analysts from CryptoQuant and Farside Investors provide granular data supporting this, showing that ETF activity correlates more with accumulation phases than capitulation events.

Frequently Asked Questions

What Causes High Unrealized Losses for Short-Term Bitcoin Traders?

High unrealized losses for short-term Bitcoin traders, typically those holding for one to three months, arise from price corrections that drop below entry points, leading to 20-25% deficits as seen in recent weeks. Factors include market-wide sell-offs triggered by macroeconomic news and profit-taking by long-term holders, per CryptoQuant analysis.

Are Bitcoin ETFs a Major Source of Selling Pressure in 2025?

Bitcoin ETFs have contributed minimally to selling pressure this year, making up just 3% of total sales according to Bloomberg’s Eric Balchunas. With net inflows dominating year-to-date and recent positive flows of $58 million, these funds support price stability rather than driving declines, as confirmed by Farside Investors data.

Key Takeaways

- Capitulation Opportunity: High unrealized losses among short-term traders signal potential bottoms, offering accumulation chances once selling exhausts, as noted by CryptoQuant’s Darkfrost.

- Limited ETF Impact: ETFs accounted for only 3% of selling pressure, with $22.5 billion in YTD inflows underscoring their role in long-term growth over short-term volatility.

- Recovery Signals: Positive ETF inflows and Bitcoin trading above key cost bases point to stabilization, encouraging investors to focus on 2026 upside potential.

Bitcoin ETF Flow USD, million. Source: Farside Investors

Conclusion

Bitcoin unrealized losses continue to challenge short-term traders in this cycle, with cohorts facing 20-25% deficits amid ongoing corrections, yet the resilience of spot Bitcoin ETFs—contributing just 3% to selling pressure—highlights broader market strength. As inflows resume and institutional optimism from sources like Grayscale builds, 2026 holds promise for recovery and growth. Investors should prioritize informed strategies, monitoring on-chain data from CryptoQuant and flow metrics from Farside Investors, to navigate volatility and capitalize on emerging opportunities in the evolving crypto landscape.