Bitcoin Slips Below $90K Amid Signs of Meme Coin Mania Fading

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

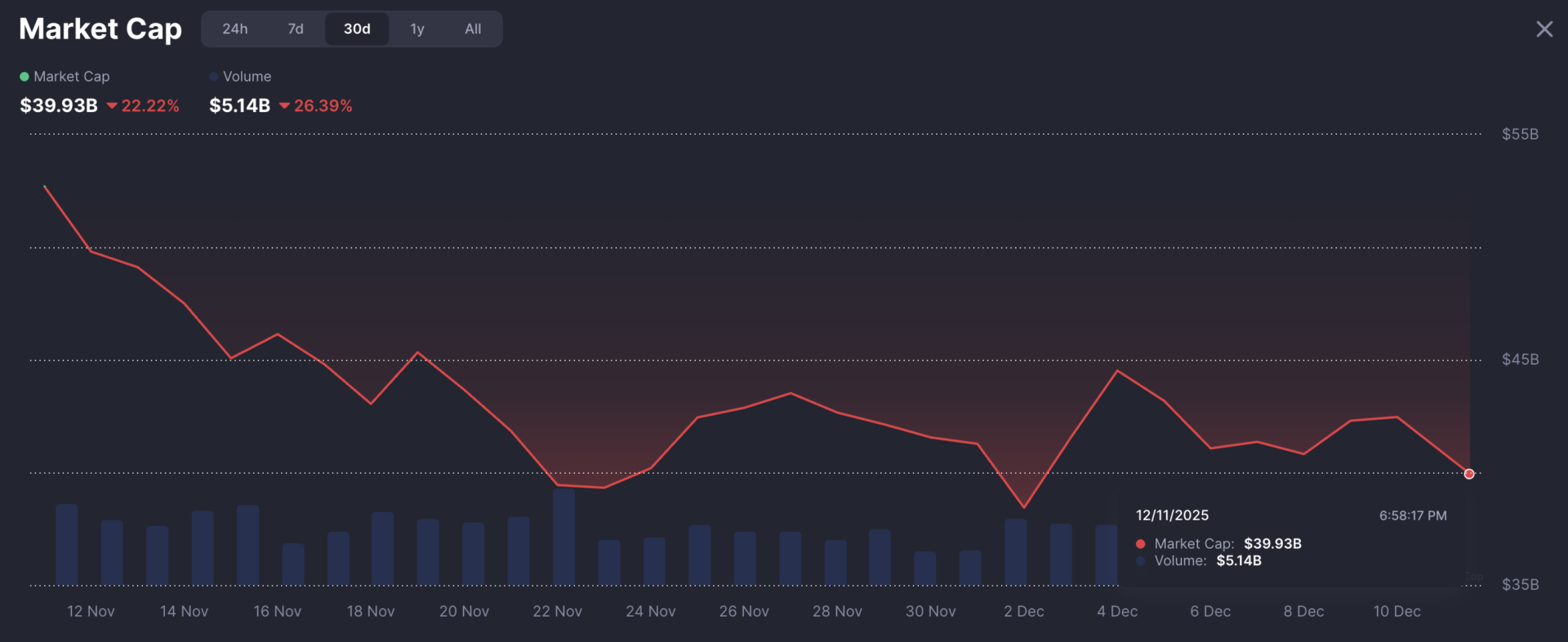

The meme coin mania of 2025 is fading as market enthusiasm wanes, with the sector’s capitalization dropping 22% to around $40 billion amid declining trading volumes and investor fatigue. Bitcoin’s slip below $90,000 has amplified broader crypto market jitters, pushing the total capitalization down 3% to $3.07 trillion.

-

Meme coin trading volume falls 27% to $5.15 billion, signaling reduced speculation.

-

Pump.fun platform activity returns to early levels after launching millions of tokens.

-

Prominent tokens like OFFICIAL TRUMP lose 92% from peaks, now trading at $5.64 with a $1.2 billion market cap.

Discover how the 2025 meme coin mania is burning out with a 22% market crash. Explore key factors and expert insights on crypto’s shifting trends. Stay informed and adjust your strategy today.

What Is Driving the End of Meme Coin Mania in 2025?

Meme coin mania in 2025 has reached its peak and begun to subside, driven by oversaturation, investor losses, and a return to more fundamental crypto investments. The sector, once fueled by hype around joke tokens on platforms like Pump.fun, now faces a 22% decline in market capitalization over the past month, totaling around $40 billion. This shift coincides with Bitcoin’s retreat below $90,000, contributing to a 3% drop in the overall crypto market to $3.07 trillion, as measured by the Fear and Greed Index signaling widespread caution among investors.

The frenzy began with an explosion of meme coins, peaking with tens of millions of tokens launched throughout the year. However, sustained trading volumes have evaporated, dropping 27% to $5.15 billion in the last 30 days. Established names like Dogecoin and Shiba Inu reflect this trend, with year-to-date losses of 57% and 61%, respectively. Dogecoin trades at $0.138, while Shiba Inu lingers 90% below its all-time high. These developments underscore a broader exhaustion in the speculative bubble that defined much of the year’s crypto narrative.

Market participants are increasingly recognizing the lack of underlying value in most meme coins, leading to heavy sell-offs. The political-themed tokens, such as OFFICIAL TRUMP, have been particularly volatile, plummeting 92% from its $8.8 billion high to a current valuation under $1.2 billion. Efforts to pivot these assets, like repurposing OFFICIAL TRUMP into a “Billionaires Club” mobile game, highlight the desperation to maintain relevance amid fading interest.

How Has the Meme Coin Market Evolved in 2025?

The meme coin market in 2025 evolved from explosive growth to rapid contraction, with over 13 million tokens issued this year alone, according to a16z crypto’s 2025 State of Crypto report. This surge was enabled by easy launch platforms like Pump.fun, which flooded the ecosystem with joke-based assets lacking any real utility. Trading activity on such platforms has reverted to post-launch lows, indicating a loss of momentum.

Supporting data from CoinMarketCap shows the cumulative meme coin market cap at approximately $40 billion, a sharp 22% decline from 30 days prior. Volumes mirror this downturn, falling 27% to $5.15 billion. Expert Mikko Ohtamaa, a blockchain analyst, notes, “There was never a real investment case behind these tokens; people bought them hoping someone else would buy higher.” This speculative nature, devoid of fundamentals, has left many holders with significant losses, accelerating the sector’s cooldown.

Even veteran meme coins are struggling. Dogecoin, celebrating its 12th anniversary, remains in a prolonged consolidation phase, down 57% year-to-date at $0.138. Shiba Inu fares worse, trading 90% below its peak after a 61% YTD drop. The political-meme niche, including tokens like LIBRA (Milei) and OFFICIAL TRUMP, exemplifies the risks: bought on hype rather than policy merits, these assets have seen promoters scramble for survival strategies. Ohtamaa adds, “Calling it ‘investing’ stretches the definition; no one analyzed policies before purchasing.”

Broader market dynamics exacerbate the fade. Bitcoin’s dip below $90,000 has eroded risk appetite across crypto categories, with the total market cap at $3.07 trillion after a 3% 24-hour decline. The Fear and Greed Index remains in “Fear” territory, reflecting investor wariness with no immediate recovery in sight. This environment has shifted focus away from high-volatility memes toward more stable assets.

Regulatory discussions, as outlined in a16z’s report, point to the U.S. absence of formal digital-asset rules as a catalyst for this unchecked proliferation. The firm advocates for the Digital Asset Market Clarity Act to provide structure, protecting consumers and fostering legitimate innovation. While meme culture persists online, its financial translation into tokens appears to be waning, with the supply of eager speculators drying up after repeated losses.

Meme coin market cap. Source: CoinMarketCap

Meme coin market cap. Source: CoinMarketCapAnalysts observe that the 2025 meme coin wildfire, once raging uncontrollably, has exhausted its fuel. The crowd’s attention has moved on, leaving behind a landscape of diminished valuations and lessons in speculation’s perils. This evolution suggests a maturing crypto market, prioritizing sustainability over fleeting hype.

Frequently Asked Questions

What Caused the 22% Crash in Meme Coin Market Cap During 2025?

The 22% crash in meme coin market capitalization to $40 billion in 2025 stems from oversaturation, with over 13 million tokens launched via platforms like Pump.fun. Investor fatigue followed heavy losses, compounded by a 27% drop in trading volume to $5.15 billion and broader market downturns as Bitcoin fell below $90,000.

Is the Meme Coin Mania in 2025 Completely Over?

While the peak of meme coin mania in 2025 has passed, with volumes and caps declining sharply, the sector isn’t entirely extinct. Internet culture will continue spawning memes, but financial speculation has cooled due to repeated losses and regulatory calls for clarity, as noted in a16z crypto’s report.

Key Takeaways

- Meme Coin Oversupply: Over 13 million tokens issued in 2025 led to market exhaustion, with Pump.fun activity dropping to early levels.

- Investor Losses Dominate: Tokens like OFFICIAL TRUMP lost 92% from highs, trading at $5.64, while Dogecoin and Shiba Inu fell 57% and 61% year-to-date.

- Regulatory Path Forward: Experts urge acts like the Digital Asset Market Clarity to restore order and protect against speculative excesses.

Conclusion

The meme coin mania of 2025 has undeniably burned out, with a 22% market cap decline to $40 billion and 27% volume drop underscoring the end of unchecked speculation. As Bitcoin stabilizes below $90,000 and the broader crypto market at $3.07 trillion reflects caution, investors are wise to focus on fundamentals. Looking ahead, clearer regulations could pave the way for sustainable growth—consider diversifying your portfolio with established assets to navigate future volatility.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026